Solution to America's Economic Gridlock Crisis

Economics / Economic Theory Jan 31, 2012 - 07:23 AM GMTBy: John_Mauldin

How do we resolve the current political gridlock over healthcare, the economy, and a myriad of other problems? It is clear that there are no easy solutions, and putting off making choices will just make the ultimate cost we pay that much more expensive.

How do we resolve the current political gridlock over healthcare, the economy, and a myriad of other problems? It is clear that there are no easy solutions, and putting off making choices will just make the ultimate cost we pay that much more expensive.

This week for our Outside the Box we deal with just this question, in a piece from a master of logic and reasoning and one of my favorite writers. I absorb everything I can get my hands on from Dr. Woody Brock. He has written a new book, called American Gridlock: Why the Left and Right are Both Wrong" ( www.amazon.com/gridlock). I am doing something very unusual and giving him two back-to-back editions of Outside the Box, this week and next, to outline his own book in his own words. He generously agreed to do so, as he (and I) are passionate about the topic of getting to a solution. If we do not solve this crisis in the making, it will impair our future generations for a long time, not to mention its effects on our own lives.

I should note to my non-US readers that the principles in this book extrapolate to situations outside our borders, and I suggest you too read this OTB carefully. Gridlock is not just an American phenomenon, but a result of the changing of the way we process information in the age of Big Data. From this piece:

"Regrettably, what has happened in recent years is that 'pure' inductive logic has been replaced by that bastardized form of data analysis all too familiar from today's Dialogue of the Deaf: As time goes on, each side cherry-picks ever more data to strengthen their prejudiced positions. Thus, positions become ever more shrill. Belief modification and dialectical progress are rarely achieved. In this sense, giving young research associates Excel spreadsheets plus the wealth of information accessible from the internet is proving very dangerous to informed debate. 'Factoids' are confused with serious logic, and young people are all but clueless about Hume's imperative: You cannot data-crunch your way to the Truth. Ever."

I know some of you will disagree with Woody on certain things, but your disagreement will probably be with his basic assumptions, not his reasoning thereafter. What he is talking about is akin to some things I studied way back in the day, but that have fallen from fashion –as Woody points out.

Coincidentally, Woody will be here in Dallas tomorrow night and Wednesday, and we will break bread (and other culinary delights) at Stephan Pyles' fabulous namesake establishment with Rich Yamarone, and then attend the CFA Forecast Dinner here in Dallas on Wednesday.

You can learn more about Woody and his economic services at www.SEDinc.com, as well as see some of his previous essays. Enjoy your week; I know I am going to enjoy mine.

Your thinking about First Principles analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

American Gridlock

Why The "Left" And The "Right" Are Both Wrong

Commonsense 101 Solutions to the Economic Crises

Dr. Woody Brock

Pessimism is ubiquitous throughout the Western World as the pressing issues of massive debt, high unemployment, and anemic economic growth divide the populace into warring political camps. Right- and Left-wing ideologues talk past each other, with neither side admitting the other has any good ideas, and with no effort expended to seek higher-order policy solutions that entirely transcend the arguments of both the Right and the Left. My new book American Gridlockis an optimist's antidote to this state of affairs, and to today's pessimism. I attempt not only to bridge, but in fact to transcend today's Left/Right divide and arrive at win-win solutions to a host of policy dilemmas confronting the nation. These solutions illuminate a clear path out of today's economic quagmire, a path leading to a much brighter future.

The celebrated economist Nouriel Roubini has aptly summarized the thrust of this new book:

With rigorous logic, American Gridlock identifies five major problems confronting the nation. These range from salvaging today's "Lost Decade," to the unequal distribution of wealth, to preventing bankruptcy from future "entitlements" spending, and to preventing future financial market crises. Woody Brock does not simply offer his opinions about these crises. Rather, he deduces his win-win solutions to each of these from First Principles. It is high time for such a book, especially during an election year.

In this first of a two-part description of the book's themes, I shall discuss the first three of six chapters. The three topics are: (1) How to terminate today's deafening Dialogue of the Deaf between our two political parties — that embarrassing shouting match between Left and Right that has generated gridlock; (2) How to revivify the US economy today, and spare us a so-called Lost Decade; and (3) How to rein in entitlements spending without reducing social services needed by millions of Americans — medical services in particular. In a sequel to this essay next week, I shall confront three other policy challenges: How to prevent future Financial Perfect Storms of the kind that brought the world down in 2008; How not to bargain with China as we have for decades, with the US ending up on the losing side of most negotiations despite possessing about four times the "net power" of China measured correctly within game theory; and finally, What exactly is an "idealized" resource allocation system? By what criteria can we legitimately rank communism versus socialism versus capitalism versus whatever? And more fundamentally, what exactly do we mean when we speak of "fair shares" of income and wealth?

