Illusion Of Economic Recovery – Feelings & Facts

Economics / US Economy Feb 07, 2012 - 03:17 AM GMTBy: James_Quinn

"There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as the final and total catastrophe of the currency involved." - Ludwig von Mises

"There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as the final and total catastrophe of the currency involved." - Ludwig von Mises

The last week has offered an amusing display of the difference between the cheerleading corporate mainstream media, lying Wall Street shills and the critical thinking analysts like Zero Hedge, Mike Shedlock, Jesse, and John Hussman. What passes for journalism at CNBC and the rest of the mainstream print and TV media is beyond laughable. Their America is all about feelings. Are we confident? Are we bullish? Are we optimistic about the future? America has turned into a giant confidence game. The governing elite spend their time spinning stories about recovery and manipulating public opinion so people will feel good and spend money. Facts are inconvenient to their storyline. The truth is for suckers. They know what is best for us and will tell us what to do and when to do it.

The false storyline last week was the dramatic surge in new jobs. This fantastic news was utilized by the six banks that account for 80% of the stock market trading to propel the NASDAQ to an eleven year high and the Dow Jones to a four year high. The compliant corporate press did their part with blaring headlines of good cheer. The entire sham was designed to make Joe the Plumber pull out one of his 15 credit cards and buy a new 72 inch 3D HDTV for this weekend's Super Bowl. When you watch a CNBC talking head interviewing a Wall Street shyster realize you have the 1% interviewing the .01% about how great things are.

What you most certainly did not hear from the MSM is that the NASDAQ is still down 42% from its 2000 high of 5,048. None of the brain dead twits on CNBC pointed out the S&P 500 is trading at the exact same level it reached on April 8, 1999. Twelve or thirteen years of zero or negative returns are meaningless when a story needs to be sold. On Friday the hyperbole utilized by the media mouthpieces was off the charts, leading to an all-out brawl between the critical thinking blogosphere and the non-thinking "professionals" spouting the government sanctioned propaganda. Accusations flew back and forth about who was misinterpreting the data. I found it hysterical that anyone would debate the accuracy of BLS (Bureau of Lies & Swindles) data.

The drones at this government propaganda agency relentlessly massage the data until they achieve a happy ending. They use a birth/death model to create jobs out of thin air, later adjusting those phantom jobs away in a press release on a Friday night. They create new categories of Americans to pretend they aren't really unemployed. They use more models to make adjustments for seasonality. Then they make massive one-time adjustments for the Census. Essentially, you can conclude that anything the BLS reports on a monthly basis is a wild ass guess, massaged to present the most optimistic view of the world. The government preferred unemployment rate of 8.3% is a terrible joke and the MSM dutifully spouts this drivel to a zombie-like public. If the governing elite were to report the truth, the public would realize we are in the midst of a 2nd Great Depression.

The unemployment rate during the Great Depression reached 25%. Without the BLS "adjustments" the real unemployment rate in this country is 23%. Cheerleading and packaging the data in a way to mislead the public does not change the facts:

- There are 242 million working age Americans. Only 142 million Americans are working. For the math challenged, such as CNBC analysts, that means 100 million working age Americans (41.5%) are not working. But don't worry, the BLS says the unemployment rate is only 8.3%. Things are going so swimmingly well in this country the other 33.2% are kicking back enjoying the good life.

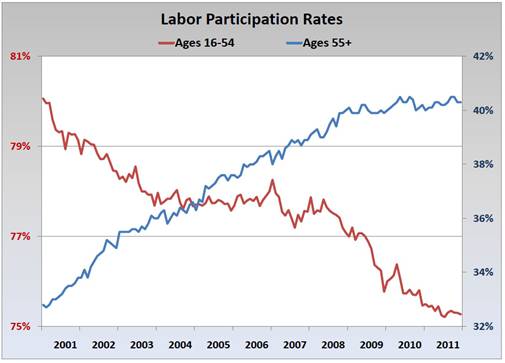

- The labor force participation rate and employment to population ratio are at 30 year lows. The number of Americans supposedly not in the labor force is at an all-time record of 87.9 million. A corporate MSM pundit like Steve Liesman would explain this away as the Baby Boomers beginning to retire. Great storyline, but the facts prove that old timers are so desperate for cash they have dramatically increased their participation in the labor market.

