Stock and Financial Markets Crash is Coming, Key Signs of Reversal

Stock-Markets / Financial Crash Feb 03, 2012 - 05:41 AM GMTBy: FNN24

2012 has begun with a bang for risk assets and there is no doubting the rally. Never trade your bias. You may want the markets to crash for the cause of the crisis that the world faces, but markets were never created to reflect the reality. It is a facade and there are rules of the game. If you obey the rules unwavering, you will make money. FNN24 in association with Deutsche Boerse provides real time news and FNN24 traders provide quant based trading analysis.

2012 has begun with a bang for risk assets and there is no doubting the rally. Never trade your bias. You may want the markets to crash for the cause of the crisis that the world faces, but markets were never created to reflect the reality. It is a facade and there are rules of the game. If you obey the rules unwavering, you will make money. FNN24 in association with Deutsche Boerse provides real time news and FNN24 traders provide quant based trading analysis.

We provide a part of the premium analysis here which cover both Macro and Technical analysis.

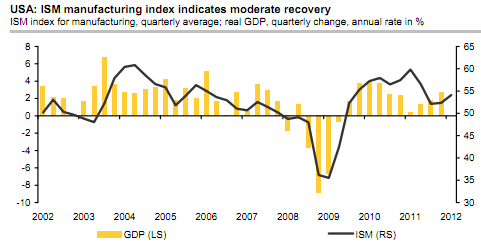

US Manufacturing

The ISM index for manufacturing increased to 54.1 in January from a downwardly revised 53.1 (originally reported as 53.9) that reflects new seasonal factors. This level is the highest since June and consistent with a moderate expansion. The consensus was a gain to 54.5. The increase parallels the positive trend in other manufacturing surveys. Only the Chicago PMI decreased in January, but from an exceptionally high level. Details were somewhat mixed: Production declined 3.2 to a still-high 55.7, possibly on the phasing out of incentives for capital expense items at the end of 2011. The forward-looking new orders component gained 2.8 to 57.6, the highest since April. The employment sub-index slipped 0.5 to 54.3. Outside the components of the headline index, new export orders were up another 2.0 to 55.0. The solid increase in foreign demand puts fears about negative spillovers from the global economy into perspective. Also on the positive side, the backlog of orders index increased 4.5 to 52.5, indicating a greater backlog for the first time since May. On the other hand, the indices on both own inventories and customers’ inventories increased in January, reflecting the recent build-up in stockpiles which may damp future production. In sum, the report indicates that the manufacturing sector continues to improve, consistent with a moderate expansion of the overall US economy (chart).

China PMI

China’s manufacturing PMI, a general indicator of the overall Chinese manufacturing and industries sector, failed to beat expectations and fell to its lowest level since February 2009. The June figure came in at 50.9, lower than a surveyed 51.5 and previous 52.0. A reading of above 50 means the sector is expanding, while a figure below 50 would indicate a shrinking manufacturing economy.

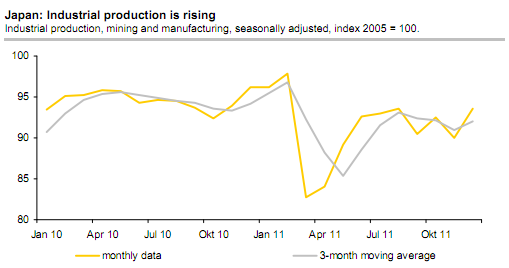

Japan Industrial Production

Japanese industrial production was up considerably in December 2011, by 4.0% monthon-month. The downtrend, which had been in place since mid-year, seems to have come to an end. Stable domestic demand and sufficient energy supply should continue to support industrial output. As a result, overall growth will probably be more dynamic during the first half of the year.

Following a decline in November, industrial manufacturing and mining output was up strongly in December, by 4.0% month-on-month. This outcome exceeded expectations Corporates believe that production will rise by another 2.5% in January. The industrial sector is well on the way towards offsetting the drop in production seen after the floods in March 2011. The rise in output was mainly supported by the automotive sector and electronic information and communication devices.

