Gold, Stocks and Euro Fall As Possible Greek Debt Default Looms

Commodities / Gold and Silver 2012 Feb 06, 2012 - 09:23 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,717.00, EUR 1,315.31, and GBP 1,090.85 per ounce.

Gold’s London AM fix this morning was USD 1,717.00, EUR 1,315.31, and GBP 1,090.85 per ounce.

Friday's AM fix was USD 1759.50, EUR 1,335.48, and GBP 1,110.66 per ounce.

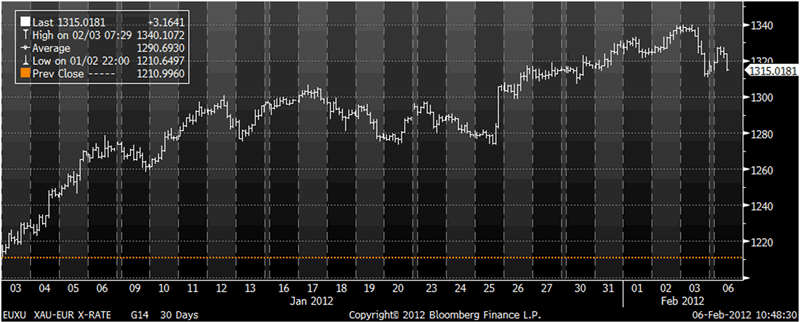

Gold has followed the now familiar trading pattern of gains in Asia followed by weakness in Europe. While gold has fallen and is weaker in most currencies gold remains higher in euro terms due to euro weakness on the concern of a Greek default.

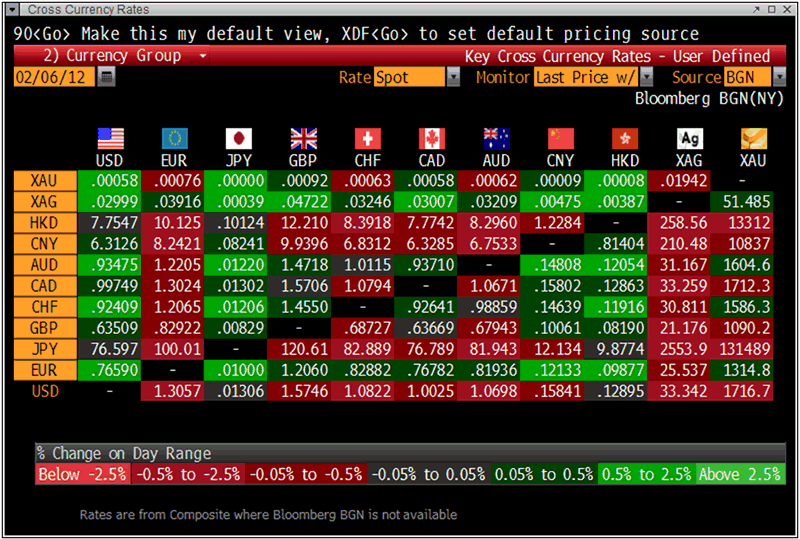

Cross Currency Table – (Bloomberg)

Spot gold bounced back in Asian trading Monday as investors snatched up bargains after a 2% dip the previous session. The Greek debt debacle is still supporting the price as a deal remains elusive.

There continues to be concerns of a “Lehman moment” but markets remain fairly sanguine of a positive outcome despite the continual risk of a Greek default.

At 11.00 GMT German industrial orders will be published for market watchers. The US jobs data surprise released Friday boosted equities but bullion recorded its largest daily fall in a month.

XAU-EUR Exchange Rate – 30 Days (Bloomberg)

Gold remains an essential diversification as central banks keep money loose with record low interest rates and Asian powerhouses China and India still drive demand.

Silver has also fallen this morning. Barclays Capital, who have been quite bearish on silver in recent years, say that they are “expecting prices to rise in the next few sessions, along with gold, pegging silver's next resistance level at $35.70/oz and support near $33/oz.”

NEWSWIRE

(Bloomberg) -- Gold holdings in exchange-traded products backed by the precious metal expanded for a fourth day on Feb. 3 to 2,385.664 metric tons, data compiled by Bloomberg show. The assets are within 0.3 percent of a Dec. 13 record.

(Bloomberg) -- Hedge-fund managers and other large speculators increased their net-long position in New York gold futures in the week ended Jan. 31, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 171,359 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 29,136 contracts, or 20 percent, from a week earlier.

Miners, producers, jewelers and other commercial users were net-short 209,862 contracts, an increase of 30,094 contracts, or 17 percent, from the previous week.

(Bloomberg) -- Zimbabwe’s mining ministry has raised license fees by as much as 5,000 percent, the state-controlled Sunday Mail said, citing a government decree.

Registration of diamond mining licenses, known as claims, will rise to $5 million from $1 million, while an application for a platinum mining license has increased to $500,000 from $200, the Harare-based Sunday Mail said on its website. Should the application be successful, the license to operate a platinum mine will climb to $2.5 million from $500, the Sunday Mail added.

The increase in fees, published by the government, has been criticized by both small-scale and large-scale miners, the Sunday Mail said.

Zimbabwe has the world’s second-largest platinum reserves after neighboring South Africa.

(Bloomberg) -- Nationalization of platinum assets, a 50 percent windfall tax and a reduction in royalty taxes were recommended by a study ordered by South Africa’s ruling African National Congress, City Press reported, citing the report.

The windfall tax of up to 50 percent should be imposed on superprofits, which the report defined as a return on investment of 22 percent, in return for investment in infrastructure and a reduction in the overall tax rate, the Johannesburg-based newspaper said. Royalty taxes should be cut to 1 percent from 4 percent and platinum, regarded as South Africa’s sovereign resource, should be nationalized through “targeted interventions,” according to the study, City Press said.

(Bloomberg) -- Sudan is expected to earn $2.5 billion from gold exports this year, President Umar al-Bashir said at a Cabinet meeting today in Khartoum, the capital.

The increased income from the metal will help offset the decline in revenue from oil exports following the secession of South Sudan last year, Bashir said.

(Bloomberg) -- Harmony Gold Mining Co. Chief Executive Officer Graham Briggs said gold may average $1,850 an ounce in the company’s fiscal year through June 30 and could rise to $2,000 around the end of calendar 2012.

(Reuters) - Harmony Gold, South Africa's third-largest bullion miner, cut its full-year production target by 13 percent on Monday, as safety stoppages threatened to crimp a surge in profit from record gold prices.

Harmony, which more than doubled its second quarter earnings compared with the first quarter as it reaped the benefits of a weak rand and a sky-high gold price, said shutdowns because of fatalities could take some lustre off its future output.

South Africa's government has been clamping down on miners to cut their accident rates, leading to lower output. Mines are usually shut down for several days at a time following a fatality.

(Reuters Global Gold Forum) - Bullion prices may be slightly down at heel today but HSBC's outlook is sharpening the bull's horns: "Two by products of the global financial crisis are declines in investor confidence and eroding trust in the financial system and government policies. The climate is conducive to investors to re-establish and build long positions in the bullion market."

SILVER

Silver is trading at $33.40/oz, €25.61/oz and £21.21/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,606.25/oz, palladium at $691/oz and rhodium at $1,400/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.