Taxes, Why Shouldn't Everyone Pay Something?

Politics / Taxes Feb 26, 2012 - 10:28 AM GMTBy: John_Mauldin

Don't Tax You, Don't Tax Me

Tax that Man Behind the Tree!

– Senator Russell Long, Democrat Louisiana (1918-2003)

Last week's letter on taxes drew more response than any letter I have written in years. Questions that were raised simply beg for an answer, and some of the replies were very thoughtful, well-written suggestions for alternatives. This week I am going to do something I can't ever remember doing, and that is to use the entire letter to involve and respond to my readers. Let me begin by thanking all of those who responded, and to observe that every response I read was polite and courteous, even when aggressively disagreeing. Not every site on the internet has such a civil discourse among its readers. I appreciate that. Next week we will return to All Greece, All the Time or whatever the crisis du jour is, although I am much more interested in China of late. I will have to address the world's largest nation at some point soon. At the end of the letter, I provide some very interesting and fun links and a note on an upcoming webinar with investment legend Israel "Izzy" Englander. Now, let's zero in on taxes.

The Fair Tax

A rather significant and vocal number of you wrote in support of what is called "the Fair Tax," which is basically a national sales tax, suggesting it is a better alternative than a value-added tax (VAT). I should note that there are 70 members of Congress who have cosponsored a Fair Tax bill, so this is not outside the realm of possibility. It also speaks to the possibility of a tax on consumption being politically feasible, which I will again address later.

I am going to use a longer, well-written reply from Roger Buchholtz of Kalamazoo, Michigan. I will only interrupt him a few times with a reply in brackets […] and then add a longer reply at the end. Roger wrote:

"Dear Mr. Mauldin,

"I just finished reading your article "The Cancer of Debt and Deficits" and agreed with your conclusion that it is time for radical tax reform. Actually, what was radical was the adoption of the 16th Amendment in 1913, after our Founding Fathers had twice prohibited it in the Constitution.

"I am delighted to see that you recognize that consumption taxes are less damaging to an economy than income taxes. Income taxes tax productive behavior (work, saving, investing, etc.), thereby reducing the return/reward for that behavior. They, in essence, punish people when they are contributing to society.

"As you have apparently concluded, a simple, Flat Income Tax is not the answer. I agree, because it will remain neither for very long. It will just allow all the tax favors to be bought and sold all over again, which will exacerbate today's corruption of our representative form of government to the point that our representatives too often represent special interests rather than their constituents. [I am not opposed to a flat tax, as I will address below.]

"In addition, the Flat Income Tax would only slightly reduce compliance and efficiency costs (as all records must be maintained and returns filed) and it would continue the practice of imbedding taxes in the prices of the goods and services that citizens buy. Today, an average of 22% of the producer price of all American-produced goods and services are taxes imbedded in the price. This practice of imbedding much of our tax burden in the prices of our products places American labor and business at a great competitive disadvantage with foreign labor and businesses. In essence, a Flat Income Tax would have no long-term benefits and could delay true tax reform for a generation.

[While I am not sure of whether it is exactly a 22% embedded tax cost, it is certainly high. There were several objections to a VAT because it would be a burden on businesses. I would note that ALL taxes are a burden. Others objected to a VAT as being a burden on consumers. As Roger points out, consumers are already paying a great deal in hidden taxes on what they purchase. Either the Fair Tax or a VAT can be structured to be revenue-neutral and eliminate the other embedded costs. What both proposals do is eliminate nearly all other taxes, including Social Security, which adds directly back into both employee and business income.]

"Now, let's compare two consumption taxes: the Value Added Tax (VAT) proposed by Marc Sumerlin and Larry Lindsey in their book and the Fair Tax Act that is now before Congress with over 70 cosponsors and the subject of two best-selling books. Both proposals replace the current Internal Revenue Code and are revenue neutral. The Fair Tax (HR 25) replaces the income tax, Social Security & Medicare taxes, and death and gift taxes with a retail sales tax. [As does the VAT.]