This last topic is my favorite. Amongst other issues, it requires us to make a distinction between true Adam Smith capitalism versus that bastardized form of capitalism so visible today — where K Street has replaced the Invisible Hand of perfect competition with the Visible Fist of money and corruption. Additionally, when we confront the thorny issue of "fair shares," I shall sketch a new theory of social justice that integrates the two fundamental strands of the theory of Distributive Justice: Distribution in accord with workers' Relative Contributions, versus distribution in accord with citizen's Relative Needs. In any satisfactory theory of justice, both these moral norms must find a proper place.

What is perhaps most novel about American Gridlock is the way in which solutions to the various policy problems are arrived at, a point stressed by Roubini: I utilize deductive logic (deductions from First Principles), as opposed to inductive logic (inferences often derived from ideologically-driven data analysis). New and powerful forms of deductive logic are introduced throughout the book, as and when needed. These include game theory, a new theory of "optimal" government deficits, the economics of uncertainty, new extensions of the Law of Supply and Demand, and modern moral theory. The new perspectives these theories make possible become the levers and pulleys that permit the discovery of new win-win policy solutions that transcend today's Left/Right divide, and in so doing help break up policy gridlock.

It is important to understand this point up front, for the over-arching goal of the book is to demonstrate the existence of new win-win policies that can neutralize gridlock in Washington. While some of these new theories will be unfamiliar to many readers of the book, they are introduced in a very relaxed manner, and no mathematics is required. Believe me, no publisher keen to sell books will allow an equation to be seen! To me, these fascinating new theories are all part of the syllabus of the new course I hope to develop when I retire: Commonsense 101.

Chapter 1: Today's Dialogue of the Deaf – And How to End It

In this first chapter, I set the stage for what follows. First, it is shown how the Dialogue of the Deaf is one (but not the only) source of policy gridlock. In Washington, matters have reached the unprecedented point whereby Republican and Democratic congressmen no longer eat at the same restaurants. The news media are characterized by the familiar Left/Right back-and-forth between the New York Times on the Left, and the Wall Street Journal on the Right, between MSNBC on the left, and Fox News on the right. Those classical courses in rhetoric and in debating which inculcated the Socratic Dialogue as a mode of reasoning and discourse have disappeared, and we are now treated to brain-dead shouting matches between warring camps.

Recall that in the Socratic Dialogues of Plato, argument proceeded from initial definitions and assumptions to compelling conclusions arrived at jointly by all those engaged in debate. There is a reasoning process that leads from proposition A to B, B to C, and ultimately to the conclusion Z. Many steps of logic are required as the debate unfolds. In many cases, everyone agrees with the conclusion Z, if and when it is reached. Participants agree because they have been part of the process of preceding from A to Z. Contrast this with today's shouting match between the Left and Right. There is no reasoned dialectic. There are only recycled sound bites that the public increasingly tunes out. Both parties are "prejudiced" in the etymological sense of that word: They have pre-judgedtheir positions, and are rarely interested in modifying their prior positions.

The Two Rivalries Forms of Logic: This logjam is one reason why it is important to discuss the superiority of deductive versus inductive logic —and what could be less fashionable! Going back to Plato and Euclid, the deductive process lends itself to belief modification and consensus agreement as an argument progresses from initial assumptions (First Principles), and ultimately to conclusions. Often, the process linking the basic assumptions to the conclusions is watertight so that, if a participant in the debate agrees with the First Principles, then he or he mustagree with the conclusion. Moreover, by their very nature, First Principles are usually compelling and non-controversial. For example, an axiom of number theory states that, for any number n, there is always a next number n+1. Try doing arithmetic without this helper!

At the most ambitious level of thinking, the goal is to demonstrate not only that there is a solution to a problem that is consistent with First Principles, but that there can be no other solution. This is referred to as the demonstration of "the existence and uniqueness of a solution." In American Gridlock, I demonstrate this procedure by showing that there is a unique policy that can drive national health-care expenditure down as a share of GDP while at the same time increasing the quantity of services provided, and the number of people covered. It turns out you can have your cake and eat it too. The same will be true in the case of a policy that could prevent a Lost Decade right now. Both of these examples are discussed just below.

One reason for today's Dialogue of the Deaf is that deductive reasoning of this kind is neither taught to students in school, nor applied in policy analysis. It has gone the way of the Dodo bird. It has been replaced by a form of data-based inductive logic that I call "bastardized induction." In its broadest form, induction refers to the process of arriving at truths by seeking them in real-world data, data that are transformed and analyzed. Courses in statistics are where students first learn about induction. The root problem of induction was famously identified by the 18th century Scottish philosopher David Hume, Adam Smith's colleague and best friend: No matter how large a sample you have, and no matter how much data you possess, you can never learn the absolute truth as you can via the process of deduction. Seeing ten thousand white swans does not permit an inference that no black swans exist, an inference that all swans are white.

