Markets Risk Train Chugs Along, Overbought Does Not Mean a Correction is Coming

Stock-Markets / Financial Markets 2012 Feb 08, 2012 - 07:05 AM GMTBy: Capital3X

This market has been overbought since mid January 2012 and it has shown very little signs of slowing down leave alone reversal. The action post Ben speech yesterday was another breakout and this time unless its fake in which case we will know in the next 48 hours, this train is picking up speed. While we were not along in fading this market in feb but we have quickly reversed positions with strong evidence (laid below) of a new wave of risk buying if we get through key levels and days (feb 9 is imp day)

This market has been overbought since mid January 2012 and it has shown very little signs of slowing down leave alone reversal. The action post Ben speech yesterday was another breakout and this time unless its fake in which case we will know in the next 48 hours, this train is picking up speed. While we were not along in fading this market in feb but we have quickly reversed positions with strong evidence (laid below) of a new wave of risk buying if we get through key levels and days (feb 9 is imp day)

We look at bond markets, FX markets and Gold to analyse key trends as they stand in the first half of Feb.

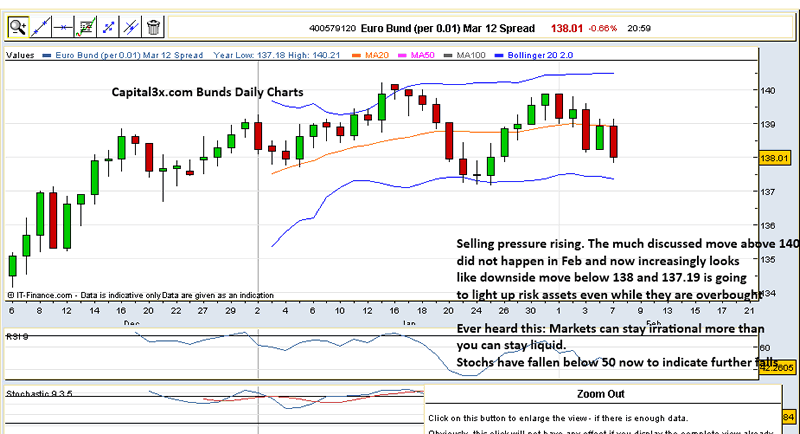

Bunds charts

Lots more on FX, ES, S&P500, Gold charts for registered members

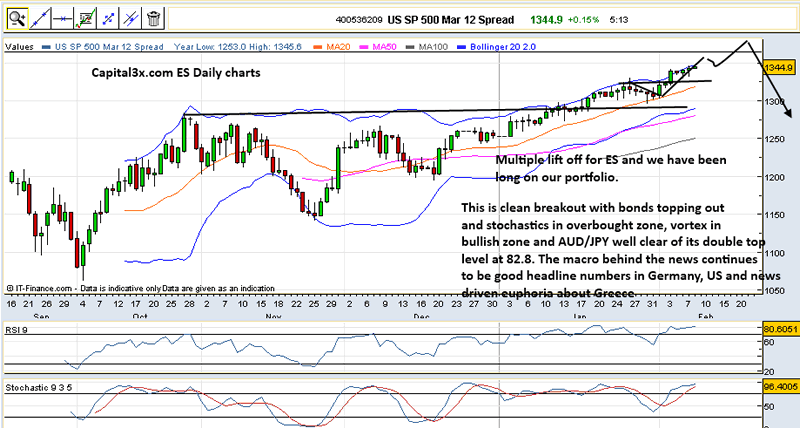

ES Charts

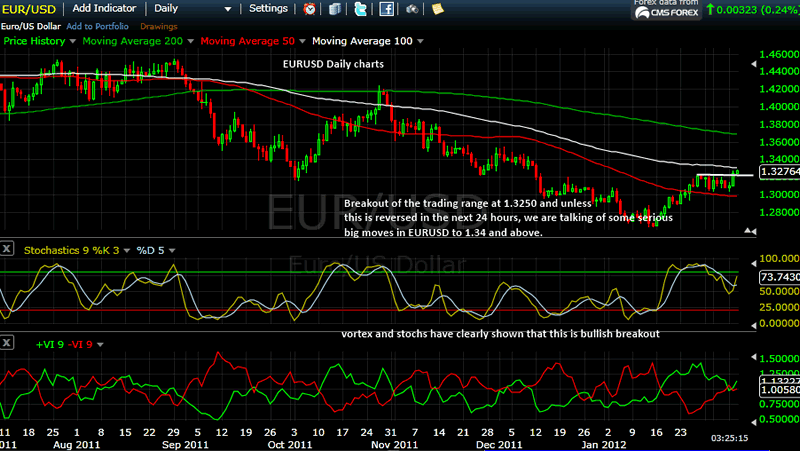

EUR/USD Charts

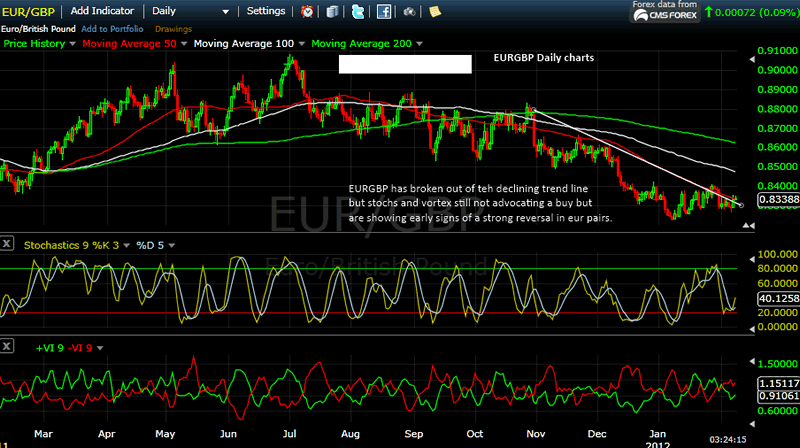

EUR/GBP Charts

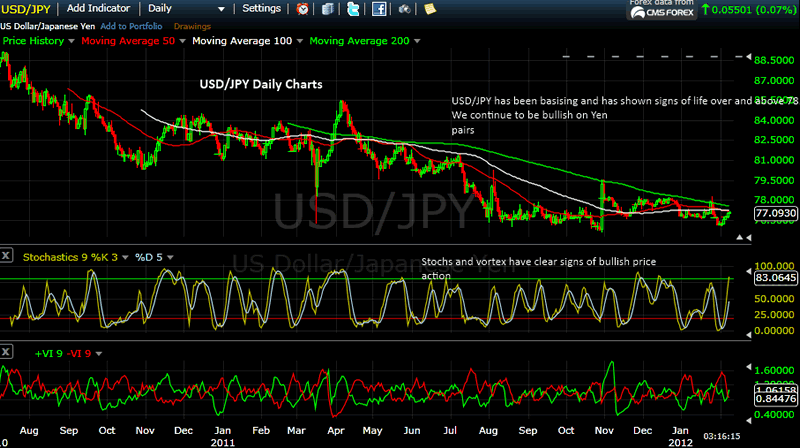

USD/JPY Charts

AUD/JPY Charts

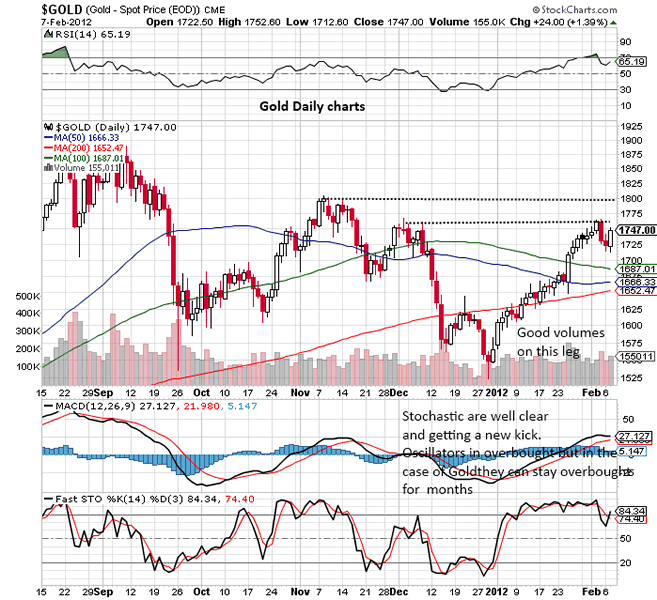

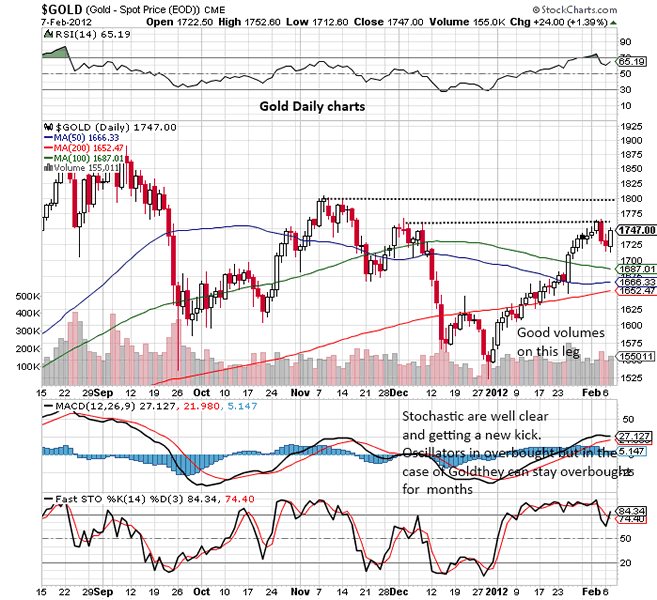

Gold Charts

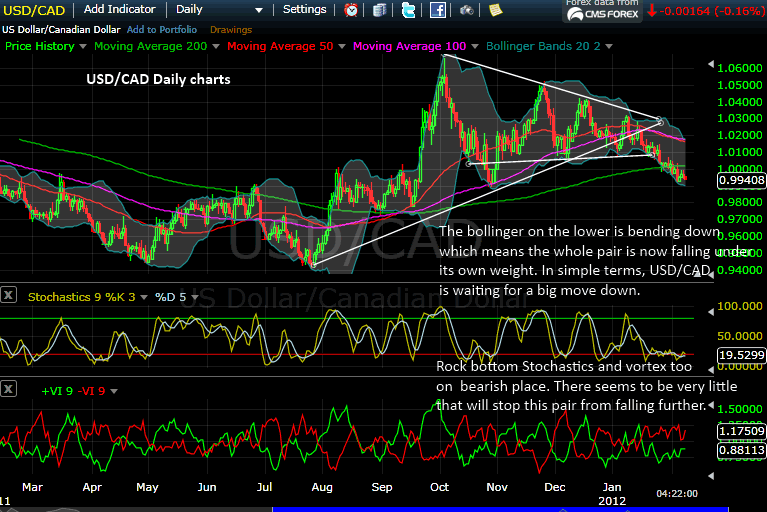

USD/CAD Daily Charts

More charts and commentary to be added. Stay clued.\

Two of three macro news in the last 15 days has aided and given new impetus to the bulls as it has torn and shred down traders who have been trying to short this market.

US employment picks up

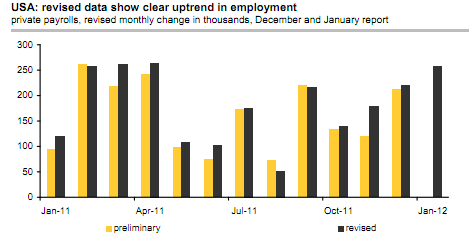

The US labor market has strengthened significantly in January. Nonfarm-payrolls increased by 243k and the unemployment rate continued its downward drift, falling to 8.3%. Increased hiring should support private consumption, creating upside risks to our forecast of 2% economic growth in 2012. At the same time, the hurdle for QE3 has increased.

The previously published level for December was revised upward by 266k on the annual benchmark revision and other adjustments. The strong increase in January and the revisions have led to a much more encouraging picture of the labor market compared with the December report (chart) as hiring has clearly picked up. Job gains were broad-based across sectors with the usual exception of government employees (-14k).

Manufacturing added 50k jobs, underlining the strength of the sector. Part of the explanation why the increase in January surprised on the upside is that the BLS has revised its seasonal adjustment factors to better reflect the strong seasonality in the hiring of couriers and messengers. As this has eliminated the previously reported 42k increase in December, there was also no pullback in January, in contrast with expectations.

