Gold Near-Term Forecast 2012

Commodities / Gold and Silver 2012 Dec 29, 2011 - 01:27 AM GMTBy: Pete_Grant

Gold is consolidating below $1600 as we enter the last week of the year. The last London gold fix of 2010 was $1405, so barring any dramatic price changes in the last week of the year, the yellow metal is on-track for yet another double-digit gain of about 14%.

Gold is consolidating below $1600 as we enter the last week of the year. The last London gold fix of 2010 was $1405, so barring any dramatic price changes in the last week of the year, the yellow metal is on-track for yet another double-digit gain of about 14%.

That's pretty impressive given the dramatic delveraging sell-off from the 1920.50 record high we saw in September, which prompted all manner of commentary proclaiming the end of gold's decade-long rally. More recently — amid another bout of deleveraging associated with rising uncertainty about the fate of European Union — the yellow metal retested the September low at 1534.06 along with important channel support. While much was made of the technical damage done by the recent move below the 200-day moving average, gold continues to display good resilience, underpinned by solid fundamentals.

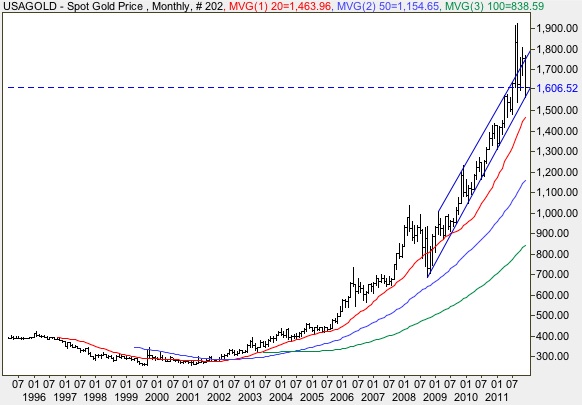

Monthly Gold Chart

Daily Gold Chart

Those supporting fundamentals are unlikely to change anytime soon as the world continues to seek solutions for an overwhelming level of debt and anemic growth prospects. Thus far, the focus remains on creating more of what is arguably to primary source of the problem. Debt.

Of course someone needs to buy that debt, so we have also witnessed unprecedented — and in some instances "unlimited" — liquidity pumps to perpetuate the now institutionalized game of "hide the debt." I don't think that anyone really believes that more debt is really the answer to our global debt crisis, but in staving off a complete economic catastrophe several years ago with massive deficit spending and liquidity schemes, the United States effectively set the tone. Actually, the US was simply following the example set by Japan more than 20-years ago; drive interest rates to zero and hold them there by printing currency and buying bonds with it.

In fact, Japanese debt is fast approaching ¥1 quadrillion! That rather ominous benchmark is expected to be surpassed by the end of Japan's fiscal year in March. The BoJ's balance sheet is a startling ¥138 trillion. Meanwhile the Fed's balance sheet has contracted in recent months, but is still in excess of $2.7 trillion. But perhaps most troubling is the expansion of the ECB's balance sheet. Despite their persistent assurances that quantitative measures simply aren't an option, the ECB's balance sheet has grown by nearly a third, approaching €2.5 trillion. Hey Mr. Draghi, if you're not engaged in QE, explain that exploding balance sheet.

There are policymakers in Europe, including ECB board member Lorenzo Bini Smaghi, that favor true — or at least un-obscured — quantitative easing by the ECB to prevent another recession in Europe. Imagine the implications for the central bank's balance sheet if the objections are ultimately circumvented.

Late in December, the ECB unleashed a wall of money, €489 bln ($638 bln) in 3-year LTROs to 523 eurozone banks. The positive reaction to all this new liquidity was very short-lived. The euro remains under pressure and eurozone spreads have widened back out.

As the FT's Gillian Tett pointed out in a recent column, the hope was that the banks would use this abundance of cheap ECB money to buy European sovereign debt, much in the same way that US banks plowed the proceeds from mortgage backed securities sales to the Fed into US Treasuries. Basically, the private sector ends up financing the government with funds provided by the government. Being in the middle of this financing cycle results in a potential profit bonanza for the banks.

If you would like to broaden your view of gold market, we invite you to sign-up for our regular newsletter and receive quality commentary like what you are now reading. It's free of charge and comes by e-mail. You can opt out at any time.

ZIRP and liquidity. Liquidity and ZIRP. From here to eternity...

There are growing rumblings that the Fed is about to extend their ZIRP guidance from mid-2013 out to 2014 and potentially beyond. I'm sure when the BoJ launched their quantitative measures they were expected to last maybe a couple of years. Here it is 20 some years later and Japan still has 0% interest rates. Do you suppose this is our fate as well?

Some of the major financial firms are predicting lofty average gold prices for the coming year: Goldman Sachs $1810, Barclays $2000 and UBS $2050 to name just a few. We maintain that the long-term uptrend in gold is protected as long as we remain in a negative real interest rate environment. This in fact seems all-but assured for quite some time. On top of that, the ongoing expansions of debt, monetary bases and central bank balance sheets, along with broadly positive supply/demand dynamics — highlighted by robust investment and central bank demand — conspire to underpin gold as well in the new year.

On behalf of everyone here at USAGOLD - Centennial Precious Metals, we wish you a Happy New Year and a most prosperous 2012.

Peter Grant spent the majority of his career as a global markets analyst. He began trading IMM currency futures at the Chicago Mercantile Exchange in the mid-1980's. Pete spent twelve years with S&P - MMS, where he became the Senior Managing FX Strategist. The financial press frequently reported his personal market insights, risk evaluations and forecasts. Prior to joining USAGOLD, Mr. Grant served as VP of Operations and Chief Metals Trader for a Denver based investment management firm.

This newsletter is distributed with the understanding that it has been prepared for informational purposes only and the Publisher or Author is not engaged in rendering legal, accounting, financial or other professional services. The information in this newsletter is not intended to create, and receipt of it does not constitute a lawyer-client relationship, accountant-client relationship, or any other type of relation-ship. If legal or financial advice or other expert assistance is required, the services of a competent professional person should be sought. The Author disclaims all warranties and any personal liability, loss, or risk incurred as a consequence of the use and application, either directly or indirectly, of any information presented herein.

By Pete Grant , Senior Metals Analyst, Account Executive USAGOLD - Centennial Precious Metals, Denver

For more information on the role gold can play in your portfolio, please see The ABCs of Gold Investing : How to Protect and Build Your Wealth with Gold by Michael J. Kosares.

Pete Grant is the Senior Metals Analyst and an Account Executive with USAGOLD - Centennial Precious Metals. He has spent the majority of his career as a global markets analyst. He began trading IMM currency futures at the Chicago Mercantile Exchange in the mid-1980's. In 1988 Mr. Grant joined MMS International as a foreign exchange market analyst. MMS was acquired by Standard & Poor's a short time later. Pete spent twelve years with S&P - MMS, where he became the Senior Managing FX Strategist. As a manager of the award-winning Currency Market Insight product, he was responsible for the daily real-time forecasting of the world's major and emerging currency pairs, along with gold and precious metals, to a global institutional audience. Pete was consistently recognized for providing invaluable services to his clients in the areas of custom trading strategies and risk assessment. The financial press frequently reported his expert market insights, risk evaluations and forecasts. Prior to joining USAGOLD, Mr. Grant served as VP of Operations and Chief Metals Trader for a Denver based investment management firm.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.