U.S. Iran War Imminent in Straits of Hormuz? $200 a Barrel Oil?

Politics / Crude Oil Jan 03, 2012 - 12:08 PM GMTBy: OilPrice_Com

The pieces and policies for potential conflict in the Persian Gulf are seemingly drawing inexorably together.

The pieces and policies for potential conflict in the Persian Gulf are seemingly drawing inexorably together.

Since 24 December the Iranian Navy has been holding its ten-day Velayat 90 naval exercises, covering an area in the Arabian Sea stretching from east of the Strait of Hormuz entrance to the Persian Gulf to the Gulf of Aden. The day the maneuvers opened Iranian Navy Commander Rear Admiral Habibollah Sayyari told a press conference that the exercises were intended to show "Iran's military prowess and defense capabilities in international waters, convey a message of peace and friendship to regional countries, and test the newest military equipment." The exercise is Iran's first naval training drill since May 2010, when the country held its Velayat 89 naval maneuvers in the same area. Velayat 90 is the largest naval exercise the country has ever held.

The participating Iranian forces have been divided into two groups, blue and orange, with the blue group representing Iranian forces and orange the enemy. Velayat 90 is involving the full panoply of Iranian naval force, with destroyers, missile boats, logistical support ships, hovercraft, aircraft, drones and advanced coastal missiles and torpedoes all being deployed. Tactics include mine-laying exercises and preparations for chemical attack. Iranian naval commandos, marines and divers are also participating.

The participating Iranian forces have been divided into two groups, blue and orange, with the blue group representing Iranian forces and orange the enemy. Velayat 90 is involving the full panoply of Iranian naval force, with destroyers, missile boats, logistical support ships, hovercraft, aircraft, drones and advanced coastal missiles and torpedoes all being deployed. Tactics include mine-laying exercises and preparations for chemical attack. Iranian naval commandos, marines and divers are also participating.

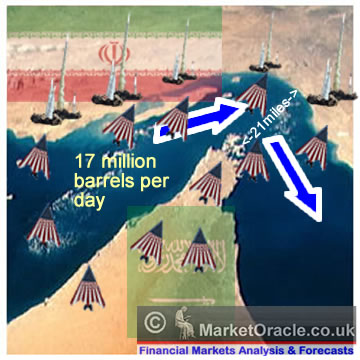

The exercises have put Iranian warships in close proximity to vessels of the United States Fifth Fleet, based in Bahrain, which patrols some of the same waters, including the Strait of Hormuz, a 21 mile-wide waterway at its narrowest point. Roughly 40 percent of the world's oil tanker shipments transit the strait daily, carrying 15.5 million barrels of Saudi, Iraqi, Iranian, Kuwaiti, Bahraini, Qatari and United Arab Emirates crude oil, leading the United States Energy Information Administration to label the Strait of Hormuz "the world's most important oil chokepoint."

In light of Iran's recent capture of an advanced CIA RQ-170 Sentinel drone earlier this month, Iranian Navy Rear Admiral Seyed Mahmoud Moussavi noted that the Iranian Velayat 90 forces also conducted electronic warfare tests, using modern Iranian-made electronic jamming equipment to disrupt enemy radar and contact systems. Further tweaking Uncle Sam's nose, Moussavi added that Iranian Navy drones involved in Velayat 90 conducted successful patrolling and surveillance operations.

Thousands of miles to the west, adding oil to the fire, President Obama is preparing to sign legislation that, if fully enforced, could impose harsh penalties on all customers for Iranian oil, with the explicit aim of severely impeding Iran's ability to sell it.

How serious are the Iranians about the proposed sanctions and possible attack over its civilian nuclear program and what can they deploy if push comes to shove? According to the International Institute for Strategic Studies' The Military Balance 2011, Iran has 23 submarines, 100+ "coastal and combat" patrol craft, 5 mine warfare and anti-mine craft, 13 amphibious landing vessels and 26 "logistics and support" ships. Add to that the fact that Iran has emphasized that it has developed indigenous "asymmetrical warfare" naval doctrines, and it is anything but clear what form Iran's naval response to sanctions or attack could take. The only certainty is that it is unlikely to resemble anything taught at the U.S. Naval Academy.

The proposed Obama administration energy sanctions heighten the risk of confrontation and carry the possibility of immense economic disruption from soaring oil prices, given the unpredictability of the Iranian response. Addressing the possibility of tightened oil sanctions Iran's first vice president Mohammad-Reza Rahimi on 27 December said, "If they impose sanctions on Iran's oil exports, then even one drop of oil cannot flow from the Strait of Hormuz."

Iran has earlier warned that if either the U.S. or Israel attack, it will target 32 American bases in the Middle East and close the Strait of Hormuz. On 28 December Iranian Navy commander Rear Admiral Habibollah Sayyari observed, "Closing the Strait of Hormuz for the armed forces of the Islamic Republic of Iran is very easy. It is a capability that has been built from the outset into our naval forces' abilities."

But adding an apparent olive branch Sayyari added, "But today we are not in the Hormuz Strait. We are in the Sea of Oman and we do not need to close the Hormuz Strait. Today we are just dealing with the Sea of Oman. Therefore, we can control it from right here and this is one of our prime abilities for such vital straits and our abilities are far, far more than they think."

There are dim lights at the end of the seemingly darker and darker tunnel. The proposed sanctions legislation allows Obama to waive sanctions if they cause the price of oil to rise or threaten national security.

Furthermore, there is the wild card of Iran's oil customers, the most prominent of which is China, which would hardly be inclined to go along with increased sanctions.

But one thing should be clear in Washington - however odious the U.S. government might find Iran's mullahcracy, it is most unlikely to cave in to either economic or military intimidation that would threaten the nation's existence, and if backed up against the wall with no way out, would just as likely go for broke and use every weapon at its disposal to defend itself. Given their evident cyber abilities in hacking the RQ-170 Sentinel drone and their announcement of an indigenous naval doctrine, a "cakewalk" victory with "mission accomplished" declared within a few short weeks seems anything but assured, particularly as it would extend the military arc of crisis from Iraq through Iran to Afghanistan, a potential shambolic military quagmire beyond Washington's, NATO's and Tel Aviv's resources to quell.

It is worth remembering that chess was played in Sassanid Iran 1,400 years ago, where it was known as "chatrang." What is occurring now off the Persian Gulf is a diplomatic and military game of chess, with global implications.

Washington's concept of squeezing a country's government by interfering with its energy policies has a dolorous history seven decades old.

When Japan invaded Vichy French-ruled southern Indo-China in July 1941 the U.S. demanded Japan withdraw. In addition, on 1 August the U.S., Japan's biggest oil supplier at the time, imposed an oil embargo on the country.

Pearl Harbor occurred less than four months later.

Source: http://oilprice.com/Energy/Oil-Prices/War-Imminent-in-Straits-of-Hormuz-$200-a-Barrel-Oil.html

This article was written by Dr. John CK Daly for Oilprice.com who offer detailed analysis on Crude Oil, Geopolitics, Gold and most other commodities. They also provide free political and economic intelligence to help investors gain a greater understanding of world events and the impact they have on certain regions and sectors. Visit: http://www.oilprice.com

© 2011 Copyright OilPrice.com- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.