Regrettably, what has happened in recent years is that "pure" inductive logic has been replaced by that bastardized form of data analysis all too familiar from today's Dialogue of the Deaf: As time goes on, each side cherry-picks ever more data to strengthen their prejudiced positions. Thus, positions become ever more shrill. Belief modification and dialectical progress are rarely achieved. In this sense, giving young research associates Excel spreadsheets plus the wealth of information accessible from the internet is proving very dangerous to informed debate. "Factoids" are confused with serious logic, and young people are all but clueless about Hume's imperative: You cannot data-crunch your way to the Truth. Ever.

The Paradox of Information Overload: This last point is directly related to the burden of "information overload" that so many people are now complaining about. Reliance upon inductive logic inevitably leads to the belief that, the more information you have, the better. There is no awareness that "information" is no substitute for serious thought, in particular for the activity of deduction from First Principles.

For example, suppose you were attempting to determine a solution to John F. Nash Jr.'s celebrated bargaining problem: How will two different players with different tastes, endowments, and risk appetites agree to divide a pie (money)? Both players would like all the pie, of course, but they will have to compromise at shares of 50/50, 70/30, or whatever. You seek a formula that can predict what the division of the pie will prevail in any situation. Just think of the vast amount of data you might want to crunch to determine which of 40 possible "factors" best explain bargaining behavior, and thus permit the creation of a good forecasting model of pie division. Think of all the experiments you could conduct to discover the dozen or so variables that really matter!

In doing so, however, you would never possibly conceive of what the Beautiful Mind discovered via the deduction from five axioms of a theory of bargaining completely devoid of any data: There is only one variable that matters to the bargaining outcome—the degree of risk aversion of Player 1 compared to that of Player 2. Nash showed that, the more risk averse one player is relative to the other, the more he will get "bargained down" to accept a smaller share of the pie. No information overload here. The same holds true in much of physics. Just recall the elegant simplicity of the great "laws" of Newton and Einstein, respectively: F = MA and E = MC2. Only three variables in each. No information overload here either.

The irony in all this is the widespread failure to appreciate the complete irrelevance of most of the data now available for problem solving. The great poet T.S. Eliot stressed this point some eighty years ago with his prescient query: "Where is the wisdom we have lost in knowledge? And where is the knowledge we have lost in information?" Bingo!

None of this implies that data per se are irrelevant, as they certainly are not. But their primary role is to permit the testing of propositions that have already been generated deductively.

Origins of Today's Dialogue of the Deaf: The chapter offers several explanations for the triumph of sloppy induction over rigorous deduction, and the Dialogue of the Deaf that has resulted: (i) The culture wars of the 1960s and 1970s in which citizens were forced to choose between "absolutist" alternatives posited as black and white extremes in a very politicized environment; (ii) The decline in teaching students the classics — a rich heritage discarded as the detritus of Dead White Males; (iii) The lifestyle changes and foreshortened attention-spans that have made it increasingly profitable for the media to replace compelling step-by-step analyses with partisan sound bites; and (iv) The advent of spreadsheets and of the internet facilitating "cherry-picking induction" (garnering facts that support yourview), and fostering today's fallacious conceit that it is possible to data-crunch your way to the Truth.

Professors who know better should assiduously remind students that virtually all great scientific advances were all arrived at by geniuses who deduced their theories from First Principles, often with little if any data. Such theories ranging from game theory, to relativity theory, to quantum theory, to information theory, to the concept of the stored-program computer, to defining and measuring "relative power," to the Law of Supply and Demand in economics, and even to axiomatic theories of "fair shares" in modern moral theory.

Terminating Today's Dialogue of the Deaf: The chapter concludes with a series of suggestions as to how to tune down today's the Dialogue of the Deaf and thus end policy gridlock. Here is a sketch of my proposals. First, it must be demonstrated that win-win solutions free of Right-or Left wing biases actually exist. In short, it must be shown that there is an alternative to today's gridlock. Doing so is the primary purpose of American Gridlock. Second, the media and the schools of government must become involved in an effort to hold public officials accountable for today's policies that further and further mortgage our children's future. Along these lines, readers will be heartened and amused by my proposal for a new game of "Gotcha!" that I want to be developed at the Kennedy School of Government at Harvard. I want government officials publically stigmatized not for their sexual and financial peccadilloes, but rather for their "Idiocy Quotients."

