2012 Stoking Another Deadly Recession

Economics / Recession 2012 Jan 10, 2012 - 08:09 AM GMTBy: FNN24

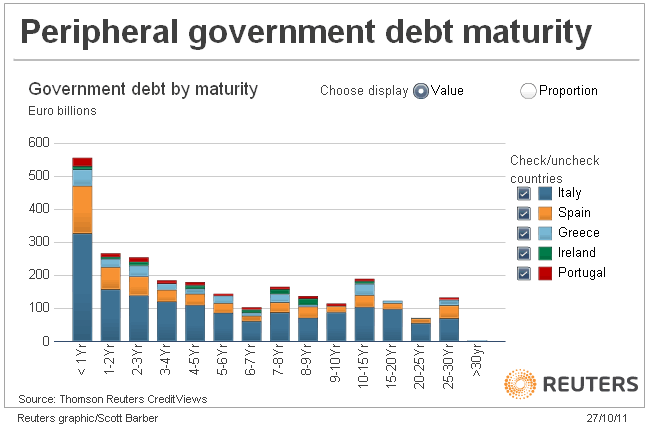

Our weekly update, published here takes a look at economic fundamentals across EU, US and UK while also looking at charts from FX markets and bond markets. Data has been mixed over the last few months with a case being made for US and UK to outperform all other markets while EU economies present a mixed picture with Germany standing out. But even then, we believe there are kinks in the growth picture across US, UK and EU as EURO crisis is expected to take an iron grip of the flow of credit over the next few months. Over EUR 1 trillion are set to be rolled over.

Our weekly update, published here takes a look at economic fundamentals across EU, US and UK while also looking at charts from FX markets and bond markets. Data has been mixed over the last few months with a case being made for US and UK to outperform all other markets while EU economies present a mixed picture with Germany standing out. But even then, we believe there are kinks in the growth picture across US, UK and EU as EURO crisis is expected to take an iron grip of the flow of credit over the next few months. Over EUR 1 trillion are set to be rolled over.

So while 2011 does present a mixed economic health picture, we believe the full effects of EUR crisis is to be seen in 2012.

A quick glance over economic data from Germany, US and UK and ECB purchases and strategies follows.

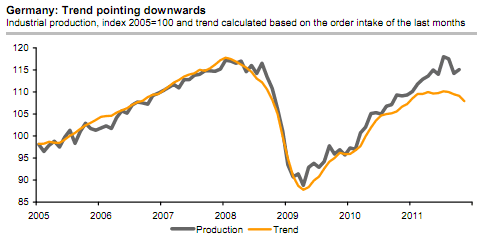

German Factory Orders stoke recession fears

Order intake in German industry was down by no less than 4.8% in November, eroding the gains made in October. The hard figures bear out the much gloomier view of the order situation expressed in surveys. It goes to shop how much manufacturing suffered in the second half of the year, and make it increasingly likely that the German economy contracted at the turn of the year. After the very welcome October figures reported, the order intake figures for November will have come as a rude awakening to the optimists’ camp. These were down 4.8% year on year, completely eroding the prior-month increase. There were no significant one-off effects involved either: Orders for miscellaneous vehicles, a highly volatile sector, admittedly fell by just short of 30%, but even when this is excluded, orders overall were down 3.5%.

