Monday Financial Markets Madness – What’s This Greece Thing?

Stock-Markets / Financial Markets 2012 Feb 06, 2012 - 09:57 AM GMTBy: PhilStockWorld

NOW Greece is going to matter?

NOW Greece is going to matter?

Just when we were planning to get bullish, the Futures are off half a point as concerns about Greece, of all things, come back to the forefront as pretty much the entire country is poised to strike this evening on the expected news that even stricter austerity measures will be jammed down the throats of a Nation that is already suffering from 20% unemployment.

Greece's debt is "only" 159.1% of their GDP – that's just lunch money to Japan and you don't see anyone worrying about them, do you? Portugal's debt to GDP ratio has gone from 106.5% to 110.1% last quarter but the year before it was at 91.2% so let's look on the bright side and say their debt acceleration is slowing. Ireland also "only" rose to 104.9% (not 105%!) from 102.3% and that's much slower than the run from the previous year's 88.4%, which is about where the UK is now (85.2%) and that's below the EU average of 87.4% so bravo Britain and all that!

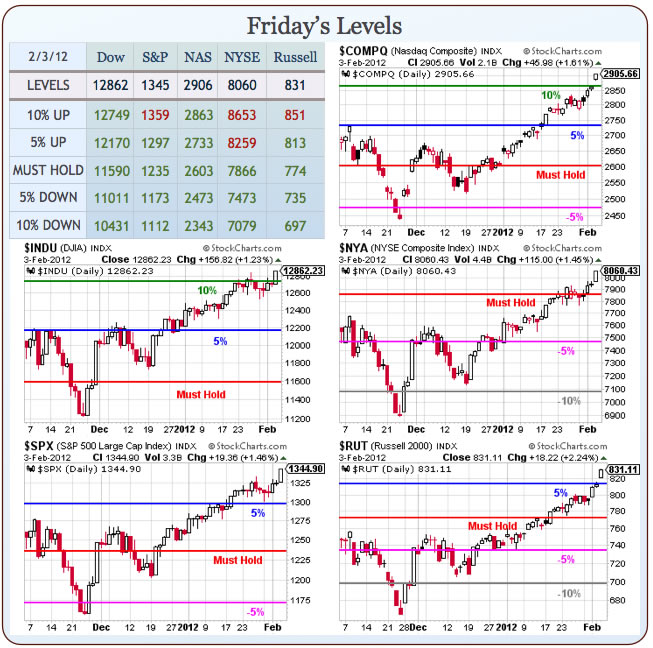

As I said to Members in this morning's Chat, I am resolved to only look on bright side of the news until we fail to hold our technical breakouts at Dow 12,749, S&P 1,333, Nasdaq 2,863, NYSE 7,866 or Russell 815 – as long as those hold up, we are beyond the reach of news gravity and should all do our best to ignore all that silliness going on on Earth and just concentrate on which stocks don't have p/e's of 100 yet so we can keep buying along with the crowd.

Looking at our Big Chart, we certainly have an impressive-looking breakout and far be it for me to point out it came at the expense of a weak Dollar so, unless you were 100% in stocks and gained along with the S&P faster than the Dollar fell, you probably had a net loss of wealth during this "rally" as the declining Dollar decimated the value of everything else you worked to build over your entire life but, hey – look at that S&P go!