These widely publicized Idiocy Quotients would be posted and updated monthly, with a new 1-to-10 Idiocy Scale scoring the extent of damage their policies will do to tomorrow's young, and by extension to America's future. By damage, I mean the dollar value of foregone jobs, income, and social stability. I want TV interviewers and the press in general to hound politicians on such matters — outing them (in the manner of the Amish) for policies that diminish the American future. All this would be part of a strategy to elevate the standards of national debate, and to shift towards forms of reasoning and debate that would lead politicians to adopt win-win policies, once these have been shown to exist.

These initiatives would be augmented by a wholly new Civics course to be taught in high schools, a course aimed at getting students to demand better behavior from their politicians. Don't be cynical. Great progress can be made. Never forget that the invention of double-entry bookkeeping in Genoa over five centuries ago did more to make corrupt businessmen honest than anything else before or after. Investors in an enterprise could finally know where their money was or wasn't going!

Third, I am on the lookout for a Pied Piper to organize the young so that they can gain the voice they currently do not have. This leader will give a voice not only to the Wall Street Occupiers, but to all young people whose future employment and retirement prospects are being shredded by current Washington policies. At present, no Pied Piper exists, but I have identified two young people who might just play this role, and I am backing them.

Consider the following moral scandal of our times: Tomorrow's elderly will regain their lifetime contributions to Social Security over 25 years of retirement (if they live that long) versus less than 5 years for my late father. This is akin to legislating that a woman is one-fifth as good as a man. Or that a gay is one-fifth as good as a straight. Or that a black is one-fifth as good as a white. What is outrageous is that the entitlements policies that lie at the heart of this inequity have been championed by those who call themselves "liberal" and pretend to be concerned with "fairness." In AmericanGridlock, I refer to such mental midgets as "phliberals" (phony-liberals) since a true liberal would surely call for give/get retirement packages equalizedacross generations, not front-loaded in favor of today's elderly. Yes, a Pied Piper is sorely needed, one who organizes the young and makes them fully aware of their diminished future prospects. Want a great stock market tip? Buy shares in those four companies that have a monopoly in manufacturing pitchforks. Not only will your investment soar in value, but having a few pitchforks around the house may well come in handy once the 99% start coming after you.

Chapter 2: Must There Be a Lost Decade of 2011–2020?

The remainder of the book centers on concrete public policies. The second chapter addresses what we can do to avoid a Lost Decade marked by subpar economic growth, excessive fiscal budget deficits, and record-high unemployment for a recovery — especially amongst the young. I first review the Seven Headwinds explaining why growth has been and will remain tepid, notwithstanding the stimulus of the "easiest" monetary and fiscal policy in over half a century.

I next lay down the four "First Principles" or Basic Assumptions that must be satisfied by any policy proposal aimed at preventing a Lost Decade. Finally, I deduce the existence of a unique policy that satisfies these Basic Assumptions. This takes the form of an extended Marshall Plan dedicated to profitable — not unprofitable —infrastructure of a magnitude not previously proposed. And by infrastructure, I do not mean roads, bridges, and potholes alone!

What is perhaps most interesting in this chapter is that, to arrive at a compelling win-win policy proposal, a fundamental rethink is required of what we mean by the term "fiscal deficit," and indeed of fiscal policy itself. I will demonstrate that "deficit" has become a politically charged word throughout the West, but a term that is devoid of any meaning and is thus a poor guide for public policy.

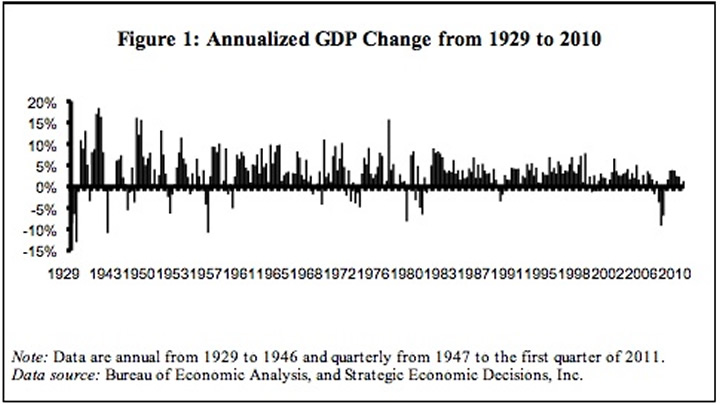

The Seven Headwinds: As is well known, the recent business cycle has been the worst in many decades, as measured both by the aggregate loss of output and by the laggard pace of recovery. Given the extraordinary fiscal and monetary stimulus that were applied to remedy matters, it is unprecedented that, some 30 months into the recovery, GDP has just recently regained its pre-recession output level of 2007. Moreover, the unemployment rate measured most broadly on the U6 scale is still hovering around 15%. Figure 1 puts matters into a long-term perspective. Focus on the structure of recessions and recoveries during the past sixty years.

