China's Gold Imports From Hong Kong Surge to Highest Ever - PBOC Buying?

Commodities / Gold and Silver 2012 Jan 11, 2012 - 09:06 AM GMTBy: GoldCore

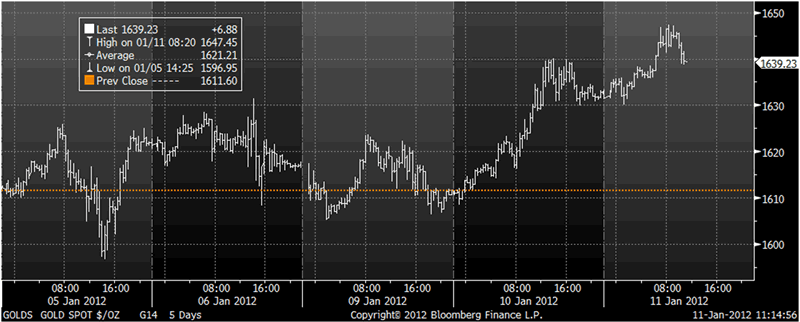

Gold’s London AM fix this morning was USD 1,641.00, GBP 1,063.51, and EUR 1,286.25 per ounce.

Gold’s London AM fix this morning was USD 1,641.00, GBP 1,063.51, and EUR 1,286.25 per ounce.

Yesterday's AM fix was USD 1,627.00, GBP 1,051.91, and EUR 1,271.49 per ounce.

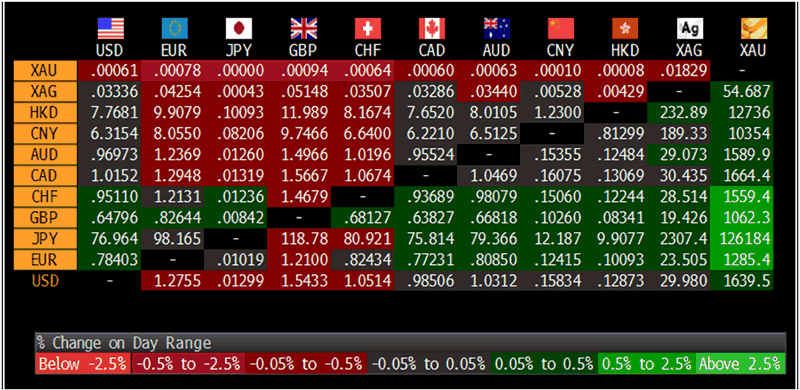

Cross Currency Table

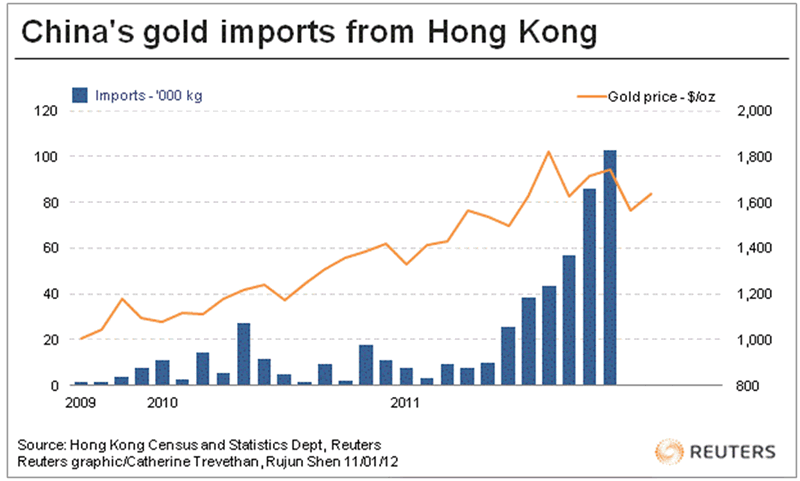

Demand for gold bullion in China continues to surge.

Mainland China's imports from Hong Kong surged to 102,779kg/oz from 86,299kg/oz in October. This is a 20% increase from the already high number seen in October and a 483% y/y increase.

The run into Chinese Lunar New Year has again seen higher than expected Chinese demand for gold and China's voracious appetite for gold is surprising even analysts who are positive about gold.

As Chinese people's disposable incomes gain and concerns grow over inflation and equity and property markets, Chinese consumers and investors are turning to gold as a long term investment hedge.

There is informed speculation that commercial Chinese banks may have taken advantage of the recent price dip to build stocks of coins and bars and accumulate bullion.

China's demand for physical gold bullion has rocketed past India with the country now overtaking India in the third quarter as the largest gold jewellery market according to the World Gold Council.

There is also informed speculation that some of the buying was from the People's Bank of China with one analyst telling Bloomberg that “there is always the possibility that some purchases were made by the central bank.”

As we've stated in the past, the PBOC is gradually diversifying their huge FX reserves and likely will announce upward revision of total gold reserves again in the coming months. Whether official buying is responsible for the huge surge in gold imports from Hong Kong is more difficult to ascertain The Chinese Central Bank does not release their figures on gold purchases.

As of June, 30, 2009, they held 33.59 million ounces or 1,054 tons. This is the 5th largest holding by country but some officials are on record with regard to Chinese aspirations to hold as much gold as the Federal Reserve's 8,100 tonnes of gold reserves.

What is particularly bullish about the import data is that there is a ban on exporting gold from China so gold bullion is in strong hands in China.

Platinum group metals rose a third straight day due to concerns on supply disruption in South Africa, as the national grid warned about extremely tight power supply in January. The gold-platinum spread narrowed to just below $165 an ounce, its smallest in two weeks. The price of platinum has been lower than that of gold since September 2011, as gloomy economic outlook dampened sentiment on platinum, while gold's safe-haven appeal helped limit its price decline.

Gold Spot $/oz - 5 Days

Finally, markets were looking forward to a meeting between German Chancellor Angela Merkel and Italian Prime Minister Mario Monti later in the day in Berlin, while IMF's Christine Lagarde, is to meet French President Nicolas Sarkozy in Paris. Markets are also watching Spain and Italy’s plan to sell as much as EUR17 billion in debt on Thursday and Friday respectively.

The continuation of the eurozone crisis and risk of global financial contagion will continue to support gold's safe haven status.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.