Financial Markets 2012, When Leverage Fails

Stock-Markets / Financial Markets 2012 Jan 29, 2012 - 03:02 AM GMTBy: Ty_Andros

The saga continues as we head into 2012. That saga is the demise of Ponzi finance and an ASSET-backed economic model in the developed world. We do not know whether the currency and financial system extinction event will occur this year or ten years from now. The questions we hope to answer in this 2012 economic analysis regard only the unfolding of short to intermediate-term ups and downs in economies, financial systems and societies. We will be covering different sectors of the 2012 economy (stocks, bonds, precious metals, commodities, real estate, etc.) over the next several editions of TedBits; this is part one -- a global-macro Austrian overview, the BIG PICTURE so to speak. Don't miss future issues; subscriptions to TedBits are FREE at www.traderview.com/subscribe/

The saga continues as we head into 2012. That saga is the demise of Ponzi finance and an ASSET-backed economic model in the developed world. We do not know whether the currency and financial system extinction event will occur this year or ten years from now. The questions we hope to answer in this 2012 economic analysis regard only the unfolding of short to intermediate-term ups and downs in economies, financial systems and societies. We will be covering different sectors of the 2012 economy (stocks, bonds, precious metals, commodities, real estate, etc.) over the next several editions of TedBits; this is part one -- a global-macro Austrian overview, the BIG PICTURE so to speak. Don't miss future issues; subscriptions to TedBits are FREE at www.traderview.com/subscribe/

What we do know is that the demise of the DEVELOPED world's currencies, financial systems and economies are set in stone, just as one's fate is sealed when they slip below the EVENT horizon of a cosmic BLACK hole. This time the black hole is INCOME destruction from centrally-planned economies, runaway welfare states, crony capitalism, regulation, taxation and endless MONEY printing out of thin air... a toxic cocktail of wealth destruction.

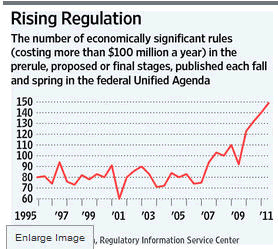

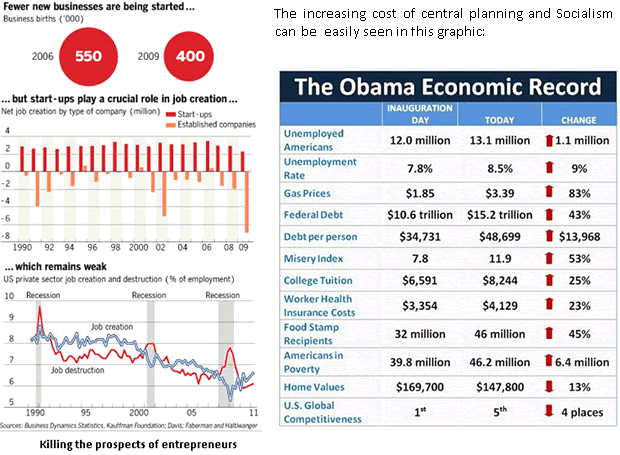

Exploding uncertainty and impediments to growth

A DEPRESSION has been written into law in the United States by the Socialist-progressive, legislative supermajorities of 2008 to 2010 in the form of (1) Permanent government expansion (20-25%) via the misnamed STIMULUS Bill, Obama Care (which is no more than NATIONALIZING, further politicizing and tax goodies for sale to the highest bidder/campaign contributor) along with the health care industry, and finally Dodd Frank (more financial regulation for sale and political allocation of credit). These bills are wrapping themselves like PYTHONS around the largest economy in the world. And (2), SQUEEZING the life out of the economy via 80,000 pages of new regulations a year (sold to the highest bidder from K Street, aka lobbyist row and the biggest campaign contributors), poorly written and in haste by unelected bureaucrats who have no experience in the industries and businesses they are regulating.

