Buffett Says "Right To Be Fearful" of "Paper Money" Favours Stocks Over Cash, Bonds and Gold

Commodities / Gold and Silver 2012 Feb 10, 2012 - 08:49 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,715.50, EUR 1,295.21, and GBP 1,084.25 per ounce.

Gold’s London AM fix this morning was USD 1,715.50, EUR 1,295.21, and GBP 1,084.25 per ounce.

Yesterday's AM fix was USD 1,733.00, EUR 1,304.77, and GBP 1,094.20 per ounce.

The pattern of gold trading higher in Asia and falling just before or at the open in Europe continued again today. Gold ticked a little higher in Asian trade prior to sharp falls before the open at 0800 GMT when gold fell quickly fell from $1,729/oz to $1,715/oz.

A cut in COMEX gold trading margins by the biggest operator of U.S. futures exchanges, the CME Group, failed to start a rally in gold but is short term bullish.

The tragedy that is the Greek debt crisis continues. Although Greek political leaders inked a form of deal in the 9th hour, the bailout is still pending approval of international lenders, leading to jitters amongst investors which should support gold.

European ministers declared that Athens did not meet all targets and demanded more within a week in exchange for a 130 euro billion “bail out” to stave off bankruptcy – at least in the short term.

The Troika gave the debt ridden country yet another ‘deadline’ - until the middle of next week to find an extra €325 million in savings, and pass the cuts through a divided parliament. They will also seek “written guarantees” that brutal austerity measures will be implemented even after the elections of a new government in April, said Jean-Claude Juncker, the Luxembourg prime minister who chaired yesterday’s meeting of finance chiefs of the 17 euro countries.

US International trade numbers hit the market at 13.30 GMT.

Buffett: "Right To Be Fearful" of "Paper Money" - Favours Stocks Over Cash, Bonds and Gold

Warren Buffett, the billionaire chairman of Berkshire Hathaway, has released an interesting, if contradictory, adaptation from his upcoming shareholder letter - Warren Buffett: Why stocks beat gold and bonds .

In it, Buffett again extols the virtues of stocks over paper money, bonds and gold.

The Oracle of Omaha acknowledges and correctly warns that investors are "right to be fearful" of "paper money." Buffett said low interest rates and inflation should dissuade investors from buying bonds and cash. "They are among the most dangerous of assets."

Buffett again reaffirmed his opinion about gold’s “significant shortcomings.” He said that gold is “neither of much use nor procreative.” He also suggested that gold was a bubble and compared it to the internet stock and housing bubbles.

Buffett Incorrect Regarding Gold

Buffett’s thoughts regarding gold are a rehash of similar negative views on gold repeated in recent years.

Buffett criticises gold for having two shortcomings – it is “neither of much use nor procreative”.

This is true, however Buffett completely ignores gold’s primary use throughout history and today which is as finite money, a monetary safe haven asset, as financial insurance and as a store of value.

Buffett contradicts himself by suggesting that those who buy gold are fearful and they believe “that the ranks of the fearful will grow.”

However, in the same article, he says that investors are “right to be fearful” of “paper money.”

Buffett should have a chat with James Grant or other monetary authorities who realise gold is the ultimate form of cash. As Grant says "nothing beats a little cash in a bear market, of course, and the oldest form of cash is gold."

Buffett suggests that gold is a bubble and that the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. He writes that as "bandwagon" investors join any party, they create their own truth -- for a while.

His article also shows a lack of knowledge regarding gold - Buffett says that gold is “currently a huge favourite of investors.”

The data and statistical evidence shows that gold remains a fringe investment and remains under owned by retail investors in the western world. This is beginning to change and ownership has increased in recent years but ownership remains miniscule when looked at in historical context and when viewed versus ownership of stocks, bonds and cash today.

Buffett compares gold to the internet stock and housing bubbles.

This is a highly simplistic and dubious comparison. The very uncertain world of 2012, with a myriad of significant investment risks is leading to continuing strong fundamental demand for gold bullion amid constrained global supply.

These real fundamentals driving today’s gold market were absent in the final years of the dotcom and property bubbles.

The fundamentals driving the gold market are not going to disappear in the foreseeable future and may be with us for the rest of this decade.

Also, gold so massively underperformed in the 1980s and 1990s (after huge outperformance in the 1970s and a parabolic price move in late 1979, January 1980) that gold has in effect been playing “catch up” with other assets in recent years.

