Euro-zone Credit Implosion Secret, ECB Cannot Stop Collateral Contagion Collapse!

Interest-Rates / Eurozone Debt Crisis Dec 27, 2011 - 12:38 PM GMTBy: Gordon_T_Long

How long can the European media keep the EU credit implosion a secret? The disgraced former IMF Director, Demonic Strauss Kahn said on Tuesday December 12th, 2011 that No 'Firewall' Exists and Europe Has 'Only Weeks'. Of course within minutes of this Financial Times news release which detailed his vent on EU leadership and the perilous situation in Europe, the article disappeared.

How long can the European media keep the EU credit implosion a secret? The disgraced former IMF Director, Demonic Strauss Kahn said on Tuesday December 12th, 2011 that No 'Firewall' Exists and Europe Has 'Only Weeks'. Of course within minutes of this Financial Times news release which detailed his vent on EU leadership and the perilous situation in Europe, the article disappeared.

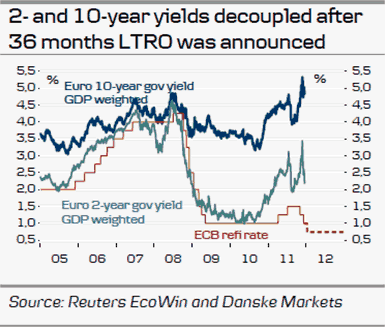

The details of the European liquidity crisis are generally reported, but for some reason no media source wants to pull the pieces together so everyone can see the magnitude and futility of the crisis. A growing Collateral Contagion is being shrouded in the apparent belief that the solution to the European Financial and Banking crisis is a grand change in Treaty governance. Obviously the European Central Bank (ECB) was well aware of the reality, when it was forced to deploy a historic and unprecedented LTRO (Long Term Purchase Operations) on Wednesday December 21, 2011. 560 banks desperately and immediately grabbed what they could, to the tune of €489B.

The LTRO bought the EU private banks some time. It did nothing to solve the EU Sovereign Debt Crisis. After less than one week, the cash held at the ECB surged €133B to a new record €347B. Since the net LTRO was only €210B, it tells you that the EU banks not only have a cash problem, but more specifically, as ECB President Mario Draghi says: "hoarding at the ECB signals that the problem afflicting the Eurozone is not so much about the amount of liquidity but that this liquidity is not circulating around the region's banks".

I would argue that the problem short term is a shortage of real collateral and that US dollar cash, versus 'encumbered' cash flow, is now king. It is clear that the rampant advancing Collateral Contagion will quickly eat this futile attempt like ravenous wolves. A well circulated Tweet from PIMCO bond king Bill Gross said it all: " What does LTRO stand for? 1- A shell game; 2-Cash for trash; 3 Three-card Monti; or 4. All of the above."

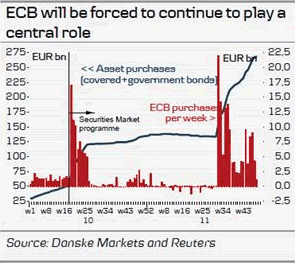

Here is the stark reality of what forced the ECB to offer unprecedented three year loans at absurd rates and most alarmingly, the acceptance of collateral that no other financial institutions will accept. The ECB has sacrificed its balance sheet in yet another EU "kick at the can".

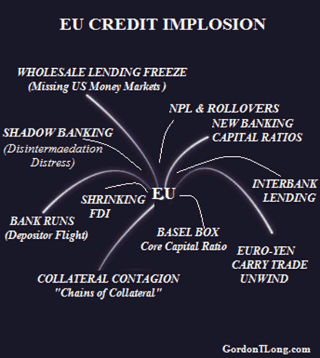

- COLLATERAL CONTAGION: There is a cascading Collateral Contagion crisis in which secured lending, based on sound assets, has replaced unsecured lending based on future expected cash flows.

- WHOLESALE LENDING: Wholesale bank lending, which is a unique cornerstone of European banking, has completely frozen since the failure of Dexia and US Money Market Funds will no longer risk short term capital having learned their lesson in 2008.

