Gold Bull Market Bigger than Ever

Commodities / Gold and Silver 2012 Feb 03, 2012 - 06:14 AM GMTBy: Jan_Skoyles

We recently wrote about the difference between gold’s price and its value, demonstrating a significant difference between the two. We asked many fundamental questions which show whether or not the gold price is proximate to its value. The answer was it was not.

We recently wrote about the difference between gold’s price and its value, demonstrating a significant difference between the two. We asked many fundamental questions which show whether or not the gold price is proximate to its value. The answer was it was not.

Late last year we wrote of the on-going ‘Gold Wars’ between so-called industry experts and gold investors. We repeatedly found ‘experts’, who write in the mainstream media, were calling the end of the gold bubble whenever the price of gold dipped slightly.

For many commentators, the rapid increase in the price of gold over the last decade has led them to conclude that we must be coming to the end of the gold bull market. However, as we pointed out, those that are bearish on gold are failing to look at the fundamentals which drove the gold price upwards in the first place.

Our friend Ronald Stoeferle has emailed us some compelling evidence which suggests the gold bull market is far from over. In fact, his work shows that gold is still significantly undervalued.

Rather than looking at the nominal prices, Mr Stoeferle has decided to carry out comparisons against monetary aggregates and other asset classes. This is key in gold price analysis as it puts the price of the metal into perspective alongside fundamentals which are heavily influenced by both monetary policy and confidence in the economy.

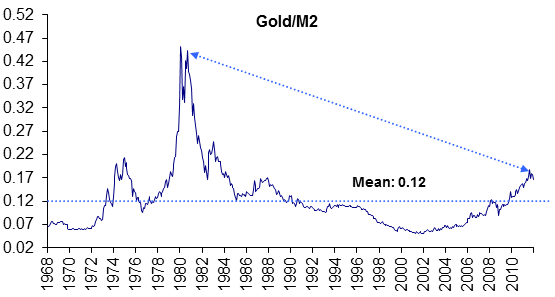

Measuring gold price against M2 money supply

The first chart shows the Gold/M2 ratio. The ratio currently trades at 0.16, which as Mr Stoeferle points out:

- Is nowhere near the ratio at which the last bull market ended in 1980 which traded at 0.47

- Bull markets do not end ‘around the long term median, they end in extremis’

In order to reach a similar ratio to that seen in 1980, gold would now have to rise to more than $4,500.

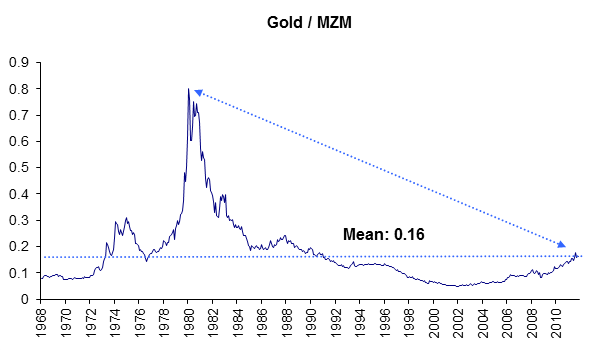

Measuring gold price against the MZM supply

MZM, the Money Zero Maturity measure, measures the liquid money supply in an economy. For some countries it is the preferred money supply as it measures the money which is readily available in the economy.

This demonstrates the difference between the value of gold and the money supply as even more extreme version of the earlier graph; the ratio of gold price to MZM is trading at the long term mean of 0.16. This again, is significantly off the 1980 ratio of 0.8.

Mr Stoeferle states that in order for the 1980 ratio to be matched today, the gold price would need to increase to $8,500.

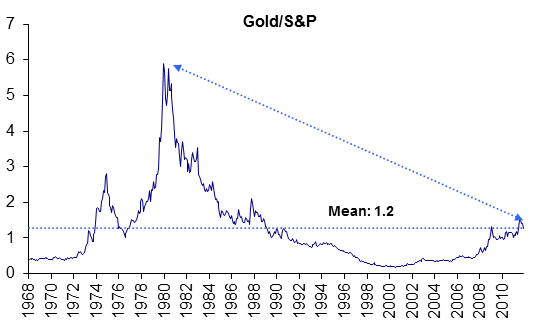

Measuring the gold price against the S&P 500

As is clear from the graph, the current gold/S&P ratio is only just above the long term mean of 1.2. In order to reach the 1980s ratio of 6, the gold price (again, according to Mr Stoeferle) would have to reach in excess of $8,500.

Is this gold bull the same as the last one?The last bull market ended in 1980 at a peak of $850. Are the fundamentals which both drove the gold bull market and stopped it in its tracks the same for today?

We don’t think so.

In the years prior to 1971, when the dollar had operated on a gold exchange standard, individuals were savers. They had faith in their currency. However, when gold was removed from the dollar, there was little reason to save. In the US, the CPI increased to 15% after the removal of the gold exchange standard. Add to this the issue of the oil shocks, ailing stock markets and loss of purchasing power in other currencies.

As Ferdinand Lips states in Gold Wars, ‘It was not surprising that Americans started to vote by buying gold in whatever form they were legally allowed to do so.’

The reason the gold bull market peaked at $850 is due to Paul Volcker, Chairman of the US Federal Reserve, increasing the interest rate to 20%. This gave stability to the US Dollar at home and improved exchange rates on the international currency markets.

Is our situation today a mirror image of that seen in the 1980s? Back then inflation was rampant, as it is today (unofficially). Back then, the stock markets were shaky, as they are today. Back then, currencies are losing the trust of the international market, as they are today.

Greater extremes for gold investment

But the extremes of today are much greater than in the 1970s, currency imbalances especially.

For a start, the participants in the global marketplace were only represented by the Western World. We looked at this previously. In the 1970s the USSR, India, South America and China were not the significant players they are today. Their roles have now expanded to such a degree that the number of players in the global market has increased tenfold and there is ten times more currency in circulation.

We are now a far more integrated market place. With much more paper money; controlled by governments, who like this easy money as it means they can promise lots of things their countries cannot afford.

Back in 1980 there was no Eurozone crisis, no repeat rounds of quantitative easing, no trillion dollar government debts and the real interest rates were positive.

Do we think there is a chance of Bernanke, or the ECB, or the Bank of England inflicting a Volcker flavoured medicine on the US economy? No, we don’t. With news last week of the Fed’s decision to keep interest rates at a minimum for the next two years, and with rumours of QE3 just around the corner, the Volcker treatment does not seem likely.

This gold bull can only get bigger

The gold price is climbing because of a loss of confidence in the fiat money system – as we looked at previously with Detlev Schlichter, confidence is the only thing which backs such money.

2011 did not end brilliantly for gold investors according to the mainstream commentators, but it still ended 14% higher than the previous year. At the time of writing the yellow metal is sitting comfortably above $1700. It has responded to Federal Reserve reassurances of further money printing and low interest rates, as it should have – by going up in price and demonstrating its role as a safe haven.

As Mr Stoeferle demonstrates, the gold price needs to go much, much higher in order to even begin to match 1980 levels, and even then the situation today is much, much worse. The gold price rising is merely the monetary system resetting itself from a state of imbalance that is far greater than in the 1970s.

Our thanks to Mr Stoeferle for sending us his graphs and analysis.

- Read Ronald Stoeferle’s In Gold We Trust report here

Are you worried about the imbalances in the global monetary system? Learn how to invest in gold and silver.

Jan Skoyles contributes to the The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals.

The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power.

© 2012 Copyright Jan Skoyles - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.