I identify Seven Headwinds that all but guaranteed the tepid recovery we are experiencing: (1) A depressed labor market, partly due to a very high productivity growth rate exceeding 4% growth during four quarters; (2) Household deleveraging due in part to over-borrowing in the past, and in part to the collapse in the value of their principal asset — their house; (3)Housing industry depression, with the recovery in housing started and in re-hiring laid off construction workers the worst since the 1930s; (4) State and local government contraction of a magnitude never experienced before, with consequences for employment almost as bad as in the construction industry; (5) Lackluster business investment spending within the US, in part due to the absence of an Industrial Revolution like the telecom/internet boom of the 1990s, and partly because of heightened policy uncertainty and its counterpart of corporate risk aversion; (6)High commodity prices and health-care costs, with gas prices, heating oil, and medical costs further weighing on consumer sentiments and budgets; and (7) An inevitable reduction in fiscal stimulus, due in part to growing bond market concerns about 10% deficits, auguring a decade of fiscal drag and austerity.

The Four Basic Assumptions or Goals: Whatever policy is adopted to get the economy moving, it must satisfy these four policy requirements —requirements which play the role of First Principles in our analysis. Like any set of First Principles, these national goals should strike you as being as "reasonable" as apple pie and motherhood are desirable. (1)Much more rapid GDP growth; (2) Much reduced Unemployment; (3) A contented bond market unlikely to go on strike; and (4) Infrastructure reconstruction before our infrastructure "goes critical" which is now expected to start happening in many different areas.

The Policy Solution: I propose that a Marshall Plan sufficiently large to redress our infrastructure crisis (a good $1 trillion per year) is the only solution that achieves these four goals. By infrastructure, I do not only refer to roads and bridges, but to the nation's electric and refinery grid, public transportation, and new modes of delivering medical and educational services. These proposals are fleshed out at length in American Gridlock. Your initial skepticism will probably take the form of two questions: First, does the nation have the physicalresources for an investment of this magnitude — one which can easily show to be "needed"? Second, does the government have the financial resources to fund such a program? Surely it does not. After all, we are told daily that today's deficit without any infrastructure spending must itself be slashed. Like many nations in Europe, we confront a decade of fiscal austerity lest the bond market go on strike, and we suffer soaring interest rates and long-term bankruptcy.

The only problem is that such conventional wisdom is completely misconceived. We can indeed afford proper infrastructure investment of the right kind, and borrowing the required funds need not upset the bond market. To explain all this, I shall excerpt part of a Socratic Dialogue between myself and President Obama appearing in Chapter II of my book.

Economist: The solution lies in redefining the very concept of a "deficit" in a manner that permits a new theory of deficit spending, a theory that applies to the situation in the United States right this minute. When I say "new" here, let me be clear that the basic idea is not so much new as it is currently unrecognized. Out of some 500 op-ed columns on the subject of deficit spending that I have read in the past few years, I have seen perhaps four articles that set forth the basic thrust of this approach. Yet none of these four suggested that the proposed approach to deficit spending could simultaneously solve all four crises that the United States now confronts if it is to avoid a Lost Decade. Nor have I ever seen this approach justified by first principles stemming from the Arrow-Kurz theory of optimal fiscal policy lying at the foundation macroeconomic theory. [This very advanced theory offers a second justification from First Principles of my policy proposals, and is discussed at length in the book.] Mr. President, given the urgency of the U.S. crisis, and given today's strong prejudices against ongoing large fiscal deficits, a very strong justification is needed for what I am going to propose. The Arrow-Kurz theory provides this.

President: Can you explain the main point here in the simplest possible terms? And please be sure to make clear how can the nation afford your highly ambitious plan. There will be many skeptics.

