Silver Bubble Bursting Clarification

Commodities / Gold and Silver 2012 Jan 12, 2012 - 08:15 AM GMTBy: Willem_Weytjens

Two days ago, I wrote an article called “Did The Silver Bubble Burst?“. I got many emails from people saying that this is nonsense, and that I should look at fundamentals instead of Technical charts.

Two days ago, I wrote an article called “Did The Silver Bubble Burst?“. I got many emails from people saying that this is nonsense, and that I should look at fundamentals instead of Technical charts.

While that is partly true (trust me, I DO know that the fundamentals for both Gold and Silver have never been brighter), I think that one should not ignore the technicals either.

I also wrote that Silver has a good chance of rising back towards $38 (based on the Silver vs Nasdaq Comparison) in the short term.

So even though we MIGHT have seen the top in Silver back in April 2011 (we have warned our readers back then that this was a possibility), it doesn’t mean that we are BEARISH on commodities. In fact, I am actually quite BULLISH on Gold and Silver right now, which I will explain later on in this post. If we get to $38, it remains to be seen what will happen next. It could be that silver just keeps on rising, and ignores the “Nasdaq Similarities”. If that happens, I will change my view, rather than being stubborn. If I would have held on to “Fundamentals” when Silver reached $49, I would have burned my hands. Fortunately I didn’t, and I saved myself as well as my subscribers a lot of money.

I am not a BULL nor a BEAR in ANY asset class, but I would rather say that I’m a REALIST.

I hope this helps to clarify.

****************************************************************************************************

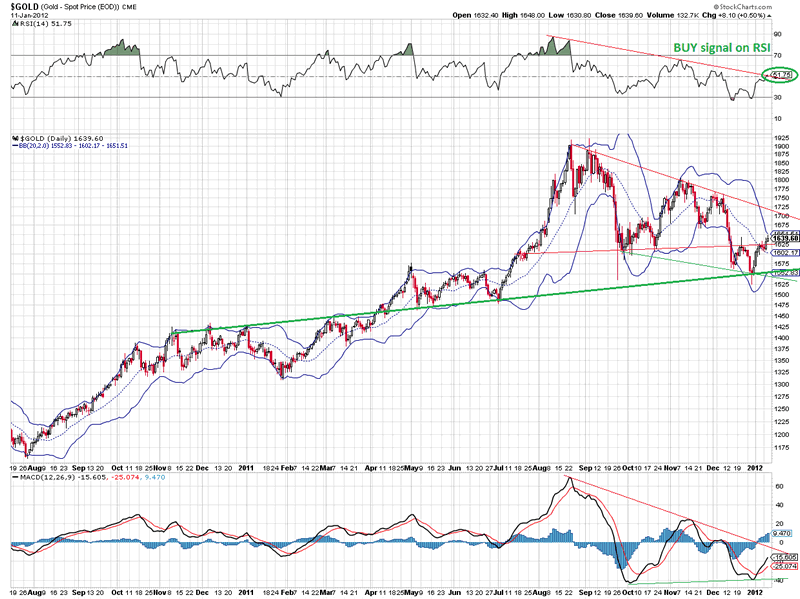

We now have a BUY signal on the RSI for Gold. Price has also broken above a key resistance level, and has made a higher high.

However, we still don’t have a BUY signal on the MACD (yet), and Price is now close to the upper Bollinger Band, which often acts as resistance.

