Gasland – More Drama Than Documentary, Don't Frack Me Up

Commodities / Natural Gas Jan 19, 2012 - 03:09 PM GMTBy: Marin_Katusa

Marin Katusa, Casey Research writes: To many walking the planet, fracking has a seriously bad reputation. Thanks to hyperbole and misinformation, fracking opponents have convinced a lot of people that the operators who drill and then hydraulically fracture underground rock layers thumb their noses at and even hate the environment.

Marin Katusa, Casey Research writes: To many walking the planet, fracking has a seriously bad reputation. Thanks to hyperbole and misinformation, fracking opponents have convinced a lot of people that the operators who drill and then hydraulically fracture underground rock layers thumb their noses at and even hate the environment.

Anti-fracking claims may be twists on reality – for example, that a legislative loophole makes fracking exempt from the America's Safe Drinking Water Act, when really this federal legislation never regulated fracking because it is a state concern. Then there's the completely absurd, such as the idea that frac operators are allowed to and regularly do inject frac fluids directly into underground water supplies.

We decided to set the record straight by using facts, not playing on emotion like many of the frac-tivists do. It's important because unconventional oil and gas constitute an increasingly pivotal part of the world's energy scene. In the United States, where shale gas abounds but imported energy rules the day, this is especially true.

America's shale deposits hold a heck of a lot of gas. According to the United States Geological Survey, the Marcellus Shale alone is home to 84 trillion cubic feet (TCF) of technically recoverable natural gas. Estimates of the amount of recoverable gas contained in all of America's shale basins range as high as 3,000 TCF.

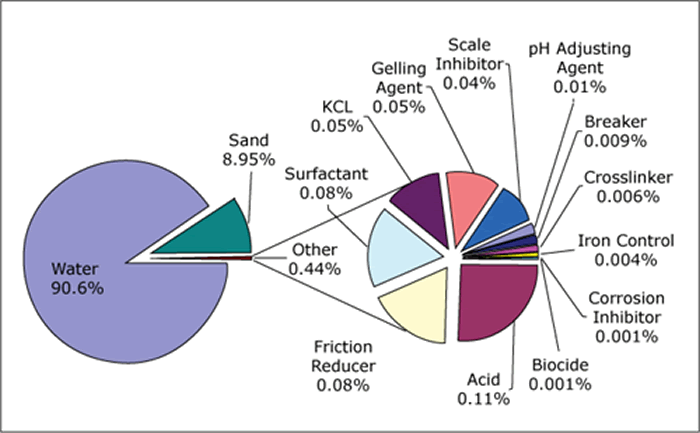

To access this gas, fluids made of water, sand, and chemicals to increase lubrication, inhibit corrosion of equipment, and possessing other qualities are pumped into the shale formation. When the pressure from the fluids exceeds the strength of the rocks, the rock fractures, and in a demonstration of might by the mighty small, the granules of sand prop the fractures open. Once the fracturing is completed, the internal pressure from the formation pushes the injected fluids to the surface again.

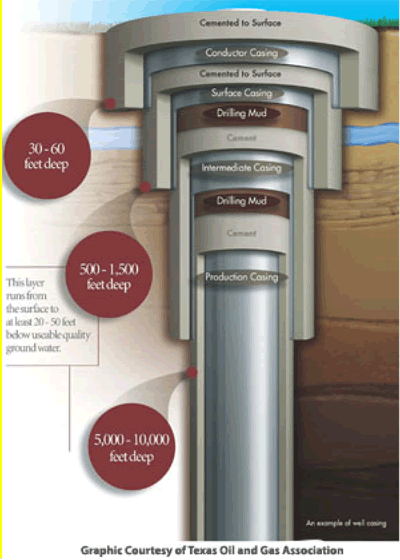

Frac wells are only open to the surrounding rock at the depth of the target formation. Starting at 250 feet (76 meters) or thereabouts above the producing interval – it varies a bit from state to state – the production casing must be cemented. This graphic, borrowed from the Texas Oil and Gas Association, shows what the procedure entails.

