Panic Buying of Agricultural Sector as Global Grain Inventories Hit Record Lows

Commodities / Agricultural Commodities Jan 07, 2008 - 03:10 AM GMTBy: Joseph_Dancy

The agricultural sector was one of the areas we found most attractive in 2007. We expect that will remain the case. Long term global price and demand trends remain positive. Recent developments include:

The agricultural sector was one of the areas we found most attractive in 2007. We expect that will remain the case. Long term global price and demand trends remain positive. Recent developments include:

- High ocean freight rates have pushed the delivered price of wheat upward but it is not choking off export demand according to analysts. Export sales of U.S. wheat are ‘beginning to look like panic buying' according to some commentators. Overseas buyers are purchasing grain, anticipating the U.S. will run out of wheat. Analysts claim this may happen in the market for hard red winter and white wheat. Wheat exports ‘simply can not be sustained at current levels' according to agricultural experts. ‘Either price will have to increase more to ration the remaining supply or, as was rumored in grain markets this week, the U.S. government will step in'.

- Officials last month forecast U.S. wheat stocks will shrink to their lowest level in 60 years. The U.S. is the world's largest exporter of wheat, and importing countries are bidding heavily for its crops as other exporters cut supplies. The USDA has cautioned in six months wheat exporters in the US have already sold more than 90 percent of what the agency expected to be exported for the entire year.

- Russia , the world's fourth-biggest wheat exporter, announced plans last month to cap exports of the grain once exports reach 12.5 million tons. The threshold may be breached as early as January, according to Russia 's Grain Union, which comprises the nation's biggest grain producers and traders. The Russian government also said it would raise its wheat export tariff sharply, to 40 percent from 10 percent, to keep grain at home. The move should restrict the world's exportable supplies and could boost demand for U.S. wheat.

- China announced late last month that the export of wheat, corn, rice, soybeans, and various processed grains will be subject to export levies in 2008. The export levies will range from 5% - 25%, covering 57 types of grain or grain products. In 2007 China offered tax rebates on grain exports, a 13% rebate on 84 categories of grain and grain products. Levies for wheat and wheat products will be 20% and 25% respectively, while the export levy for corn, rice, and soybean will be 5%. Export levies on processed corn, rice and soybean products rates were fixed at 10%.

- The Canadian Wheat Board, one of the world's largest sellers of wheat and barley, expects wheat prices to remain elevated well into next year because of low global stockpiles. “We see current strong prices being maintained” according to a spokesman.

- Wheat rose above $10 a bushel in the futures market for the first time last month. Rice also jumped to a record, while soybeans reached the highest in 34 years. Corn was its costliest in nine months.

- The U.S.D.A. issued a report last month forecasting soybean inventories will decline by 68 percent from year earlier levels. The agency also increased projected export volumes. An analyst noted the strong demand: “If we were not to plant anymore soybeans next year than we planted this year, and demand stayed the same, we would run out of soybeans in the U.S. on May 1 of 2009.”

- Soybeans may lead gains among agricultural commodities next year because of crop shortages and rising demand for biofuels according to Goldman Sachs Group Inc. The New York-based bank raised its 12-month forecast for the crop last month by 61 percent to $14.50 a bushel from $9 a bushel. Wheat may trade at $7.50 a bushel in a year compared with a previous forecast of $6, Goldman said. The bank raised its estimate for corn by 20 percent to $5.30 a bushel from $4.40.

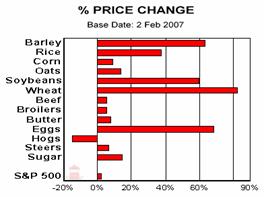

• Price gains in the agricultural sector in 2007 far outpaced the S&P 500 index. Note specifically the gains in the price of eggs, wheat, soy, and barley in the chart at right (chart courtesy of Ned W. Schmidt, publisher of Agri-Food Value View).

