Financial Markets Jan 2012 Moves Against Popular Expectations

Stock-Markets / Financial Markets 2012 Jan 30, 2012 - 11:27 AM GMTBy: Capital3X

Set against the backdrop of an entire continent breaking up and the gloom of a world wide recession, the financial markets continue to surprise. When my 70 year old uncle who has never traded the financial markets, tell me that the world is going to fall apart cause of the debt on European countries, we know bears dont have a chance in the near future.

Set against the backdrop of an entire continent breaking up and the gloom of a world wide recession, the financial markets continue to surprise. When my 70 year old uncle who has never traded the financial markets, tell me that the world is going to fall apart cause of the debt on European countries, we know bears dont have a chance in the near future.

What started as a feeble move in 1st week of January has now whip lashed into powerful uptrend on the risk assets with an extraordinary event about to appear on the S&P 500. The 50 DMA is all set to cross the 200 DMA. It has happened more than 12 times since 1990. This is one measure which never lies.

In this update which is a follow up to our premium analysis , we look at political, economic and financial state of affairs as they stand in January 2012.

France: Uncertainties galore

Francois Hollande, the socialist party’s presidential candidate, currently leading in the polls by a significant margin, has published his platform. Its economic content is more skewed towards traditional, statist French socialism than what we expected. Among the issues at stake, the willingness to renegotiate the “fiscal compact” with Angela Merkel is the most immediately concerning, as it may impair market perceptions of swift progress on the new economic architecture of the monetary union. In the medium to long run, the absence of supply-side reforms may question the capacity to bring back French trend growth to 2.0/2.5%, a higher pace than before the recession of 2008, which itself would threaten the sustainability of Hollande’s ambitious deficit reduction program.

Spain

- Spain is responding particularly well to the ECB’s “diagonal” approach. Spanish credit institutions alone account for nearly a quarter of Euroland’s bank debt redemptions coming due in 2012. The resounding success of the last few bond auctions there, which have allowed the sovereign to cover one-fifth of its entire bond issuance program for 2012 in less than a month, can probably be traced back to a surge in domestic banks’ take-up of government securities after being fully reassured about their own funding issues. They seem to be ready to engage in carry-trade.

- Still, even if this casts away any immediate sovereign risk, Spain still needs to do much more on structural issues to assuage market concerns in a lasting fashion. We argue here that the deal reached between the unions and the employers on wage settlements and labour market flexibility is a very significant step forward. We also welcome the first signs of a more radical approach to deficit cutting in the autonomous regions.

- However, progress in these two areas contrasts with continued political indecision on the banking industry. As we have constantly maintained for the last two years, a significant recapitalisation of banks, which in our view cannot be realistically done without additional public sector money, is a pre-requisite to any meaningful recovery of the Spanish economy. Now that the Spanish government seems to be ready to negotiate with the EU authorities a relaxation of the deficit targets for 2012, showing more political commitment to address the banking issues, on top of the progress already seen on structural reform, could be an important element in the bargain.

UK: Sluggish GDP growth masks the real problems

- GDP fell by 0.2% in Q4 last year, slightly weaker than our view of -0.1%. But the surveys (including this week’s CBI report) and sentiment have been more positive recently. Depending on the PMIs at the start of next month we think the MPC could justify further asset purchases of either GBP50bn or GBP75bn next month.

- This week’s public finance figures provided some better news, December being the fourth consecutive month that the budget deficit has fallen relative to a year earlier. However, some of this improvement looks to be due to issues related to the timing of departmental payments.