- The data being dished out by the government on a daily basis does not pass the smell test. The working age population since 2000 has grown by 30 million people. The number of people working has grown by only 4.7 million. A critical thinker would conclude the unemployment rate should be dramatically higher than the reported 8.3%. But the government falsely reports the labor force has only increased by 11.8 million in the last eleven years. They have the gall to report that 17.9 million Americans just decided to leave the workforce. The economy was booming in 2000. It sucks today. Don't more people need jobs when times are tougher? The Boomers retiring storyline has already proven to be false. The fact that 46 million (15% of total population) people are on food stamps is a testament to the BLS lie. A look at history proves how badly the current figures reek to high heaven:

- 2000 to 2011 - Not in Labor Force increased by 17.9 million.

- 1990's - Not in Labor Force increased by 5 million.

- 1980's - Not in Labor Force increased by 1.7 million.

- 74% of 16 to 19 year olds are not employed

- 85% of black 16 to 19 year olds are not employed

- 31% of black 25 to 54 year old men are not employed

- 40% of 20 to 24 year olds are not employed

- 22% of 25 to 29 year old males are not employed

- 22% of 50 to 54 year old males are not employed

- According to the BLS, 11% of men between 25 and 54 are not in the labor force

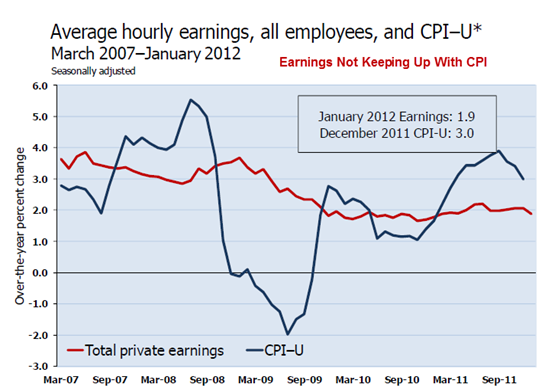

Not only is real unemployment at Depressionary levels, but those that do have jobs are falling further and further behind. Wages have gone up less than 2% in the last year and have been rising at an annual rate below 3% for the last four years. According to our friends at the BLS, inflation has risen 3% in the last year. This is almost as ludicrous as their unemployment rate. Anyone living in the real world, as opposed to the BLS model world, knows that inflation on the things we need to live has been rising in excess of 10%. It is a fact that if you measure CPI exactly as it was measured in 1980, at the outset of our great debt inflation, it exceeds 10% versus the fake 3% reported without question by the MSM to a non-thinking public. A poor schmuck making the median salary of $25,000 who gets a 2% raise thinks he has $500 more to spend when in reality he has lost $2,000 of purchasing power. Federal Reserve created inflation is an insidious hidden tax that destroys the 99%, while enriching the 1%.

Until Debt Do Us Part

“Insanity is doing the same thing, over and over again, but expecting different results.” - Albert Einstein

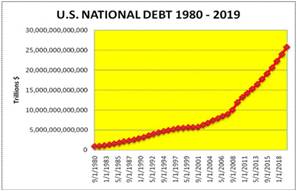

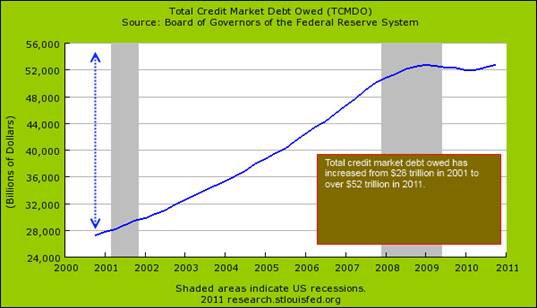

The recovery storyline being touted by the oligarchy of politicians, bankers and media is designed to make consumers feel better. This is a key part of their master plan. Any honest assessment of the financial disaster that struck in 2008 would conclude it was caused by too much debt peddled to too many people incapable of paying it back, too few banks having too much power, the Federal Reserve keeping interest rates too low for too long, and that same Federal Reserve doing too little regulating of the Too Big To Fail Wall Street mega-banks. I wonder what Albert Einstein would think about the "solutions" rolled out to fix our debt problem. Would he find it insane that total credit market debt has actually risen to an all-time high of $53.8 trillion, up $533 billion from the previous 2008 peak? Our leaders have added $6.1 trillion to our National Debt in the last four years, a mere 66% increase. This unprecedented level of borrowing certainly did not benefit the American people, as real GDP has risen by $96 billion, or 0.7%, over the last four years.

