Stock Market Back on Crash Alert

Stock-Markets / Stock Markets 2011 Dec 29, 2011 - 11:29 AM GMT Yesterday the SPX decline to mid-cycle support/resistance at 1249.27. This morning it is taking a brief bounce to retest the 200 day moving average at 1258.87. As an alternate, it may challenge the 50% Fibonacci retracement at 1259.02.

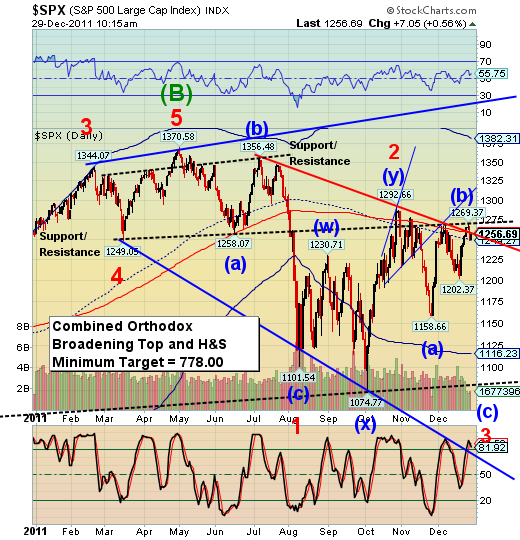

Yesterday the SPX decline to mid-cycle support/resistance at 1249.27. This morning it is taking a brief bounce to retest the 200 day moving average at 1258.87. As an alternate, it may challenge the 50% Fibonacci retracement at 1259.02.

Additional support may lie at the 50 day moving average at 1235.61 or the intermediate-term trend support at 1230.87. However, other circumstances dictate that those supports may have little influence on the decline.

Where back on flash crash alert, starting today.

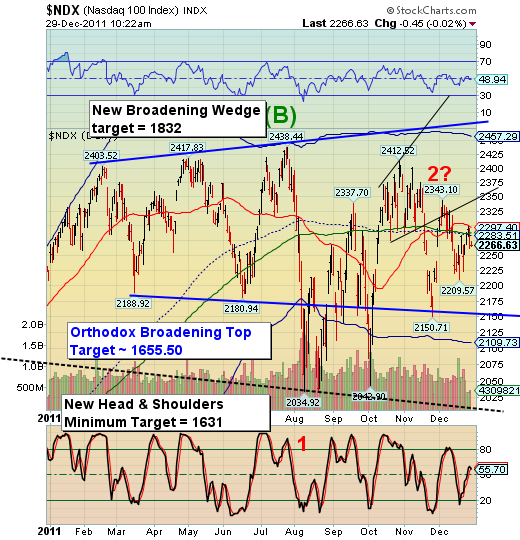

The NASDAQ has no such problems with supports, since it is already decline beneath them. It barely held mid-cycle support/resistance at 2283.51 for a day before losing its grip. The 200 day moving average also corresponds closely to mid-cycle support/resistance.

The new broadening wedge has an average target of 1832.00. But in the process of getting there, it will cross a massive head and shoulders neckline near 2000.00, validating a new target in the mid-1600s.

The NASDAQ is also on a flash crash alert.

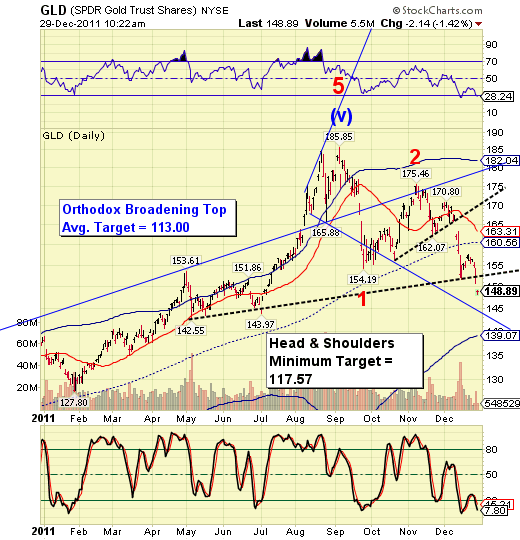

I had to chuckle is morning when GLD had a new low at 148.27. I had recently erased the smaller Head and Shoulders neckline minimum target of 148.68. The point is, GLD has completed a perfect five wave impulse and may be due for a back test of its larger Head and Shoulders pattern.

This by no means negates the crash pattern in GLD. We may simply see a brief respite before the decline returns in earnest.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.