Gold Nears 1,300EUR/oz - Euro Lower After EU Downgrades and Greece Jitters

Commodities / Gold and Silver 2012 Jan 16, 2012 - 10:45 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,643.50, GBP 1,074.60, and EUR 1,298.90 per ounce.

Gold’s London AM fix this morning was USD 1,643.50, GBP 1,074.60, and EUR 1,298.90 per ounce.

Friday's AM fix was USD 1,642.00, GBP 1,070.27, and EUR 1,281.71 per ounce.

Spot gold is again above the 200 day moving average near $1,638/oz. Gold prices have rallied 5% so far in 2012, with the eurozone debt crisis and the growing tension between Iran and the west supporting gold's safe haven status.

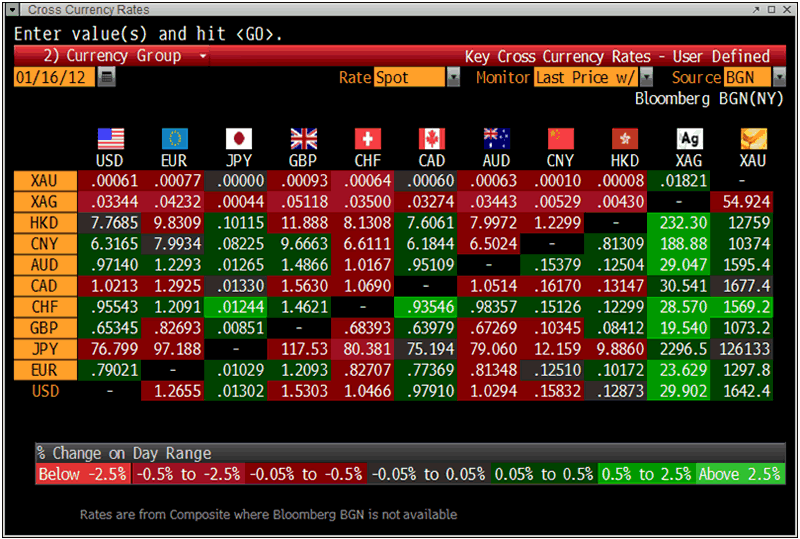

Cross Currency Table - Bloomberg

Although gold had its largest drop in the last 2 weeks on Friday, (-1.6%), it was 1.3% higher on the week and trading higher this morning. Many analysts feel that current sovereign, macroeconomic and geopolitical risks are not reflected in gold's price.

Friday's news of France's loss of its AAA rating has put the European Financial Stability Facility (EFSF) at risk. The Eurozone economy resembles a large ship sailing in rough seas since France fund's 20% of the EFSF fund and 8 other members were also downgraded.

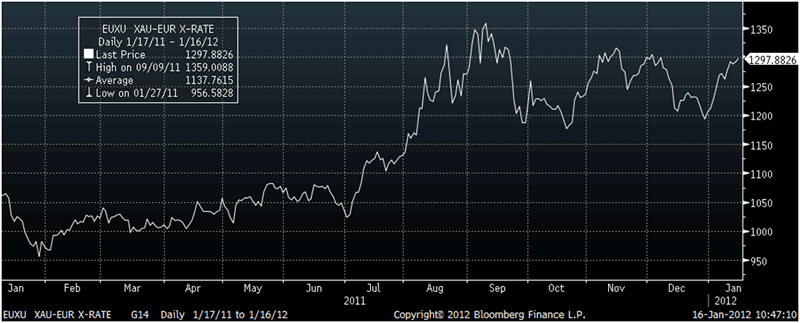

Gold XAU-USD Rate - G14 Daily - Bloomberg

This will almost certainly lead to the EFSF's downgrade which would result in the fund too paying more to borrow as credit costs rise. There are icebergs lurking in increasingly murky Eurozone waters. The European downgrades were long expected and may have been priced in the markets. The risk of a non orderly Greek default and of contagion in the Eurozone remains and is not priced into markets. It would lead to the euro falling sharply against other fiat currencies and particularly against gold.

XAU-EUR Rate G14 Daily - Bloomberg

Gold has risen 7.4% in euro terms in the first two weeks of the year. Gold at €1,298/oz today is less than 4.7% from its record high in euros of €1,359/oz (09/09/11). Given the scale of the crisis, new record highs in euro terms could be seen in the near future.

The situation with Iran is also likely to support gold prices. Crude oil prices remain near recent highs due to concerns over supply disruptions - after Iran warned Arab countries of consequences if they raised oil output to replace Iranian production facing international sanctions.

Gold jewellery demand in India has risen from 5 to 7 % in 2011, and is projected to grow another 10 to 15 percent this year said the head of India's largest jewellery retailer confirmed on Sunday.

UBS saw an increase in physical gold demand last Friday to the highest so far in 2012 confirming that India is a buyer at these levels although Reuters report that demand was more lack lustre in India overnight.

This strongly suggests that demand in India is more robust and less sensitive to higher prices than the bears have claimed. The Indian sub continent continues to buy the dip.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.