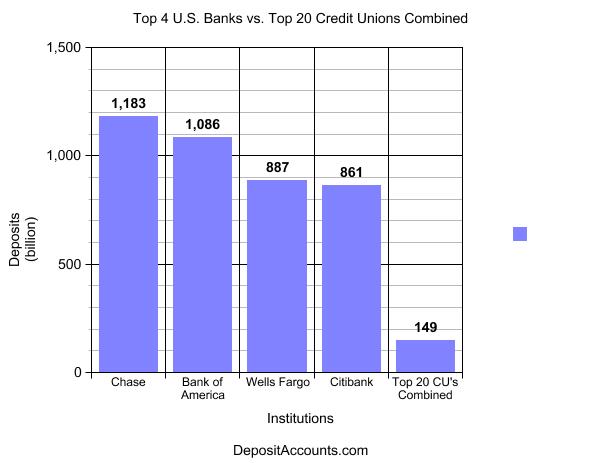

Would Einstein find it insane that the governing elite would encourage the 4 biggest banks, that were the main culprits in creating a worldwide financial collapse, to actually get bigger. The largest banks in the U.S. now control 72% of all the deposits in the country versus 68.5% in 2008. The Too Big To Fail are now Too Bigger To Fail. Rather than liquidating the bad debts, breaking up the insolvent banks, selling off the good assets to well-run banks, firing the executives, and wiping out the shareholders & bondholders foolish enough to invest in these badly run casinos, the powers that be chose to protect their fellow .01% brethren and throw the 99% under the bus.

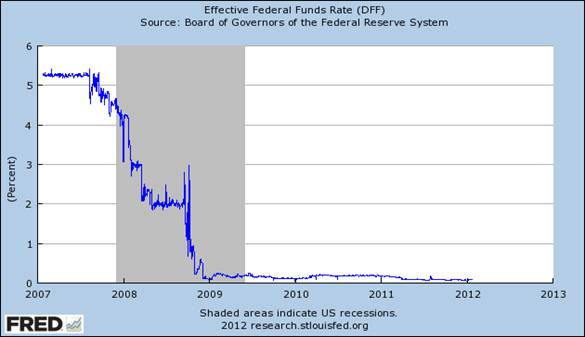

Ben Bernanke, in conjunction with Tim Geithner and his masters on Wall Street, implemented a zero interest rate policy designed to enrich the Wall Street banks, force investors into the stock market, and encourage Americans to borrow and spend like it was 2005 again. Rather than accepting that our economy has been warped for decades, with over-consumption utilizing debt as the driving force, and allowing a reset, the Federal Reserve insanely encouraging banks and consumers to do the same thing again. We do know Bernanke has stolen $450 billion of interest income going to savers and senior citizens and handed it to Jamie Dimon, Vikrim Pandit, Lloyd Blankfein and the rest of the Wall Street cabal. The "austerity is bad" storyline is pounded home on a daily basis by the politicians, corporate chieftains, Wall Street billionaires, and MSM pundits. The definition of austere is "practicing great self-denial". Did you see the mob scenes on Black Friday? Americans are incapable of any self-denial, let alone great self-denial, and the masters of our country will not allow it to happen. One look at our GDP figures confirms the non-austerity occurring in this country. In 2007, prior to the collapse, consumer spending accounted for 69.7% of GDP. Today, consumer spending accounts for 71% of GDP, with investment accounting for 12.7% of GDP. In the good old days of 1979 prior to the epic debt bubble, when the financial industry do not run this country, consumer spending accounted for 62% of GDP and investment accounted for 19% of GDP. What an insane concept. You spend less than you make and save the difference. You then invest that money where you can get a reasonable return (.15% in a money market account is not exactly reasonable).