- BANK RUNS: Bank Runs are quietly and insidiously occurring throughout the peripheral EU countries as corporate and private depositors seek safe havens for their cash holdings.

- SHADOW BANKING SYSTEM: The European Shadow Banking System off balance sheet and unreported leverage structures, such as SIV (Structured Investment Vehicles) is collapsing due to non performing loans which must finally be rolled nearly 3 years since the financial crisis began.

- GLOBAL INVESTORS PULLING SOVEREIGN EU INVESTMENTS: Net outflows from the euro-zone's financial account reached €32.1 billion in October alone, on an unadjusted basis. The drop reflects the sale by foreign investors of €53.3 billion in euro-zone debt instruments and €6.6 billion in equities.

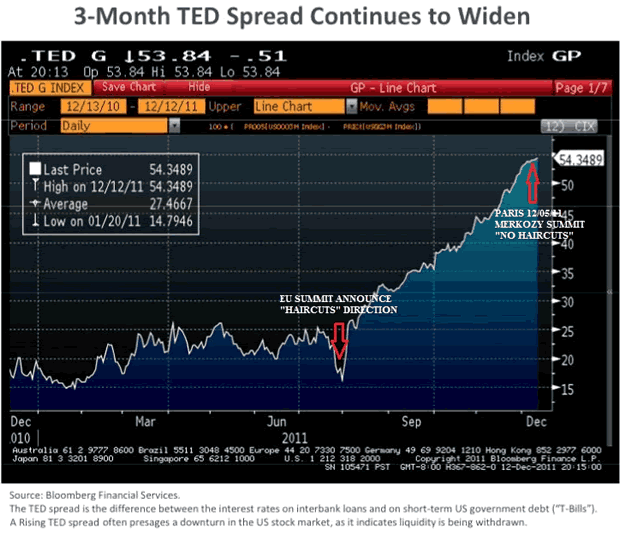

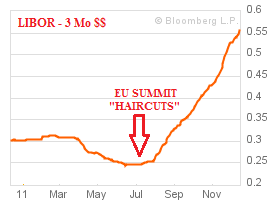

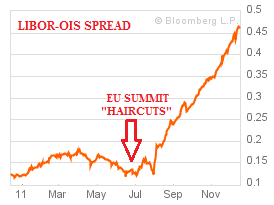

- INTERBANK LENDING: Prior to LTRO, overnight interbank lending was impaired as LIBOR, LIBOR-OIS and TED spread yields were going almost straight up on a percentage change basis.

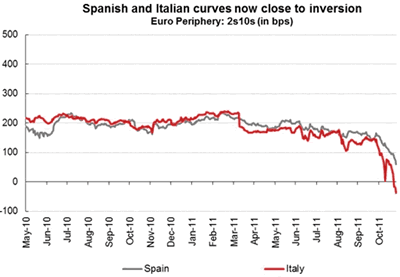

- INVERTED YIELD CURVES: Prior to LTRO, yield curves in the EU peripheral countries were either inverted or nearing inversion prior to LTRO.

- US DOLLAR SWAPS: A shortage of US dollar denominated loans forced the US federal Reserve and other global central banks to intervene and offer what is turning out to be unlimited US dollar SWAPs for minimal interest rates and unprecedented, extended durations, not previously considered.

- SOVEREIGN BOND MARKET: The EU Sovereign Bond Market is being avoided by almost all Global financial institutions. The only participant are Central Banks desperate to buy more time until confidence is restored.

- GERMAN BUND SCARE: You cannot have a currency without a risk free bond. The German Bund had become a proxy for this, but recently even the Bund has come under pressure as selling escalated in a flight from Europe.