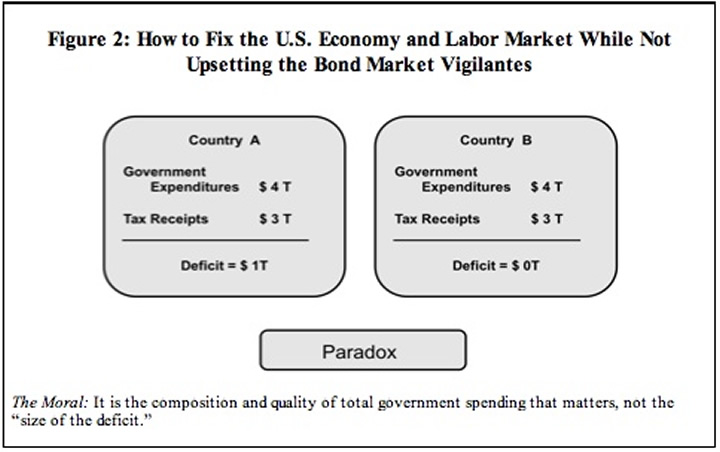

Economist: Yes. Please consider Figure 2, which contrasts the fiscal status of two countries with ostensibly identical deficits. Assume that Country A's government spends $4 trillion on defense, administrative costs, interest expenses on its debt, and transfer payments such as Social Security and Medicare. Its tax revenues of $3 trillion fall $1 trillion short of this $4 trillion, so that the nation runs a deficit of $1 trillion. More specifically, its Treasury Department will have to issue $1 trillion in new government bonds. The expense of servicing this new debt (or repaying it) will fall on tomorrow's taxpayers, who just might renege on it if total debt gets too large. It is this prospect that increasingly worries the bond market.

As the magnitude of total national debt outstanding grows each year because of these marginal additions to total debt (i.e., each year's deficit), a point will be reached where the bond market fears future insolvency, or else a printing away of the debt. As a result, investors will demand higher yields, which crimp the growth rate of the economy, and cause the cost of refinancing the debt to explode. The infamous "debt trap" could soon be reached—a fiscal red hole from which few nations escape. Country A is modeled after the United States, of course, and during 2010–2011 investors worldwide began to question its long-term solvency, especially in light of the inability of both political parties to cope with runaway spending.

President:But what is different about Country B, whose revenues and outlays are identical to those of country A, but which you claim in our figure has no deficit? Is this a trick? Are you the Houdini of macroeconomics?

Economist:Thank you, but no. Country B differs in one regard: of its total $4 trillion in government spending, $1 trillion of this is spent on profitable investments (human capital and infrastructure investments) which are certified by an independent research organization to generate a positive expected return on capital, as calculated by the methods of the modern theory of public finance. The remaining $3 trillion are normal expenditures on defense, interest payments, administrative costs, and transfer payments like Social Security and Medicare. When bond market vigilantes understand this breakout, they see a nation whose unproductive but necessary government spending of $3 trillion is fully matched by current tax revenue ass the figure makes clear. As a result, in Country B there is no deficit from unproductive spending in Country B that does not pay for itself.

On the other hand, the nation is borrowing an extra trillion dollars to invest in projects that are "certifiably productive," as it were, and that pay for themselves over time in the same way that productive capital investments in the private sector pay off. So, overall, no new debt has been chalked up that future generations must service. That is why the figure shows a deficit of zero for Country B. The bond markets are placated, interest rates are not driven up, and large-scale government spending of a disciplined kind continues, thus preventing fiscal drag.

President: I am supposed to think of Country A as America today, and Country B as America the way it could be tomorrow, correct?

Economist: Yes. More specifically, think of Country B as the America that would be, were Congress able to redirect a good chunk of government spending (up to $1 trillion per year) away from existing spending toward productive spending. Historically, such spending included investments in the highway system, the space program, the Internet (known originally as the DARPANET), the interstate highway system, R&D, the Erie canal system, the railroads, the energy grid, water resources (the Hoover Dam), and so forth. Congress is not to cut $1 trillion of government spending as many deficit hawks would like, but which would drag down economic growth and employment. Rather, it is to reconfigure total spending in the manner required to maximize GDP growth, employment growth, and productivity. As a result, there are no net layoffs, and no fiscal drag at all.

President:So your sleight of hand is to introduce two kinds of deficits, "good" and "bad" deficits that differ according to the type of spending that generated the deficit.

Economist:Yes. Emphasis accordingly must shift away from the overall size of the deficit to its composition of good versus bad spending. I am not claiming here that nonproductive spending is bad per se, as it is not. But in the future, such spending must be matched by tax revenues so as to no longer increase "bad debt," the burden on future Americans that rightly troubles bond market vigilantes. This is not true in the case of "good debt" incurred for profitable infrastructure spending that earns a positive rate of return on invested capital.

In American Gridlock, much of the subsequent Socratic Dialogue addresses the President's concerns about ancillary issues such as: What exactly is productive versus unproductive infrastructure investment? How is "rate of return" measured in the case of public as opposed to private investment projects? What kind of decision-making process must be used to identify worthwhile projects, and what can be done to guarantee that decisions are notpoliticized (hint, a new form of international investment bank with foreign investors welcome)? How can we redress the obstacle of NIMBYISM, both by executive orders of the kind President Obama cited in his recent State of the Union address, and by edicts the Supreme Court? (Invoking national security concerns can go a long way here, as was the case in building the Interstate Highway System.) Finally, a much deeper justification of the proposed Marshall Plan is given by utilizing the advanced theory of "optimal fiscal deficits" set forthby Kenneth Arrow and Mordecai Kurz in their treatise on this subject, "Public Investment, Rate of Return, and Optimal Fiscal Policy."

