Inflation Means Less Cluck for Your Buck

Commodities / Agricultural Commodities Feb 24, 2012 - 11:06 AM GMTBy: Ned_W_Schmidt

An important trend for many years has been the rising preference of consumers for chicken. Apparently those boneless, skinless, tasteless, chicken breasts are quite popular. In the U.S., production of broilers, table chicken, exceeds by ~50% the production of either pork or beef, when measured by weight. And those "clucks" are now costing more bucks.

A significant reason for the popularity of chicken has been price. Relative to other meats, chicken has been under priced for years. As we consider the chart below, and other factors, we believe the era of cheap, boneless, skinless, tasteless chicken breasts may have come to an end. Beneficiaries of this shift should be all those that produce broilers, or table chicken.

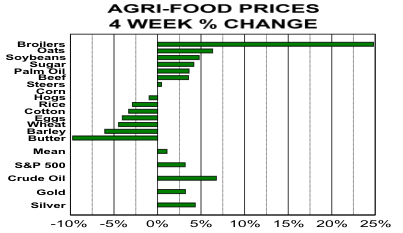

In the above chart is portrayed the price change over the past month of a large sampling of Agri-Commodities. Dominating the top of the chart is broilers, the price of which has risen near 25% over the past month. Since the lows of last Summer, U.S. broiler prices have risen by more than 50%. Broilers are the only Agri-Commodity at a new 90-week high.

All Agri-Commodities have some kind of seasonality. Production and consumption are not matched in the real world. Obvious reason for that is none are produced in a factory. Broilers have a positive seasonal influence at this time of the year. That said, the recent price action seems more than simply seasonal. Higher prices and more reasonable grain price also suggest that most producers returned to profitability in the last quarter of 2011, and they should have a very nice 2012.

We also note in that chart that despite all the excitement and chatter over the recent run in the prices of Gold and Silver, that bowl of sugar in your cabinet performed as well. Quite likely that sugar prices will perform better than either metal in year ahead. Palm oil and cotton price are likely to also.

A general expectation had been that the commodity price rise of 2010-2011 would be reversed in the fashion of the disastrous 2008-9 period. That has not happened. Factor contributing to the more positive recent experience is that fundamentals rather than credit induced speculation have been dominant. Agri-Commodity prices have not collapsed. As a consequence, the cash flow of Agri-Producers and related companies have continued to perform well.

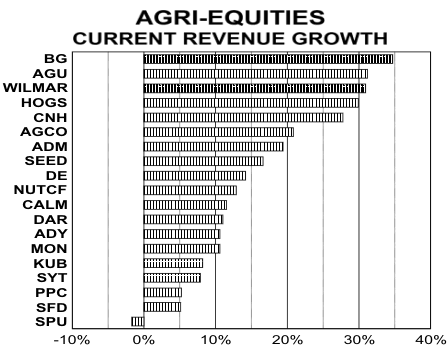

In the above chart is plotted the current revenue growth of a significant sampling of Agri-Equities. Revenue growth here is defined as the six-month rate of change in trailing 12-month revenues. As is readily apparent, the revenue growth at these companies continues to be quite positive.

Excellent fundamental performance of the Agri-Companies, as evidenced by the above chart, is part of the reason our index of Tier One Agri-Equities recently rose to a new high. In the year ahead those companies above with exposure to China should be considered for research by investors. Some have extremely favorable situations. For example, SEED has the only genetically modified corn seed approved for commercial production in China, and coming in 2013.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2012 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.