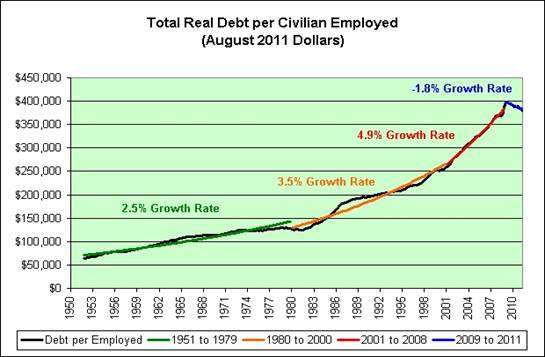

As Ludwig von Mises pointed out, a false boom created by credit expansion will ultimately collapse. We had the chance in 2008 - 2009 to voluntarily abandon the Wall Street induced credit expansion and allow our country to reset. The pain and misery would have been great, especially for the 1% who own most of the stocks, bonds and peddle the debt to the ignorant masses. As you can see in the chart below, the powers that be need debt per employed American to grow at an ever increasing rate to maintain their power and wealth. The miniscule reduction in debt from 2009 to 2011 was unacceptable. The governing powers will not be satisfied until von Mises' final currency catastrophe is achieved.

Bernanke and his Wall Street puppet masters' plan is actually quite simple. It's essentially a confidence game. A confidence game (also known as a con, flim-flam, gaffle, grift, hustle, scam, scheme, or swindle) is an attempt to defraud a group by gaining their confidence. The people who commit such tricks are often known as con men, con artists, or grifters. The con man often works with one or more accomplices called shills, who help manipulate the mark into accepting the con man's plan. In a traditional confidence game, the mark is led to believe that he will be able to win money or some other prize by doing some task. The accomplices may pretend to be random strangers who have benefited from successfully performing the task. Bernanke and the 1% are the con men. They are attempting to defraud the 99% by convincing them their "solutions" will benefit them. The shills acting as accomplices are Wall Street bankers, bought off economists, politicians, journalists, and mainstream media pundits. You are the mark. The game has multiple facets but is based on more freely flowing low interest easy debt. The con man has reduced interest rates to zero at the behest of his puppet masters. The Wall Street accomplices offer enticing financing to the marks for big ticket items like automobiles, furniture and electronics. As the marks go further into debt, the Wall Street shills report record earnings ($26 billion from loan loss reserve accounting entries), consumer spending rises and GDP goes higher. The mainstream media accomplices dutifully report an improving economy. The government accomplices massage the employment and inflation data and declare a jobs recovery with no inflation. The marks are supposed to feel better about the future and spend even more borrowed money. This is what is considered a self-sustaining recovery by the psychopaths running this country.

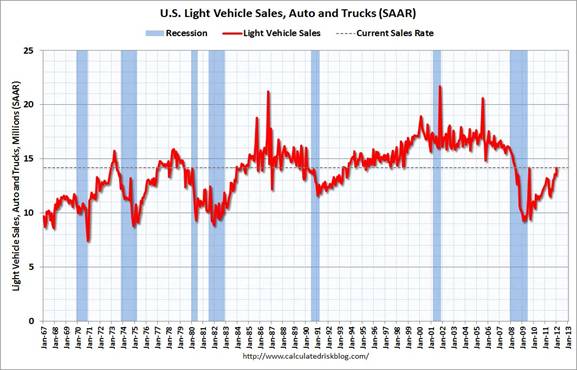

All you have to do is open your daily paper to see the confidence game in full display. Last week the MSM reported another surge in automobile sales. Our beloved American automobile manufacturers are back baby!!! Automobile sales are now pacing above 14 million on an annual basis. This is up from the depths of the recession in 2009 when the annual rate was below 10 million. We've breached the Cash For Clunkers level and there is nowhere to go but up. The storyline is that Obama was right to save GM and Chrysler with your tax dollars. They are now making splendid vehicles (except for the exploding Chevy Volts) and employing millions of Americans. This is a true American comeback success story. Clint Eastwood should do a commercial about it.

There is one little problem with this storyline. It's bullshit. Remember GMAC? You bailed them out when all their subprime auto and mortgage loans went bad in 2009. They have a brand new business plan. Change your name to Ally Bank and start making as many subprime auto loans as possible. You will be happy to know that according to Experian, 45% of all auto loans being made today are to subprime borrowers. What could possibly go wrong? In addition, the average loan term has grown to almost 6 years. Executives at Ally Financial said that subprime car lending had become "very attractive" because profit margins on the loans more than cover the cost of expected losses from borrowers who fail to repay what they owe. I'm sure they have everything completely under control. Gina Proia, a company spokeswoman, said the company places "greater emphasis on the higher end of the nonprime spectrum" and only lends to people who show they can pay. I can't believe they are restricting their loans to only people who they think can pay. I'm surprised Obama isn't condemning them for such restrictive loan terms. If you open your paper to the auto section you will see financing offers of $0 down-payment, and 0% interest for 7 years across the board on most models. But why buy, when you can lease a luxury automobile for $300 per month? It is simply amazing how many vehicles you can "sell" when "credit challenged" Americans can rent them for seven years. I wonder if this explains why I see dozens of $40,000 luxury autos parked in front of $25,000 dilapidated hovels during my daily commute through West Philadelphia. It also seems the Big Three are "selling" a few extra vehicles to their dealers in January as pointed out by Zero Hedge. No need to let a few facts get in the way of a feel good story.

