U.S. Economy GDP on Recession Track

Economics / Recession 2012 Jan 27, 2012 - 11:47 AM GMTBy: Mike_Shedlock

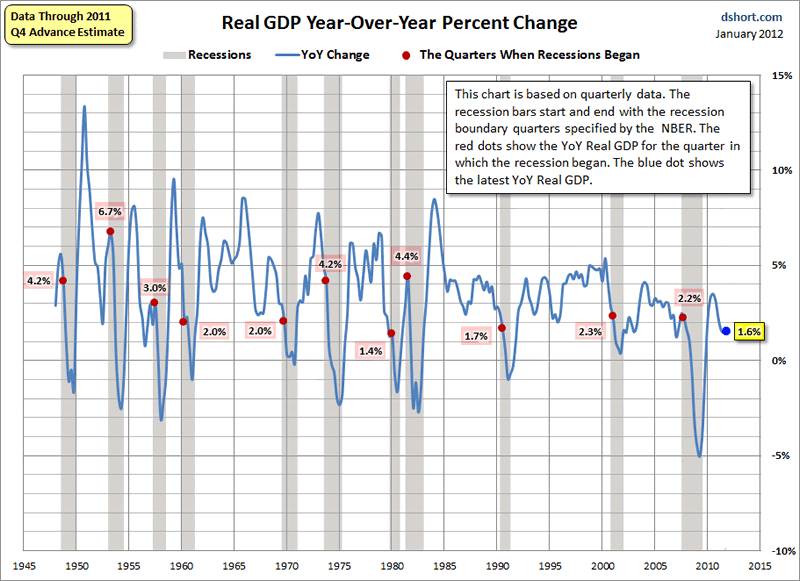

The headline real GDP number of 2.8% does not sound too bad until you dig beneath the surface. A full 1.9 percentages points of that 2.8% was inventory replenishment. Real GDP vs. a year ago is +1.6% and that is on a recession track as well.

The headline real GDP number of 2.8% does not sound too bad until you dig beneath the surface. A full 1.9 percentages points of that 2.8% was inventory replenishment. Real GDP vs. a year ago is +1.6% and that is on a recession track as well.

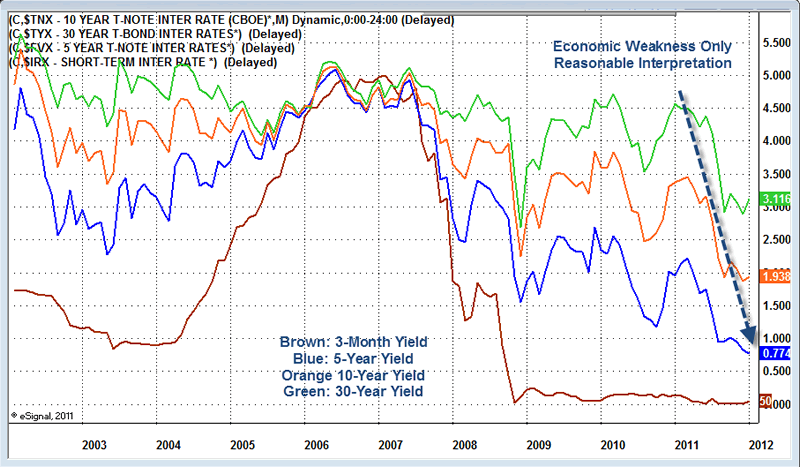

Five-Year Treasury Yield Hits Record Low

Bloomberg reports Treasury Five-Year Yield Declines to Record Low as GDP Misses Forecast

Treasury five-year note yields fell to a third consecutive record low after slower-than-forecast U.S. growth added to speculation the Federal Reserve will expand asset purchases to spur economic growth.

Ten-year note yields fluctuated as stockpile rebuilding accounted for 1.9 percentage points of the 2.8 percent economic expansion, sparking concern growth may be weaker than expected in the first three-months of this year. Fed Chairman Ben S. Bernanke said Jan. 25 he’s considering additional bond purchases to boost growth after the Federal Open Market Committee announced that the target lending rate would stay low through late 2014.Yield Curve over Time

Stock Symbols in Above Chart

- $IRX Brown: 3-Month Yield

- $FVX Blue: 5-Year Yield

- $TNX Orange 10-Year Yield

- $TYX Green: 30-Year Yield

Sustained economic weakness is the only reasonable explanation for this decline in yields. Yes, there is Fed intervention. However, the reason the Fed is intervening is "sustained economic weakness".

However, the Fed's actions are counterproductive. Driving down interest rates does not encourage bank lending, rather it does five things the Fed does not want.

Five Unwanted Results of Fed Policy

- Low interest rates clobbers those on fixed income - See Hello Ben Bernanke, Meet "Stephanie"

- Low interest rates and quantitative easing encourages bond market speculation and sure profits instead of bank lending - See Premature Dollar Obituaries and Mainstream Economists' Monetary Insanity; Keynes-Inspired Great Depression; Lessons Not Learned

- Low interest rates encourage commodities speculation especially food and energy and that puts a price squeeze on manufactures. Input prices rise, but demand and prices decline. - See Chart of the Day: Apparel Import Data in Square Meters and Dollars; J.C. Penney's Slashes Prices on All Merchandise by "At Least 40%", Offers Every Day Low Pricing

- Low interest rates drives up the price of gold - See Gold, Silver, $HUI React to Bernanke Pledge to Hold Rates near Zero "At Least" through Late 2014; Hello Stephanie, Ben Promises More of the Same

- The beneficiaries of the Greenspan Fed and the Bernanke Fed policies have been the 1% not the 99%

Fed Policy Not Working

Fed policy is not working, nor will it work.

This is what happens when an academic wonk with no real-world practical thinking sits in a box with other academic wonks with no real world experience and they collectively divine economic policy as if they were god.

The Fed is responsible for the housing bubble, the resultant collapse, and the anemic economic recovery.

GDP on Recession Track

Here is an interesting chart from Doug Short regarding Real GDP and the Next Recession

Doug Short writes ...

As the chart illustrates, the latest YoY real GDP, at 1.6% is up from last quarter's 1.5% (to two decimal points it's 1.56% versus 1.46% for Q3). At 1.6% the YoY number is below the level at the onset of all the recessions since quarterly GDP was first calculated — with one exception: The six-month recession in 1980 started in a quarter with lower YoY GDP (at two decimal places it was 1.42% versus today's 1.56%). And only on one occasion (Q1 2007) has YoY GDP dropped below 1.6% without a recession starting in the same quarter. In that case the recession began three quarters later in December 2007.In contrast to popular belief, recessions typically start with GDP in positive territory. As you can see, Real GDP vs. a year ago is +1.6% and that is consistent with a recession track.

It is highly likely Bernanke was aware in advance that a full 1.9 percentages points of that 2.8% rise in GDP was inventory replenishment when he pledged on Wednesday to "Hold Rates near Zero "At Least" through Late 2014" and opened the door for another round of Quantitative easing as well.

Nonetheless, for reasons noted above, another round of quantitative easing will be counterproductive. The beneficiaries of Bernanke policy will be the 1%, not the 99%.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.