"Actually, Sumerlin and Lindsey's VAT and the Fair Tax have much in common, but the differences are critical.

*Both proposals replace the current Internal Revenue Code

*Both are revenue neutral

*Both tax final consumption only once

*They have the exact same tax base, if they both have no exemptions

*Business to business purchases are not taxed

*The full amount of the tax is paid by the consumer

*Both improve U.S. international competitiveness, as neither of them taxes exports, and are border-adjustable

"How are they different?

"The Fair Tax has a prebate, so that no individual pays taxes on their personal consumption up to the poverty level. This eliminates the perceived regressive nature of a consumption tax. The $100,000 personal exemption of their VAT serves a similar purpose, but everyone under their VAT will pay imbedded taxes that are even greater than they are today.

"The Fair Tax collects the tax at the retail level, which is simple to understand and comply with. Only sellers of goods or services for final consumption (retail businesses) file monthly sales tax returns. This would reduce tax filers and compliance costs by about 90%.

"The VAT, on the other hand, is collected from all businesses at every stage in the production process. Each business has to keep track of what taxes they paid on their purchase of inputs and subtract it from the tax they owe. This is called a credit-invoice system. It is complex record keeping and especially difficult for small businesses who don't have in-house tax experts.

"The Fair Tax is transparent, the amount of the Fair Tax being clearly stated on the retail receipt. VAT retail receipts may state the rate of tax, but they generally do not state the actual amount of taxes paid. The visibility of the Fair Tax provides the natural restraint on the size and reach of government intended by our Founding Fathers.

"European countries have tried to solve the perceived regressive nature of VAT taxes by creating all kinds of exemptions in attempts to make necessities tax-free. This opens the door for more and more exemptions, and vendors start gaming the system to qualify for the exemptions. These exemptions and gaming add to the already high cost of compliance under a VAT and encourage the buying and selling of tax favors, similar to today's corrupting trade in tax favors that occurs in the U.S. under our income tax system.

"This combination of the Fair Tax Prebate (monthly payment to every legal household which offsets taxes paid on spending up to the poverty level, similar to today's personal exemption on our income tax return) and taxing ALL consumption at the same rate creates a consumption tax that treats everyone the same, is transparent, and is much simpler and much less costly to comply with. In addition, it eliminates the argument for exemptions, as all necessities are not taxed. That is the genius of the Prebate.

"There is no evidence that the Fair Tax will encourage tax evasion via black markets or barter systems. In fact, the compliance rate for the Fair Tax, projected to be around 94%, is expected to be many times better than the 69% of the current tax system. Some of the reasons the Fair Tax will have a high compliance rate are:

"Major corporations account for over 90% of all retail sales today, with 3.6% of corporations collecting 87.5% of all sales taxes (I don't think I'll be able to convince the clerk at Walmart not to charge me the tax),

"Items most likely to be subject to barter are used goods, and used goods are not taxed by the Fair Tax,

"Under an income tax or a VAT it takes only one individual to cheat on a tax return, but under the Fair Tax both the seller and buyer must cheat (Would you like to go to jail for me?), and

"Because the Fair Tax reduces the number of collection points by over 90% (just retail businesses collect the tax) there will be considerably more audit capability by the government on those collection points.

"With over $23 million in research on the Fair Tax, it is one of the most researched public policy issues in history. The many studies on its economic and social impact can be viewed at www.fairtax.org." – Roger Buchholtz

I understand the philosophy behind the Fair Tax. Part of it is to get rid of the income tax and all the inequities that are built into the current tax code. And I like the fact that it is a consumption tax. Truth be told, if this is what came to the floor of Congress, I would be for it, over simply tinkering with the current system.

And with a VAT, one could use a "prebate" type of structure as well, to deal with the regressive nature of a consumption tax, or exempt food or other items, as many countries do with a VAT. What I wrote last week was not meant to be a detailed analysis but more along the lines of a general proposal. The current system is broken. Rather than trying to "fix" it, let's use the coming need for reform to truly restructure the tax code.

