What’s Wrong With China’s Stock Market?

Stock-Markets / Chinese Stock Market Feb 13, 2012 - 03:10 PM GMTBy: Sy_Harding

It wasn't just the U.S. and Europe that took on massive debt loads to provide the extraordinary global stimulus efforts that prevented the 2008 financial meltdown from morphing into the next 'Great Depression'. China also provided massive stimulus to its economy, and in the process is thought to have taken on much more debt than it has revealed.

It is known that part of China's response to the crisis was a massive $1.7 trillion of loans from central government owned banks to provincial and city governments. Those local governments in turn used the loans to provide economic stimulus through highway construction and other infrastructure improvements, as well as an overbuilding of homes and office buildings.

Those loans are coming due for repayment in the next few years, and the local governments and their construction partners are in no condition to repay them.

To avoid a wave of defaults the Financial Times reports that China's central government has instructed the banks, which would suffer the losses from defaults, to begin a major program of rolling those existing loans over into new ones that will come due further down the road, up to four years further down the road.

Analysts say China is far from being another Greece. No recession for it. China's massive 2009 stimulus efforts boosted its economy into an overheated condition, and even after its efforts of the last two years to slow the growth to a more sustainable pace, its GDP is still expected to grow around 8% this year.

In kicking its debt crisis down the road China is no different than the U.S. and Europe, hoping it will provide time for a global economic recovery to make the problem go away, or at least be small enough to manage.

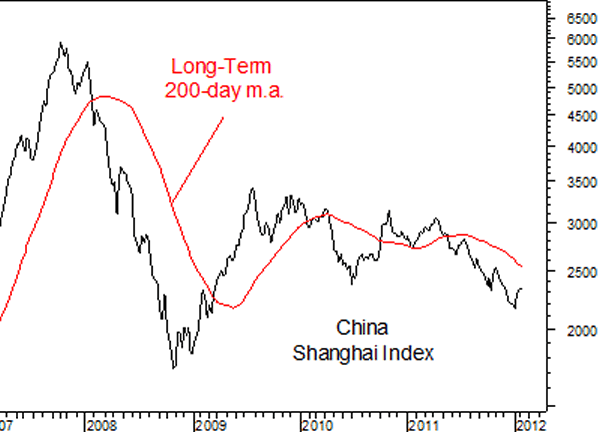

However, if China's debt and economic problems are not major why is its stock market looking more like that of a nation with very serious problems, finding new lows even as much of the rest of the world has been experiencing a significant rally off the October lows, and still 32% below its mid-2009 level?

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2012 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.