Waiting to Pounce on Gold and Silver Profits

Commodities / Gold and Silver 2012 Feb 09, 2012 - 06:26 AM GMTBy: Adam_Brochert

Let me start by re-iterating that I am a secular permabull on physical precious metals, particularly Gold. When you're dealing with the end of the road for the current international monetary system (a la the 1930s and the 1970s), there's only one asset that is a complete no-brainer to own. As a hint, that asset is shiny and owned by every central bank in the world "just in case."

Let me start by re-iterating that I am a secular permabull on physical precious metals, particularly Gold. When you're dealing with the end of the road for the current international monetary system (a la the 1930s and the 1970s), there's only one asset that is a complete no-brainer to own. As a hint, that asset is shiny and owned by every central bank in the world "just in case."

However, I also like to trade. When trading, I would sell or buy anything if I though there was a profit to be had. For example, my subscribers and I have been short senior Gold stocks as a "scalp" trade over the past week. Does this make me a traitor? I don't think in those terms, as I am a more practical Gold bug/bull. The more paper I make, the more metal I can buy.

However, once the current short-term correction finishes, it is back to bull mode. Gold, silver, and Gold and silver stocks - they're all going to go higher. The only real conundrum is which of these items to buy as a bull trade once the correction is complete. In another week or so, we'll hit bottom and find out which of these items will outperform.

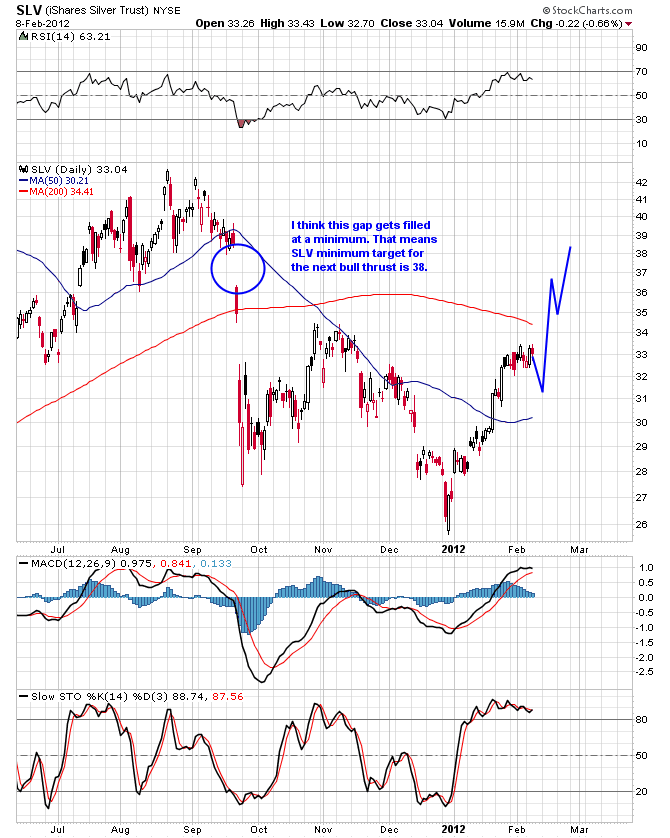

I like the prospects for the entire precious metals patch. From a trader's perspective, I think silver has an obvious minimum target when using the SLV ETF. Here's an 8 month daily chart of the SLV ETF thru today's close to show you what I mean:

Once we correct a little (likely in a scary fashion over a few days for silver and senior Gold stocks, as they both seem to enjoy volatility as much as Bernanke likes creating money out of thin air), a decent 15-20% move higher is likely. After that, we'll have to see. All precious metal bulls know that we'll ultimately make new highs in silver above $50/oz., but the exact timing is uncertain from a trader's perspective. This is why it is best to simply buy physical metal and hold on for the volatile ride. However, some of us like to speculate with a portion of our capital and this message is for you fellow punters out there in the PM patch.