These regulations are nothing less than central government nationalizing the private sector by stealth, and directing economic activity to CRONY capitalists. Crony capitalists gain these monopolies through regulation; they can behave like any monopolist by providing less to the public for a higher cost. This is the Congress and Executive Branch PAYING OFF special-interest campaign supporters.

These are explosions in regulations and they represent the prohibition of INNOVATION, RISING PRODUCTIVITY and CAPITALISM (more goods and services for less money) by LAW. Has anyone heard of a law or regulation being repealed? Very rarely. The Executive Branch is in a rush to get control of these industries whether it is done right or wrong. Unfortunately, it is only just beginning; less than 20% of the new laws and regulations have been implemented and as they unfold the depression will deepen.

Exploding uncertainty and impediments to growth are killing the prospects of entrepreneurs. What will become known as the greatest depression in history HAS BEGUN and will continue to unfold.

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." ~ Ludwig von Mises

The Keynesians' approach is articulated quite nicely by former Treasury Secretary, Larry "canary in the coal mine" Summers:

"The central irony of financial crisis is that while it is caused by too much confidence, too much borrowing and lending and too much spending, it can only be resolved with more confidence, more borrowing and lending, and more spending". ~ Lawrence Summers

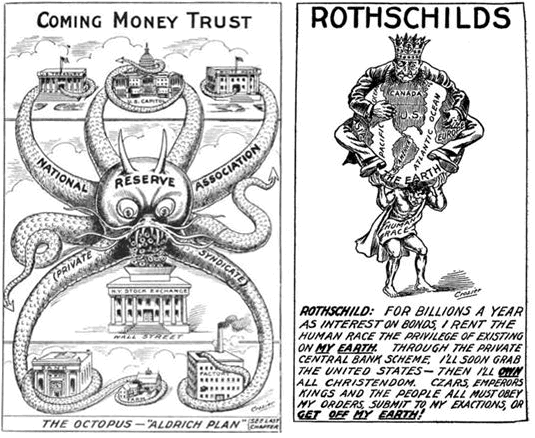

Of course, today's government, elites and banking leaders have chosen the latter route as have ALL those who have gone before them. In the long run NONE have succeeded. This will destroy Keynesian Economics and expose FIAT money as the fraud that it is. This is multi-century fraud; it has been perpetrated over and over again by the same group of banksters, elites and their descendants. Hereafter known as "The powers that be," they own and control 60 percent of the world's wealth one way or another and they control most, if not all, of the governments in the developed world. The booms and busts they engineer is how they gather their wealth; investors must learn how to PIGGYBACK and PREY upon this process. They have performed this dozens of times and are doing so now!

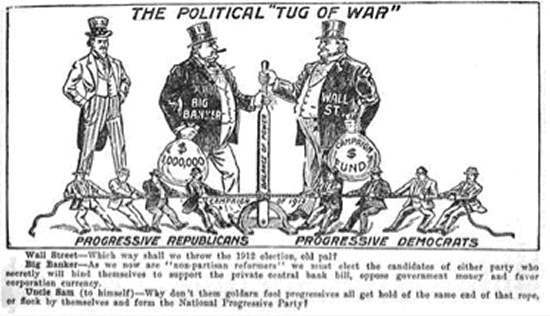

The founding fathers of the United States were fully aware of their efforts and successfully eluded their grasp until Woodrow Wilson committed the ultimate treason. He PRIVATIZED the central bank and set in motion the idea that the US economy would be run for the benefit of the BIG BANKS and brokers. In exchange, he granted a monopoly on money for unlimited FUNDING of progressive government. Leviathan government here we come. It is illustrated by these cartoons from 1913:

Investors are being confronted with the fight of their lives: How to protect and build their portfolios during a FIAT currency and credit-based, financial system extinction event. Eighty investors out of a hundred will LOSE most, if not all, of their wealth. The other 20% will gather that wealth to themselves through foresight, a solid understanding of financial history and applied Austrian Economics as outlined by Ludwig Von Mises, Frederic Hayak and Bastiat.