- Ford month-end inventory 86-day supply at end of Jan. (492k vehicles) vs 60-day supply (466k) as of Dec. 31

- Chrysler had 83-day supply (349k units) end of Jan. vs 64-day (326k units) as of Dec. 31

- GM month-end inventory 89-day supply (619k units) vs 67-day supply (583k) Dec. 31

The facts prove the issuance of billions in easy credit is creating the illusion of recovery. Non- revolving (auto & student loans) consumer credit outstanding is now at an all-time high of $1.7 trillion. Even with billions in bad debt write-offs since 2009 the amount outstanding has risen by $100 billion. Does this sound like austerity is gripping the nation? The Federal government is dishing out student loans like candy, as hundreds of thousands of students get worthless degrees from for-profit diploma mills like the University of Phoenix and its ilk. By keeping them occupied in school, the government is able to keep them in the Not in the Labor Force category. Not to be outdone, our friends at GE Capital, Wells Fargo and the other too big to fail entities have been doing their part on the revolving credit side of the scam. I've recently been seeing an ad by the largest U.S. furniture retailer, Ashley Furniture, offering 0% interest with no payments for 7 years. I don't know about you, but my kids destroy a couch in less than 7 years. Wells Fargo Credit doesn't seem too worried. A critical thinker might ask, how can Wells Fargo possibly make money offering these terms? But there is the rub. Ben Bernanke is loaning Wells Fargo money at 0% so they can perpetuate the confidence game. These insane bankers truly believe they can kick start this moribund debt saturated economy by issuing billions more in debt to people incapable of repaying them. Einstein would be amused.

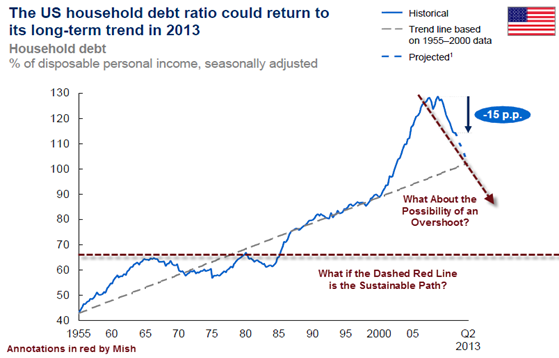

The McKinsey Group put out a report a couple weeks ago analyzing the amount of American household debt and optimistically concluding that it could be back on a sustainable path by 2013. Mike Shedlock pointed out that sustainable is in the eye of the beholder. It seems the bright fellows at McKinsey haven't grasped the concept of regression to the mean. First of all their analysis is flawed because real disposable personal income is actually declining and Ben Bernanke's master scam is working and Americans are now adding to their household debt. The little blue line has turned upwards since they gathered their data. Secondly, as Mish so accurately points out, the sustainable level of household debt is really at the levels prior to the debt bubble that began in the early 1980s. That is a debt level of approximately 70% of disposable personal income, as opposed to the current level of 110%.

The implications of household debt levels regressing to their long-term mean would be catastrophic to the 1%. Their kingdom of debt would come crashing down. Their power and wealth would be swept away. This is why it is so vital for them to create the illusion of recovery. Their confidence game is built upon an ever increasing flow of credit expansion. It will not work. There is no avoiding the final collapse of a boom created solely by credit expansion. Those in power will never voluntarily relinquish their grand game of pillaging the wealth of the nation, so economic collapse will be the ultimate result. They will continue to use propaganda, printing presses, and half-truths to further their agenda. But those who examine the facts will come to a logical conclusion that we are being sold a great lie.

“Half the truth is often a great lie.” – Benjamin Franklin

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2012 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.