Choosing the Wrong Personal Loan Could Prove Costly

Personal_Finance / Debt & Loans Jan 09, 2008 - 04:10 AM GMTBy: MoneyFacts

If your new year’s resolution is the tackle your debt by consolidation, tread carefully as you could be caught out by high interest rates and over priced insurance. Lisa Taylor, analyst at Moneyfacts.co.uk investigates:

If your new year’s resolution is the tackle your debt by consolidation, tread carefully as you could be caught out by high interest rates and over priced insurance. Lisa Taylor, analyst at Moneyfacts.co.uk investigates:

“Consolidating your debts onto one loan can prove an ideal solution. It could cut your monthly payments and see your interest bill lower. Also for those less disciplined, the fixed monthly repayment might offer the structure you need to commit to repay the debt within a given time.

“Firstly you need to decide if a loan is the best option for your situation. Of course 0% credit cards are the most competitive method to borrow, but this can be dangerous unless you are strong willed enough to stick to a fixed monthly payment and not to continue using your plastic. This method may also only be suitable for smaller amounts of borrowing, typically less than £5K and currently is only available up to a maximum term of 15 months.

“If your budget shows that you need longer than 12-15 months to repay the debt, a low rate balance transfer deal may offer a better solution. First Direct for example offers a 4.9% deal for five years, while Citi has a Life of Balance MasterCard with a 5.8% rate until the balance is repaid. These rates are substantially lower than any personal loan rate currently on the market.

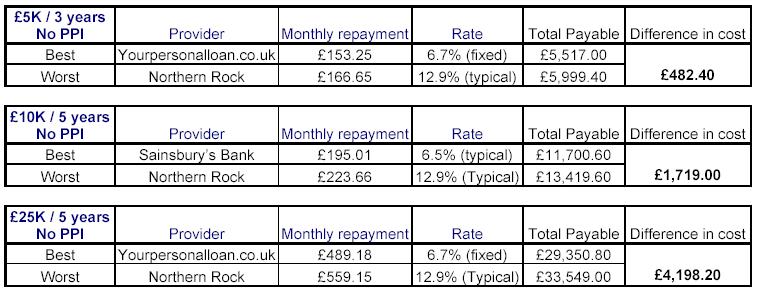

“The credit crunch has caused the personal loan market to tighten, lenders have withdrawn from the market and rates have seen a continuous increase throughout 2007. Don’t be fooled into thinking that your existing bank or building society will always give you the best deal, just because you have a relationship with them. With detailed computerised credit scoring systems used these days, loyalty makes little difference. The difference between the best and worst interest rates can be almost double, so choosing the wrong loan provider can be a costly mistake.

“The tables below show just how different the cost of the same loan varies:

Source: Moneyfacts.co.uk

“While interest rates should be relatively easy to compare and evaluate if you are getting a good deal, there is the added complication of typical and personal priced loans. In fact 89% of loans are priced on a typical rate, meaning that 66% of accepted applicants will receive the advertised rates, while the remaining 33% of applicants could be offered a higher or lower rate depending on their individual credit rating.

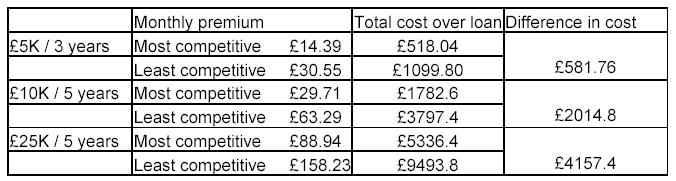

“But the biggest area to be aware of in the loans market is the insurance you may be offered. The payment protection insurance (PPI) generally provides cover against accident, sickness and unemployment but could also include features such as hospitalisation benefit and even critical illness cover.

“The difference in the most competitive and most expensive cover can add an additional £1760.40 to a £5K loan over three years or as much as £4157.40 to a £25K loan over five years.

“By shopping with an independent provider such as paymentcare.co.uk, the cost of PPI could be slashed dramatically to £316.80* for a £5K loan over three years and £1,650* for a loan of £25K over five years.

“Remember, a personal loan is usually a large long term fixed financial commitment, so don’t blindly plump for the first deal you see. Make sure you know you are getting a competitive rate. If you are taking the PPI, consider the option of an independent provider, make sure you know the level of cover you are getting and read the exclusions and terms and conditions carefully.

“Getting the best deal will mean your monthly repayment will be cheaper and you can escape from your debt burden much earlier.”

*£5.50 per £100 LASU

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.