WE ARE SEEING THE GREATEST OPPORTUNITY IN HISTORY as this is the greatest FIAT currency and credit-based INSANITY in history. The last great depression provided the basis for some of the greatest fortunes in the world, and this time the opportunities are MANY TIMES GREATER. What is happening now is simply HISTORY repeating and this is the biggest episode EVER. The entire world is afloat in an ocean of FIAT currency; never in history has this been so.

ABSOLUTE-Return Alternative Investments (with the potential to thrive in up, down and sideways markets) are essential in preserving and building your wealth. Investors must preserve purchasing power FIRST. Learning to invest as markets zoom up and down (re-pricing due to the behavior, past and present, of public servant, elites and banksters) will challenge you as never before. Creating these investments is what I do for a living. To request more information CLICK HERE

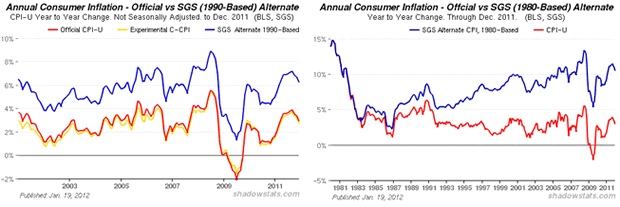

Investors are caught in what's known as financial repression in mal-investments which yield considerably less than the REAL rate of inflation.

Most FINANCIAL assets are MISPRICED due to runaway leverage which has been insanely increasing since Bretton Woods II set us on the path to the destination at which we find ourselves today.

This is a Ponzi finance scheme where gains come from one greater fool than the next buying an overpriced asset using ever-increasing leverage. GAINS come not from cash flow, but capital gains as these assets re-price to reflect the lower purchasing power of the currencies in which they are DENOMINATED. This gives the illusion of appreciation to the asset holder and a taxable gain to government when actually NO REAL GAIN EXISTS. It is invisible theft by debasement; it is government and central banks preying on you.

THIS GAME IS OVER and it will not return until the great deleveraging is OVER. The volatility this will create is a RARE opportunity. The greatest credit bubble in history is in the process of becoming history. The volatility will be enormous, and volatility is opportunity for the prepared investor. BUY and HOLD is DEAD. Gold and silver-backed, absolute-return alternative investments are part of the solution. At Traderview, we specialize in this type of investment...

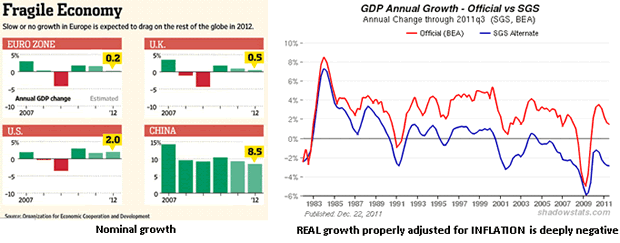

Looking at two different rates of calculating inflation (1990 and 1980 versions by www.shadowstats.com) provides prospective on how political correctness has INFLUENCED an accurate measure of the price changes confronting investors and consumers today:

Mal-investments and financial repression can be identified if your investments DO NOT YIELD more than inflation (as measured above) plus 1 to 3 percent, thereby providing a REAL return AFTER INFLATION. If your investments do not, then you are losing REAL wealth at a compound rate by which they underperform. For example: If you buy a 10-year Treasury Bill yielding 2 percent, then you are LOSING 4 to 8 percent compounded annually. Eventually these mal-investments will FALL in VALUE until they yield more than the inflation rate and provide a REAL return. You can apply this to stocks which yield 2 percent if you look at the S&P 500 or real estate. All will eventually decline in value until they provide a real rate of return after inflation and the REAL return will justify LENDING for the purchase of them. THIS IS NOT DEFLATION.

