U.S. Real Consumer Spending Falls in December

Economics / US Economy Jan 31, 2012 - 03:55 AM GMTBy: Asha_Bangalore

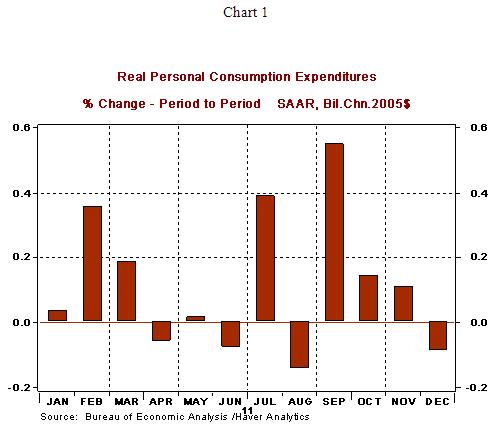

Real consumer spending slipped 0.1% in December after postings in October and November. All major components – durable goods (-0.1%), nondurables (-0.1%) and services (-0.1%) – fell in December and trimmed the pace of consumer spending in the fourth quarter.

Real consumer spending slipped 0.1% in December after postings in October and November. All major components – durable goods (-0.1%), nondurables (-0.1%) and services (-0.1%) – fell in December and trimmed the pace of consumer spending in the fourth quarter.

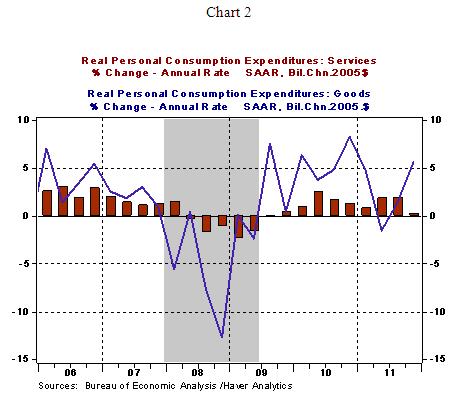

The weakness in consumer outlays on services stands out in the fourth quarter (see Chart 2). Service outlays rose only at an annual rate of 0.2%, while that of goods advanced 5.7%, reflecting a nearly 15% surge in purchases of durables and a 1.7% increase in expenditures on non-durables.

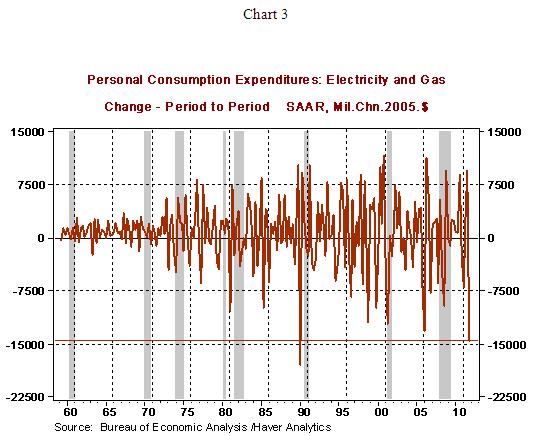

Details of consumer spending indicate that purchases of gas and utilities fell sharply in the fourth quarter (-$14.5 billion) due to atypically warm weather in the entire fourth quarter. As shown in chart 3, the magnitude of the decline in purchases of electricity and gas is an outlier and noteworthy. If outlays on gas and utilities had held steady in the fourth quarter, real GDP would have risen at an annual rate of 3.2% instead of the 2.8% headline.

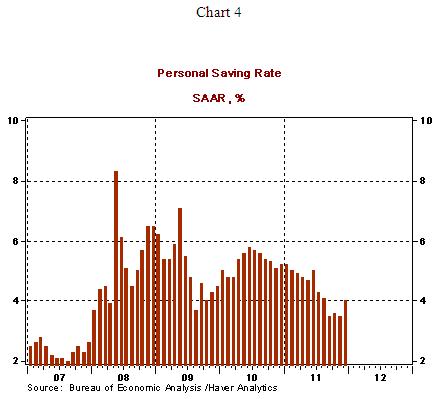

The saving rate of the U.S. economy increased to 4.0% from 3.5% in December, putting the annual average at 4.4% following a 5.3% mark in 2010.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.