Casings are the liners that isolate the inside of the well from the surrounding rock, and from any

Casings are the liners that isolate the inside of the well from the surrounding rock, and from any water that might be contained in that rock. The surface casing is the first line of defense, while the production casing provides a second layer of protection for the groundwater.

Casings do require proper cementation to be effective: the cement seals the annular spaces between successive casing layers to provide a barrier to vertical and horizontal fluid movement. A poor cementation job was a significant factor in the Deepwater Horizon well blowout, and that transpired because deepwater regulations were insufficient. On land, however, cementation is highly regulated, and inspections of wells in progress, announced and unannounced, are common.

Unlike deepwater drilling, fracking is not new. Nor is fracking specific to natural gas or to the United States. Drillers frac many thousands of oil and gas wells around the world every year. In America, oil and gas producers have been using hydraulic fracturing since at least the 1940s to enhance recoveries from older oil wells and to access the oil in tight reservoirs, such as the Bakken.

Then there's shale gas, a domestic source of energy for North America that's much more reliable and secure than the millions of barrels of oil that come from places like Nigeria, Venezuela, Iraq, Angola, and Algeria every day. And as we've said, accessing that gas using hydraulic fracturing is much less dangerous and damaging than many people think.

Gasland – More Drama Than Documentary

Frac-bashing really took off last year, with the debut of the film Gasland. After receiving a letter offering his family US$100,000 for the right to drill frac wells on their land, a documentary film maker by the name of Josh Fox decided to investigate. Gasland is the product of that investigation, which took Fox to Pennsylvania, New York, Ohio, and West Virginia to interview other people living atop the newly discovered Marcellus Shale. Fox also visits Colorado, Wyoming, Utah, and Texas to talk to those who have been living alongside natural gas drilling for the last decade.

The resulting film is well crafted, dramatic, and emotional. However, documentaries are also supposed to convey context and a fair representation of the facts. That's where Fox failed.

Let's be clear: fracking is not without drawbacks (and more on that in a moment). What drives us Casey "Focused on Facts" Research types crazy is messing with the data. Some examples:

Industry Efforts

As we alluded to earlier, fracking does has its drawbacks, two of which stand out in particular. The first is that hydraulic fracturing uses a fair chunk of water – an average multi-stage frac requires a total 5 million gallons of water. To put that number in context, electric generation uses nearly 150 million gallons per day in the Susquehanna River Basin of Pennsylvania.

Nonetheless, industry engineers are working hard to reduce water usage. After all, they know as well as anyone else what their livelihood depends on.

The most important shift here has been toward recycling frac fluids. In Pennsylvania, the fracking industry now reuses more than 60% of its water, for example. In addition, companies are exploring other, more creative water reduction strategies. In British Columbia, energy giant EnCana Corp (T.ECA) and its partner Apache Corp (NYSE.APA) spent nine months and C$10 million finding a deep, sour water aquifer and then figuring out how to make the super-salty, hydrogen sulfide-laced water usable for fracking. This novel technique could significantly reduce the need for fracking operations to use freshwater supplies.

The second drawback is that the fluids that flow back to the surface after a fracturing are often stored in containment units that have been known to leak.

As we pointed out, pits, lined or not, are being phased out in many jurisdictions, precisely because it's truly difficult to tell whether a pit dug into the earth is leaking. This is where companies like Poseidon Concepts (T.PSN) come in. Instead of lined pits and even the dozens of steel tanks that are the not-so-ideal alternative, PSN offers above-ground lined frames that are inexpensive and much more environmentally sound.

Another way to ease the problem of frac fluids spills or leaks is to make frac fluids so benign that we could literally drink them. It sounds pie-in-the-sky, but the world's second-largest oilfield services company is working hard on the idea. In fact, Halliburton (NYSE.HAL) has created a frac fluid called CleanStim, made from materials sourced from the food industry. A Halliburton executive showed the stuff at a recent conference – and then tossed it down his gullet.

