What Will 2012 Bring for Global Central Banks Monetary Policy?

Interest-Rates / Central Banks Dec 28, 2011 - 08:30 AM GMTBy: CentralBankNews

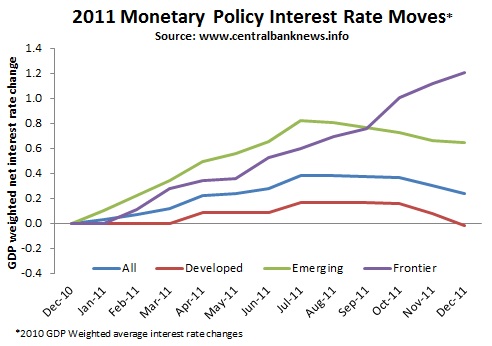

he year of 2011 was an interesting and eventful year in monetary policy. As the chart below shows, the GDP weighted average interest rate of central banks crept up in the first half of the year as commodity prices remained buoyant, economic recoveries showed signs of gaining momentum, and inflation was the key concern in emerging markets. But this was then followed by a reversal in course in the later part of the year as the specter of the European debt crisis and slowing global growth raised downside risks for growth and price stability, spurring central bankers to cut rates and otherwise ease policy settings.

At this point we turn it over to our loyal readers to come up with their own predictions for monetary policy in 2012. Please submit your top 5 predictions for monetary policy and central banking in 2012 in the comments below, or email them to us. We will post a follow up article with the most popular and controversial predictions, with due attribution and links to blogs where appropriate (or no attribution for those who wish to remain anonymous).

Permalink: http://www.centralbanknews.info/2011/12/what-will-2012-bring-for-global.html

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.