Chinese 'Gold Rush' -Year of Dragon First Week Sees Record Sales– Up 49.7%

Commodities / Gold and Silver 2012 Jan 30, 2012 - 07:48 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,720.50, GBP 1,097.40, and EUR 1,310.06 per ounce.

Gold’s London AM fix this morning was USD 1,720.50, GBP 1,097.40, and EUR 1,310.06 per ounce.

Friday's AM fix was USD 1,722.00, GBP 1,095.98, and EUR 1,310.30 per ounce.

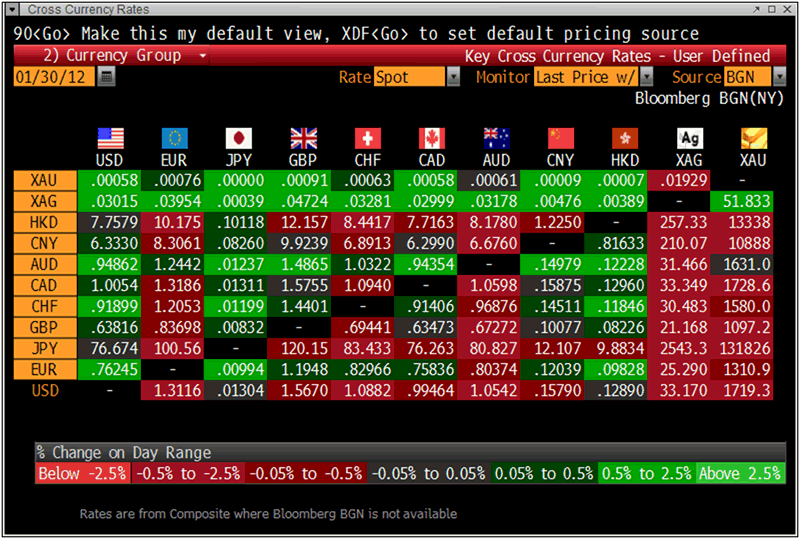

Cross Currency Table - Bloomberg

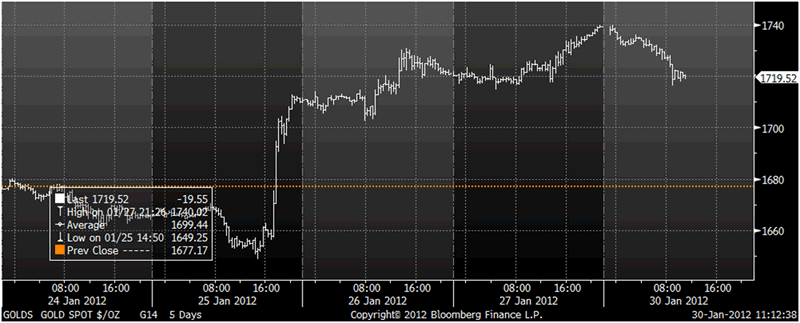

Gold prices fell in Asia and in Europe this morning with profit taking after last week’s 4.3% gains seems the primary reason for today’s weakness.

However, gold prices are likely to continue to be supported by the continuing Greek debt saga (and risk of contagion) and developments in the increasingly tense situation with Iran (and the risk of war).

Iran

India is planning to purchase Iran's oil with gold, according to new report over the weekend. India has not confirmed nor denied the story. India is the second largest oil customer of Iran, the first being China, with purchases of nearly $12 billion of crude per year.

US President Obama, signed a law on December 31st that seeks to penalize countries that import Iran's oil or transact with the Islamic Republic's Central Bank. Europe has also imposed sanctions on Iran's oil imports from July 2012. Measures also include an immediate ban of all new oil contracts with Iran and a freeze on the assets of the country's central bank within the EU, due to their nuclear program.

Gold Spot Dollar/oz – 5 Days (Bloomberg)

India has had friendly relations with Iran for years and will now find itself in a mire of political manoeuvring . It wishes to keep relations on a good footing with the US and Europe but has the dilemma of being dependent on oil from Iran and other countries.

EU

These tensions plus the decline of the dollar’s value has strengthened gold in the past month.

European leaders are meeting today in Brussels about jobs and economic growth but the Greek debt situation may again dominate.

As long as the failed panacea of recent years - to print and electronically create money and pile more debt upon already massive levels of debt – continues to be seen as the solution – gold’s foundations remain very secure.

XAU-EUR Exchange Rate – 5 Days (Bloomberg)

Only the massive writing down of and forgiveness of debt and massive deleveraging in the banking system can help ameliorate the European and global debt crisis.

China

Xinhua, the official press agency of the government of the People's Republic of China reports that a "gold rush" swept through China during the week-long Lunar New Year holiday this year, with demand for precious metals and jewelry surging since the Year of the Dragon began.

Data released by China's Beijing Municipal Commission of Commerce shows a 49.7% increase in sales volume for precious metals jewelry and bullion during the week-long holiday (over last year), which lasted from January 22 to 28 over that of last year's Spring Festival.

One of Beijing's best-known gold retailers, Caibai, saw sales of gold and silver jewelry and bullion rose 57.6% during the week long New Years holiday according to data released by the Ministry of Commerce (MOC) on Saturday,

Other jewelry stores across the country also saw sales boom during the period, with customers favoring New Year themed gold bars and ingots and other types of Dragon themed jewelries.

During the week-long holiday, which lasted from January 22 to 28, the sales volume in just one gold retailer, Caibaiand Guohua, another of Beijing's top gold retailers, reached about 600 million yuan (nearly $100 million).

Caibai began selling gold bars as investment items during the 2008 Beijing Olympic Games, but the trend of buying gold or silver bars during the Spring Festival has taken off in the past two years.

In much of the western world where gold remains a fringe investment of the smart money (some pension funds, central banks and high net worth) the retail public has predominantly been selling gold (in the form of jewellery) and very few own gold coins or bars.

XAU-GBP Exchange Rate – 5 Days (Bloomberg)

This is in marked contrast to China where buying gold as a hedge against inflation and as a store of wealth has now firmly entered the mainstream in a country of 1.3 billion people.

"Long treasured by Chinese, gold is no longer owned only by a privileged few, but has become a new investment channel open to all," said Guan Qiang, assistant manager at Caibai.

Gold's secular bull market will likely continue until gold has entered the mainstream and a 'gold rush' consumes the retail public in the EU, UK, US and other western nations.

SILVER

Silver is trading at $33.17/oz, €25.28/oz and £21.14/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,598.00/oz, palladium at $676/oz and rhodium at $1,325/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.