Following the disaster in March 2011, the Japanese industry quickly recovered some of the losses at first. However, the trend (three-month average) pointed downwards from mid-2011 (see chart). Industrial production was dampened by a slowdown in important export countries and by the yen appreciation. Later, the floods in Thailand interrupted supply chains and weighed on industrial output. The recent, strong data seem to have put an end to the downward trend. We expect industrial output to rise further in the next few months. In particular, reconstruction activities after the floods should generate stable domestic demand. Sufficient energy supply and the rebuilding of supply chains should ensure adequate production capacities.

While analysts across are negative on Japan, the corporates in Japan are richest in the world in terms of Net Debt levels. Every major block of Yen buying over the last 5 years has been led by a major Japanese corporate in a bid to protect and hedge their sales. This even while BOJ has solde over USD 50 bn worth of Yen.

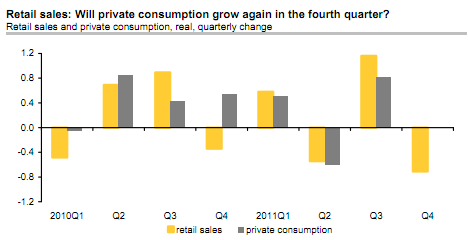

German Retail Sales

German retail sales surprisingly declined in December, by 1.4% month-on-month. In real terms, Christmas retail sales were even down year-on-year in 2011. Nevertheless, private consumption probably increased in the final quarter of 2011. Consumption should continue to support German growth in the coming quarters.

What conclusions can be drawn for private consumption as a whole? On average, retail sales were down 0.7% quarter-on-quarter in the fourth quarter. However, there is no 1:1 relationship between retail sales and overall consumption. After all, retail spending by private households amounts to less than one-quarter of overall consumption. We believe that private consumption continued to rise slightly in the fourth quarter. The palpable increase in employment and significant wage growth should make sure that private consumption stabilises the German economy in 2012; we expect consumption to grow by an estimated 1.25%.

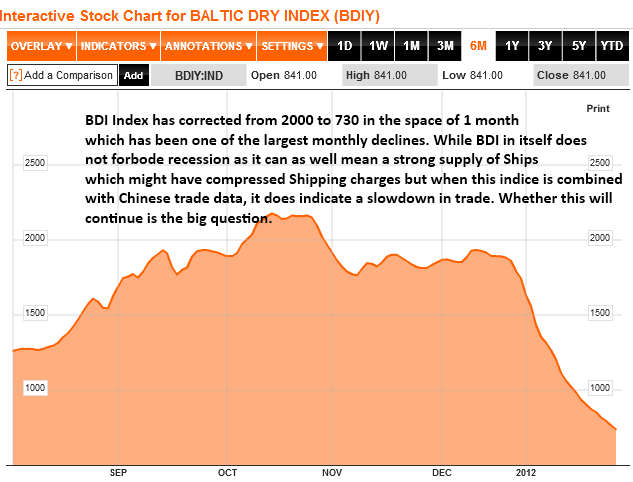

BDI Index

On the technical front, Bond market and FX charts are analysed here.

