Powerful Consolidation Coming in Banking as a Consequence of Overcapacity

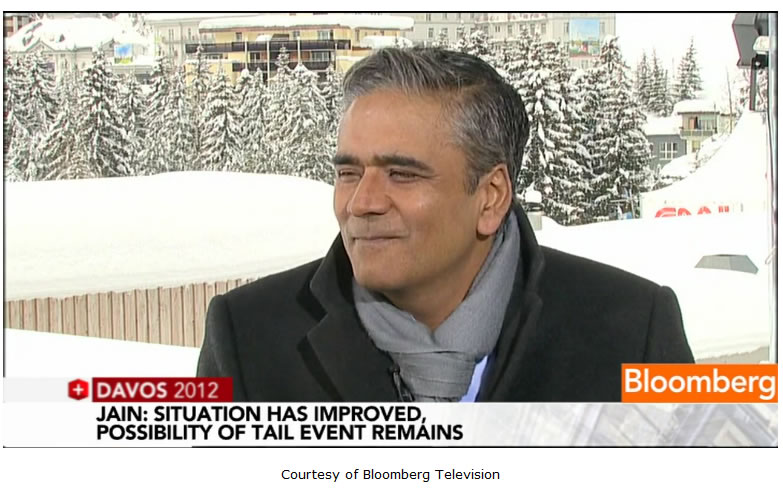

Companies / Banking Stocks Jan 27, 2012 - 02:44 AM GMTBy: Bloomberg

Bloomberg TV's Erik Schatzker spoke to Deutsche Bank incoming co-CEO Anshu Jain, who said that he foresees "powerful consolidation" in the industry and those banks who survive will '"actually wind up with a margin expansion over time."

Bloomberg TV's Erik Schatzker spoke to Deutsche Bank incoming co-CEO Anshu Jain, who said that he foresees "powerful consolidation" in the industry and those banks who survive will '"actually wind up with a margin expansion over time."

On profitability in the banking business:

"Let's look at the underlying factors that drive earnings. There's a numerator which is earnings and then there is a denominator which is capital. Thanks to Basel III, and a lot of it is justified, the amount of capital that'll underpin financial institutions, those needs will nearly double. As you move from Basal II to Basal III, you'll get a doubling of the denominator. Thanks to a series of restrictive legislation that is coming, there will be restrictions on the business model as well."

"Both of these are unhelpful and will not argue for higher ROEs, for sure. Having said that, there's going to be powerful consolidation without our industry, which means that those who survive this will actually wind up with a margin expansion over time. "

"Put those variables together, I think you'll get a dip in ROEs in the short run. Perhaps it will return to slightly more normal levels two or three years down the road."

On compensation at Deutsche Bank:

"If you choose to work on Wall Street or in the financial services industry for purely short-term compensation, you may find other avenues: hedge funds, shadow banking system, whatever. You won't be faced with the strictness in pay that we'll be imposing for some time. Our best people are motivated by a variety of factors, of which compensation is one and we have not seen a significant diminution of talent."

"Deutsche Bank's led the way when it comes to aligning shareholder interest with employee interests. We've had a higher percentage of deferrals than most of our competition for a long time. The total quantum of pay has come down pretty substantially. There's been considerable revision in practices. Having said that, we're committed to paying competitively for the best talent. Recruiting and retaining the talent remains one of our key goals."

"I wouldn't characterize it strictly as a buyer's market but yes, if you were to look at the demand for supply dynamics of talent, I would say the banking industry is probably game on that front."

On whether the retrenchment on Wall Street creates opportunities:

"We've had overcapacity in wholesale banking for a long time. I would say some of the perimeters of change we've talked about will create a winnowing out in our industry. You'll wind up with a handful of real survivors. And that is an opportunity in our industry."

On whether regulation will prevent consolidation in the industry:

"You are totally right. Sadly, this will be one of the many unintended consequences of regulation. It is hard to see what the spate of regulations that we've seen unfold over the last 18 months would do other than consolidate our industry any further."

On Deutsche Bank's outlook:

"These are challenging times for the financial institutions industry overall. It's hard not to be cautious. We are beginning this year on a mildly better note than the one we finished on in the fourth quarter."

"I think broadly the [overall market] situation has improved, particularly the one in Europe, but the possibility of a tail event continues to hang over us. I think high volatility is the new norm and one we'll all need to just live with."

On whether the market is prepared for a tail event like a Greek default:

"The big difference between the events of September 2008 and now is that [the events of September 2008] came as a true surprise. The market was very optimistic, very little risk was priced in, correlation was very low, so all your precursors of warning weren't in place. We're in a very different place today. A lot of the bad news is priced in and frankly the tail events which we're most concerned about are pretty well flagged by prices."

On the European crisis:

"I think the situation in Europe is more complex than people give it credit for. The concept that we can deficit spend our way out of the mess we are in, and all that is required is a US-style cutting of rates, quantitative easing, modernization of debts, and profligate spending, I don't subscribe to this idea. I think it's complex situation. We've had multiple years of high deficits built up in multiple countries. I don't think you're going to get a magic solution in the short term that the markets would really like."

On Germany:

"I believe a lot has been accomplished in the fiscal compact, that had been questioned by some. I accept the point that Europe needs to get back to growth. I think there is an increased focus on that. Equally, I would point out that I think it's important to bring fiscal rectitude to countries that haven't had any for a long time."

Copyright © 2012 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.