The Gold Price and Gold Investment

Commodities / Gold and Silver 2012 Feb 01, 2012 - 04:03 AM GMTBy: William_Bancroft

In this article Will Bancroft takes a look at an issue central to gold investment, and one that is so often underappreciated by those yet to invest in gold; the difference between value and price. Investors often pay too much attention to the gold price, and forget that the most important thing is actually the value of gold. Read on to understand why it is value you should weigh up before deciding whether to buy gold.

In this article Will Bancroft takes a look at an issue central to gold investment, and one that is so often underappreciated by those yet to invest in gold; the difference between value and price. Investors often pay too much attention to the gold price, and forget that the most important thing is actually the value of gold. Read on to understand why it is value you should weigh up before deciding whether to buy gold.

After appreciating that to invest in gold is to preserve one’s capital and purchasing power before chasing any potential capital appreciation, investors need to understand another critical issue within gold investment.

Investors often ask if the fact that the gold price has risen by over 6 times since 2000 means that this gold bull market cannot go much further. The short answer is no, but to understand this means understanding the different between judging gold investment simply by the gold price, or by the actual value of gold.

Gold price versus the value of gold.

There is a great difference in investment between price and value.

To worry that now is a bad time or too late to buy gold just because the gold price has done so well since 2000 is to misunderstand gold.

The accusations of gold being in a bubble tend to focus on the fact that the gold price has soared, but forgetting the reasons that sent it higher are still in evidence.

Demand for gold investment increased at the beginning of this millennium because investors perceived gold to be undervalued relative to the integrity of the monetary and financial systems. The gold price was around $250/ounce, and some thought this undervalued the metal of kings against the contemporary fiat money system.

There were a few far sighted investors calling the start of this bull market at the turn of the millennium, and they vary in how they decide that gold is undervalued or not.

How to value gold?

Gold is money, and has been for around 6000 years, and gold investors tend to balance the price of gold against previous inflation adjusted gold prices and against the alternative monetary system that we currently have. This modern purely fiat system has only existed since August 1971 when President Nixon closed the gold window.

For the sake of brevity we will use US dollar examples, which is not bad thing considering that America continues to manage (mismanage?) the reserve currency of the world.

Let’s start with a look at the inflation-adjusted gold price over recent decades. We need to remember that to do this we have to rely on inflation statistics, which are a political tool. Government statistics of inflation often underreport that extent of price rises. We should not be surprised about this, governments as large debtors are keen to see the value of their liabilities diminish, and inflation eases their obligations. It suits governments not to openly admit how their irresponsible financial practices are eroding our purchasing power and standard of living.

For this reason how inflation statistics are calculated has been altered by Governments over time. The USA’s Bureau of Labour Statistics (BLS) has altered the meaning of the CPI (Consumer Price Index) over the last few decades, and now the CPI cannot be regarded as a measure that reflects the standard of living enjoyed by Americans. The actions of the BLS have been reflected by the actions of Government bureaus around the world.

Gold investment and inflation

As we have mentioned before, the best inflation statistics for investors to use for the USA are produced by John Williams of shadowstats.com.

At the peak of the last gold bull market on January 21st 1980 the gold price hi $850/ounce. Using the BLS’s inflation figures, the inflation adjusted high of 1980 would give a gold price today of around $2,500/ounce. However, using the methodology that the BLS used in 1980 to calculate this inflation adjusted high, this calculation would give us an implied gold price of around $8,500/ounce.

Doing the same calculation for silver, which topped $50/ounce in the 1970s bull market, also yields some interesting results. Using BLS data we get close to a $150/ounce silver price, and using purer inflation inputs from 1980 we get close to $500/ounce.

Taking a look at the gold and silver price today compared to this suggests a significant amount of relative undervaluation.

Valuing gold against the money supply

The gold price that investors most commonly refer to is quoted in US dollars, and another way to appraise gold’s value is against the supply or stock of these US dollars. Investors should understand that this is a moving target because the money supply can be expanded, or contracted, according to the whims of central bankers.

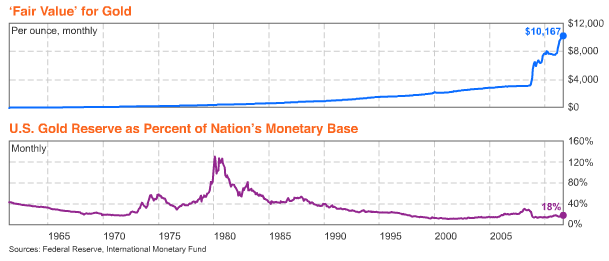

Followers of the gold market may remember Dylan Grice of Société Générale’s research released in September 2011 that suggested that gold’s ‘fair value’ could be $10,000/ounce.

Mr Grice’s charts show the price at which each U.S. dollar would have been backed by an ounce of gold over the last 50 years. The bottom chart represents the value of U.S. gold holdings as a percentage of the US monetary base over the sample period. This percentage was 18% in August 2011, yet US gold holdings peaked at 131% of the monetary base in January 1980.

Mr Grice referred to “a demand for an honest currency”, and that “the last time honesty was perceived to be so scarce – in the 1970s gold mania – the dollar was over-backed by gold. If it happened then, why not again?”

Some analysts prefer other methods to measure gold’s value, and the one touted by legendary gold investor James Sinclair is worth paying close attention to.

Mr Sinclair uses an equation that seeks to compare US external debts against the value of US gold reserves: external debt/US gold reserves= indicative gold price.

What the equation seeks to find is the required gold price for the US Treasury to be able to satisfy its external debt obligations with gold bullion. Using this equation today gives a potential gold price of over $13,500.

These two methods of valuing gold are not the only way, or the perfect way, but they are excellent reference points.

One can use various different numbers for money supply (M1, M2, M3, M4 etc) and inputs, most of which are publically available on the Federal Reserve’s website.

Is it too late to buy gold?

The numbers we have looked at above suggest that gold is still relatively undervalued. This also appears to be the case for silver.

You can also ask yourself questions about the fundamental drivers of the gold price this last 12 years to better appreciate whether gold is undervalued.

- Is confidence in the financial and the monetary systems repaired?

- Are the sovereign debt problems in Europe solved?

- Are sovereign debt levels worldwide still worryingly high?

- How will the US repay its $16 trillion odd debt load without some level of currency dilution?

- Are central banks still printing money and increasing the money supply?

- Is there likely to be more money printing in the future, or less?

- Are real interest rates positive yet?

- Is there greater responsibility returning to the financial system?

If like us you cannot answer any of these questions positively, then the fundamentals of gold investment would seem to still be in place.

Protect yourself from bankers and politicians. Buy gold bullion safely and securely with The Real Asset Company.

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2012 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.