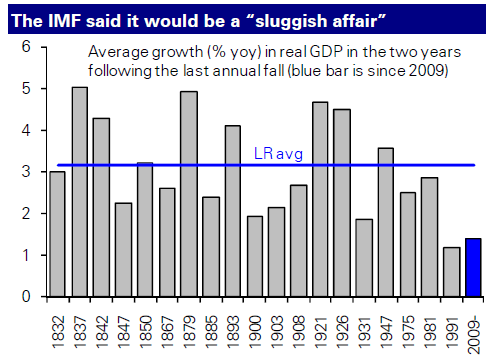

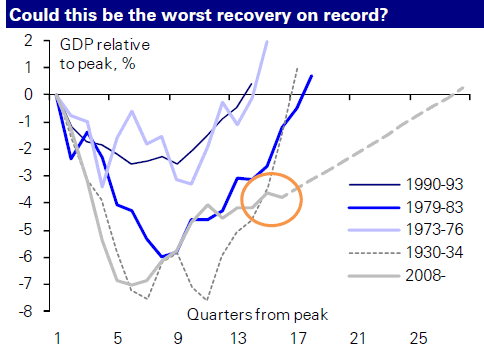

If the recovery continued at this pace, then it would take until the end of 2014 before GDP reached its peak again – in other words, almost seven years to get back to its prerecession peak and the worst recovery on record. This is shown by the grey (actual) and dotted (based on current recovery rate) lines in the chart below.

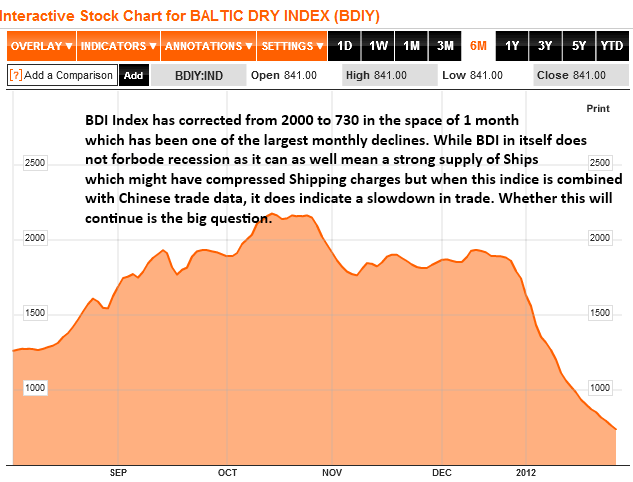

BDI Index

US Durbale goods expand albeit less slowly

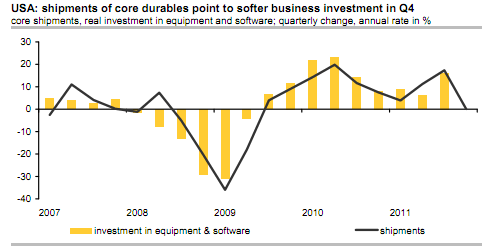

Orders for US durable goods rose 3.0% in December. Likewise, orders for ‘core’ capital goods excluding aircraft increased 2.9%, indicating that the US manufacturing sector remains an important driver of the economic recovery. The durable goods report pointed to strong demand in December, consistent with rising industrial production and the 57.6 reading in the new orders component of the ISM index: Orders increased 3.0%, bang-on our forecast but above consensus expectations of 2.0%. This follows on top of an already strong 4.3% increase in November (revised from 3.8%). Surging aircraft orders contributed to the increase in both months. The details of the report, however, were much better in December. In particular the core category of nondefense capital goods excluding aircraft, a proxy for future investment spending that had posted a 1.2% decline in November, did much better in December (+2.9%). Aside from problems with seasonal adjustment which have tended to push up orders in the last month of a quarter at the expense of the first two months, activity was probably boosted by companies pulling forward investment as favourable depreciation rules began phasing out at the end of 2011. As shipments in the core category directly feed into GDP, they are an indication of investment in equipment and software. Following three straight monthly declines, core shipments increased 2.9% in December, too late to have a big effect on the fourth quarter which is flat on the third quarter (chart). This suggests that business investment has lost momentum towards the end of the year. This may be partly a payback after the surge in the third quarter. Moreover, when taking net trade of capital goods and stronger demand for autos into account, business investment probably still increased by about 4%. We expect capital spending to continue to expand in 2012, although the first quarter should be damped by a pull-back because of the investments that were brought forward to 2011 for tax reason

