Has Zero Interest Rate Policy Held Back Economic Recovery?

Interest-Rates / US Interest Rates Feb 08, 2012 - 02:45 AM GMTBy: Asha_Bangalore

The Fed instituted the zero-interest-rate policy (ZIRP) in December 2008 in response to the financial crisis. The ZIRP policy has been extended to late-2014 following the January 24-25 FOMC meeting, which will make it a six-year project. The current ZIRP policy of the Fed has its critics and advocates; Bill Gross presents arguments in today's Financial Times article for putting an end to the ZIRP policy because it is the root cause of economic woes today. His focus is on the absence of incentives for banks to find suitable projects to finance if they can park money at the Fed risk free for 25bps. He also adds that investors are most likely to shun Treasury securities as "there are multiples of downside price risk compared to appreciation."

The Fed instituted the zero-interest-rate policy (ZIRP) in December 2008 in response to the financial crisis. The ZIRP policy has been extended to late-2014 following the January 24-25 FOMC meeting, which will make it a six-year project. The current ZIRP policy of the Fed has its critics and advocates; Bill Gross presents arguments in today's Financial Times article for putting an end to the ZIRP policy because it is the root cause of economic woes today. His focus is on the absence of incentives for banks to find suitable projects to finance if they can park money at the Fed risk free for 25bps. He also adds that investors are most likely to shun Treasury securities as "there are multiples of downside price risk compared to appreciation."

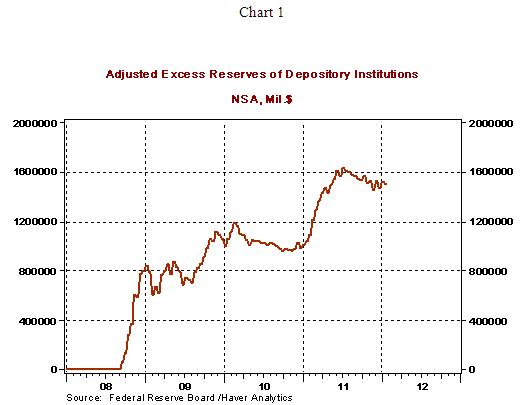

Excess reserves peaked in July 2011 and continue to show a downward trend (see Chart 1); a speedy decline is desirable but a gradual pace is the most likely case. U.S. Treasury securities remain a much sought after asset with the current yields still attracting to buyers. Yields would have been higher if the risks alluded to prevailed over other considerations. If stronger economic momentum is in place, be assured that bond yields will turn north swiftly.

Chairman Bernanke addressed the most cited criticism of ZIRP that low interest rates for an extended period impose costs on the saving population. At the November 2, 2011 press conference he was asked about the costs low interest rates have on people relying on fixed income instruments as a source of income. (Bernanke had a similar answer in today’s Q&A session at the Senate.) Bernanke's response in November 2011:

"We are quite aware that very low interest rates, particularly for a protracted period, do have costs for a lot of people. They have costs for savers. We have complaints from banks that complain that their net interest margins are affected by low interest rates. Pension funds will be affected if low interest rates for a protracted period require them to make larger contributions.

So we are aware of those concerns, and we take them very seriously. I think the response is, though, that there is a greater good here, which is the health and recovery of the U.S. economy, and for that purpose we’ve been keeping monetary policy conditions accommodative, trying to support the recovery, trying to support job creation.

After all, savers are not going to get very good returns in an economy which is in a deep recession. I mean, ultimately, if you want to earn money on your investments, you have to invest in an economy which is growing. And so, we believe that our policy will ultimately benefit not just workers and firms and households in general, but will benefit savers as well, as the returns that they can earn on their investments will improve with the improvement in the economy."

From the Chairman Bernanke's point of view, the benefits of ZIRP essentially outweigh short term considerations.

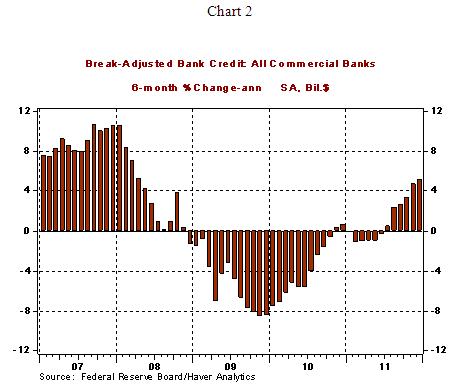

Let us step back and ask a hypothetical question: Following the Bill Gross recommendation, what if the Fed raises the federal funds rate on the grounds that it is low and not suitable to promote economic growth? The consequences are a higher cost of credit, higher mortgage rates, and so on. Therefore, the outcome from higher interest rates in the absence of strong demand is not positive. In case we are missing the obvious, a cogent explanation how higher rates would be beneficial to the economy will be useful. As a closing point, banks have resumed lending in the past few months (see Chart 2), implying that the 25bps risk free return at the Fed is not attractive anymore for some, not all bankers.

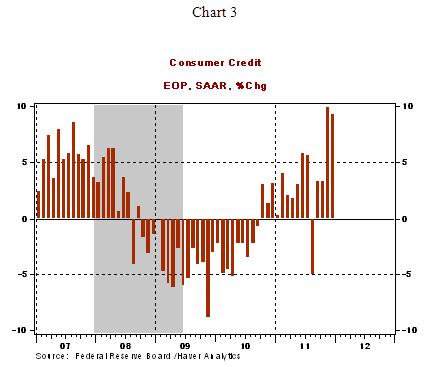

The December consumer credit report suggests that household deleveraging is probably in the final stage. Consumer credit has risen at annual rates exceeding 9.0% in November and December. Is it a seasonal distortion? Probably not, because these are supposedly seasonally adjusted data, additional monthly readings will be necessary to rule out the case of a temporary surge. Therefore, ZIRP and quantitative easing have succeeded in turning the economy around. The focus in the future should on promoting bank lending and hiring across all categories of employment.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.