Chart courtesy stockcharts.com

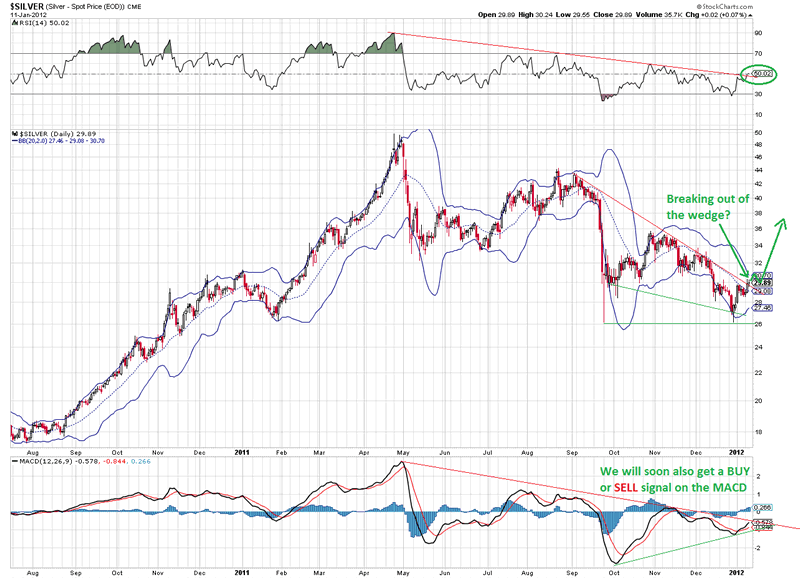

We also have a BUY signal on Silver, as the RSI broke above the red resistance line and above 50.

We will soon get a BUY or SELL signal on the MACD, which will decide whether Silver will rise or fall.

Chart courtesy stockcharts.com

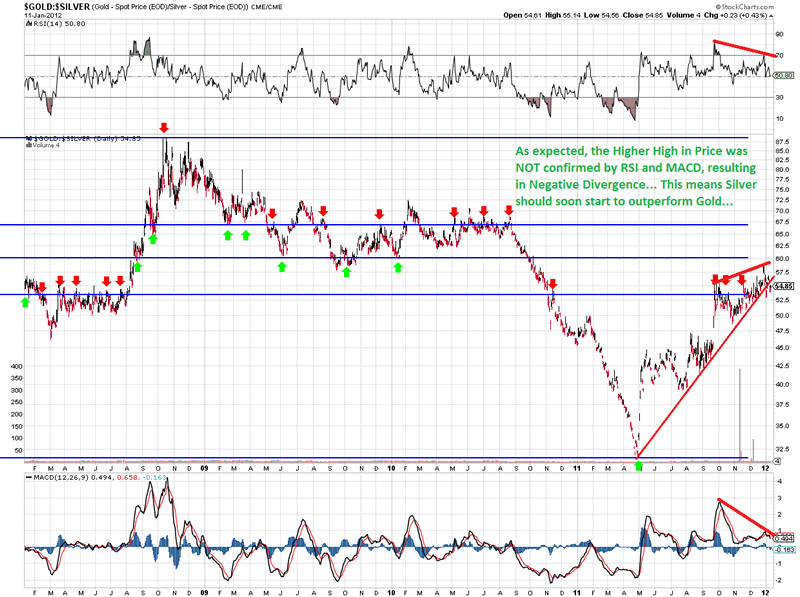

As expected, the higher high in the Gold:Silver ratio was not confirmed by the RSI and MACD, resulting in Negative Divergence, meaning the ratio should soon start to drop. This means Silver should soon outperform Gold. Given the BUY signal on both Gold and Silver, I expect both to rally over the next couple of weeks.

Chart courtesy stockcharts.com

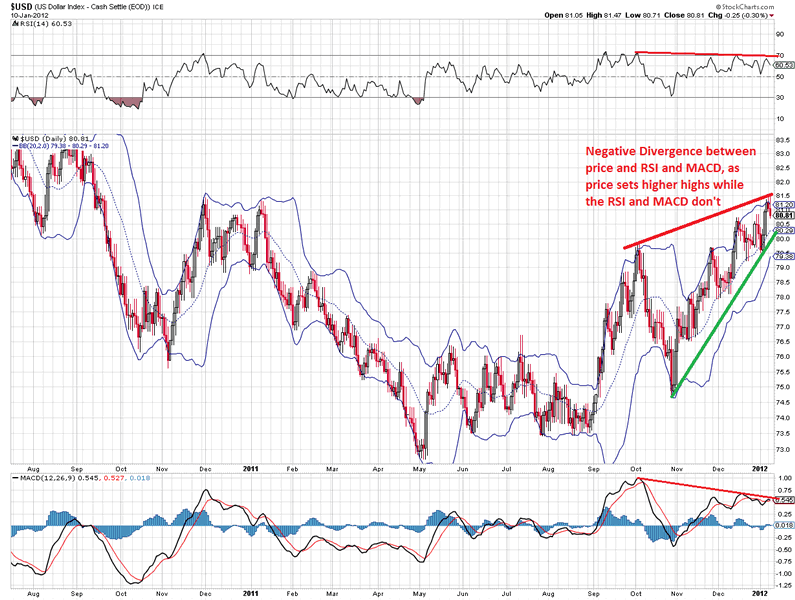

What Gold and Silver will do, greatly depends on the movement of the US Dollar.

