The Only New Dividend Aristocrat Stock You Should Buy Today

Companies / Dividends Jan 23, 2012 - 06:39 AM GMTBy: Money_Morning

Kerri Shannon writes:

If you are looking for a steady stream of safe dividends in today's troubled markets, the list of "Dividend Aristocrats" is a good place to start.

Kerri Shannon writes:

If you are looking for a steady stream of safe dividends in today's troubled markets, the list of "Dividend Aristocrats" is a good place to start.

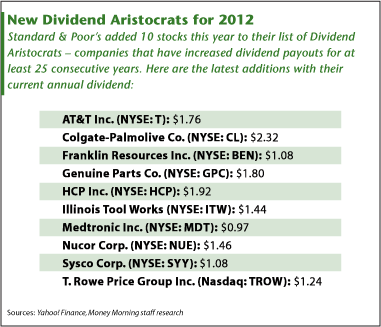

Compiled and tracked by Standard & Poor's, Dividend Aristocrats are companies that have consistently increased their dividend payouts for 25 consecutive years.

Currently, there are 51 of them, including the 10 new Dividend Aristocrats added this year.

That offers yield conscious investors a choice of 51 solid companies with a reliable track record of providing guaranteed payments-even during volatile markets and down economic cycles.

"The problem with going for capital growth is that you very often don't get it, and then you've got nothing - the investment just sits there," said Money Morning Global Investing Specialist Martin Hutchinson.

"Dividends" Martin says, "are easy."

Not only are they easy, they're also increasing.

Dividends on the Rise in 2012

Standard & Poor's reported that dividend increases for all their indices in 2011 almost doubled the dividends paid in 2010.

Standard & Poor's reported that dividend increases for all their indices in 2011 almost doubled the dividends paid in 2010.

Total dividend increases hit $50.2 billion last year - an 89.2% rise over 2010's dividend increases of $26.5 billion - and are expected to climb even higher in 2012.

That's welcome news for investors searching for steady income sources in a zero-growth environment.

Few other assets - especially bonds - are expected to deliver an increased payout this year.

"With 10-year Treasury bond yields below 2%, bonds just don't give you the income they used to," said Hutchinson. "Dividend stocks can give you a better yield than bonds, and if you pick the right ones, will provide both protection against inflation and a chance to share in global economic growth. While they'll fluctuate with the market, dividend stocks of attractive companies are thus really a three-fer."

Dividend Aristocrats even go a step further than ordinary dividend stocks because of their lengthy payout history.

But before you dive into investing in these Dividend Aristocrats, the list needs some scrutiny.

Even though all 51 Aristocrats are known for increasing dividends, not all of them make for great investments in today's market.

"All you have to do is figure out which companies are run by sharpies - and are paying dividends out of capital - and which companies have genuinely solid business models that aren't going away," said Hutchinson.

In fact, there's only one of the freshly-minted Aristocrats that you should add to your portfolio right now.

The Best of the New Dividend Aristocrats

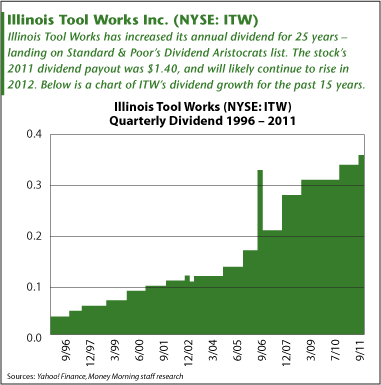

It's Illinois Tool Works Inc. (NYSE: ITW).

Illinois Tool Works manufactures a very broad range of industrial equipment. About 40% of its revenue comes from its power systems, electronics, and transportation-related products divisions.

Revenue climbed 16% to $4.6 billion for the third-quarter ending Sep. 30, 2011. Net income rose 20% to $507.6 million ($1.04 per share). (The company is due to report fourth-quarter earnings Jan. 31).

In 2010-11, organic sales growth was a healthy 10%-11% annually.

"That kind of growth in organic sales is a very good number when you're in the realm of mature products - it suggests a solid upward trend in earnings," said Hutchinson.

"That kind of growth in organic sales is a very good number when you're in the realm of mature products - it suggests a solid upward trend in earnings," said Hutchinson.

Illinois Tool Works also has another key component of successful companies: emerging market exposure. Half of its revenue comes from outside the United States, with substantial operations in China and India, so the company is geographically diversified with a good presence in growth markets. Organic revenue in China grew 16.2% in the third quarter from the previous year.

The stock has a P/E ratio of only 12.9, and a price/earnings/growth (PEG) ratio of 0.95. Its return on equity is an attractive 21% and its balance sheet is in decent shape with debt less than tangible net worth.

Its dividend yield is 2.8% and is more than twice covered, meaning earnings per share are more than twice the dividends per share.

"A lot of high-yield companies pay out a high percentage of their earnings, and hence the dividend is vulnerable," noted Hutchinson. "Illinois Tool's dividend isn't, and indeed has room to grow further as it has for 25 years."

Source http://moneymorning.com/2012/01/23/the-best-buy-of-the-new-dividend-aristocrats/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.