What About Those Who Will Not Vote for Any Tax?

The next response comes from Stanley Harrison:

"John, How can we accept your current plan or any similar (Simpson/Boles) plan that requires compromise to implement when large numbers of Republican congressmen have pledged to vote 'no' to any tax increase? They will not compromise, yet the founders of this republic had to compromise. Are you going to campaign against them?"

The short answer is yes. Not dealing with the deficit will cause so much economic pain that it is hard to get people to imagine it. That has to take priority over not raising taxes. It is not a matter, at least for me, of what is desirable, but of what is necessary. I would prefer a smaller government, lower taxes, etc. But unless Republicans manage to install far more members of Congress than seems likely today, that's not going to happen. Waiting until there is a train wreck to fix the track is not sound public policy.

What Should Seniors Do?

Bill Daugherty wrote:

"One very large obstacle to the idea of VAT replacing income taxes would seem to be the seniors lobby. 'What? I paid taxes on my income all my earning life, and now you want to change to tax me on my spending life as well?' Getting from Here to There will always be a problem. No solution can be beneficial to all age and earning cohorts."

And David Oldham answered:

"I think a VAT with exports exemption is a good idea. The point made in comments here about VAT hitting retired folk already hit by low savings returns is valid (I am in that category myself), but one has to ask the question, what do we older generations deserve for being instrumental or oblivious to creating such a mess for our kids and grandkids? We will all have to suffer the ultimate consequences."

David makes a very solid point. Borrowing from our children, which they must pay in the future, to enjoy our benefits today is not right, any way you look at it. And with a prebate, that should take much of the argument away.

Why Shouldn't Everyone Pay Something?

But that leads us to this note from Robert Dumper:

"John, do you really mean 'If you make less than $100,000 you pay nothing'? I believe that one of the worst things you can do is to allow some people to pay no taxes at all.

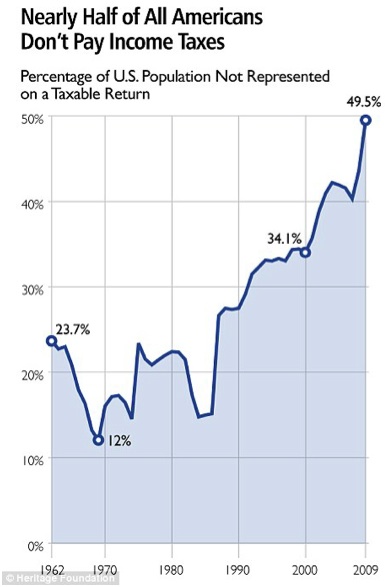

"Paying no taxes just leads people to believe that all the government provides is free. They have no incentive to limit what the government spends. Their incentive is to just take all they can. I believe that people earning less than $100,000 would make up over half the electorate. You can imagine what kind of political force they would represent. They would have no investment in the system. I think this would be a recipe for financial disaster. I guess the Bad News is that almost half our current electorate pay no income taxes today, and look what that has done for us."

Others wrote with similar concerns. A tax on only those making over $100,000 creates a large majority of people who would pay no taxes at all. I would reply that they would be paying a VAT. Under a consumption tax, everyone pays (although with a rebate/check for the lowest incomes, as I suggested).

Others argued that it will reduce consumer spending as it raises prices. I can understand the concern, but I think that misses the insidious nature of all the hidden costs on what we buy. Getting rid of those would offset much if not all of the rise in costs. And not paying Social Security and other taxes would increase income, to also offset the rise in costs.

Actually, Robert, it is closer to almost half of the country than you might think. The graph below from the Heritage Foundation came my way today (courtesy of Bill King, from a paper in England!). As of 2009, 49.5% of the population is not represented on a taxable return.

Actually, Robert, it is closer to almost half of the country than you might think. The graph below from the Heritage Foundation came my way today (courtesy of Bill King, from a paper in England!). As of 2009, 49.5% of the population is not represented on a taxable return.