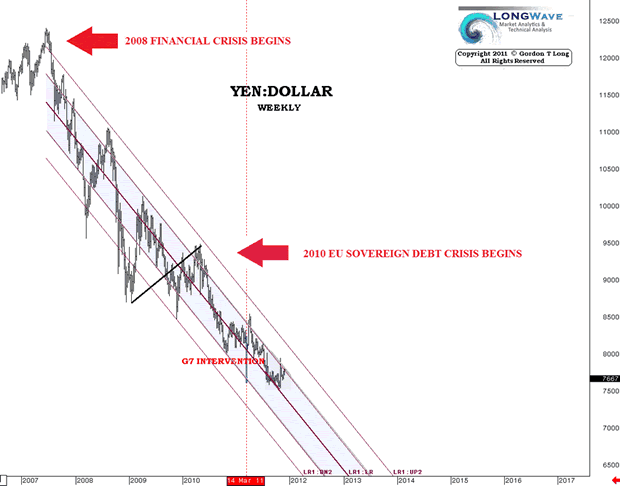

- YEN CARRY TRADE: The YEN Carry Trade which has been a major financing source for the EU, even prior to its inception, is being forced to unwind due to a significantly weakening Euro and the threat of a serious drop.

- BASEL BOX: The Tier 1 Core Capital requirements have forced many banks to actually shrink lending to meet requirements. A significant withdrawal from lending in Central and Eastern Europe and many Emerging countries is now clearly seen as a direct result.

- CREDIT DOWNGRADE ONSLAUGHT: S&P placed the long-term sovereign-debt ratings of 15 euro-zone nations, including struggling Italy and Spain, on negative watch. That typically means there is at least a 50% chance of a downgrade within 90 days. France is likely to soon lose its coveted AAA rating, which will impact the European Financial Stability Fund (EFSF) borrowing costs.

The list is even longer, but it will need to suffice for this shorter article.

The above issues suggests, minimally, an immediate €4-8 Trillion EU problem.

The EU has no ability to solve this problem short of simply printing Euros, which unlike the US Federal Reserve, Bank of England and Bank of Japan, the ECB presently (I stress presently) refuses to do.

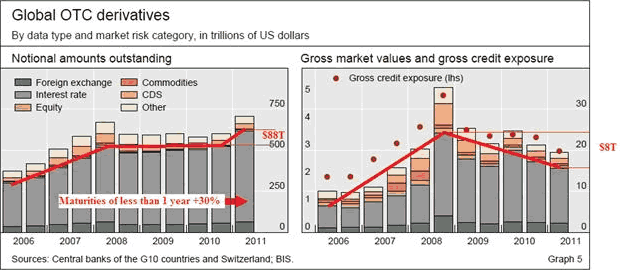

Let's briefly discuss a few of these so we can appreciate the seriousness of the EU problem and what lays behind a first half 2011 surge of $107 TRILLION in derivative SWAPS.

COLLATERAL CONTAGION

Collateral is the grease that oils the lending system.

Large banks typically reuse securities held by them on behalf of large institutional investors such as insurers, pension funds and hedge funds. Banks pledge the assets through various mechanisms such as the securities lending market or the repo market. It is the reuse of securities that lubricates the global financial system.