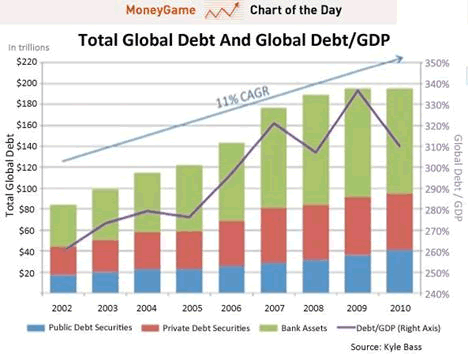

The developed-world's economies are TRAPPED in death..... er, debt spirals and they are literally in the fall of their existence. There is NO ESCAPE from this outcome. Government debt in the developed world is compounding at about 11 percent annually and has done so since the global financial crisis started in 2000. Worldwide debt has almost TRIPLED since 2000 in all sectors (finance, non-financial corporate, government and household) from approximately $80 trillion to almost $200 trillion.

While in REAL terms there has been NO INCOME GROWTH to service the additional borrowing. While GDP is growing at approximately 2 percent or less, nominally, and is negative 3-5 percent if properly adjusted for inflation (and this is a low ball).

Let's see, GDP has compounded at a negative 2 percent since 2000, while debts have compounded at an 11 percent annual rate. So, for those with access to a printing press, money printing will have to do to repay these debts, and for those who don't, disaster looms.

Even worse, the people who created the problem are incapable of solving it. Decades in the making, today's economic and societal problems will not yield to more of the same policies. Furthermore, CREEPING SOCIALISM and STATISM will not solve the problems created by more of the same. The only remedy to this problem is the policies of wealth creation, semi-sound money and growth. Just like you or I cannot prevent death, neither can elites, public servants or banksters prevent the demise of the developed-world economies, currencies and financial systems. Their unrestrained greed, hubris and lust for control over others are the cause of it.

Big government PROGRESSIVES, aka liberals in disguise, now dominate political debate; whether it be Republican or Democrat, Conservative or Liberal, Tory or Labor, CDU (Christian Democratic Union of Germany) or SPC (Socialist Party of Germany), they are all bought and paid for by banksters and crony capitalists. They now control the halls of government as was predicted when the Federal Reserve was created in 1913. They can be compared to organized crime families, such as the Gotti's and Gambino's, fighting turf wars known as elections to see who gets the front-row seats for taking freedoms through runaway legislation, regulations, taxation and screwing the public they claim to serve. There is no difference between the two once they are elected; their job is to take freedoms and transfer public wealth to their supporters.

"When you see that in order to produce, you need to obtain permission from men who produce nothing; when you see that money is flowing to those who deal not in goods, but in favors; when you see that men get rich more easily by graft than by work, and your laws no longer protect you against them, but protect them against you...you may know that your society is doomed." ~ Ayn Rand, Atlas Shrugged

The thought of TOO-BIG-TO-FAIL banks is an attempted crime against nature; it is an attempt to outlaw death. The victims shall be the citizens. The required economic and social medicine to revive their economies is INCONCEIVABLE to them. Eating the most productive in their societies will only feed them until all the productive elements have been EATEN or have moved out of their grasp and into the emerging markets (which are solidly underway). Then the dust bowl of poverty will reign. You can't eat money printed out of thin air or created with a keystroke.

The emerging world's economies are in the spring of their SECULAR growth cycles. The wealth of the world has ROTATED as well as the ability to generate and grow wealth. These emerging tigers are hardy souls ready to compete for prosperity, and just as the developed world's wealth and deep middle classes were created by industrial societies and capitalism, theirs will as well. This is the bedrock of Austrian Economics: Produce more than you consume, save and invest your wealth and create self-sustaining optimism based upon personal growth. As their economies RISE so will their political and military might.

