Commodities have Broken Out to the Upside

Commodities / Commodities Trading Feb 22, 2012 - 06:55 AM GMTBy: Chad_Bennis

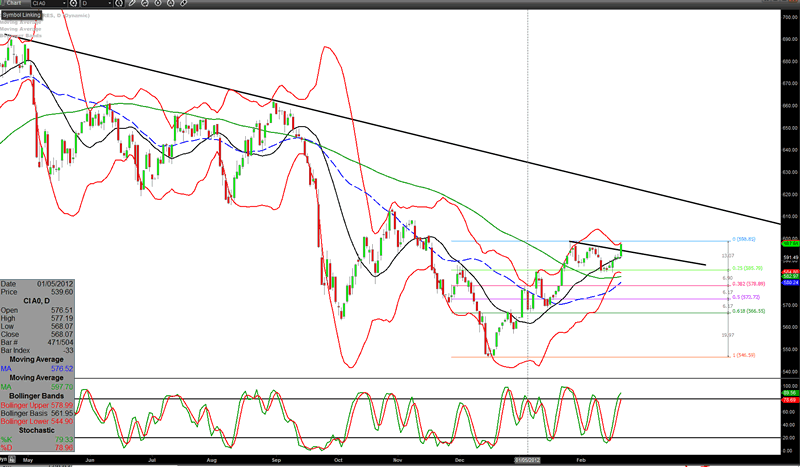

With Greece in the rearview mirror, investors turned their attention to the risk on trades. The CRB index painted a clear breakout from its consolidation over the past few weeks. This breakout has been confirmed in silver, gold, oil and copper.

With Greece in the rearview mirror, investors turned their attention to the risk on trades. The CRB index painted a clear breakout from its consolidation over the past few weeks. This breakout has been confirmed in silver, gold, oil and copper.

This rally should remain fueled as central banks around the world have eased interest rates, lowered reserve requirements and purchased bonds in an attempt to create liquidity and stability to fragile financial systems. This action will ultimately be seen as inflationary which is being reflected by today’s movement in the commodity sector.

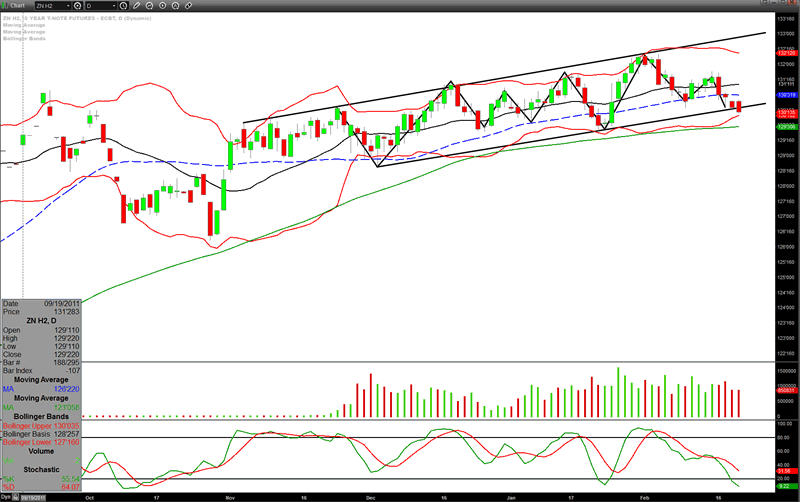

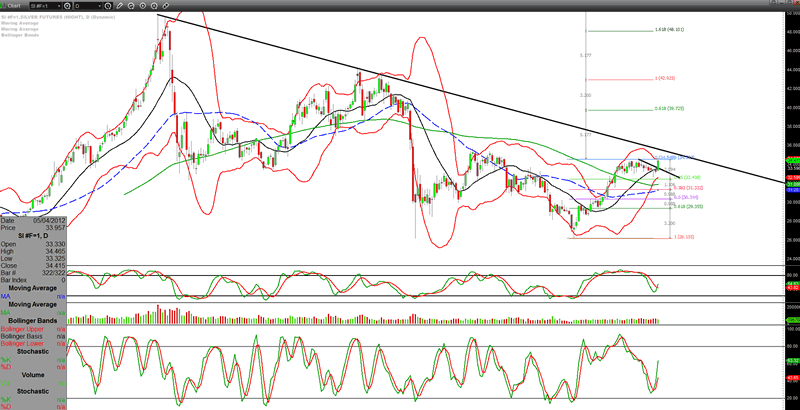

The 10 year note has broken below its recent uptrend line. This should keep the risk trades well bid as money seeks higher yields in other markets. Silver has been particularly sensitive to the 10 year note and should see higher prices ahead.

Silver, once again, leads the rally in percentage points gained as it receives a bid in today’s session.

All in all, with oil forging higher, the metals should follow along. Add this to the fact that notes and bonds are starting to see an exodus of funds and we should have a nice rally into summer.

Dr. C.A. Bennis

-an independent thinker and trader

www.wheatcorncattlepigs.wordpress.com

wheatcorncattlepigs@gmail.com

© 2012 Copyright Dr. Chad Bennis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.