- The U.S.D.A. World Supply and Demand report issued last month lowered the estimated U.S. ending inventory levels for wheat, corn, and soybeans, mostly because of stronger than expected exports.

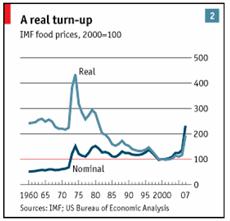

Food prices have increased substantially in the last year, but in real terms prices are still well below levels seen in the 1970's. None-the-less, the upward trend in pricing is troubling to both economists and consumers. Chart at right courtesy of the Economist.

Food prices have increased substantially in the last year, but in real terms prices are still well below levels seen in the 1970's. None-the-less, the upward trend in pricing is troubling to both economists and consumers. Chart at right courtesy of the Economist.

- From 2002 to 2007 the number of acres planted in corn in the U.S. rose 24%, to 86.1 million. The energy bill signed last month by President Bush mandates that oil refiners eventually boost ethanol use as a gasoline additive to 36 billion gallons a year from the current seven billion gallons – which will further increase demand for corn.

- While most of the U.S. corn crop - 43 percent - is fed to livestock to produce meat, dairy products and eggs, an increasing percentage is being used to produce ethanol. Twenty-four percent of this year's corn crop will be turned into ethanol, up from just 14 percent two years ago.

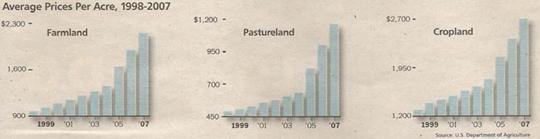

With soaring grain prices the price of U.S. farmland has also increased substantially. Farmland prices skyrocketed 50% over the past three years, to an average of close to $2,200 an acre according to the U.S. Department of Agriculture. Unlike the grain prices, the upward trend in land prices extends back over the last decade. Charts courtesy of Barron's.

With soaring grain prices the price of U.S. farmland has also increased substantially. Farmland prices skyrocketed 50% over the past three years, to an average of close to $2,200 an acre according to the U.S. Department of Agriculture. Unlike the grain prices, the upward trend in land prices extends back over the last decade. Charts courtesy of Barron's.

- Net U.S. farm income is expect to hit a record $87.5 billion in 2007, and will reach another record in 2008 as economic trends continue according to U.S.D.A. estimates.

• Over 37% of the United States is in severe to extreme drought conditions. According to the Federal U.S. Drought Monitor, at least 57% of the West and 76% of the Southeast is suffering from moderate to exceptional drought. The drought, if it continues, will hinder agricultural production.

The world is eating more than it produces and food prices may climb for years because of expansion of farming for fuel and climate change, risking social unrest, experts at the International Food Policy Research Institute concluded in a new report issued last month.

The world is eating more than it produces and food prices may climb for years because of expansion of farming for fuel and climate change, risking social unrest, experts at the International Food Policy Research Institute concluded in a new report issued last month.

- The United Nation's Food and Agriculture Organization last month warned that rising demand and falling supply represent an “unforeseen and unprecedented” shift in the global food system – raising political risks in some areas.

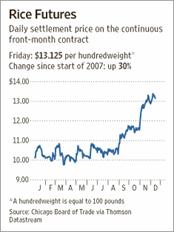

• The global commodities boom has elevated rice -- a staple food for half of the world -- to its highest level in nearly 20 years according to an article last month in the Wall Street Journal. The ‘ubiquitous grain is suffering poor harvests and tight supplies in some of the biggest rice-exporting and rice-consuming nations, and is expected to contribute to a protracted bout of food-price inflation for the foreseeable future in the developing world.' Chart courtesy of the Wall Street Journal.

In summary, we have record low grain inventories globally as we move into a new crop year. We have demand growing strongly. Which means that going forward even small crop failures are going to drive grain prices to record levels. As an investor, we continue to find these long term trends - and this niche - very attractive.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2007 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.