Source: Global insights

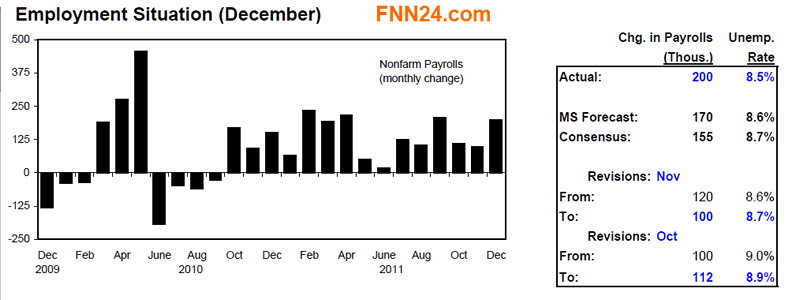

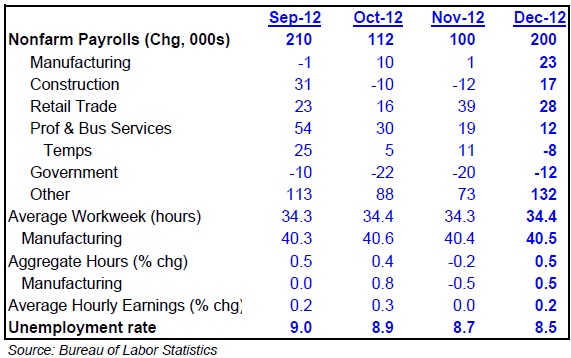

US Unemployment: Modest improvements but nothing to sing about

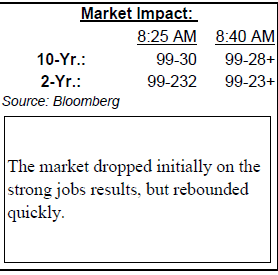

* A strong report with impressive gains in payrolls, hours and earnings. Indeed, the key aggregate weekly payrolls gauge was up a sharp 0.7%. * The unemployment rate moved lower again this month — although the latest downtick was mostly attributable to a 50,000 decline in the labor force.This report also included annual revisions to seasonal factors for the household survey data which resulted in some smoothing of the unemployment rate over the course of the past year. * Admittedly, some of the latest upside in payrolls should be discounted because of a seasonal quirk in the courier category of payrolls (FedEx, UPS,etc). Jobs in this sector jumped 42,000 in December, repeating a pattern seen in both 2009 and 2010. For some reason, the seasonal adjustment methodology is not fully capturing the surge that has been occurring in December and the ensuing layoffs that typically take place in January. This might be because the seasonal pattern has only been clear-cut for the past 3 years. In any case, we will see some payback in payroll employment next moth. Based on historical patterns, courier jobs should decline about 45,000 (SA) in the January report. * While this report contained a few quirks (courier jobs, drop in labor force, etc), it seems to be consistent with some modest underlying improvement in labor market conditions. In sum, things are looking a bit better but, we wouldn’t get too carried away just yet.

On wider sense, US macro data this week showed key bright spots. Jobless claims, construction spending, manufacturing and employment data all beat estimates, while ICSC retail sales came in slightly below expectations. Specifically, initial jobless claims were 372k vs. 375k est,, while construction spending was up 1.2% MoM, above the 0.5% est. ISM manufacturing also beat forecasts coming in at 53.9 vs. 53.5 est., and reaching its highest level in six months. Most encouraging, ADP and BLS payroll data beat estimates and the unemployment rate dropped another 20bps to 8.5% from 8.7%, more than forecasted. ADP payrolls were 325k vs.178k est., while BLS non-farm payrolls were 200k vs. 155k est. and BLS private payrolls 212k vs. 178k est. Negatively, ICSC chain store sales figure was lighter than estimates, posting a 3.5% increases YoY vs. 4% est.

2012: Some things are certain

Central banks are likely to embark on a further significant easing of the global monetary policy stance this year. We believe that governments will require and receive help as they continue to struggle to contain public debts and deficits. The global economy will likely require and receive help as it is teetering on the brink of another recession. And with headline inflation very likely to decelerate almost everywhere during the first half of 2012, central banks should be able to argue that a rising risk of unwelcome disinflation or even deflation justifies additional conventional (where still possible) and unconventional stimulus. So, while there are ample reasons to worry about recession risks, financial fragility and fiscal policy blunders, at least central banks are likely to provide a monetary backstop but even then we believe we are much closer to crumbling of the entire global economy than we were any time in our memory.

2012: Europe worst year?