And this leads into Mira Awad's comment:

"I like the idea of a progressive flat tax, similar to what some Republicans were proposing in the 1990s but without an exception for capital gains. Each household would get a large deduction for each person. They would pay 20-25% tax on the remainder of their income. (The rate would be set between 20% and 25% depending on how much money is needed, so I'm not sure of the rate.) No exemptions for anything else. It gets rid of that infernal mortgage tax credit that has jacked up the housing prices. It does so without making it impossible for families to pay their mortgages, because most middle class families will not be paying income tax (upper middle class will be).

"… The Republicans should like it, because it puts a cap on taxes for the rich at somewhere between 20% and 25%. Democrats should like it, because it taxes income and capital gains at the same rate, partly repeals the Bush cuts in capital gains tax, and puts a floor on taxes for the rich. It also provides tax relief to the working class. Yes, someone would be paying more: upper middle class people who have big mortgage deductions now and the well-to-do who are paying less than 20% now.

"This cures the basic unfairness in the American tax system, where 2 households of the same size and same income living next to one another in houses of the same value are sometimes paying wildly different portions of their incomes in tax, depending upon the source of their incomes and whether or not they have a mortgage tax break. One family can be paying 30% and another 10% while living under the same circumstances. Ridiculous. It solves the problem of Warren Buffett and his secretary. Perhaps Buffet is paying too little taxes, but no one has mentioned that the secretary's 30% tax rate is too high. (I don't know much about corporate tax structure, but it looks to me like the same flat rate could be applied to corporate income and capital gains.)"

It is worse than you think, Mira. There are ways to defer large amounts of current income taxes using various strategies of taking current deductions and realizing the income over a longer period, if you pay enough taxes to make it worth doing so and know the right places to find that deferral. You can't avoid eventually paying the tax, but you can defer it for a longer time. And if you are paying a lot in taxes, it can make financial sense. And there are ways for those who own certain types of small businesses to shelter much more income than the traditional IRA or 401k.

One small example from my own past. If you are a publishing company for a magazine or newsletter, you can write off the costs of selling a subscription immediately but only have to recognize the income over the life of the subscription. The current subscription income (even if it is all up-front) goes on your books as deferred income, which, if you ever look at the actual accounting statements of publishing companies, can reveal a great deal about the real health of the business. Which is why there are large mail campaigns in the last quarter of the year, as it helps on current taxes. Eventually you have to pay, and woe betide the publishing company that sees its subscription base fall too fast, as taxes then come due with no income to pay them. But when you are growing? It can really affect your current taxes due.

If and when we clean up the tax code, there are a lot of things that need fixing. There will be a great deal of crying and gnashing of teeth by all sorts of industries, but no business should rely upon the tax code for its existence.

Comeback, America

My friend David Walker was the Comptroller General of the United States and head of the Government Accountability Office (GAO) from 1998 to 2008. He now tours the country talking about the need for fiscal responsibility. He heads a group called Comeback America ( http://www.tcaii.org/)

David points out that if you simply eliminated all the "tax expenditures" (tax deductions), taxes would go up $1.3 trillion a year. If you combined that with serious entitlement reform, a much lower tax rate (the lows 20s as the top rate), and did $3 in spending cuts for every $1 in tax increases, you could balance the budget for the foreseeable future. His website lists numerous tax and budget proposals, besides his own. He points out the necessity (and I wholeheartedly agree) to have bipartisan cooperation to avoid a fiscal disaster. He demonstrates that we have $75 trillion in unfunded liabilities in Medicare, Social Security, and pensions.

Actually, the number $75 trillion is not all that interesting to me, for the simple reason that we can't pay it. It will never happen. Far more interesting is the question, when will we realize we can't pay it and what will we do? Or maybe, what will we do when the bond market decides we can't pay it and begins to ratchet up interest rates? Unless we begin to get control of the deficit, we could face a very bleak future.