"It's not the strongest of the species that survive, not the most intelligent, but the one most responsive to change." ~ Charles Darwin

The world is EVOLVING and growing, some are embracing change and thriving and others are trying to legislate against it. Just like the waves strike the beach, the future will strike those that resist until they are vanquished. The lesson of King Canute approaches. The people legislating against change reside in the capitals of the developed world; those who are embracing it are in the emerging world.

The world FIAT currency and credit-based financial systems are ROTTEN to the CORE, sitting on what Von Mises calls MAL-INVESTMENTS. Those mal-investments form the foundation of the world's financial and currency systems. If the risk contained in sovereign debt held as financial system reserves were required to be reserved against and marked to market, the banking systems of the developed world would be INSTANTLY BANKRUPT. They are operating in bankruptcy now through regulatory forbearance.

They have trillions and trillions of Dollars, Euros, Pounds, Yen, etc., worth of DEBT -- also known as IOU's, and furthermore they are IOU's denominated in IOU's! If one debtor doesn't get you the other one will. These IOU's are called ASSETS; unfortunately they are LIABILITIES of morally and fiscally bankrupt governments, central banks and their present and future citizens. Insane liabilities PILING up until the PUBLIC refuses to PAY. That day is approaching.

The idea that my 2-year-old son owes: $1,087,573 (on balance sheet debt $48,790 plus unfunded liabilities of Social Security, prescription drugs, Medicare and other unfunded liabilities of $1,038,783 as of 1/23/2011 www.usdebtclock.org) is absurd, obscene and immoral. Public servants who support borrowing 40 cents of every dollar to support current expenditures and argue for more borrowing or argue against reduced spending are nothing more than the DEVIL sending their constituents and future generations on a one-way ticket to HELL as DEBT SLAVES to bankers and lenders who PRINT THE MONEY out of THIN AIR. The public pays TWICE, once as interest on the debt which requires constantly-rising taxes, and again as purchasing power is invisibly reduced while the public's money sits in the bank (your balance stays the same but always buys less)

Many of the public servants who made these promises and the beneficiaries who expect to extract these sums from my son's future earnings through borrowing to pay for their current consumption are able-bodied people who did not plan for their present and future needs. They believed what was told them by the socialist teachers' unions. They elect and support people who make these impossible promises to pay.

"Men prefer a false promise to a flat refusal" ~ Quintus Cicero

Wealth creation in the developed world has DIED; it has been killed by public servants, crony capitalists and banksters over decades -- death by a thousand cuts over decades. Since REAL income and wealth creation has met its demise, in its place money printing out of thin air and inextinguishable debt has become its substitute to create an illusion of growth. Now those illusions are being UNMASKED as Mother Nature intrudes on those among us who live in them. As they WAKE UP to the realities of life the MAYHEM will ensue. Think about the movie The Matrix as it is a perfect metaphor.

In America we live in a post-constitutional country. The Constitution has been killed by central planners in Washington and banksters with the help of a corrupt Judiciary that has failed to PROTECT it and Americans from the unrestrained greed of the powers that be. These powers-that-be were well known to the founding fathers of the United States, and the wisdom, foresight and personal freedoms to produce and keep your wealth which they embedded in the constitution is now buried systematically by the schools to which we trust our children's futures. If people were properly informed of these HISTORY LESSONS, today's follies would not be considered.

Failing to understand history, today's elites, public servants and banksters have the world on the path to repeat it. The "powers that be" encourage them to do so; they profit once during the credit bubbles and then again by taking the assets off the private sector's hands at discount prices when they fall during the bust.

This is an epic battle pitting Mother Nature and Darwin against the most powerful men and Central Bankers in the world. In the developed world darkness is descending as policies implemented over decades now combine to create the perfect storm that will continue to collapse economic activity and freedom.

