Stocks Thump Yields as Economic Growth Looks On

Stock-Markets / Financial Markets 2012 Jan 27, 2012 - 11:58 AM GMTBy: Ashraf_Laidi

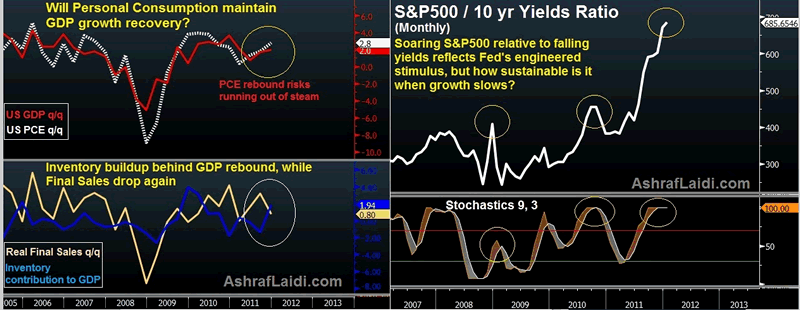

It is not a new development for US GDP growth to be largely driven by a build- up inventories (+1.9% contribution is highest since Q1 2010) in contrast to weak contribution from real final sales (+0.80% is lowest since Q1 2011). If this is a signal to future growth prospects, then how will the ultra low yields-driven stock go on?

It is not a new development for US GDP growth to be largely driven by a build- up inventories (+1.9% contribution is highest since Q1 2010) in contrast to weak contribution from real final sales (+0.80% is lowest since Q1 2011). If this is a signal to future growth prospects, then how will the ultra low yields-driven stock go on?

This helps explain the weaker than expected 2.0% rise in personal consumption expenditure (PCE), following 1.7% and 0.7% in Q3 and Q2 respectively. The PCE chart (red graph) shows a potential dead-cat bounce, which may fail to regain the 3.6% high attained in Q4 2010. Finding the growth will be challenging, especially as stalled US budget negotiations risk forcing $1.2 trillion sequesters (automatic cuts in discretionary spending) starting this year.

And if GDP growth will in fact slow as is forecast by the Fed, then how will equities maintain their surge? The chart on the right highlights the latest record highs in equities relative to 10-yr bond yields. The argument in favour of further gains in stocks/yields ratio is healthy corporate balance sheets, bond traders expectations of persistently zero rates, subdued growth and benign inflation.

Technically, the S&P500/10-yr yields ratio is nearing overbought levels as suggested by a peak in momentum. The pattern is similar to the peaks of early 2009 and late 2011. Another possibility (less likely) for a decline in the socks/yields ratio is a run-up in bond yields. This could take the form of: i) fiscal concerns with the US; ii) rebounding sovereign yields on protracted threats from credit rating agencies; or iii) upside surprise in global economic prospects. With the higher yield argument unlikely to serve as the catalyst, the equity component risks a rude awakening when QE3 appears to lose the efficacy of its predecessors.

Fed's Zero Rate Extension

The Fed announced it would extend its interest rate policy (ZIRP) into another 2 years, the ECBs Long-Term Refinancing Operations will keep 1% money flowing for 3 years, and the BoEs their phase of quantitative easing (QE3) is imminent next month. The latest re-affirmation of zero cost money from the leading central banks has suddenly removed the threatening credit-ranging agencies from the headlines.

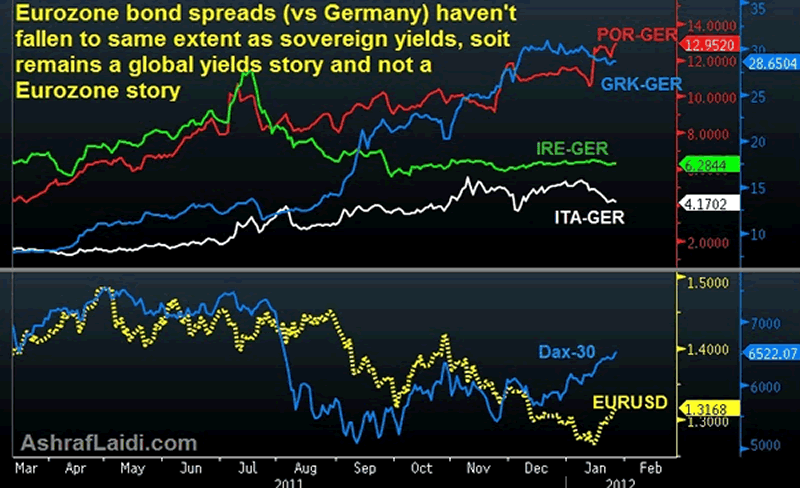

The latest euphoria lifted gold by $70 in two days, Italian 10 year bond yields fell below 6% for the first time since December 8, shedding 20% from their November highs, S&P500 hit a fresh 6-month high and the CRB index surged 2-month highs thanks to robust oil and metals.

The Fed's latest ZIRP extension relegated Eurozone concerns to the back-burner and turned markets' focus onto all that is positive; recovering US manufacturing sector, reduced supply of US housing; yield-reducing LTRO from the ECB; a looming deal on Greek debt and a potential 2-pronged Eurozone bailout fund (ESM w/ EFSF).

Downgrading the Outlook to Justify Zero Rates & Boost Sentiment

The Fed's continuous downgrading of economic projections in order to justify two more years of exceptionally low rates is aimed at signalling its readiness to do more. Despite Bernankes repeated statements that additional QE would not be rewarding from a cost-benefit analysis, the Fed Chairman recognizes all too well the positive (market) effect of additional QE. Therefore, hinting at QE3 to the markets without actually delivering it can only work for so long until we arrive at a phase similar to July-Oct 2011, when damaged markets licked their wounds after the Fed disappointed them by revealing Operation Twist (moving $400 bln of bond purchases from the short end to the longer end of the curve).

As long as the European Central Bank, the Federal Reserve and the Bank of England continue to steepen their own yield curves via LTROs, Operation Twist and QE3 respectively, markets will have a solid reason to buy the dips at the next selling phase. And with Japans trade balance having officially shifted into deficit for the 1st time in 3 decades, the fundamental catalyst for a lower yen may finally be here in addition to improved risk appetite. Central bank liquidity is clearly assuming the role of building market confidence at a time of looming Eurozone recession, subdued global economic activity and sub-par inflation.

Markets run the risk of re-entering a fresh phase of central-bank driven market complacency, whereby rising equities go in tandem with falling bond yields at a time when none of the structural debt challenges have been resolved in the Eurozone, the US or the severely austere UK.

The chart below indicates that despite falling individual sovereign bond yields, the declines in spreads over those of German yields have been more modest. This is rather the result of a global bond yields story reflecting widespread easing (G10 and BRICs) and uncertain economic outlook.

Get your free 1-week trial to our Premium Intermarket Insights on FX, commodities & equity indices

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2012 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.