The announcement that the Spanish public deficit for 2011 would be close to 8.0% of GDP, significantly above the official target of 6.0%, is a blow to the Spanish sovereign. Officially, the government wants to stick to the 4.4% of GDP 2012 target. In our view, the cost to the economy could be staggering. We believe a relaxation of the deficit targets for 2012 would be acceptable if effective ex-ante control over regional spending is put in place, if swift progress is made on structural reforms and bank capital.

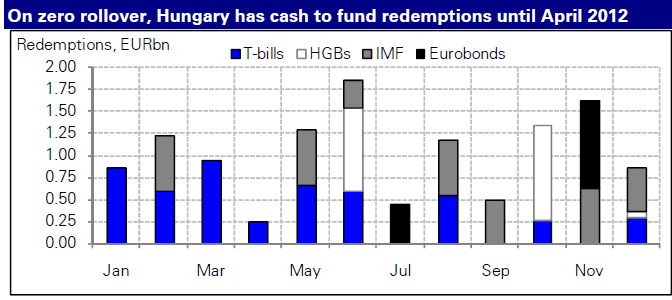

But worryingly crisis has moved outside the euro area. Ongoing uncertainty over Hungary’s ability to secure an IMF/EU package has put local assets under considerable pressure and all three rating agencies have cut Hungary to sub-investment grade. Hungary has enough liquidity to meet its financing needs through end April even in a worst-case scenario but we do not think that walking away from an IMF/EU deal is an option anymore. Concrete action will be needed.

While Hungary struggles with debt rollovers, the situation in Greece is tense where the PSI and new loan programme negotiations mean high-risk over Q1. In Ireland, the nascent success story has new challenges as loan growth and economic activity is slowing down dramatically.

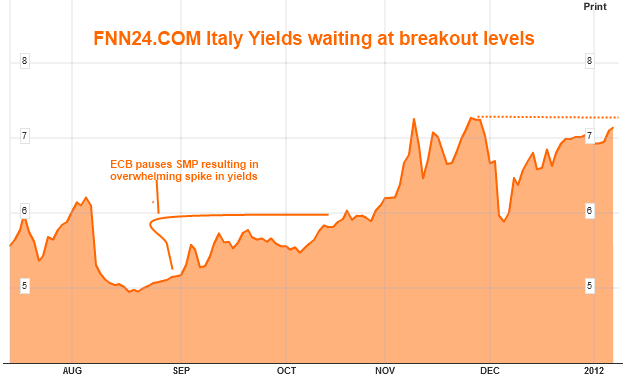

In Italy, things were stable but no improvements to write home about since we reviewed the situation in November. Compared to those in November, the last two auctions of 2011 saw a significant improvement in short-end yields and a minor improvement at the long end. But yields along the curve remained well above that at the beginning of 2011.

At the auctions’ yields, Italy could manage to slowly decrease the debt/GDP ratio to around 110% assuming average real GDP growth of 0.6% post-2013. However, the country will likely remain in a vulnerable position even in the medium term. For that reason structural reforms are essential to strengthen the sustainability of the debt. The PM said that concrete steps will be taken by the end of January (e.g. liberalisation, labour market reform, boosting R&D and human capital investment). There is, however, a substantial risk that only modest reforms will be implemented given the resistance of the parties in the parliament and of social partners. Hence, January will be a critical month in terms of understanding the government’s determination to address the causes at the core of the current confidence and liquidity crisis.

UK data: Case for cautious optimism? Not yet!

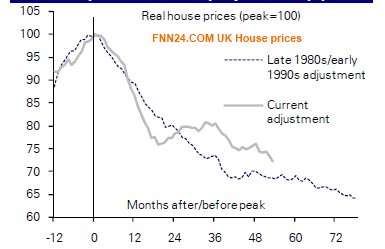

In the UK, housing market data published since Christmas has generally been a little weaker – particularly house prices, which have fallen further in December (even seasonally adjusted). We suspect that the adjustment in real prices is not yet complete, though how much of that occurs through falling nominal prices remains to be seen.