There are two important by-products of the proposed plan. First, the productive nature of the spending will by definition increase the productivity of capital and labor — both good for GDP growth. Second, each dollar spent on profitable investment creates nearly three times as many jobs via "multiplier/accelerator effects" as the same dollar spent on transfer payments (e.g., keeping state employees in their existing jobs).

All in all, it is demonstrated in the book that the proposed Marshall Plan is the only policy capable of satisfying the four policy goals that play the role of First Principles in resolving the Lost Decade crisis.

Chapter 3: Resolving the Entitlements Spending Crisis

The third chapter reviews the coming crisis in paying for tomorrow's elderly, including ballooning costs of Social Security and Medicare. Estimates of the nation's unfunded liabilities for such programs range between $40 – $60 trillion over the next half century. Contrary to what is usually supposed Social Security does not pose that great a problem. As is shown at the end of Chapter 3, there are several ways to render Social Security solvent for the next seventy-five years. A combination of reducing the rate of "indexing" of payments, and increasing the retirement age to 70 will suffice, providing that reforms are introduced very soon.

Far the greater problem lies with exploding health-care costs, currently 18.3% of GDP and likely to rise to well over 30%. This represents near bankruptcy for the nation. President Obama's Reform Act of 2008 represented a path-breaking attempt to bring this beast under control. In particular, he sought to restrain the growth rate of health-care spending, while at the same time increasing "access" to coverage by millions of Americans who are currently uninsured. Subsequently, it has been recognized that, if anything, ObamaCare will raise total expenditure on health care faster than would have occurred without his provisions for cost controls and increased access. In my own view, the verdict is still out on this matter.

Might it be possible that we can have our cake and eat it too in health-care reform, just as we could in redeeming today's Lost Decade? Is there a win-win solution, that is, one that does not require a Left-wing universal coverage system that would bankrupt the nation, or a Right-wing free market solution that would end up providing little if any coverage for the bottom half of Americans? Yes, there is a win-win solution to this problem, one that will please people on both sides of the political aisle. This solution is set forth in detail in the book, and is proved to be the only solution satisfying three Basic Assumptions (First Principles) that most anyone will find compelling.

The Three Basic Assumptions for an Optimal Health-care System: I propose the following three goals for an optimal health-care system:

Goal 1 – Greatly increased access to health care. This will be made possible by greater insurance coverage per person, and by an increased in the number of people covered. This first goal was central to President Obama's plan.

Goal 2 – Greatly increased supply of health-care services provided. This goal is often overlooked, and was bypassed by most provisions of ObamaCare. Yet it must be satisfied as a counterpart of today's emphasis on increases access. To understand why, suppose that all workers receive health insurance supplied by their employers. Suppose in addition that, when a worker calls his doctor for an appointment that he can now afford due to his new insurance, the doctor's phone never answers. Under ObamaCare, this will almost certainly happen for two reasons. First, some 25% of practicing physicians are due to retire in 20 years. Second, new "cost control" provisions lowering doctors' reimbursement rates will drive many doctors out of business. In this event, the lure of "more access" is a red herring. The purpose of my second goal is to require that a far greater quantity services are supplied to match the increase in demand driven by greatly expanded insurance coverage.

Goal 3 – An ultimate shrinkage of total health-care expenditures as a share of GDP: On the surface, the possibility of a greatly expanded health-care sector (greater levels of demand and supply) would seem completely incompatible with reducing the nation's total expenditure on health-care services. Please note that I want to reduce total expenditure in absolute terms, not simply slow the growth rate of expenditure as President Obama sought to achieve. Can we have our cake and eat it to in resolving the health-care crisis? Yes we can.