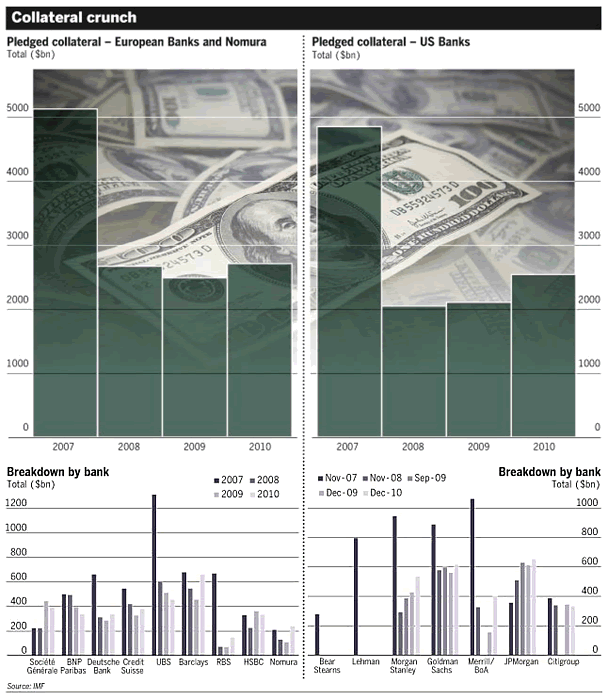

This reuse, which often cascades through the system, is referred to as "chains of collateral". According to a recent working paper from the IMF entitled "Velocity of Pledged Collateral: Analysis and Implications", the chains of collateral have become shorter and there has been a significant decline in the source of collateral. In fact, it is presently estimated that the overall reduction in collateral is between $4T and $5T. According to the IMF, it has been reduced from a peak in 2007 of approximately $10T to $5.8T in 2010. This is no doubt even lower when the final numbers are in for 2011, due to the collapse of European sovereign bonds.

The "turns" or velocity of the movement of this collateral has been reduced from an average of 3 times before the 2008 Lehman collapse to 2.4 times at the end of 2010.

There are a number of reasons for this which include:

- Significantly more collateral is being entrusted to global central banks for safe keeping,

- Counter party risk is now seen to be of paramount concern due to a breakdown in trust perceptions,

- Mounting concerns with creditworthiness of counterparties,

- Focus on how partners might use the collateral assigned to them,

- Risk manage where financial institutions are 'clipping' or taking 'haircuts' on collateral to create a 'margin of safety' and

- Higher core capital banking ratios and changing derivatives trading collateral requirements placed on banks.

There are both less and less collateral of high quality available along with a dramatically increased demand for collateral.

We have witnessed a shift from unsecured cash flows as sources of collateral to the requirement for 'secured' collateral. Triple A sovereign debt is no longer considered risk free.

As a result of the above, the transmission mechanism for monetary policy has broken down, fundamentally due to a shift in trust perceptions.

Additionally, risk has increased in the system, because risk has been transferred through new and untested instruments such as 'Liquidity Swaps' and services such as 'Collateral Transformation'.

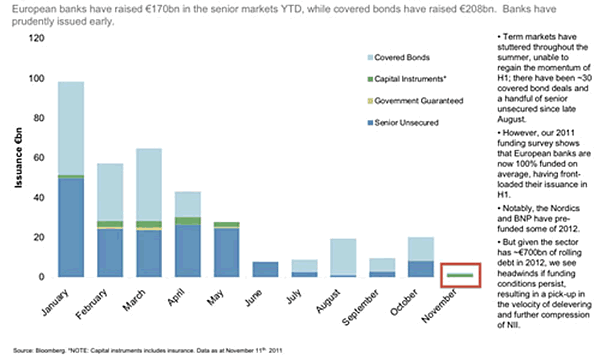

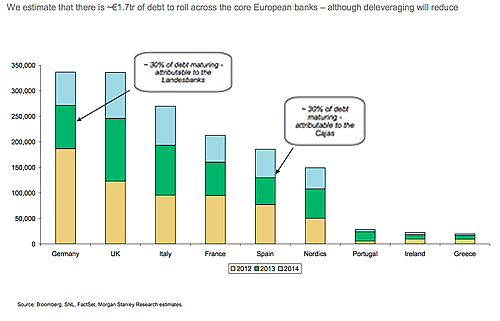

There is now a massive demand for fresh cash in the EU in the form of €1.7T in maturing debt (ignoring interest payments). When it comes to cash 'supply' or issuance of unsecured debt, the market is now completely and totally dead.

Even as soaring debt, interest rollover and redemption demands mean huge amounts of debt have to be raised.

"Term bank funding issuance has dried up. We are concerned there has been a step change in the availability and pricing of senior unsecured funding given such elevated euro-zone uncertainty and the knock-on to assets supported by unsecured funding." Zero Hedge

In other words: there is no more debt available which is "guaranteed" simply by promises of future cash flow: investors demand asset collateralization for the simple reason that fewer and fewer believe that assets are able to generate the amount of cash represented by a conflicted underwriter syndicate.