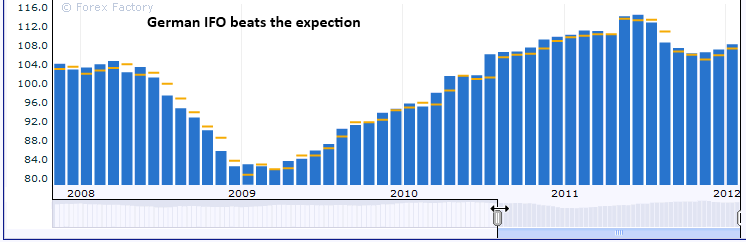

German IFO again beats expectation

The Ifo business climate index rose in January for the third straight month (from 107.3 to 108.3). This important leading indicator thus signals that the recession should end in the spring. The ECB’s three-year tender has done much to reduce the uncertainty emanating from the sovereign debt crisis. Companies have significantly raised their business expectations for the next six months. Their assessment of the current business situation is almost as positive as it was in December. Overall, the business climate has risen especially in the trend-setting manufacturing sector. Survey-based economic indicators are benefiting from the fact that the sovereign debt crisis has calmed quite significantly recently. The uncertainty emanating from the sovereign debt crisis has calmed considerably in the past few weeks.

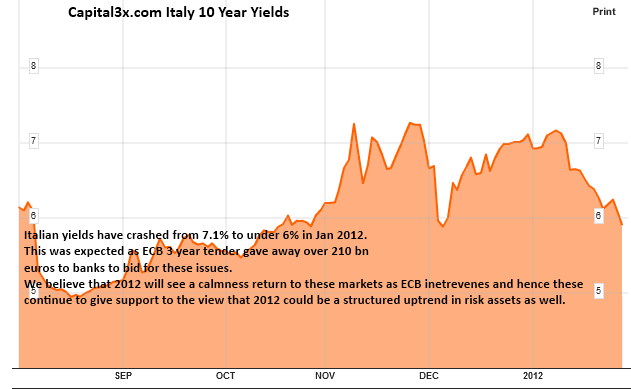

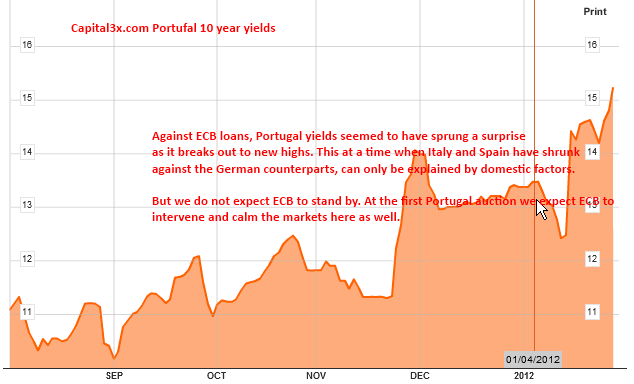

Bond Markets: ECB intervention calms the market

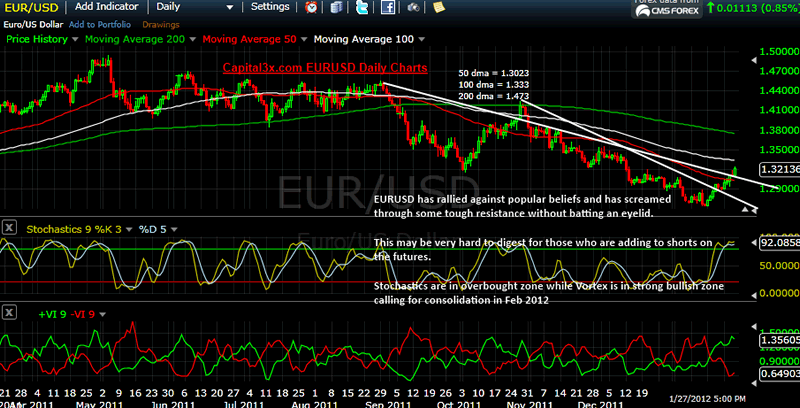

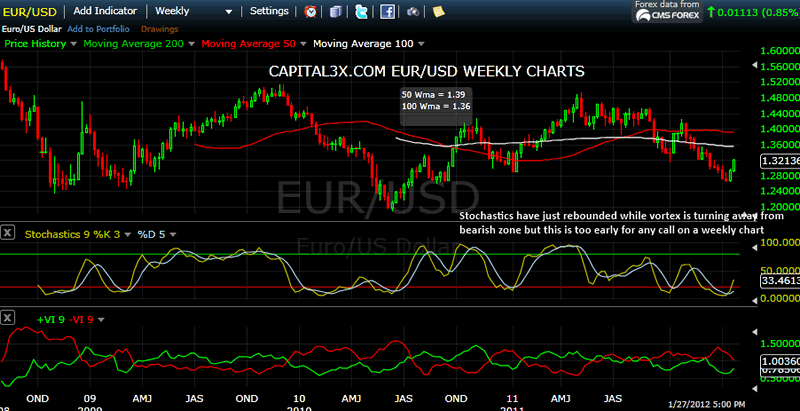

The yields of Italian and Spanish bonds have fallen markedly. But we believe that the ECB has done nothing but magnified the problem down the road rather than solve the core issues.

Forex Markets

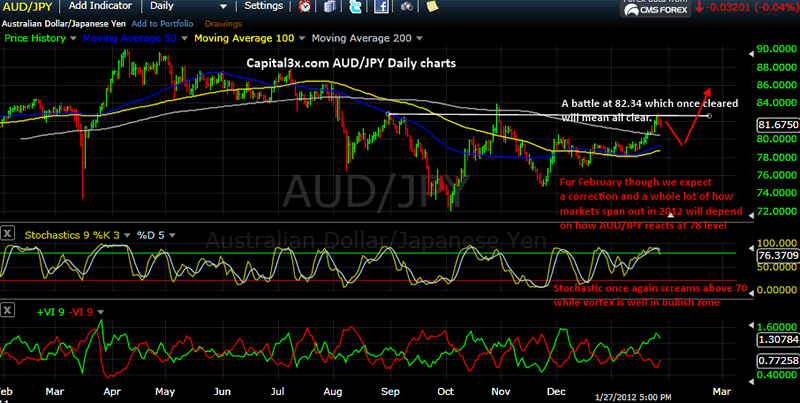

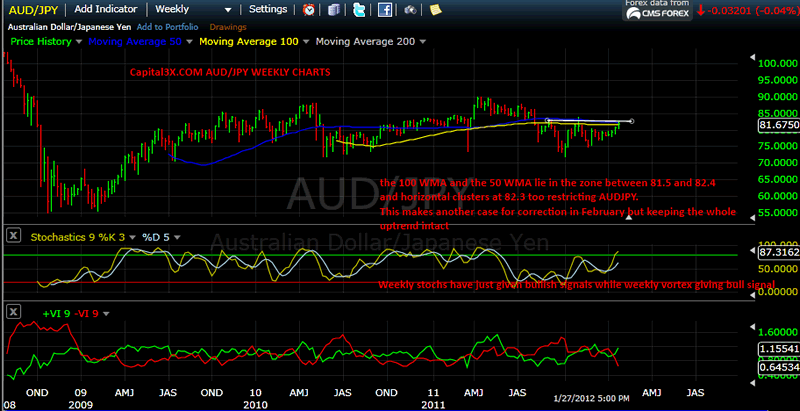

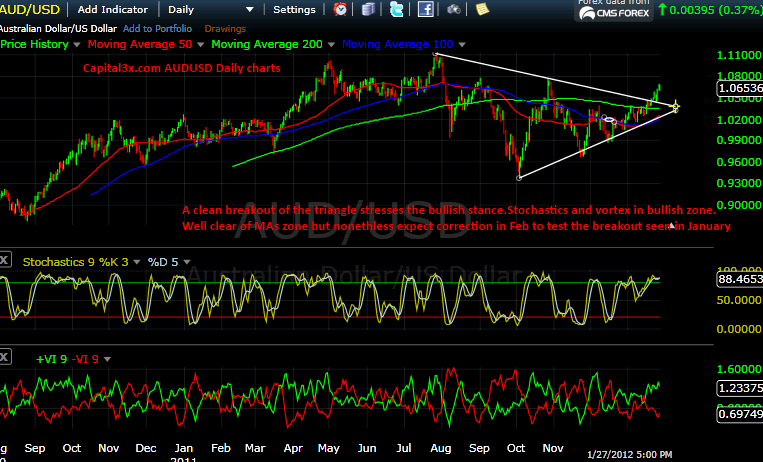

We look at AUDJPY and AUDUSD pair to give us hints to the movements in January and as usual they are our front pairs to test out different scenarios.