The dollar has set a higher high, which was not confirmed by the RSI and MACD, resulting in Negative Divergence.

Price is also in a rising wedge, which often ends badly.

Chart courtesy stockcharts.com

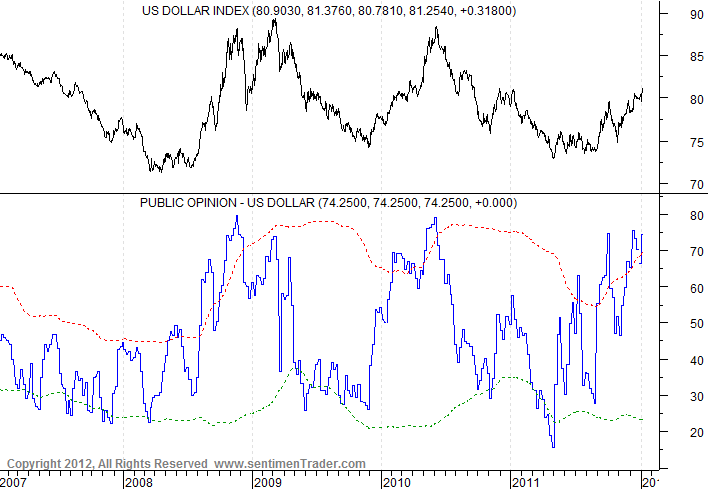

Sentiment in the US Dollar is also sky-high, adding more weight to my SHORT TERM negative view on the USD and the positive SHORT TERM view on Precious Metals.

Chart courtesy Sentimentrader.com

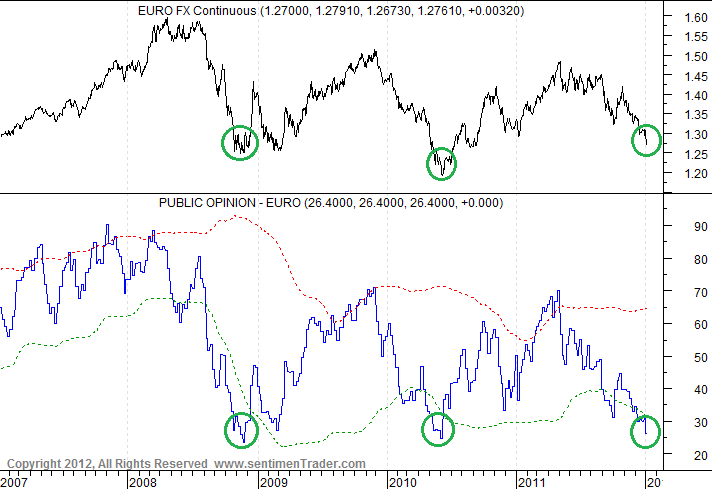

The Euro is the heavy weight in the USD index, so the recent dollar strength can be mainly attributed to the Euro Weakness.

We can see that Sentiment in the Euro now reaches historic lows. This doesn’t mean that the Euro will rise immediately, but the downside potential seems to be rather limited, based on sentiment (not price-wise).

