U.S. Economy Q4 2011 GDP Trouble Below The Surface

Economics / US Dollar Jan 29, 2012 - 11:31 AM GMTBy: Tony_Pallotta

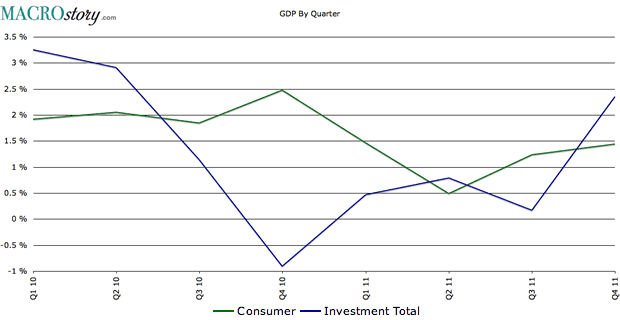

The release of Q4 2011 GDP highlighted just how close the US economy is to actual contraction as well as how vulnerable it is to the events in Europe. On the surface the 2.8% growth was a nice rebound from the 1.8% growth in Q3 2011.

The release of Q4 2011 GDP highlighted just how close the US economy is to actual contraction as well as how vulnerable it is to the events in Europe. On the surface the 2.8% growth was a nice rebound from the 1.8% growth in Q3 2011.

But like anything if you dig beneath the headline you will see three areas of concern. Interesting that just two days before this release when asked about the recent uptick in economic activity Chairman Bernanke was less optimistic than the reporter asking the question. Apparently he was privy to the soon to be released data.

The biggest area of concern relates to the simple calculation of real GDP. As the NFP data has the often generous birth / death variable, the GDP calculation has the price deflator. Similar to CPI but different the price deflator takes nominal GDP and adjusts for inflation to get real GDP which is reported each quarter.

When you underestimate inflation you in essence overestimate GDP. As an example the 12 month rolling CPI as of December shows inflation at 3.0%. The Q3 price deflator showed inflation at 2.6% and then suddenly in Q4 was "estimated" by the BEA at 0.4%. The consensus estimates were 1.5%. In other words one can easily argue that over 1% of the 2.8% GDP was a mirage, attributed to inflation that CPI captures but apparently when it comes to the price deflator simply does not exist.

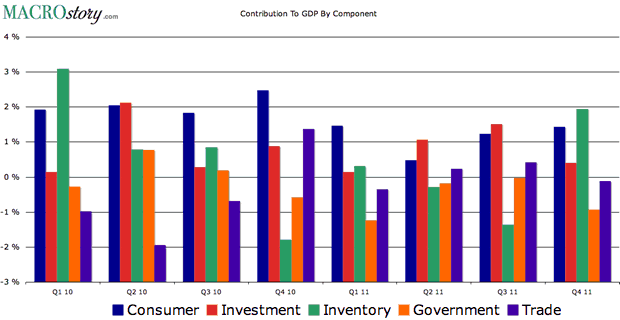

But beyond the questionable calculation two other areas need to be highlighted, the consumer and changes to inventory. The chart below shows GDP over the past eight quarters broken down by consumer, fixed investment, changes to inventory, government and net trade.

Notice the nearly 2% growth in inventory after contracting over 1% in Q3 and clearly trending lower since Q1 2010. One can argue that since the consumer held strong at 1.4% of Q4 GDP up from 1.2% in Q3 that inventory should be expanding. But if you look deeper at what drove the consumer you will find something scary.

The savings rate has fallen to multi year lows as the only way the consumer can maintain spending amidst flat to declining income growth is by saving less. This is simply an unsustainable path. And since there is no sign of growth in personal income the consumer component at over 70% of total GDP may very well have gasped its last breath of growth.

Here is where I see the problem and the probability of contraction in the coming quarters (in reality I believe the NBER will announce a recession began in 2011). With flat to declining income growth coupled with a flat labor market the consumer already spending well beyond their means simply cannot keep up this pace.

Couple that with a recession in Europe that will contract faster than most expect due to the ongoing credit event there will be no basis for further inventory expansion. Rather than invest in expanding product on shelves from wholesale to retail inventory levels will be depleted. Further jobs will be lost. The consumer will retreat further. That is how a recession begins and manifests itself.

Remember in 2008 the US went from growth in Q2 to (4%) contraction in Q3. It happens fast amidst a credit event regardless of where the event starts.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.