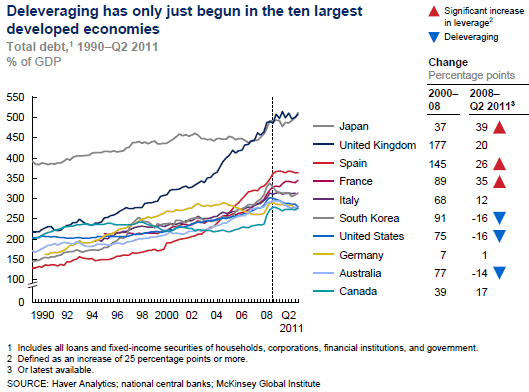

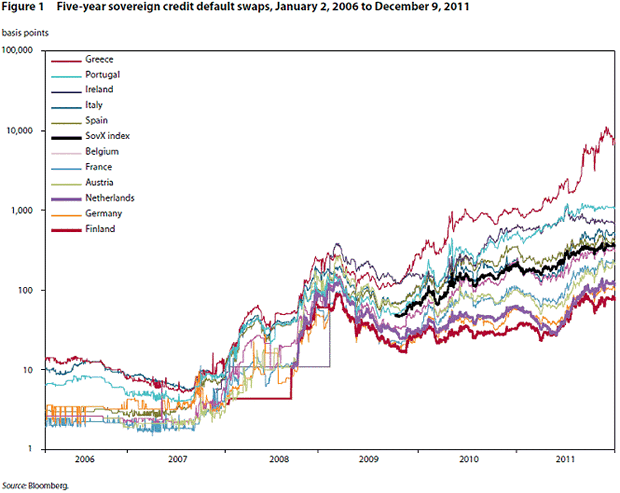

Deleveraging which is much talked about has not yet occurred. The trillions of dollars of unpayable debt has not been reduced globally. In the top ten developed economies BLOODBATHS for lenders and borrowers lie directly ahead. Take a look at a chart from a recent McKinsey Report alongside a CDS chart of the last 7 years by Bloomberg (20% of this money will NEVER be repaid):

20% of this money will NEVER be repaid

CDS risk level up 1000% to 10,000% since 2007

Virtually none of the G7 countries illustrated have made plans to reduce borrowing in the public sector. These borrowed funds are used for CONSUMPTION and welfare spending. They just want to roll the money and borrow a little more each year, but the markets are saying NO, as Credit Default Swaps signal the end of the rollover trade and the true level of sovereign credit ratings emerge. None of these countries have invested the funds "past or future" in projects which can repay the money. Now lenders are beginning to ask questions of those without access to a printing press, and soon they will ask questions of those that do.

For prepared investors it is the greatest opportunity in history, for others it will be their demise. Most of the baby boomers will not retire with their stock, bond and pension wealth. That wealth is stored in paper and will fall to its intrinsic value, aka ZERO. It is propped up by uncountable piles of paper which have no value: for example most continental and US banks buy sovereign debt of one sort or another, they do not reserve against possible default or capital losses (if reserves were required or mark to market valuations required the financial system will be INSOLVENT OVERNIGHT) and they use leverage of 10 to 1 or more (quite often 30 to 1). What if this artificial bid provided by leverage is reduced? Apply this leverage to stocks, bonds and real estate and withdraw the future leverage (as is happening NOW) and you get the idea how far these MISPRICED assets and mal-investments can FALL.

The greatest transfer of wealth from those who store it in paper to those who don't is underway.

Socialism/Progressivism has always failed as an economic and societal model. It is the policy of "misery spread widely", and it has been slowly substituted for capitalism and freedom for decades. We now live in the world of George Orwell's 1984 and Animal Farm. Socialism is now called Capitalism; Central Planning is called free markets; saving, self-reliance and investing are now evil; and dependence on government and others is now a virtue. Up is down and black is white to the USEFUL idiots that control the voting booth. In the United States more people vote for a living than work for one.

