How Corporate Debt Deleveraging Looks

Stock-Markets / Financial Markets 2012 Feb 08, 2012 - 02:49 AM GMTBy: Tony_Pallotta

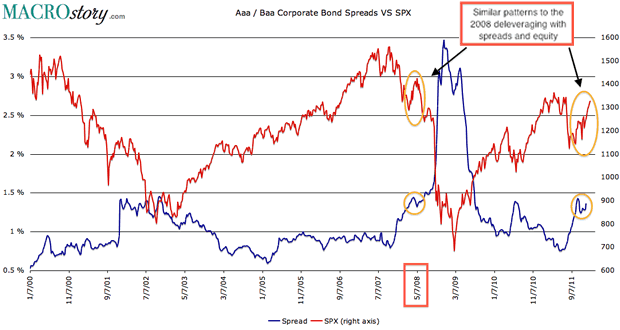

I found an interesting pattern in studying corporate debt. Specifically yield spreads which is the difference between investment grade and below investment grade yield. As investors grow risk averse they prefer to move to the safety of investment grade debt thus driving yields lower. They do this buy selling below investment grade debt thus driving yields higher. The result are higher spreads.

So in theory if you compare credit spreads to equity prices the two should have an inverse correlation and the multi year chart below shows that to be true. As equity rallied over the past eight weeks notice how spreads have actually remained flat. If investor risk aversion was diminishing as equity implies you would expect spreads to fall. Especially over that long of a timeframe. But they have not.

The last time a similar event happened was May 2008 as the previous "great deleveraging" was underway. This is just another example of the ongoing war between credit and equity.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.