Chart courtesy Sentimentrader.com

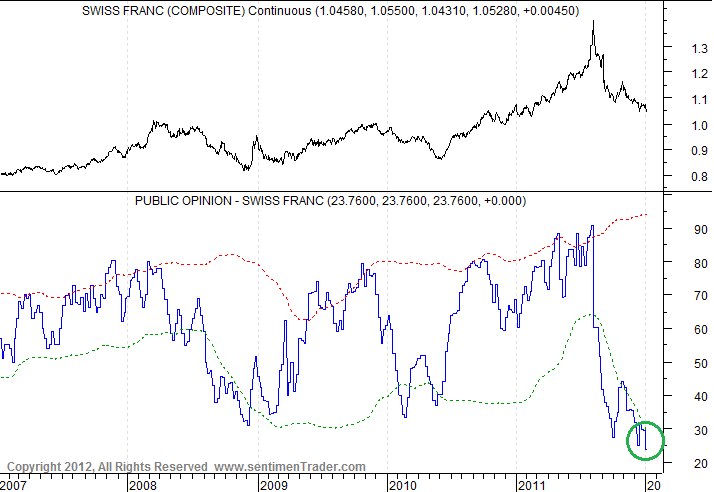

However, sentiment in the GBP and the Swiss Franc are also very negative now, meaning the dollar could be in the process of setting a top against ALL currencies now.

Chart courtesy Sentimentrader.com

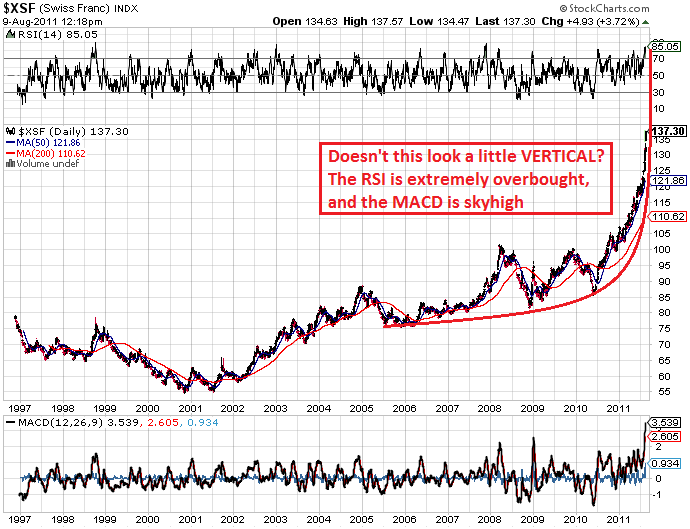

Back in August we warned of the “Swiss Franc Bubble”, which was based on Technical indicators as well as sentiment charts:

Chart courtesy stockcharts.com

That was the EXACT top, as the Swiss Central bank intervened shortly after, and we profited nicely of this opportunity by shorting the Swiss Franc at that time. $XSF (the Swiss Franc Index) is now back at 104 (coming from 140′ish)…

That combined with the UBER BEARISH Sentiment, gives me reason to believe that the Swiss Franc may be close to finding a bottom.

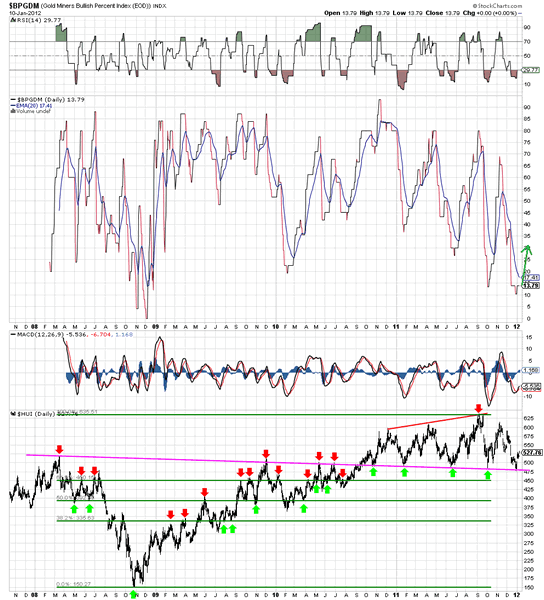

Last but not least, the Bullish % index of Gold Miners is still very depressed. This indicator shows the percentage of mining stocks in the $HUI index that are yielding a BUY signal on their point and figure charts.

Chart courtesy stockcharts.com

Conclusion: IF the Dollar is about to set a short term TOP, this will probably lead to a nice rally of both Gold and Silver, and most likely also in Mining Stocks.

For more articles, trading Updates, Nightly Reports and much more, please visit www.profitimes.com and feel free to sign up for our services!

Willem Weytjens

www.profitimes.com

© 2012 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.