In socialist economies the elites eat the last productive elements of society to supposedly save the public. They are LOCUSTS as are their something-for-nothing supporters, who have been impoverished by unsound money and the policies of insolvency. They will eat and consume everything in the developed world as well as tomorrow's production. Like the preverbal LOCUSTS, they will eat everything including the roots of their societies and the seed corn for the next year's harvest. This is what the developed world's economies are facing...

"When the people find that they can vote themselves money, that will herald the end of the Republic. This constitution in time will fail, as all such efforts do. And it will fail because of the corruption of the people, in a general sense." ~ Benjamin Franklin

Instead, public servants, elites, crony capitalists and banksters are transferring what wealth is left from the public to themselves one way or another. The public is only their fool for believing what they have been told by their government and banking masters. This is cannibalism of the worst sort and it results in the DEATH of wealth creation, for to create wealth becomes a CRIME against the mob and against those who don't create wealth. Look no further than the White House leading impoverished mobs against the private sector; these people's lives have been destroyed by the very people they are supporting: Progressive SOCIALIST/MARXISTS.

This is America today: Small-businessmen and women -- the backbone of American job creation -- are now called millionaires and billionaires and vilified by Washington DC and the mainstream media. They are turning anecdotes about Warren Buffet and extrapolating it to the small businessman next door, with the promise that any success he or she achieves will be taken from them by the revenue agencies. This is NOT a recipe for job creation.

The wealth of the developed world has been squandered by public servants and their masters in the banking industry and in its place are sclerotic, crony capitalist, socialist welfare states whose citizens have been turned into what Lenin called USEFUL idiots. While our parents paid cash for their purchases and their savings actually gained value as it sat in the bank, this process has been reversed since August 1971 when Bretton Woods II forever changed the definition of money -- which no one realized at the time.

The people today are now no more than medieval serf's -- debt and tax slaves to governments and banksters -- because the currency in which they are paid and store their wealth has lost its purchasing power, credit has been substituted as a means of maintaining lifestyles, thereby creating DEBT SLAVES. Currency as a means of storing wealth has become nothing but a cruel hoax. Sound money has gone the way of the DODO bird; it is extinct.

Gold is the currency of kings; Silver is the currency of merchants; Debt is the currency of slaves. Debt is not MONEY

"Of all contrivances for cheating the laboring classes of mankind, none has been more effective than that which deludes them with paper money." ~ Daniel Webster

"We are in danger of being overwhelmed with irredeemable paper, mere paper representing not gold, not silver, no sir, representing nothing but broken promises, bad faith, bankrupt corporations, cheated creditors and a ruined people." ~ Daniel Webster Speech in the US Senate, 1833

Of course, and this is where we find ourselves today isn't it?

Ever since the department of education was created in the United States in 1980 and curriculum was taken out of the hands of local parents and teachers. Three generations of PUBLIC schools have brain washed the populations of the developed world to the point where they are unable to think for themselves, they are told what to think, not taught how to think. This misinformation is PREYED upon by the elites, public servants and banksters using the main stream media and indoctrination centers known as public schools.

"The opinion of 10,000 men is of no value if none of them know anything about the subject." ~ Marcus Aurelius

Adam Smith wrote about the value of the public in determining future wealth in his seminal work "Wealth of Nations." The productivity of an economy is partially a function of its citizens' educations, their ability to logically solve problems and think critically, and their knowledge of history in order to prevent history's lessons from being lost. Measured on this metric, the US and European school systems would receive an F for failure. Vast oceans of able-bodied citizens wait for jobs to be created which they are unable to perform.

Instead they have become dependents upon government. They have been taught to have faith in government and told they have a right to healthcare, basic needs and good jobs.

