Economic Reports Underscore More Positives of the U.S. Economy

Economics / US Economy Jan 19, 2012 - 02:53 AM GMTBy: Asha_Bangalore

Today’s economic reports present a bullish picture of the U.S economy. Industrial production in December was strong and optimism of homebuilders improved in January, while wholesale prices fell.

Today’s economic reports present a bullish picture of the U.S economy. Industrial production in December was strong and optimism of homebuilders improved in January, while wholesale prices fell.

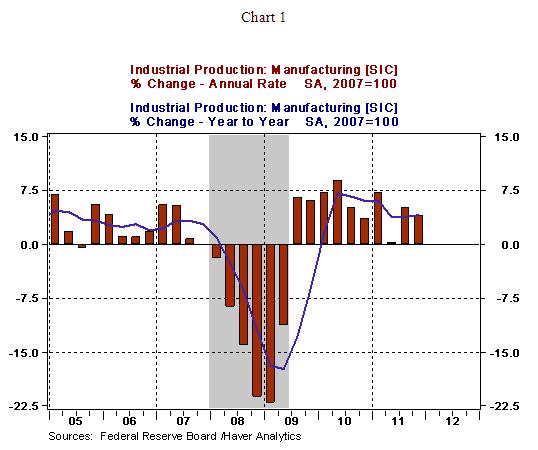

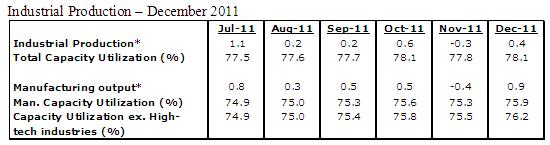

Industrial production rose 0.4% in December after declining 0.3% during November. The 0.9% jump in factory production, which accounts for the bulk of total industrial production, stands out in today’s report after a 0.4% drop in November. Factory production rose at an annual rate of 3.9% in the fourth quarter vs. a 5.00% increase in third quarter that represents a rebound from the Japan disaster. Production of factory goods was widespread in December with wood products, primary metals, computers, machinery, motor vehicles, and aerospace equipment posting noticeable gains.

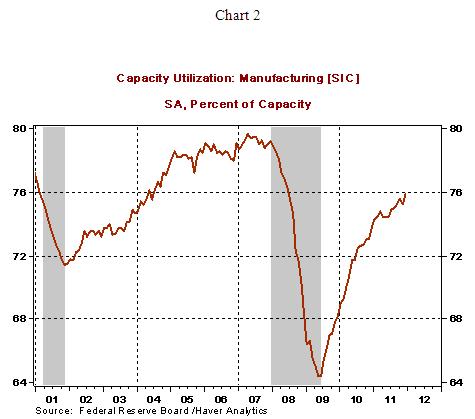

The operating rate of the nation’s industries climbed to 78.1% in December from 77.8% in the prior month, while the factory sector’s capacity utilization rate increased to 75.9% from 75.3% in the same period. The operating rate of the factory sector is nearly five percentage points below the historical mean.

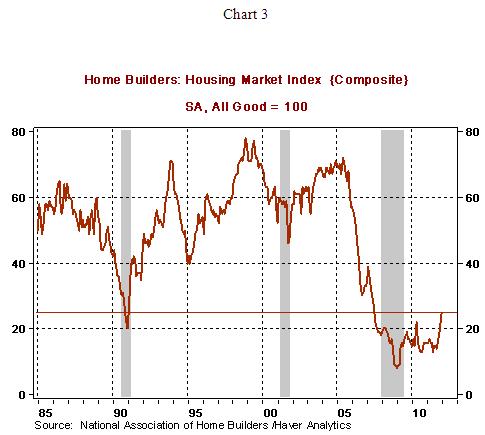

The Housing Market Index (HMI) of the National Association of Homebuilders moved up to 25 in January from 21 in the prior month. The January mark is the highest June 2007, prior to the onset of the recession in December 2007 (see Chart 3). This reading has to be corroborated by other housing market information such housing starts and sales.

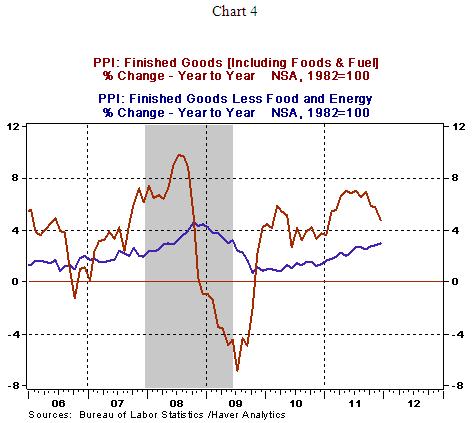

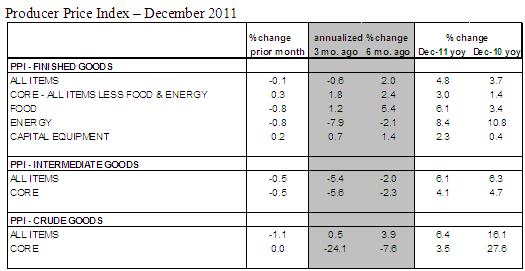

The Producer Price Index of Finished Goods fell in December, putting the year-to-year gain at 4.8% vs. 3.8% in 2010. The 0.8% decline in the food and energy price indexes accounted for a large part of the drop in wholesale price index declined in December. Energy prices have risen so far in January, implying that a reversal of the January energy price index readings is likely.

The core PPI, which excludes foods and energy, increased 0.3% in December after 0.1% gain in the prior month. The BLS attributes about 30% of the increase in the core wholesale price index to the 0.9% jump in the price index of light motor trucks. Further down the pipeline, prices of intermediate and crude goods also fell in December. The Fed has scored well on the price stability front vis-à-vis its inflation and price stability mandate. The elevated unemployment rate is the Fed’s main concern at present time.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.