Bond Markets

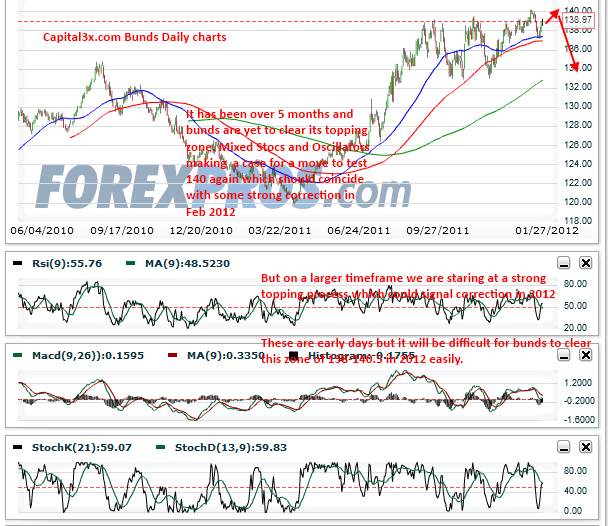

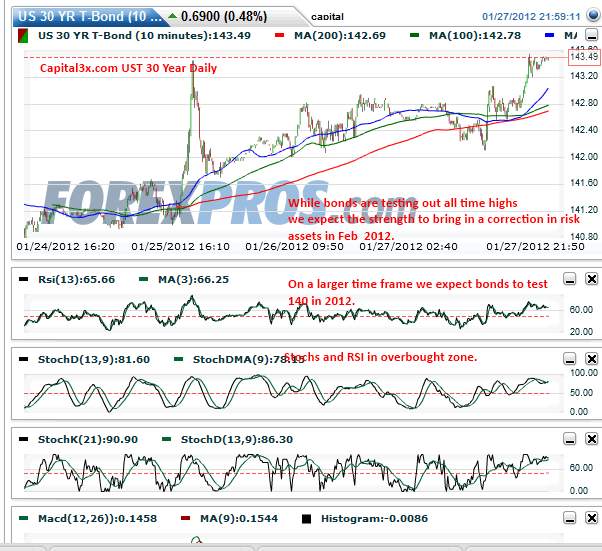

Bunds are topping out and a pattern is being put in place. Once again supports of uptrend in risk assets to continue in 2012.

Conclusion:

- European Update: Francois Hollande, the French socialist party’s presidential candidate, currently leading in the polls by a significant margin, has published his platform. Its economic content is more skewed towards traditional, statist French socialism than what we expected. Among the issues at stake, the willingness to renegotiate the “fiscal compact” with Angela Merkel is the most immediately concerning, as it may impair market perceptions of swift progress on the new economic architecture of the monetary union.

- Spanish sovereign sustainability is highlighted by recent sovereign auction success – helped by the 3Y LTRO, in our view – and was reinforced this week by clearly positive reforms of wage determination. Alongside the signing of Monti’s liberalization decree in Italy, the two big peripherals are making headway with their structural reforms. Still disappointing, however, are Spain’s weak efforts on bank capital.

- UK recovery continue to be lacklustre. The result will be higher deficits and further asset purchases from the Bank of England. The National Bank of Poland has stepped up its hawkish rhetoric significantly. But with labour market indicators deteriorating, evidence of a softer consumer, the boost to growth from trade coming from lower imports rather than higher exports, and continued fiscal consolidation, we retain our call for rate cuts from September.

- Forex markets continue to make a case for a strong 2012 rally based on liquidity but the immediate month (february) is all set to show a strong correction in risk assets as markets consolidate its gains.

- Bond markets have calmed in January with Italy and Spain yield well under control now but Portugal yield continues to tear away. German bunds are topping out but a test of 140 is still left which should see the much awaited Feb correction in risk assets.

We continue to watch the price action and will update our premium subscribers with new analysis and charts. Our trade portfolio (Forex, SPX Emini, Crude, Gold, Silver) is visible to our premium subscribers

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2012 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.