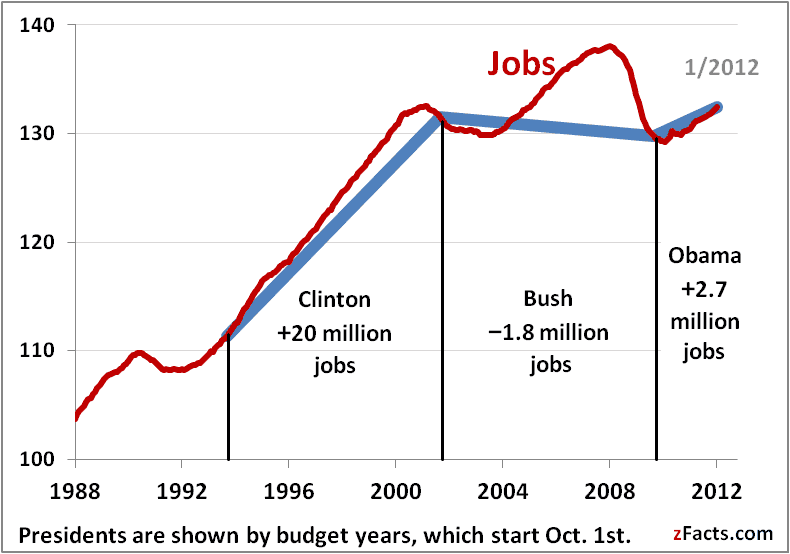

Jobs are also on the march, unless you listen to Rush Limbaugh and the rest of the Conservative Media's spin on the subject. The last thing the Right want's to see is Americans going back to work – especially during an election year when they are trying to get voters to return to the good old day's of the last decade and not endure the horror of another 4 years of Democratic job creation. If this keeps up, workers may actually want raises or – gasp! – benefits…

Reports are that the BOE is set to launch QE3 of $75Bn this week, bringing their total QE up to $500Bn, which is a very impressive 20% of their entire economy – on par with our own Fed dumping $3.2Tn on the markets – which does just so happen to be the Fed's official balance sheet, actually. Our own Treasury needs to borrow another $140Bn this month to keep the lights on and we have 3 and 6-month auctions at 11:30 this morning, 1-month and one-year auction at the same time tomorrow followed by a 3-year auction at 1pm.

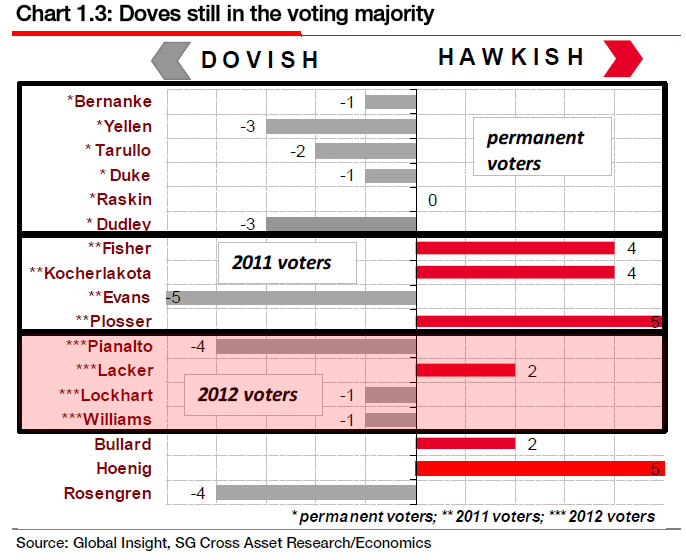

Tomorrow we also hear form Lacker, Lockhart, Fisher and Sack (VP of NY Fed) in an orgy of Fed-speak which will be followed up on Wednesday by Uncle Ben himself at 10 am, then a 10-year auction at 1pm and then Sack again after hours followed by Lockhart, who speaks again on Thursday at 12:40 – just ahead of the 30-year note auction at 1pm. We went long on TLT off that $116 line on Friday as we have faith in our Fed doves to talk up TBills into the auctions.

It's a very boring data week with Consumer Credit tomorrow along with Small Business Optimism and Michigan Consumer Sentiment on Friday but nothing else of note so the attention should be all on Greece and earnings. Since either Greece will pass a debt deal and Athens will be in flames tomorrow or Greece will not pass a debt deal and Europe will be in flames tomorrow – I am liking those TLT longs (we picked up the weekly $115 calls for $2)!

It's a very boring data week with Consumer Credit tomorrow along with Small Business Optimism and Michigan Consumer Sentiment on Friday but nothing else of note so the attention should be all on Greece and earnings. Since either Greece will pass a debt deal and Athens will be in flames tomorrow or Greece will not pass a debt deal and Europe will be in flames tomorrow – I am liking those TLT longs (we picked up the weekly $115 calls for $2)!

That's all the news we want to look at as we need to maintain a positive mental attitude if we are to go bullish at this, the former top-end of our range. Our bullish premise rests on Greece being fixed, Portugal not immediately becoming the next crisis, the rest of Europe finding a bottom, ignoring Japan's debt issues, a soft landing in China and strong growth in America with inflation while the rest of the emerging markets keep inflation in check.

What, us worry?

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.