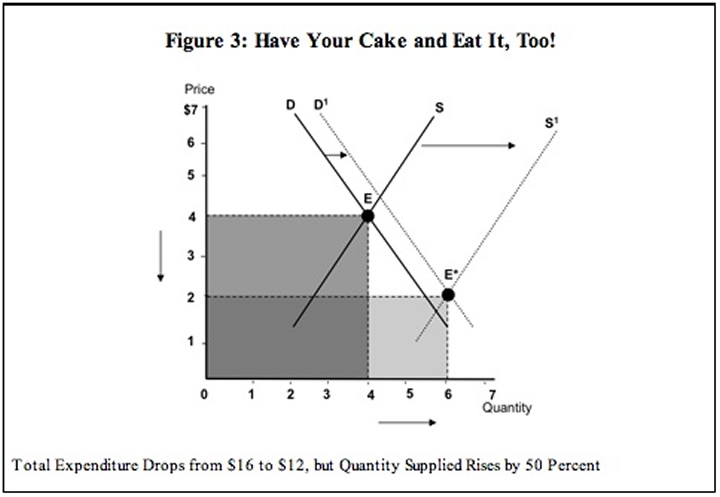

Before demonstrating this result, please recall the true meaning of the law of supply and demand in Econ 101. We are often tempted to predict future market conditions (price and quantities) by stating that supply will increase faster than demand, or vice versa. But to do so is illegitimate and has no meaning. This is because supply (a number like 20 bushels of wheat) will always equal demand, so one cannot increase faster or slower than the other. Thus, the principal lesson of basic microeconomics is that, when we state that supply will increase faster than demand, we mean that the supply curve(a function — not a number) will shift out to the right faster than the demand curve. Or vice versa. Keeping this point in mind, we have:

Principal Result: Goals 1, 2, and 3 can all be satisfied provided the following condition holds true. If it does not hold true, then total expenditure as a share of GDP will rise without bound, eventually bankrupting the nation assuming that the public continues to demand health care. The required condition is that the aggregate health-care supply curve must shift out to the right more rapidly than the aggregate demand curve does. This is true no matter how fast the demand curve might shift out, and no matter how small the difference is between the rate of shift of the supply curve versus the demand curve.

A geometric sketch of the proof of this proposition is provided just below in the context of Figure 3. In studying this, recall that total expenditure — the variable of principal interest to the nation —is always given as the arithmetic productof the price/quantity equilibrium coordinates in any market. If equilibrium (supply = demand) quantity is 12 units, and equilibrium (supply = demand) price is $7, then the total expenditure is 12 x $7 = $94. Total expenditure of any market equilibrium can thus be viewed as the geometric area of the rectangle defined by the coordinates of the equilibrium. Two such areas corresponding to the two equilibria E and E* are depicted as the two shaded areas in the figure.

Sketch of Proof: Think of the two market equilibria shown E and E* as representing the health-care market "before" and "after" new policies are put in place that satisfy our fundamental Supply/Demand condition. The numbers shown for each axis are hypothetical and illustrative. The period shown could represent, say, 15 years. Note in Figure 3 that the supply curve shifts outward far more than the demand curve does over the period in question, as required by our condition. Since the outward supply shift must be greater than the outward demand shift each and every year, by assumption, the cumulative gap between the location of the supply and demand curve grows larger and larger over time.

It is this cumulativegap that is shown in the graph over the hypothetical period of 15 years. Now note that the total expenditure on health care (to be interpreted as a share of GDP) decreases by 25 percent. This is proved by the fact that the area defined by the price/quantity rectangle associated with the new equilibrium is 25% smaller than the area of the initial rectangle. More specifically, the area $4 x 4 = $16 defined by the first market equilibrium drops to $2 x 6 = $12 in the new equilibrium, a 25 percent reduction in total expenditure. Note that this is true even though demand has increased, and even though the quantity of services delivered has increased significantly, as desired, rising 50 percent from 4 to 6 units as seen on the horizontal axis. On the other hand, the price per unit of aggregate service has decreased 50% from $4 to $2 on the vertical axis.

In short, a much-increased quantity of services gets delivered, unit costs to patients and their insurers are lowered, and the total expenditure to the nation decreases. The "proof" here is purely geometric, and only applies to the example appearing in our graphs. But the underlying logic is fully general, as is shown in Appendix B tucked in the back of American Gridlock.

Conclusion: This is the main result showing how we can have our cake and eat it too. But since this result refers to supply and demand in aggregate in the health-care sector, it is necessary to link this over-arching requirement with policy reforms at the micro level. Accordingly, the last part of Chapter 3 explores this macro-micro linkage, e.g., its implications for tort reform, for expert-system automation, and for many other dimensions of health-care reform. The main point is that, whatever the policy being considered in any given micro-market, that policy must ideally cause the supply curve in that market to shift out faster than the demand curve. This provides a wholly novel way in which to assess the myriad micro-reform proposals that appear daily in the nation's newspapers.

Postscript – Lack of Ideological Bias: In this first of a two-part synopsis of American Gridlock, I hope it will have been clear that no use has been made of Left or Right-wing prejudices. How can anyone be against remedies for bringing today's Dialogue of the Deaf to an end? Who can be against a policy for preventing a Lost Decade that solves all four of the nation's greatest challenges in one fell swoop? Who can be against more health care for more people along with a reduction in total health-care expenditure? For one last time, recall that demonstrating the existence of win-win policies of these kinds is the principal goal of this book.

H. Woody Brock, Ph.D.

New York City, NY

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.