Federal Government Spending, Hey, Big Spender?

Politics / Government Spending Feb 14, 2012 - 02:27 AM GMTBy: Paul_L_Kasriel

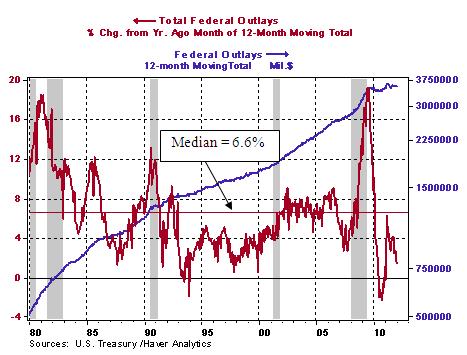

Some political movement ought to unfurl the “Mission Accomplished” banner with regard to reining in federal government spending. As shown in the chart below, in the 12 months ended January 2012, the cumulative total of federal outlays – defense, non-defense, entitlements, interest on the debt, the whole ball of wax – increased only 1.5% vs. the 12 months ended January 2011. The median growth in 12-month cumulative total federal outlays from January 1954 through January 2012 is 6.6%. Starting with the 12 months ended March 2010, this measure of growth in federal outlays has been below the long-run median.

Growth in federal spending began to balloon in the 12 months ended October 2008 when the $700 billion TARP program was signed into law. With the most severe recession in the post-WWII era commencing at the beginning of calendar 2008, resulting in a surge in the “headline” unemployment rate from 4.4% in May 2007 to a cyclical peak of 10.0% in October 2009, there were large increases in federal spending on unemployment insurance benefits, food stamps and Medicaid. Also starting in the summer of 2009, the fiscal stimulus program of $500+ billion began kicking up federal spending.

Of course, the current very slow growth in federal outlays is the calm before the Baby-Boomer storm. As 79 million of my fellow Baby Boomers retire over the next 20 years, federal spending related to Social Security and Medicare benefits will skyrocket. Let’s see which Congressmen and Senators want to campaign on reducing the entitlements of the “entitled” generation. By the way, for an excellent article on current and future entitlement spending, see [Even Critics of Safety Net Increasingly Depend on It - NYTimes.com]

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2012 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.