“No QE3″, Retracement Level Stalls Financial Stocks

Companies / Banking Stocks Feb 16, 2012 - 12:17 PM GMTBy: Chris_Ciovacco

Since financial stocks make up 14% of the S&P 500 Index, it is difficult to sustain a rally without strength in banks and financial services firms. With the Fed and ECB opening up the liquidity fire hydrant in late December 2011, bank stocks experienced another in a series of monster bailout rallies. As outlined below, the Financials Select Sector ETF (XLF) may be poised to give back some gains over the coming sessions based on numerous factors including reduced odds of QE3.

Since financial stocks make up 14% of the S&P 500 Index, it is difficult to sustain a rally without strength in banks and financial services firms. With the Fed and ECB opening up the liquidity fire hydrant in late December 2011, bank stocks experienced another in a series of monster bailout rallies. As outlined below, the Financials Select Sector ETF (XLF) may be poised to give back some gains over the coming sessions based on numerous factors including reduced odds of QE3.

Unfortunately in the debt-saddled world we live in, central banks may be the most important driver of asset prices. Dallas Fed President Richard Fisher told reporters after a speech Wednesday:

There will be no QE3. I will support no QE3, no additional mortgage-backed securities, no additional Treasuries. Wall Street keeps dangling QE3 out there - I think it’s a fantasy of Wall Street - it’s not going to happen, it’s not necessary.

As we outlined in a January 16 video, the Fed, via currency swaps, and the ECB, via unlimited three-year loans, are already keeping the money printers busy. While there is no formal QE, the Fed is still injecting new money into the global financial system in a “QE-like” fashion (see How QE Boosts Stocks).

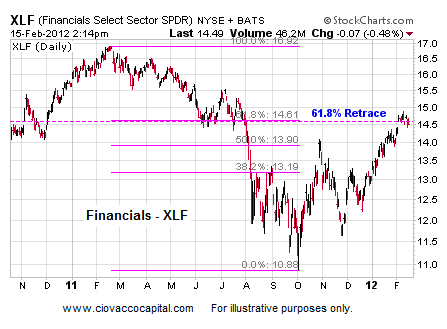

It is not unusual for markets to hesitate at key Fibonacci retracement levels, such as 61.8%. Therefore, the comments below will take on more meaning if the financials ETF shows signs of a reversal. A close below 14.42 would increase the odds of more sustained weakness. The 61.8% retracement of the losses from the spring high to October low sits at 14.61 (see right side of chart below). One more push toward 14.91 would fit well into an intermediate-term topping process; the same can be said for an S&P 500 move toward 1,363.

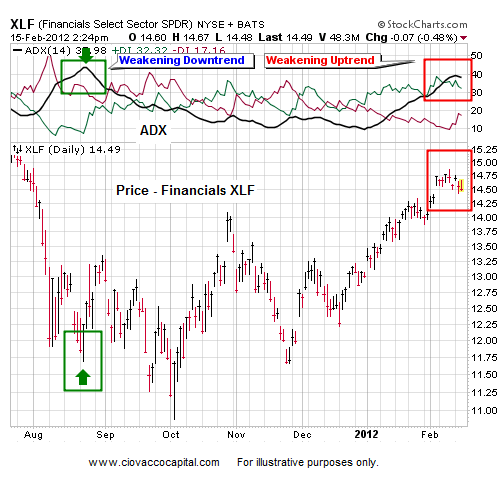

The chart of XLF below shows the ADX indicator at the top. When the black ADX line begins to roll over from high levels, it can be a warning of a possible trend reversal. On the left side of the chart (green arrows), ADX rolled over indicating the downtrend was losing steam – a sharp countertrend rally followed. We have the current ADX black line (red box top right) rolling over telling us to be open to a pullback in the financials.

No need to sound an alarm at this point, but holders of XLF, Bank of America (BAC), Wells Fargo (WFC), J.P. Morgan Chase (JPM), and U.S. Bancorp (USB) may want to keep a closer eye on things over the next week or so. These comments align well with our big picture concerns relative to a possible pullback outlined on February 10.

-

Copyright (C) 2012 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.