Silver Reversal Complete, Now In Early Stages of Powerful Uptrend

Commodities / Gold and Silver 2012 Jan 30, 2012 - 03:52 AM GMTBy: Clive_Maund

An important reversal has now completed in silver and it is in the early stages of what promises to be a powerful uptrend that should take it comfortably to new highs.

An important reversal has now completed in silver and it is in the early stages of what promises to be a powerful uptrend that should take it comfortably to new highs.

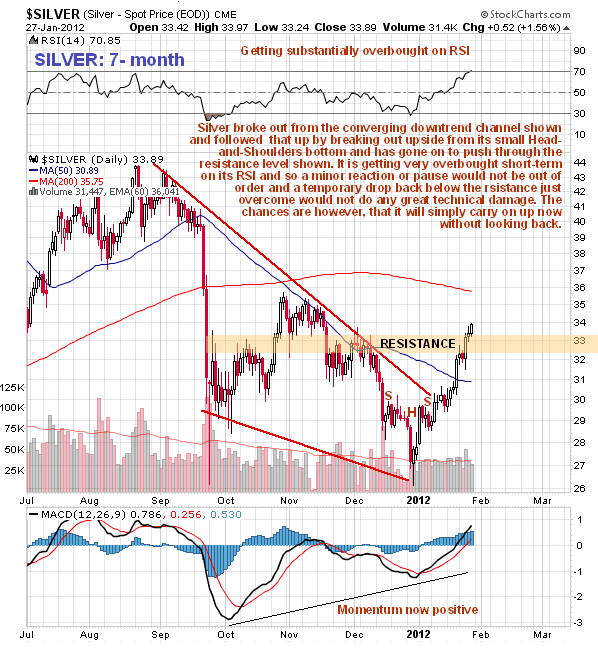

On its 7-month chart we can see how just over a week ago it broke out from its small Head-and-Shoulders bottom, an event which we had anticipated, having oberved it stealthily breaking out from its bullish Falling Wedge downtrend simply by trading sideways for a number of days, which observation was put to good use by us piling into silver bull ETFs just ahead of the H&S breakout. This past week, emboldened by gold's important breakout and robust action in PM stocks, silver has followed up by advancing through the resistance level shown, although given that it is now becoming substantially overbought short-term, as shown by its RSI indicator, it would not be surprising to see it drop back temporarily beneath this resistance again. Overall, however, the picture has become strongly positive, so it may do no more than pause briefly before continuing still higher.

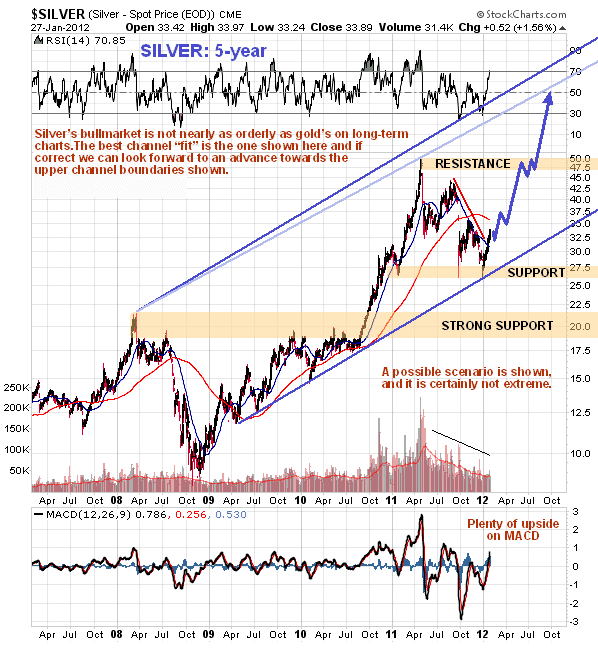

The long-term charts for silver are much more chaotic than those for gold, where we have very well defined inner and outer trend channels since the 2008 lows, which gold has adhered to with an almost religious zeal. The best channel fit we can find for silver is shown on the 5-year chart below - if anyone knows of a better one, drop me a line - I'll be interested to see it. If this channel is correct, or close to correct, and common sense dictates that it is, then the prospects for silver are very good here, as it is likely to advance towards either of the upper channel return lines shown on the chart, which would certainly result in handsome gains from the current price, and such an advance would be congruent with the bullish outlook for gold set out in the parallel Gold Market update.

The fundamental reasons for the suddenly rosy outlook for Precious Metals, and commodities generally, are set out briefly in the Gold Market update, and for ease of reference, the relevant paragraph is repeated below...

In this modern age of market manipulation and meddling, politicians are not prepared to give the forces of capitalism free rein to do their necessary work of straightening out distortions, since that conflicts with their agenda. Thus, instead of letting European banks collapse, the Fed has decided to rescue them with "back door" QE dressed up as swaps etc - the reason is, as you might expect, not altruistic - if the European banks collapse, they will drag down the US banks, and as the US banks are the Fed's masters and the bosses of the entire system, that cannot be allowed to happen, whatever the cost elsewhere. That is why the markets are rallying again across a broad front and why the outlook for gold and silver, and commodities generally, is once again bright, for the European bailout means money creation - and inflation.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.