Bond markets

German Bunds

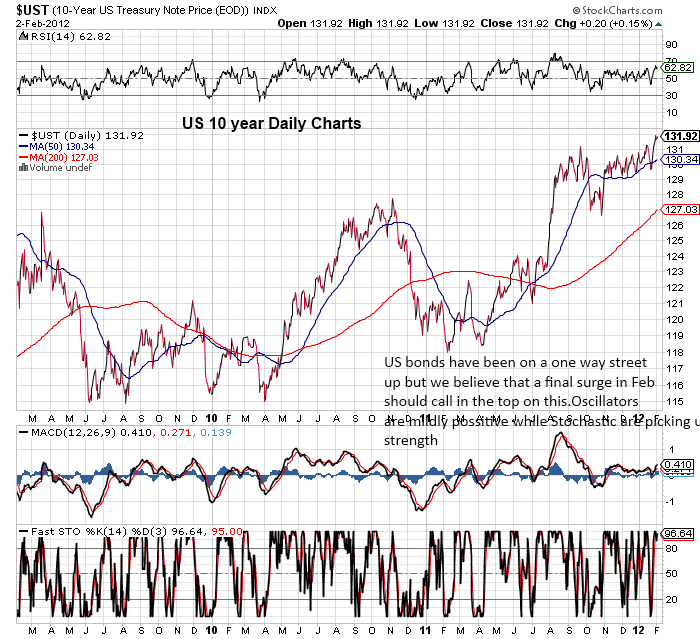

US 10 Year price

Dollar Index

Oil

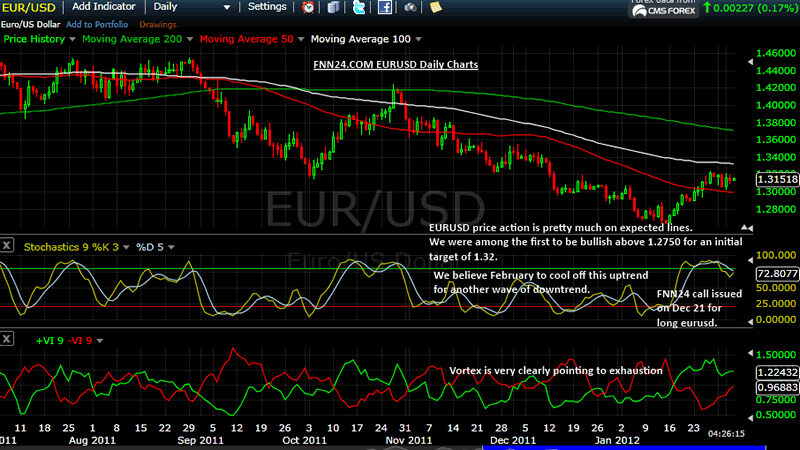

EUR/USD daily charts

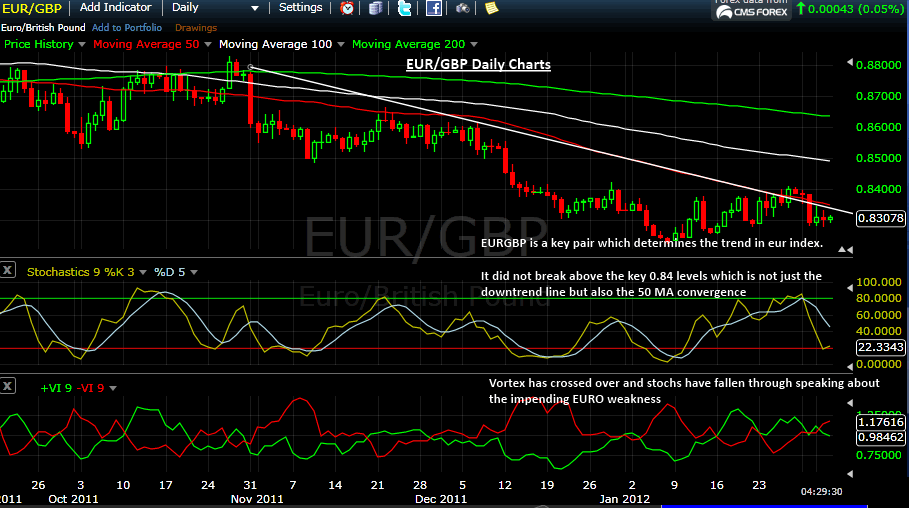

EUR/GBP daily charts

AUD/JPY

Strong bunds and falling yields have made YEN more powerful than any currency. AUD is the king of risk trades. When two titans meet, the outcome will decide the dominant trend. Needless to say the winner here till now is still the YEN. AUDJPY on the charts above needs to take out 82.3 level which we expect to be taken out in 2012 (in keeping with our premium analysis dated 30 Jan 2012), is facing immediate headwinds as it fights of at 81 levels.

