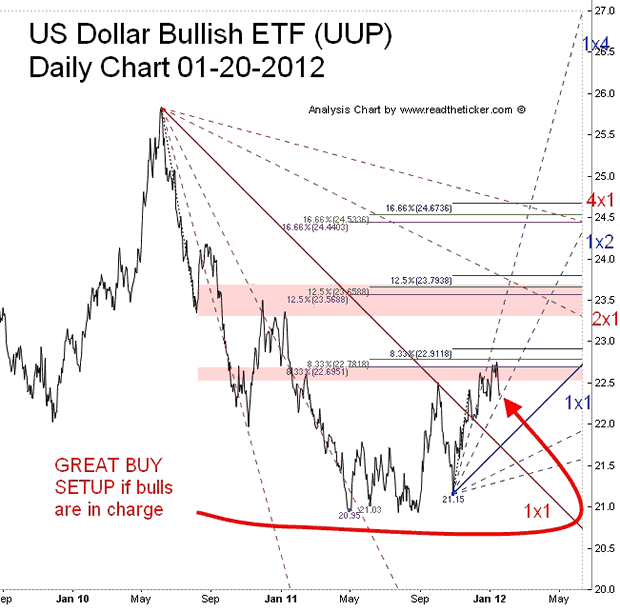

Bullish Set Up on US Dollar

Currencies / US Dollar Jan 23, 2012 - 03:58 AM GMTBy: readtheticker

The US Federal Reserve meets next week (Jan 24/25) and many are expecting Bernanke to release the next financial QE details. The markets are poised for Ben next market leading action.

The US Federal Reserve meets next week (Jan 24/25) and many are expecting Bernanke to release the next financial QE details. The markets are poised for Ben next market leading action.

- But, it looks like the next QE will be delayed until there is real pain in the markets: Fed To 'Hold Off' On QE.

- Add to this the Greece bond deal with private hedge funds is not happening as quickly as the bullish crowd wants: Greek Bondholder Talks Stalled, Agreement Unlikely By Monday Deadline (no matter what CNBC and Bloomberg say, a deal that is not 100% means nothing).

- Add to this lack luster 2011 Q4 earnings where many top line (ie Sales) results are missing there very much reduced forecasts.

- Add to this the EURUSD has popped upto 1.2980 from 1.26, yet the COT reports show the large speculators actually increased shorts to a further record high, they are NOT short covering like the US Treasury wants them to do. See here: EUR Shorts Hit New Record

- Eurozone could be posting recession numbers late January early February.

All this is bullish for the US Dollar. Yet the US Dollar and the SP500 has been doing all it can to ignore the fundamentals. Stocks within the NYSE index are very much stretched to the long side (a large percentage of stocks are above 70 on their RSI) showing complacency. Even the VIX fell below 20, wow.

At the moment it has been a dream start to 2012, the 30% less volume January market has allowed the 'big boys' to pump up stocks extremely cheaply. This means they can distribute stock float to the public at much better prices than when the SP500 was stuck under its 200 simple moving average.

We think the market is acting like 'buy the rumor sell the fact', the rumor is QE release, the fact is no QE. And thus the US dollar will continue on its trend along the blue dotted Gann Angle 1x2.

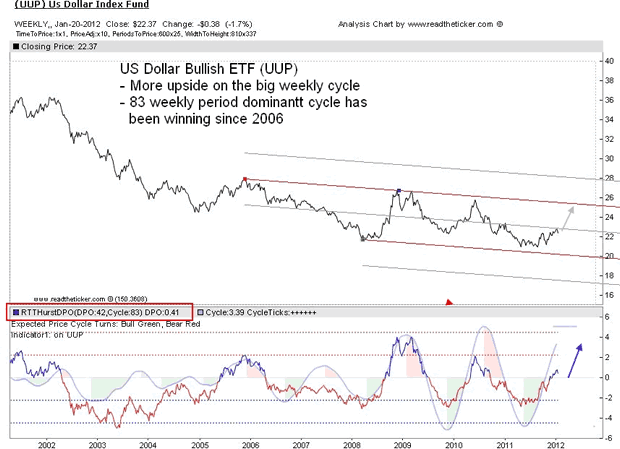

At the moment cycles are confused (cycles are bullish on FXE), but we think below is the dominant cycle leading intermarket relationships and has done since 2006. The US Dollar 83 period weekly cycle.

The comments above are actually picking a top in the SP500, and one must be crazy to do that. Thus shorting stocks will not easy. It should be noted the last time Ben Bernanke said there was no QE the market dropped 20% (August/September 2011) a few weeks after. If you dont like the UUP bullish idea, check out TVIX as volatility just may kick off after Ben dissapoints, after all he has already leaked to the market that QE is not happening, so what more do you need.

Readtheticker

My website: www.readtheticker.com My blog: http://www.readtheticker.com/Pages/Blog1.aspx

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2012 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.