There are ways to get serious entitlement reform. The very conservative Congressman Paul Ryan and the quite liberal Senator Ron Wyden have combined to come up with a plan for reforming Medicare that goes a long way toward what is needed. And it has upset a lot of people serving in Congress with them. But such compromise and cooperation is precisely what must happen if we are to avoid a true crisis. Whether you agree with every small detail in their proposal, you should applaud their willingness to seek bipartisan solutions.

I get rather strong letters from my conservative friends chiding me for not "keeping the faith." What we need, I am told, is smaller government and less spending. But when I press them as to whether the path we are on will result in crisis, they almost always agree that if nothing is done we will see a severe crisis. So my next question is, do they think we should hold the philosophical line, or allow the country to fall into economic chaos?

I have spent much of my life holding that line. But my analysis is that without a deficit solution we will enter another depression that will take years to come out of. And waiting until one party or the other has total control of Congress and the White House is not the answer. We are getting to the Endgame. Time is running out. We have a few precious years to set the ship of state back on a better course. I would rather keep the ship from sinking than argue about what should be on the menu at dinner. We can worry about that when the leaks in the boat are fixed.

And for those who asked, I still think we will do the right thing. Cutting spending will have consequences. We should do it slowly (over 4-5 years), and that will mean a Muddle Through Economy with more risks of recession. I talk of dire consequences only if we fail to fix the deficit. I think the former outcome is more likely. If you don't share my optimism, then you should plan for a depression. And if we get to the end of 2013 and it is clear that no compromise is forthcoming, I will probably get much more concerned. Maybe even become downright gloomy. Just saying.

(And just for the record, the VAT as I outlined it, or a Fair Tax, or Walker's solutions would have me paying somewhat higher taxes, not lower.)

There are more comments, and you can go to www.johnmauldin.com and click on last week's letter to read them. But this letter is already getting long and it is time to hit the send button. And move on.

California, New York, Orlando, Conferences, and Webinars

First, let me invite you to join me on Wednesday, March 7 at 3:00 pm Eastern / 12:00 pm Pacific for an exclusive webinar conversation with one of the greats of the investment world, Israel "Izzy" Englander of Millennium Management, sponsored by my partners at Altegris Investments. We will discuss the current environment and how Millennium seeks to find opportunities within it. Izzy is an absolute legend of the hedge fund industry, managing over $12 billion with over 800 people on staff, using practically every strategy available. It is very rare to get Izzy into a session like this, and we will be in for a treat. Sadly, the regulations are such that you must have a net worth of $5 million. (I hate those rules. But we must follow them. We will soon be having webinars open to all!)

You can register for the webinar by going to www.johnmauldin.com and clicking on The Mauldin Circle. My friends from Altegris will make sure you get an invitation. (In this regard I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.)

I make a quick trip to San Diego on Thursday and then drive to Orange Country for dinner with my long-time friend Jon Sundt, the president of Altegris, who is there for a conference. We just don't get enough face time anymore, so when we can get to the same area, I like to take advantage of it.

Then back to Texas the next morning to write my letter, catch up, and then fly to New York for yet another quick trip. Orlando the following weekend, speaking at a conference with my coauthor of Endgame, the young and brilliant Jonathan Tepper.

I leave you with this link to just-some fun writing from my favorite muscle-head, former Mr. Universe, the Blond Bomber himself, Dave Draper. Dave writes a column every week, and I try to read it. It inspires me to get into the gym. And this week I really need it, because I have been slack since I tore my rotator cuff a few months ago and kind of used it as an excuse to avoid the gym and "let it heal." Can't do that. Dave got me all fired up again. I will get out my Bomber Blend, the best-tasting protein shake powder I have ever come across (I love the chocolate with a banana) and get back to Brother Iron, although with a little more restraint. As my doctor noted, I am not 50 anymore! Enjoy this at www.davedraper.com/article-672-beginning.html.

Time to hit the send button. It is not too late, so I will get to bed more or less on time for a Friday night/Saturday morning and then get up and go to the gym. Have a great week!

Your ready to pump some iron analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.