Trivia

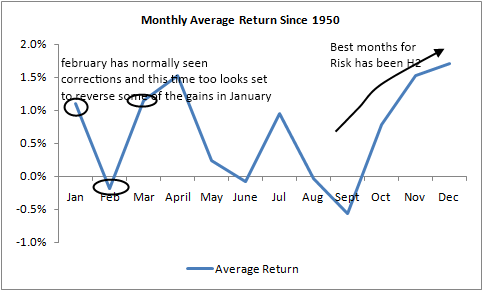

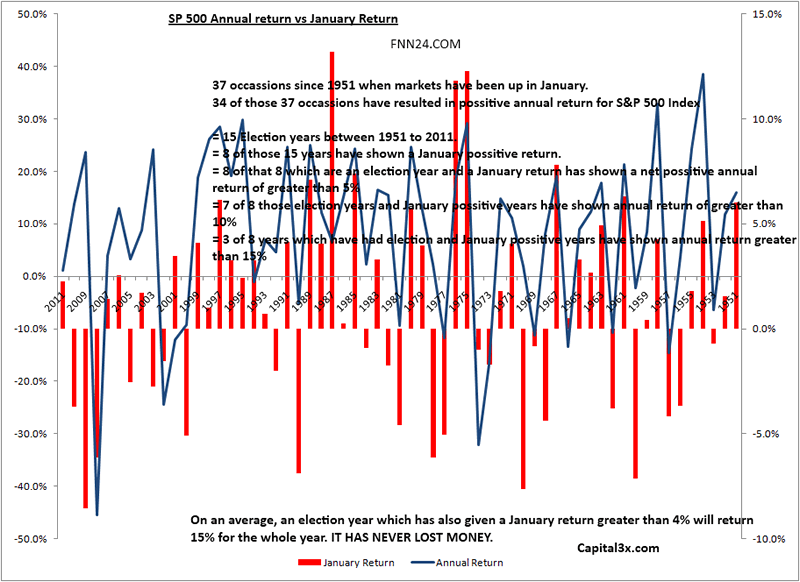

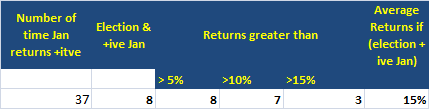

There has been a total of 37 times when the markets have been up in January. Elections have been held in 8 such years when January returns have been positive. Every time of those 8 years, markets have been up more than 5% for the year, 7 times it has been up over 10% for the year and 3 times it has been up over 15%.

On an average, when the January return is positive, markets have closed 15% positive for the year. More importantly, the markets have never even lost money in a election year when January returns have been positive.

FNN24 is premium FX trading group which provides premium FX and futures trading signals to retail audience. In association with Deutsche Boerse, FNN24 provides real time Forex and trading news. We provide timely, relevant, and critical insight for market professionals and those who want to make informed investment decisions. It is not just news but news analysis, linking breaking news to the effects on capital markets. The credibility for delivering mission-critical information has been built over three decades. The quality and experience of MNI’s 60 journalists in 12 bureaus across America, Asia, and Europe truly set us apart from other news sources. In addition to news, we also release weekly research reports on bond and FX markets.

Please check products page

Mark

Head of Research FNN24 Singapore, Mumbai, London, NY Home

URL: http://www.fnn24.com

FNN24 provides real time news bullets and economic indicators with sub second latency helping the retail trader with contextual mission critical information/data. Never miss another trade due to delayed data.

Bio: Head of Research, FNN24 a 24 hour news bullet service for the retail trader providing economic indicators with sub second latency. Never miss anothe trade due to delayed data.

© 2012 Copyright FNN24 - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.