Our preference is to focus on the Nationwide and Halifax surveys, both of which have been published over the past week – the former showing a fall of 0.2% and the latter a drop of 0.9%. This is the second consecutive month that the average of the two surveys has fallen – by 0.5% in December following a 0.2% fall in November. This average index shows a fall of 0.4% during the course of 2011 (i.e. between December 2010 and December 2011).

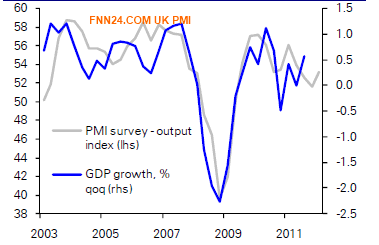

On the manufacturing side, UK PMI business surveys, all three of which have risen and been stronger than expected in December.

The manufacturing headline index rose from 47.7 to 49.6, more than 2 points above expectations of 47.3. Output is back above the 50 level and new orders rose by three points (helped by stronger export orders). Employment is contracting at a much slower pace too. The construction survey total activity index rose from 52.3 to 53.2, above expectations of 51.5. This was all due to civil engineering activity which is now growing again; housing and commercial activity continued to grow but at a weaker pace. Growth in new orders was similar in December to November. The headline business activity index of the services survey rose from 52.1 to 54.0, compared with the consensus view of 51.5. The new business index was up by nearly two points and employment moved back into expansion territory. Business expectations were weaker however, falling to their joint lowest since early 2009.

However, we continue to be bearish on UK prospects in 2012 given from the fallout of euro crisis, whether the PMIs can remain at these levels given the outlook for the euro area (a three quarter length recession) and with the service sector expectations balance weakening is questionable.

ECB Preview

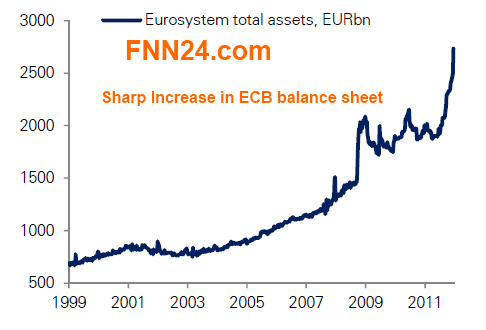

Following the EUR 489bn three-year LTRO, the ECB balance sheet has increased sharply.

But nonetheless we note that less than half of the EUR 489bn represents an increase in the amount of bank funding. In fact the net increase is obtained by deducting the already existing ECB funding for the banks that was rolled into the new threeyear LTRO and hence the net increase was EUR 191 bn.

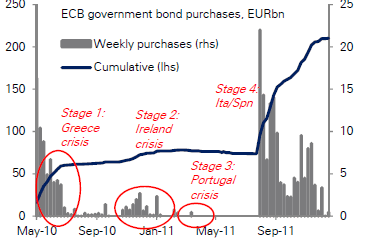

ECB is now looking at proactive measures to counter the latest rise in Italian and Spainish yields. The sharp slowdown in SMP purchase since August 2010 led to the exponential rise in EU yields. We believe that ECB may continue its SMP purchases to calm the markets but will constantly be under pressure by the council to be selective about the purchase.

The ECB purchases via the SMP slowed in December from an average of EUR 8bn since August to just above EUR 1bn. Following his Bundesbank-esque press conference, we do not see Draghi removing the uncertainty about the ECB’s use of the SMP on 12 January.

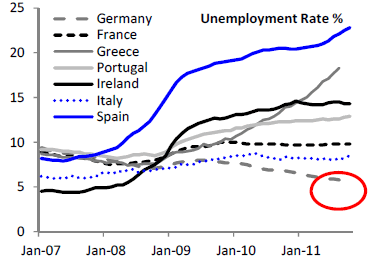

EU unemployment: Selective worsening?

