Greek Private Bondholders Reject Greece 'Haircut' Debt Default Deal

Interest-Rates / Eurozone Debt Crisis Jan 24, 2012 - 08:03 AM GMTBy: Mike_Shedlock

Reuters reports Euro zone ministers reject private bondholders' Greece offer

Reuters reports Euro zone ministers reject private bondholders' Greece offer

Euro zone finance ministers Monday rejected as insufficient an offer made by private bondholders to help restructure Greece's debts, sending negotiators back to the drawing board and raising the threat of Greek default.

At a meeting in Brussels, ministers said they could not accept bondholders' demands for a coupon of four percent on new, longer-dated bonds that are expected be issued in exchange for their existing Greek holdings.

Greece says it is not prepared to pay a coupon of more than 3.5 percent, and euro zone finance ministers effectively backed the Greek government's position at Monday's meeting, a position that the International Monetary Fund also supports.

The aim of the restructuring is to reduce Greece's debts by around 100 billion euros ($129 billion), cutting them from 160 percent of GDP to 120 percent by 2020, a level EU and IMF officials think will be more manageable for the growth-less Greek economy.

Negotiations over what's called 'private sector involvement' (PSI) have been going on for nearly seven months without a concrete breakthrough. Failure to reach a deal by March, when Athens must repay 14.5 billion euros of maturing debt, could result in a disorderly default.

World Will Not End

There is so much concern over a disorderly default that I am wondering if the market would rally following news the world did not end (just as it hasn't dozens of times before on defaults). Spain has defaulted 15 times before, France 9 times, Brazil 10 times in the last 115 years, Russia 7 times, and the UK 3 times, China 3 times, and India 3 times.

The world did not end then and it will not end now. For discussion, dates, and frog tales, please see Princess Merkozy Kisses Frog, Turns into Hopelessly Indebted Club Med Prince; Berlin Ready to See Stronger ‘Firewall’

History Lesson on Defaults

The history lesson ought to be clear by now: If you are going to default (and Greece will - actually it already has - just not in a manner that will trigger a credit event), then do it sooner rather than later.

Look at all this needless bickering for years starting with former ECB president Jean-Claude Trichet's insistence "there will be no haircuts".

Greece is now on its third haircut. What could have and should have been a 50 billion euro problem in total is now a 200 billion euro problem with another 100 billion euros waiting on deck. Worse yet, the ECB itself is sitting on 40 billion euros of junk (in a self-inflicted wound) wondering what to do about it.

The ECB's Dilemma

Courtesy of Google Translate and Zeit Online, please consider The ECB's Dilemma

Greece in the negotiations to take on debt rescheduling - and even if a voluntary agreement has been reached, the question remains whether enough investors participate in the end, to establish debt sustainability (and only then the IMF will continue to pay money). This raises the question of what to do with their stocks, the European Central Bank in the amount of about 40 billion €.Door Number Three

The answer is: There is no simple solution.

Let us assume that the ECB is involved in a debt restructuring. That would - through reduced distributions from the central bank profits - a burden to taxpayers. And it would ultimately be a form of state funding: The Federal Reserve would have the money made available to Greece. This can be very difficult to reconcile the official justification, that the intervention served only to keep open the monetary transmission channel. Would immediately begin a debate on the risks arising from the purchases of Italian or Spanish bonds. Anyway, it would be difficult for the central bank to defend its bond program arguments.

Let us assume that the ECB is not involved in a debt restructuring. Then you continue the public debate on the program spared - that this program would be less effective. Because de facto central bank would receive the status of preferential creditors, which have fewer resources in the countries concerned for the operation of non-public liabilities. Private investors have to fear that at first the ECB will be served before they have their turn - go on as in the case of Greece the debt section logically deeper in order to achieve a desired debt ratio, if the ECB will cut out. In this case, affect bond purchases by the Fed might not reassuring to investors, but discourages this: Each bond, which the ECB purchases, means greater potential losses for banks and investment companies.

The ECB has a choice: Either your program is not credible - or ineffective.

The third option and most likely one is the ECB will get Greece to buy those bonds back at the discount price the ECB paid, making Greece's problem bigger as noted in Limits of Voluntary Deal Hit as Greek Bondholders Draw Line in the Sand; Separating Fact from Fiction in Selective Reporting.

Separating Fact from Fiction in Selective Reporting

The proposal is for the ECB to sell its bonds back to Greece so that Greece will then take a hit.

With that in mind, look at this preposterous claim by a senior official "The bonds’ rate “is the only issue,” said a senior official directly involved in the negotiations. “We have to accommodate the needs of the Greek economy."

I see two sentences and two lies. Indeed the entire article is crammed pack with lies made by various IIF and EMU officials.Haircut Calculator Revisited

Let's go over that Haircut Calculator again.

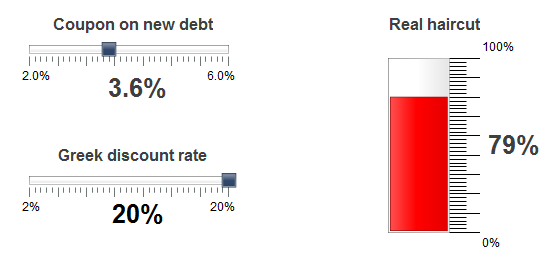

30 Year Greek Bonds yield 22.5%. Since the calculator tops out at 20% let's assume a discount rate of 20%.

Greece and the IMF insist on something under 4%. Let's assume 3.6%. This is what the losses look like.

At 4% with a 15% discount rate, bondholder losses only drop from 79% to 75%.

Are the finance ministers really bickering over that feeble percentage difference or are the finance ministers fearing still more losses down the road and would just assume take the total hit now and get it over with?

While pondering that question, here is another one to think about.

Is Debt to GDP of 120% Sustainable?

Reader Andrea from Italy pinged me with this perspective...

Hi Mish,The IMF and Germany desperately want a deal that will take Greece to a projected debt-to-GDP ratio of 120% by 2020. Why? Even if the plan worked (which it won't) what good would it do?

Reading that "The IMF wants to put Greece on a path for a debt-to-GDP ratio of 120 percent by 2020." I could not avoid to think this:

For the sake of comparison, Italy is currently at 120% debt-to GDP ratio, with a much stronger economy than Greece, a better capacity to tackle fiscal evasion (there are huge margins for improvement), a deficit below 3% now and targeted to be 0 by 2013 (let's see if they get there, anyway they will not get extremely far from this), and despite all of this, Italy is a big mess and it is almost impossible for them to get decent rates on the bond market.

So, what they can expect with Greece at 120% debt-to-GDP by 2020? Even a kid can understand that it will never work!

Best regards,

Andrea

Would someone please put Greece out of its misery? The best chance is a total and complete 100% writeoff right now.

Deadline Laugh of the Day

Those looking for the laugh of the day can find it in this Bloomberg headline EU to Have No Deadline for End of Greek Talks.

For two weeks we heard that a deal had to be reached by Monday (yesterday) or Greece would default. Monday came with no deal, and suddenly there is no need for another deadline.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.