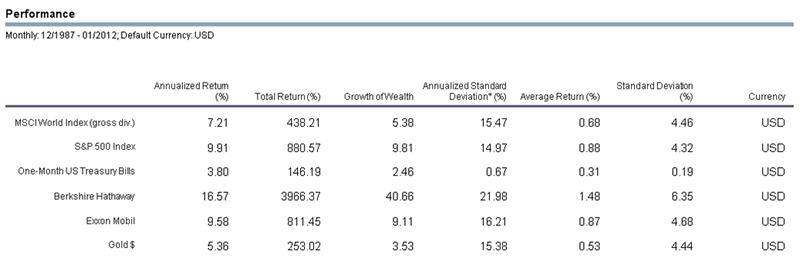

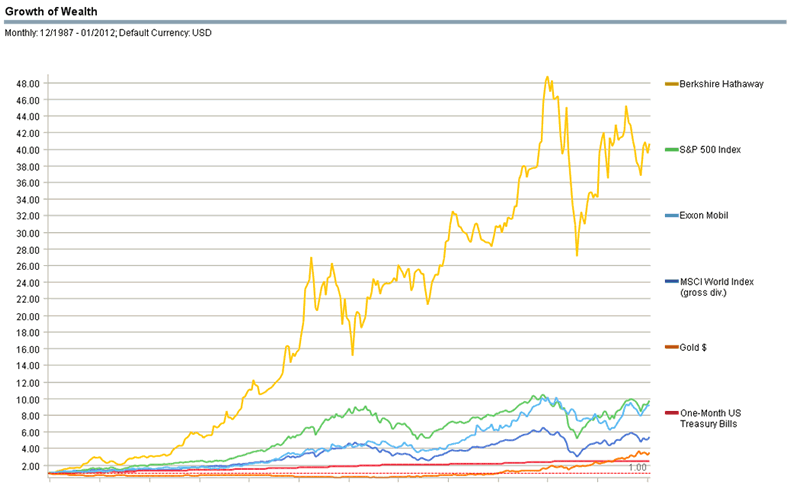

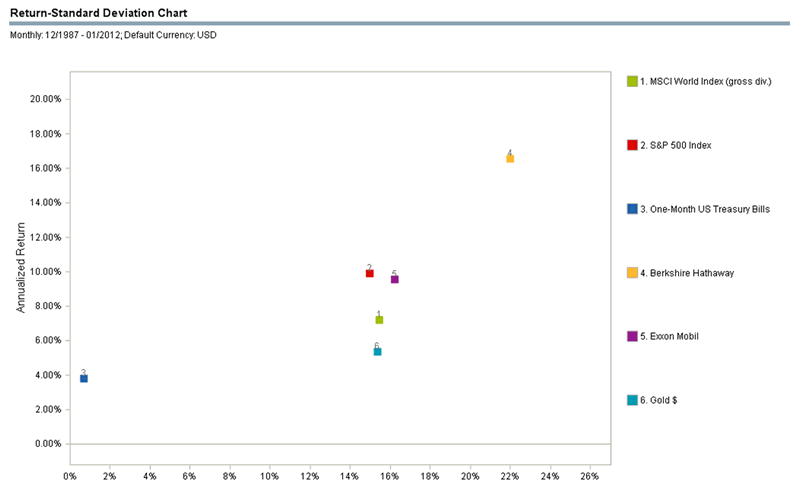

The charts and tables show that gold’s performance, since the start of Buffett’s Berkshire Hathaway, has been equivalent to that of stocks (MSCI World and S&P 500) and with similar volatility.

Berkshire’s Hathaway’s performance has been phenomenal and must be respected, however Buffett’s over concentration and allocation on stocks since 2000 has cost him and his shareholders dearly – and may do so again in the coming years.

Conclusion

Buffett shows once again he does not understand gold and he does not understand real diversification. He does not or chooses not to understand gold as a safe haven asset in a portfolio.

He does not or chooses not to understand gold as an important diversification. He does not or chooses not to understand gold as a finite currency, as a monetary asset and as money.

"What the wise man does in the beginning, the fool does in the end."

Buffett is correct when he says that the old proverb will be confirmed once again.

However, today wise men, women and institutions in the US, Europe, Asia and internationally are diversifying into gold because of concerns about “paper money” and other macroeconomic, geopolitical and systemic concerns.

The less informed continue to have a blinkered anti gold bias. They continue to focus solely on gold’s nominal price and assert it is a bubble.

They continue to posit silly “either or”, “stocks good; gold bad” arguments rather than seeing the merits of each asset class.

The uninformed continue to not understand gold as a form of financial insurance in a diversified portfolio. This is changing slowly with a very gradual growing appreciation of gold’s importance as a safe haven asset and money is a world of massive paper and digital money creation.

Putting all your eggs in any one basket in a world beset with risk is unwise. Whether that be in agricultural land, Exxon Mobil, Berkshire Hathaway, stocks, bonds, cash and even gold

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.