The divergence is in differential EU growth is seen in unemployment rates. Siince mid-2007, the unemployment rate has fallen by about 2 percentage points in Germany and increase on average by 7.3 percentage points in the five peripherals (from the 1.5pp increase in Italy to the 11.8pp increase in Spain).

Given differential EU economic health, we expect ECB SMP purchases to be the best way forward till the time EU can achieve fiscal union.

Finally we close this analysis with the technical picture across the forex world.

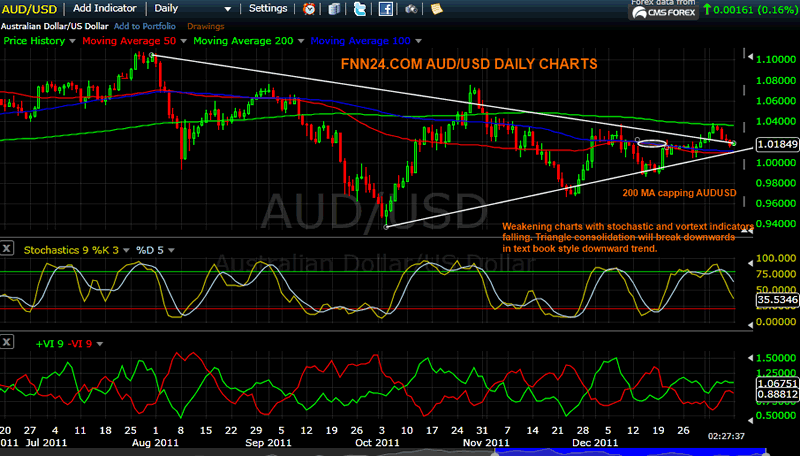

AUD/USD: Strong topping process

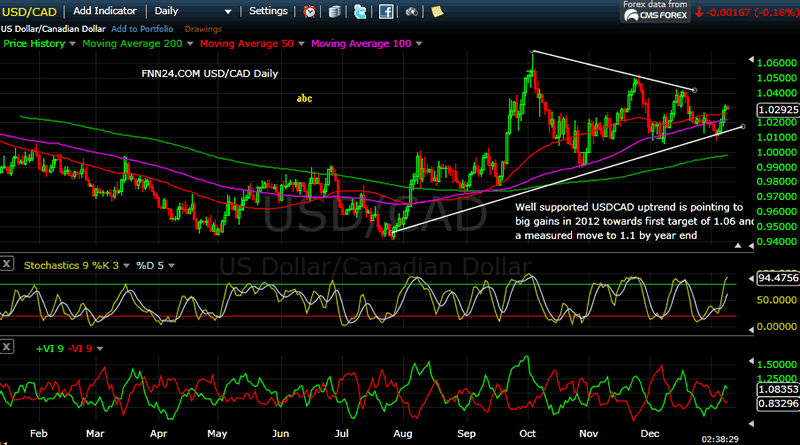

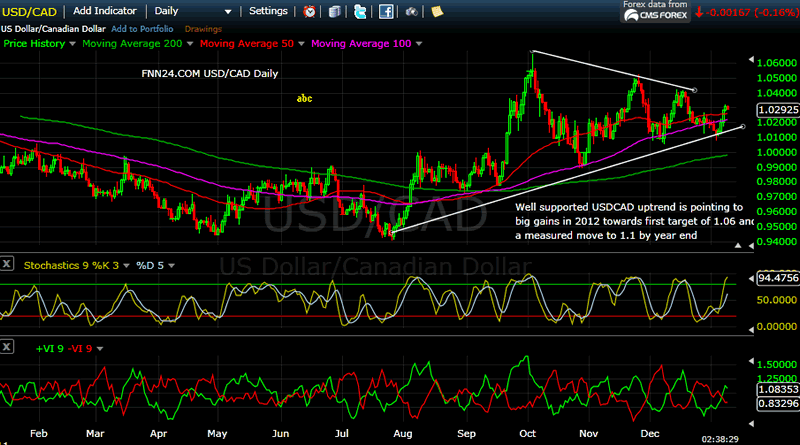

USD/CAD: Matching AUD/USD

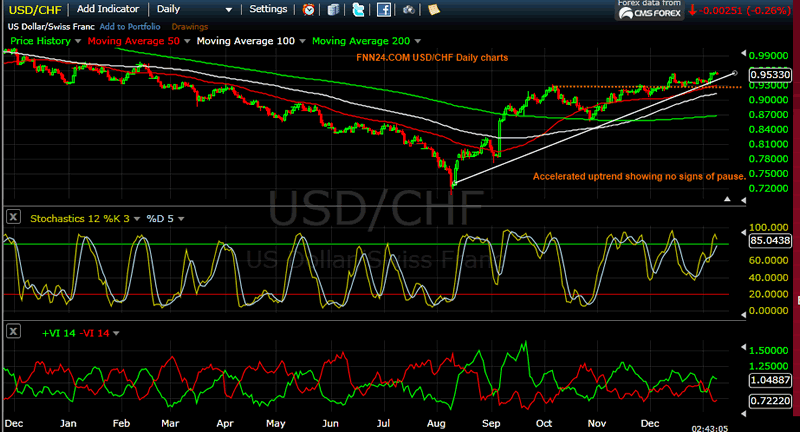

USD/CHF: Weakening CHF gives buttress to the Dollar index

SP500: False break?

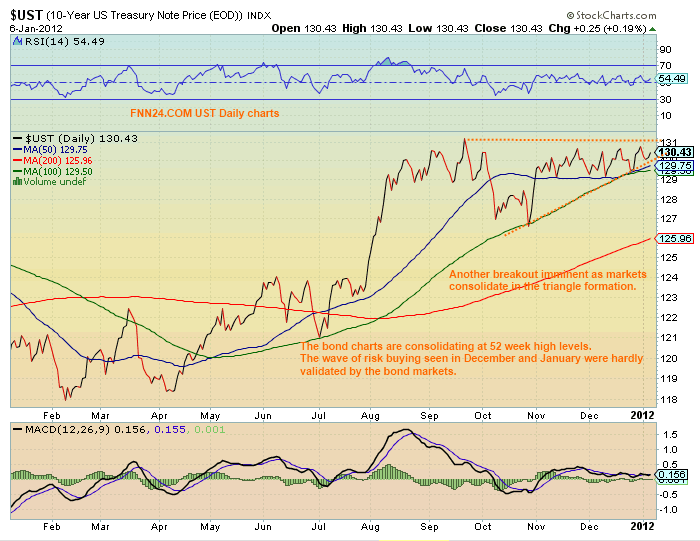

The bond market data is equally unambiguous about its expectation for 2012.

The story for the German Bunds are same as they consolidate at all time high levels aided by poor EU bond sales as investors seek the safety of the German bonds while at the same time questioning the growth prospects for the world economy.

Conclusion:

1. The economic data from UK and US has been heartening and better than expected exp on the employment front but we are yet to see significant improvement to suggest if there is any actual fundamental improvements. On the contrary, 24 months after the recession hit US and UK, we only see modestly better data than when we first started.

2. FX markets analysis seem to suggest that there is a lot more downside for all RISK trades in 2012 including SP500 and Oil.

3. Bond markets are consolidating at all time highs suggesting an impending crack in risk trades in H1 2012.

Mark

Head of Research FNN24 Singapore, Mumbai, London, NY Home

URL: http://www.fnn24.com

FNN24 provides real time news bullets and economic indicators with sub second latency helping the retail trader with contextual mission critical information/data. Never miss another trade due to delayed data.

Bio: Head of Research, FNN24 a 24 hour news bullet service for the retail trader providing economic indicators with sub second latency. Never miss anothe trade due to delayed data.

© 2012 Copyright FNN24 - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.