The unemployment rate which comes from a separate survey among households continued to surprise on the downside, slipping to 8.3% from 8.5%. Household employment increased by 847k in January, a massive rise even if about a quarter of the gain only reflects the updated population estimates. Thus, the unemployment rate is already drifting towards the lower end of the Fed’s forecast for the end of 2012 of 8.2% to 8.5%. Today’s report has therefore reduced the likelihood of further quantitative easing. However, with inflation under control and unemployment still elevated, the Fed may still feel under pressure to “do something” to fulfil its dual mandate of price stability and maximum employment. Moreover, given the very cautious view of the economy of the Fed in recent months, one excellent employment report will probably not be sufficient to convince the FOMC that the recovery has gained more speed.

German Orders gain traction

In December, German industrial companies received 1.7% more orders than in November. Against the backdrop of the steep drop in November and the figures released by the Mechanical Engineering Association, most economists had expected this countermovement. Orders increased sharply especially in the volatile sector of “other vehicles”.

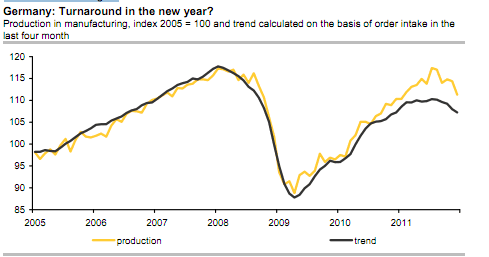

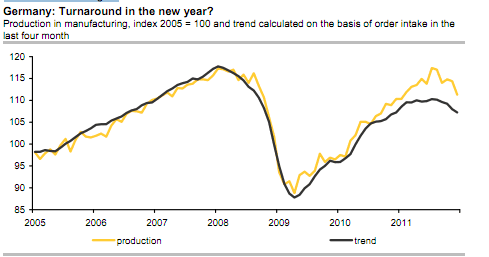

After adjustment for this category, the increase amounted to only 0.2%. Looking at the order intake by regions, the rebound in demand largely came from outside the euro zone: orders from the euro-zone countries dropped by 6% month on month. Prospects for industry improved slightly in the last few weeks. According to the Ifo business climate and the purchasing managers’ index, companies have been more upbeat of late. The uncertainty surrounding the sovereign debt crisis has eased after the ECB’s three-year tender. In January, a majority of the companies polled in the Ifo survey reported rising order intake for the first time. For this reason it is likely that official order data will also point upwards in the months ahead, signalling a year-on-year increase (chart). The trend change in orders should start to have a beneficial effect on production in spring at the latest. Following a decline in German GDP in the fourth quarter by about ¼% on the third quarter, we expect to see the economy returning to a small growth rate in the first quarter

German Industrial production surprisingly weak

In December, industrial production unexpectedly slumped by 2.9% on November. In manufacturing, the decline was only marginally less, at 2.7%, and production in the construction sector plunged by as much as 6.4%. The figures are surprising in several respects. Many had expected construction to show a large plus because of the mild weather conditions in December. Furthermore, production in manufacturing was disappointing after previously proving relatively robust: weak incoming orders had been indicating for some time that companies would have to further scale back production at some point (chart). What’s more, factory

holidays were presumably longer than usual in December because of the timing of Christmas this year. In the fourth quarter, production tumbled by 2% on the third quarter. Consequently, GDP in the fourth quarter of 2011 is likely to have fallen at a slightly sharper rate than assumed by the German Federal Office of Statistics (-¼% quarter on quarter).

Most sentiment indicators for Germany have turned upwards recently and industrial orders should point to the upside in the coming months. We therefore expect industrial production to stabilise by spring at the latest. The uncertainty emanating from the sovereign debt crisis has decreased significantly and the generally very good overall conditions for the German economy – such as low interest rates – should be able to have more of an effect again

So all in all we are in an election year and markets are well aided by a jobless recovery with central banks around the world trying to target inflation, we are setting up for another move in risk assets even while overbought conditions stay. All we can advise is: Make hay while the sun shines cause we expect this party to end sooner than later probably in 12 months time. But till then it could be a disaster to be bear in this market. Having said that: NEVER SAY NEVER in the financial markets and we will update our subscribers on a daily basis with charts and analysis. No reversal or trend will be missed.

We continue to watch the price action and will update our premium subscribers with new analysis and charts. Our trade portfolio (Forex, SPX Emini, Crude, Gold, Silver) is visible to our premium subscribers

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2012 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.