"It is not an endlessly expanding list of rights --the "right" to an education; the "right" to health care; the "right" to food and housing. That is not freedom. That is dependency. Those are not rights. Those are the rations of slavery - hay and a barn for human cattle." ~ Alexis de Tocqueville

These are the PROMISES of the developed world's leaders and decades of governments on both the right and left; they have been taught to many generations who have faith in what they have been told. That faith is undergoing a severe test, as people wake up to the truth that you must produce something others will buy in order to thrive. As people are subjected to increasing AUSTERITY (reductions in WELFARE and BENEFITS) they will drive the POPULIST politicians' attacks on those in the private sector that DO produce. Mobs will drive destruction of the private sector as they descend into desperation from UNSOUND money and as the false promises of government are REVEALED.

In Conclusion: When properly viewed and measured, NO RECOVERY has taken place since the first episode of the financial crisis in 2000, nor since round II in 2008. If expanded government spending, financed by debt, had not been (and continues to be) reported as GDP, then the DEVELOPED economies of the world would be imploding at a 4 to 12 percent annual rate, compounded annually since 2008. As the insolvencies of debt compound relentlessly, and wealth creation and incomes do exactly the OPPOSITE, you can expect the powers that be, elites, public servants, central bankers and crony capitalists to do what they have done ever since Bretton Woods II forever changed the definition of money.

When you have a gun pointed at your head what do you do? Duck or take the bullet? You can bet they will do just what you would do -- duck and let the public take the bullet just as they have always done. So you can expect that THEY WILL PRINT THE MONEY. This is what the powers-that-be have done since the Federal Reserve was founded in 1913 and Bretton Woods II really unshackled the printing press. It is how they have solved every problem since that time except when Ronald Reagan had the guts to CUT government and reduce tax slavery which produced a boom.

Mother Nature is in the process of administering a crisis that will WIPE away the illusions, progressive lies and misinformation regarded as reality. This is a repeat of history for people that have forgotten. It is the destruction that must take place before growth in the developed world can RESUME and more people will be hurt than helped.

The illusions that you can have something for nothing and you are entitled to anything without earning it will be WIPED OUT. It is how all Socialist experiments end, without exception. Communist Russia and China have learned these lessons in the last 50 years and so will the developed world. Check out the 12 Conditions of MARXISM on the internet, you can see in every way that it is the definition of the developed world's current economies.

Authors note: This is not DOOM and GLOOM; this is the greatest opportunity in generations for those that can apply history's lessons and learn to set their investment sails in the proper manner. I am an absolute-return, alternative investment specialist. I create investments that are designed to thrive and preserve purchasing power as events unfold, regardless of market direction... To request more information click here

There are dozens of Greeces, Italys and Portugals in the United States: Illinois, California and Michigan to name a few. Insolvency after insolvency will emerge as regulatory forbearance is exposed as the institutional corruption that it is. Trillions in unpayable pension obligations, Social Security, Medicare and Medicaid obligations will NEVER be paid, or they will simply print the money to pay them until the money is accepted NO MORE. This is actually the way it will play out. A Crack-up Boom looms.

Until the right to PRIVATE property is restored wealth generation cannot resume and will continue to fail. Private property rights were ended at Bretton Woods II in August 1971. Between regulation and taxation, private property is nothing more than a myth, as is the myth that the dollar is as good as gold or money. It is an IOU as are all FIAT currencies in the world; the promises to pay by morally and fiscally-bankrupt governments, elites, and central banksters. This is why the middle class is desperate and destroyed; the purchasing power has been stolen out of their money, and in the process of maintaining their lifestyles they have become serfs and debt slaves.

In the next edition of TedBits we will be covering the 2012 Outlook for Stocks, Bonds, Precious Metals and the death of Capitalism. Don't miss it. Subscriptions are FREE at www.traderview.com

Thank you for reading TedBits. If you enjoyed it...

Tedbits will be resuming a regular publication schedule going forward; subscribe for free at www.traderview.com/subscribe . We are also developing a relationship and collaboration with Gordon T Long, a brilliant technician and market analyst. Gordon’s most recent work can be found at: http://lcmgroupe.home.comcast.net/.. and I urge you to visit him.

By Ty Andros

TraderView

Copyright © 2012 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.