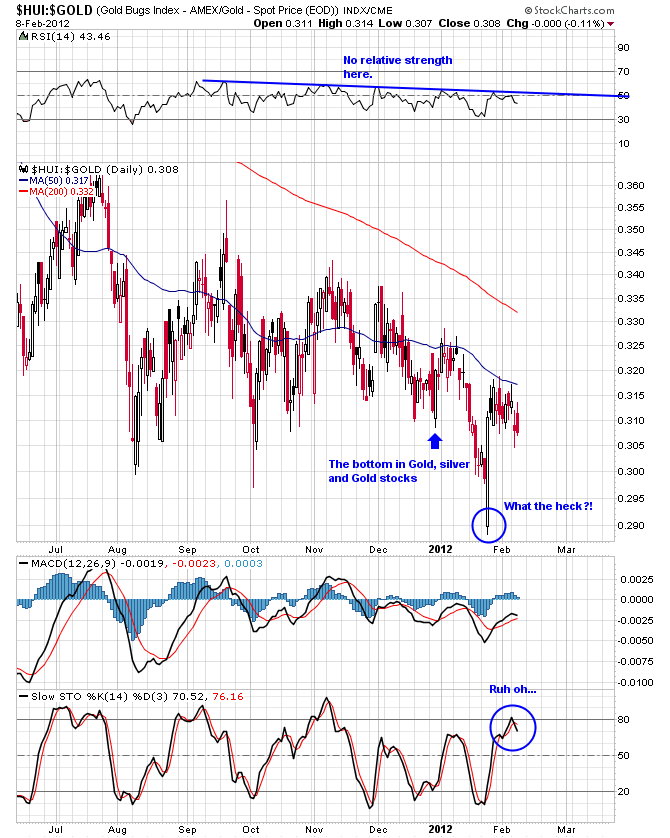

Now, the senior Gold stocks are the basket case of the PM sector. All this crap about Gold stocks leveraging the price of Gold and having bullish fundamentals doesn't mean anything if they won't perform here and now. And I'll be honest, I'm very concerned about their recent performance. That doesn't mean there isn't money to be made trading the senior Gold stock indices like the GDX ETF, but I am not impressed with the move off the late December bottom so far. Here's an $HUI:$GOLD ratio chart to show you what I mean:

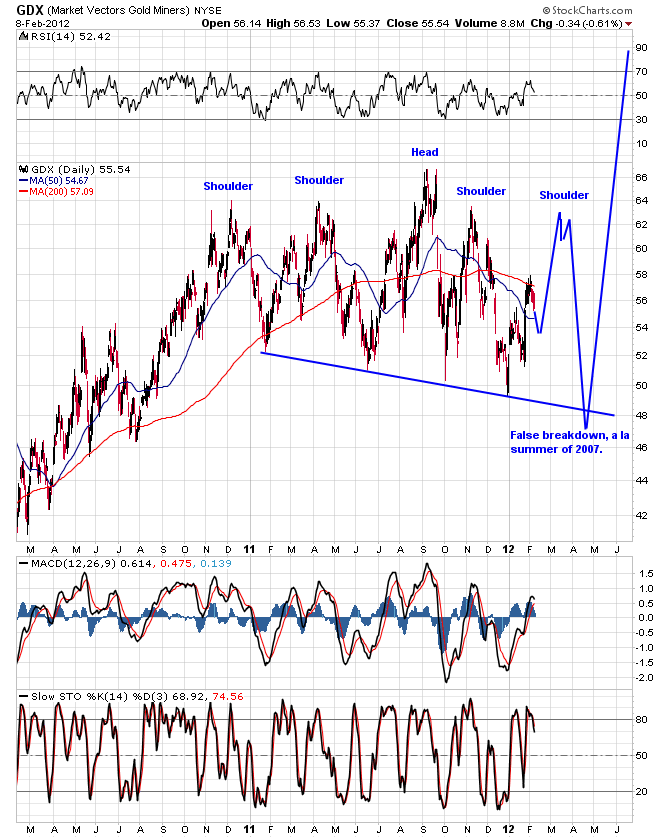

A permabull will tell you that any minute now, Gold stocks are going to blast higher and if you don't buy right now (yesterday, in fact), you're going to miss out on a quadrillion dollars. Me, I don't think so. I think this warning signal should be taken seriously. It means that the senior Gold stocks could be headed for something like this over the next few months (2 year daily chart of GDX thru today's close):

This is not a prediction, by the way, but if senior Gold stocks don't start outperforming Gold soon, don't be surprised if something like this happens. I trade Gold stocks, I don't own them. I prefer to own physical metal and then speculate in stocks and paper metal (as well as anything else that looks like it might be good for a winning trade). Investing and trading are very different and require a different type of focus and attitude. With physical Gold, I never worry about the price on a day-to-day or week-to-week basis (unless I am looking to buy more). Why? Because I understand the secular bull market in Gold and why it won't be over for some time. I never lose sleep or worry if Gold drops 10 or 20% when priced in my local currency (i.e. US Dollars). Wake me when the Dow to Gold ratio gets to 2 (and we may well go below 1 this cycle).

The bottom line is that we're going higher in the PM sector. Exactly how we get there, only Mr Market knows for sure. But I believe there are profits to be made speculating in the paper markets. After calling the exact day of the bottom in the PM patch for my subscribers and I in late December, we sold our long trading positions in senior Gold stocks 2 weeks ago in anticipation of the current correction. We went short senior Gold stocks on February 2nd, catching the high that day. In a week or so, we will be going long again in the PM sector. If you'd care to join us in the dark jungle known as the paper markets, a one month trial subscription is only $15. But please, don't even think about subscribing until you've secured a core investment in actual physical metal held outside the banking system.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2012 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.