The US Dollar in the week ahead

Currencies / US Dollar Feb 19, 2012 - 12:28 PM GMTBy: Submissions

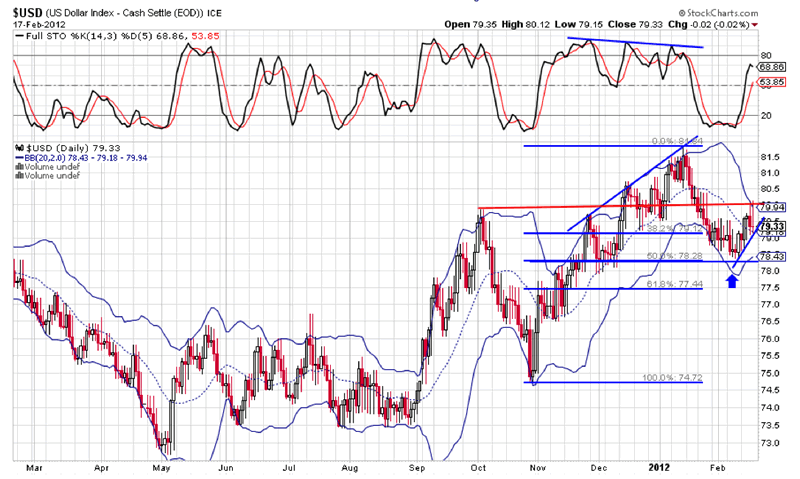

Dr. Chad Bennis writes: The rally in the US dollar beginning in November of last year saw a series of higher highs and higher lows in the price of the index. While the price action moved higher the stochastic indicator showed a bearish divergence as each successive higher high in the price action was reflected by a lower high in the stochastic indicator. This is known as bearish divergence and means that the current uptrend in price is getting weaker with each higher high in the price of the index.

Dr. Chad Bennis writes: The rally in the US dollar beginning in November of last year saw a series of higher highs and higher lows in the price of the index. While the price action moved higher the stochastic indicator showed a bearish divergence as each successive higher high in the price action was reflected by a lower high in the stochastic indicator. This is known as bearish divergence and means that the current uptrend in price is getting weaker with each higher high in the price of the index.

The US dollar is currently in a short term uptrend as it bounced off the 50% fibonacci retracement level of the last upward trend. Currently it is being met with sellers at the 80 level which is shown by the red line. The dollar needs to break through and close above the 80 level to stage another attempt at making new highs. If this scenario plays out then it should put downward pressure on stocks and commodities. But, if the price breaks down and closes below the current uptrend line then commodities like silver and gold should rally along side the general equity market. With the Greece resolution by the EU to kick that can down the road the euro may rally next week putting downward pressure on the US currency kicking off a nice trend in the metals and general equity indices.

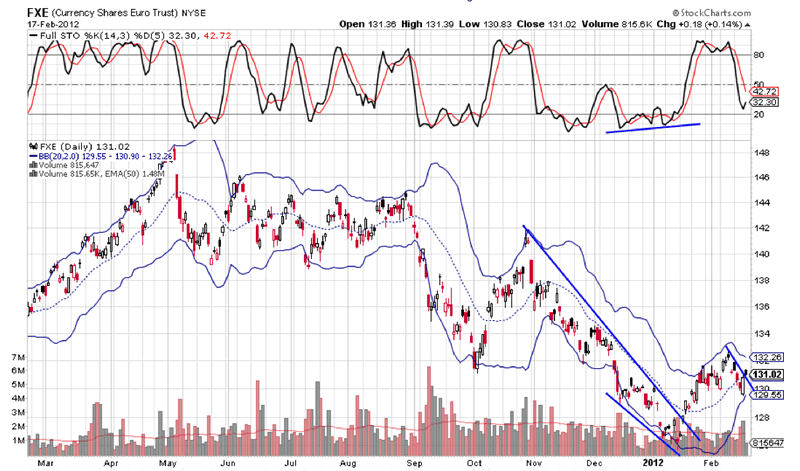

The chart of the euro currency shows the opposite of the dollar by signaling a bullish divergence in price action that led to a trend reversal at the beginning of the year. Prices are now showing a continuation pattern in conjunction with the stochastic. The current downtrend line appears to have been broken to the upside with price action.

Dr. Chad Bennis

-an independent thinker and trader

www.wheatcorncattlepigs.wordpress.com

Dr.ChadBennis@gmail.com

© 2012 Copyright Dr. Chad Bennis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.