Where there's a need, an innovator will rise to the challenge, and there are plenty of innovators in the world of oil and gas.

Fracking Earthquakes: Hazard or… Preventative?

A few weeks ago privately held Cuadrilla Resources, the first company to successfully frac natural gas shales in Europe and a Casey Energy team recommendation back in early 2008, announced that its fracking operations caused two small earthquakes in northwest England last April and May. After the earthquakes, Cuadrilla voluntarily suspended its fracking operations in the area while an independent group investigated the events.

The earthquakes measured 2.3 and 1.5 on the Richter scale. Seismic events, to be sure, but so gentle they were barely felt. Indeed, the independent report found that Cuadrilla's work had caused the tremors, but the earth moved so little that they posed no threat to anyone or anything.

And what others may consider concern, we consider potential. As two plates of Earth's crust naturally shift along their fault line, they can sometimes get hung up on rocky "hooks" called asperities. As the plates keep trying to move, stress builds and builds. The huge earthquakes we all fear occur when the stored energy has built enough to break through the asperity: the gradual slide becomes a destructive jerk.

Small tremors, on the other hand, reduce the pressure one bit at a time. Whenever there is a major earthquake or a discussion of when California or Vancouver or Japan will get hit with the next Big One, someone often laments, "If only we had a way to release the pressure beforehand!"

What if hydraulic fracturing could relieve the stress on the faults in earthquake-prone areas? Clearly the notion needs a battery of modeling and tests before it's anything but a concept, but on a basic level the idea makes sense. Perhaps by releasing the accumulated stress at depth slowly with small tremors, we could mitigate the Big One enough that it might not be so big after all.

If nothing else, the concept is a reminder not to fear serendipity. Finding something you didn't expect when attempting something else is how the scientific world achieved many of its major breakthroughs.

A Resource We Can't Ignore

The ability to produce clean-burning natural gas from the 48 shale basins in 32 countries around the world could transform the global energy economy and increase energy security, starting in the United States.

Hydraulic fracturing has become a scapegoat, targeted by environmentalists as another attempt by the oil and gas industry to lock America into fossil fuel dependence. The thing is, America is already addicted to fossil fuels. Until that changes, even environmentalists will need to heat their homes, charge their cell phones, and purchase products made at gas-powered factories.

We of the Casey Research energy team are always looking for alternative energy ideas that stand the test of economics, but to date only geothermal and run-of-river power have come close. In the case of geothermal power, the industry has gotten ahead of itself and for now, at least, has failed to come through on its promises. As for run-of-river, the projects often work, but they provide only a drop into the big bucket of power needs, and each project requires major negotiations from landowners afflicted with NIMBY ("not in my back yard") syndrome.

So next time someone says that America should put an end to fracking, ask them how they plan to ensure America's energy security over the next 30 to 50 years. If the answer involves alternative or renewable energies, ask for some hard facts and numbers to support it. Like it or not, none of our alternative energies are as yet even close to stepping up as a major energy pillar for America.

Natural gas is ready to step up. It's not a perfect solution – it's much better at providing peak demand than baseload power, still takes energy to produce, and still produces greenhouse gases – but it's an important part of the solution for now. Not only does America have the reserves, the fracturing process that can unlock them has been demonstrated as safe – and equally important, not demonstrated as not safe. And the industry that uses it seeks and incorporates improvements along the way. Just the facts, ma'am.

[Recent political events demonstrate that relying on Middle East oil is very unwise… and worse, OPEC has its own dirty little secret. Learn more about it – and more important, how you can profit from that knowledge.]

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Kevin

23 Jan 12, 12:46 |

If fracking is so great...

...then maybe the author should have a fracking well installed in their backyard. |