US Recession Will Ultimately be More Severe than Current Forecasts

Economics / Recession Jan 10, 2008 - 04:25 AM GMTBy: Bob_Bronson

Despite permabull hype, as reflected especially by many of Larry Kudlow's guests on CNBC, the second revision in 3Q GDP neither obviated nor postponed the persistently developing -- and very predictable -- recession.

Despite permabull hype, as reflected especially by many of Larry Kudlow's guests on CNBC, the second revision in 3Q GDP neither obviated nor postponed the persistently developing -- and very predictable -- recession.

Our stock market and economic cycle template, or SMECT model clearly illustrates the "perfect storm" of several business and economic cycles contracting simultaneously and suggesting, well in advance, that the oncoming recession will be more severe than average

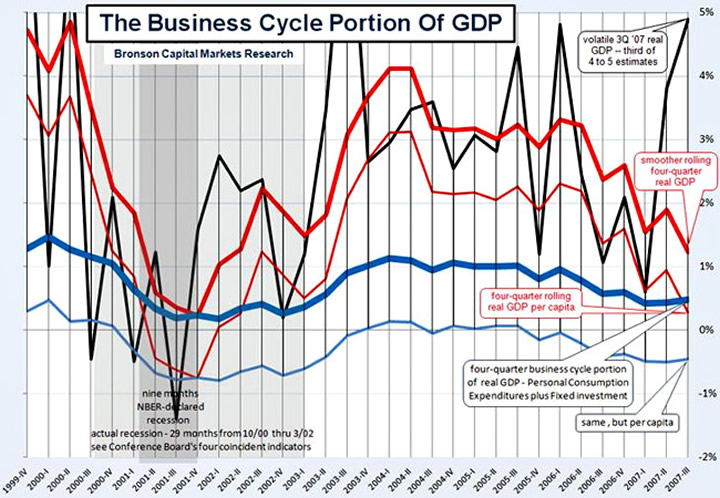

We have also pointed out that GDP, which does not include crucial employment data, is not the best measure of the business cycle. The 87% of GDP that does reasonably reflect the true business cycle -- that is, Personal Consumption Expenditures plus Fixed Investment from the National Income and Product Accounts (NIPA) data -- adjusted for price inflation and population growth (i.e., per capita), reasonably reflects the true business cycle. The business cycle portion of the NIPA data has been contracting for the past eight quarters (see the narrow blue line in the first chart below).

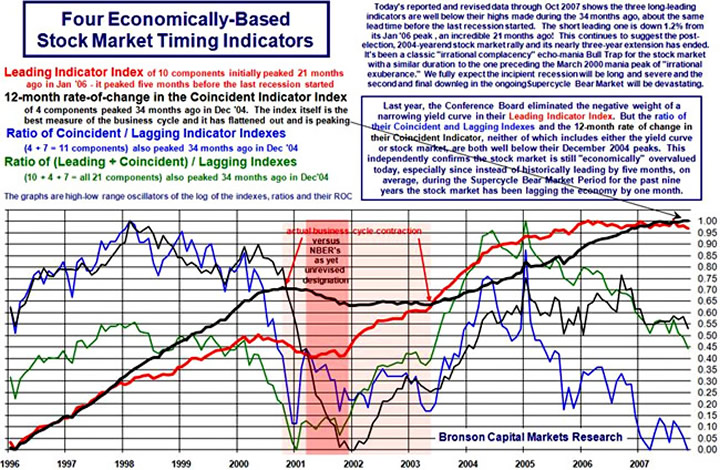

One of the best measures of the business cycle is the coincident indicator index produced by the Conference Board, which does include s nonagricultural payrolls as one of its four-component index (see the bold black line in the second chart below). This index is in the process of topping out, as we have been expecting, especially with further downward revisions.

The last recession sharply declined at first, then double-dipped, persisting for a full 2.5 years -- not just the eight months designated by the National Bureau of Economic Research (NBER) -- again see the bold black line, and along with the light and dark grey shaded areas in the second chart below. In contrast, the current recession has been developing more slowly. If it continues at this slow pace, then it will likely persist for longer – perhaps much longer – than the last one. Thus, we fully expect it will be ultimately perceived as severe, if not very severe (i.e., duration times magnitude).

Consistent with our observations concerning employment (which is, again, not part of the NIPA data for GDP), Merrill Lynch economist David Rosenberg says Friday's weak jobs report leads him to believe the recession is already here. Friday's employment report confirmed his suspicion that the economy was transitioning into an official recession towards the end of last year.

Here are Rosenberg's observations, with which we agree as slightly modified, plus a confirming chart from Chart of the Day:

At no time in the past 58 years has the unemployment rate risen 60 basis points (50 bps is the actual recession threshold) from the cycle low without the economy slipping into recession, and now have the jobless rate hitting 5% in December versus the March/07 trough of 4.4%.

Aggregate hours worked in the economy contracted at a 0.4% annual rate in 4Q, and this comes on the heels of a 0.6% decline in 3Q. Back- to-back declines in total hours worked have always been associated with recession.

Aggregate hours worked in the economy contracted at a 0.4% annual rate in 4Q, and this comes on the heels of a 0.6% decline in 3Q. Back- to-back declines in total hours worked have always been associated with recession.

The breadth of the report was also very poor, with the diffusion index for private sector employment slipping below the 50 bps? cutoff mark, just like the Purchasing Manager's ISM index fell to 48.4% from 52.2% in November. A number below 50 indicates that a plurality of industries are now in the process of cutting jobs outright. Heading into the last recession, this index fell below 50 in February 2001 and the recession began ... exactly one month later.

The level of unemployment is up 13% YoY, again a development that has always been consistent with past recessions. The YoY rate of change in the level of the unemployed who have been idle for at least 15 weeks is particularly ominous - +20%, which is a pace that prevailed in the early stages of prior economic downturns (hitting this trend in April/01 and in Aug/90 when the recessions were one month old).

And Household Employment contracted 49,000 in 4Q and the YoY trend slowed to +0.2% in December from +2.2% a year ago, another classic recession signal. Consider for a second that in March 2001 that trend was running at +0.8%, and in July of 1990 the pace was +1.1% - those two months represented the onset of a technical recession and yet the trend in Household jobs is weaker now than it was then.

In sum, Rosenberg believes last Friday's employment report strongly suggests that an official recession has arrived. The recession dating committee at the NBER will be the final arbiter for him, but since it waits for conclusive evidence, including benchmark revisions, it may be two years before they make that call. However, according to Bloomberg news, Martin Feldstein, chairman of the NBER, said this morning that, in his opinion, last Friday's jobs data increased the odds that the economy is already in recession to greater than 50%, and he has previously opined that this recession “could be deeper and longer than the recessions of the past.”

By Bob Bronson

Bronson Capital Markets Research

bob@bronsons.com

Copyright © 2008 Bob Bronson. All Rights Reserved

Bob Bronson 's 40-year career in the financial services industry has spanned investment research, portfolio management, financial planning, due diligence, syndication, and consulting. At age 23, he and his partner founded an investment research firm for institutional clients and were among the first to use mainframe computers for investment research, especially in the areas of alpha-beta analysis and risk-adjusted relative strength stock selection. Since 1967, he has served as an investment strategist and consultant to various investment advisory firms and is the principal of Bronson Capital Markets Research. If you wish to read more, read his BIO

A note to visitors ~ We do not have a website, but we maintain a private e-mail list. I'm also often asked why we provide research and forecast information for free. Since we are not looking for new business from the internet, I periodically post some of our research and forecasts in exchange for feedback from others. And since we don't publish in academic or industry trade journals, such internet discussion gives us as much peer review as we want and can conveniently assimilate at this time.

Also, the few archiving discussion boards in which I have the time to participate give us new ideas and allow us to establish and maintain intellectual property copyrights for our proprietary research, and to establish a verifiable forecasting record. At the same time, we are able to publicly document our forecasts and help others who otherwise don't have access to our work.

To be added to our private e-mail list, we only ask that you periodically provide feedback: questions, comments and/or constructive criticism to keep our research work and forecasts as error-free, readily comprehensible and topically relevant as possible. If you would like to be added, please explain, at least briefly, what you do, since our e-mailing list is categorized by the backgrounds of the recipients.

Robert E. Bronson, III Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.