Unfortunately, there is nowhere near enough hard assets to fund secured assets at even modest LTVs, and it will only get worse and worse as less and less cash actually goes to regenerating a rapidly depreciating and amortizing asset base.

WHOLESALE LENDING

The first nail in the EU coffin was the failure of Dexia, a major Belgium - French bank. Dexia is representative of the Wholesale banking structure so prevalent across Europe. To understand the significance of Dexia, consider the following.

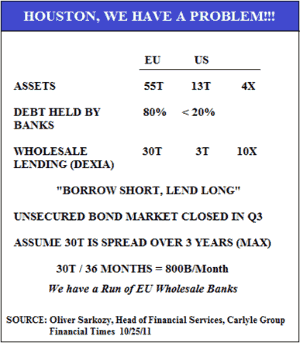

There are approximately $55T of banking assets in the EU. This compares to only $13T in the US. Bank Assets in the EU are 4 times as large as the US.

In the US, debt held by the bank is smaller because retail deposits are a primary source of funds. EU banks use wholesale lending and, as a consequence, the debt held by banks is closer to 80% versus less than 20% by US banks.

Wholesale bank lending in the EU approximates $30T versus only $3T in the US, a 10 X differential.

Wholesale lending is fundamentally borrowing from money market funds and other very short term, unsecured instruments. The banks borrow short and lend long. It all works until short term money gets scarce or expensive. Both have occurred in the EU and this recently placed DEXIA into bankruptcy, forcing them to be taken over by the Belgium and French governments. The unsecured bond market fundamentally closed in the EU in Q3 2011, as fears mounted that an EU solution was not forthcoming.

Assuming $30T of loans is spread over three years, EU banks have a requirement for $800B / Month of rollover financing for wholesale lending outstanding.

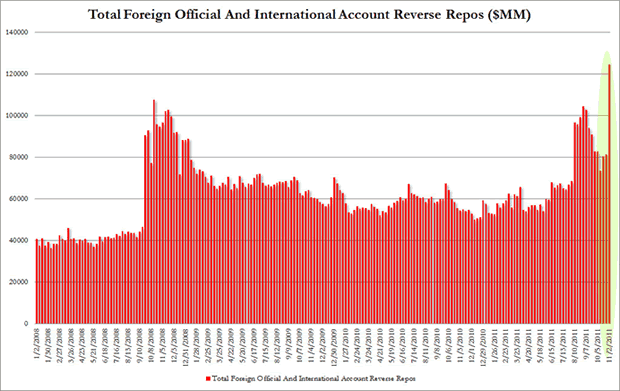

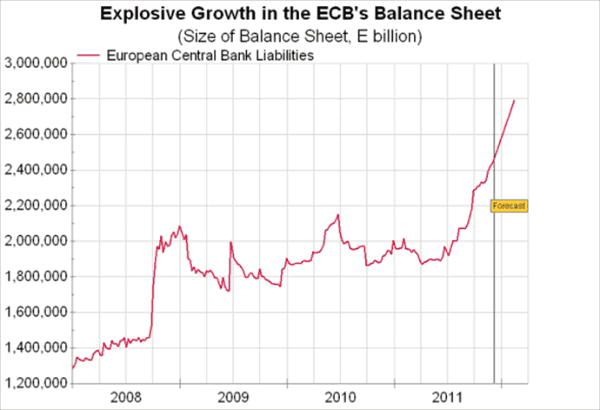

Where is this money going to come from? No one is waiting around to find out as there will be cascading counterparty failures soon surfacing. Banking money in Europe is fleeing to custodial and official accounts of the ECB, the US Federal Reserve and any other central Bank willing to accept their cash. The chart below graphically shows this flight to perceived central bank safety.

The latest charts show an increase of $4.5T in a one week period.

BANK RUNS

BANK RUNS - Unnoticed, Insidious and Persistent

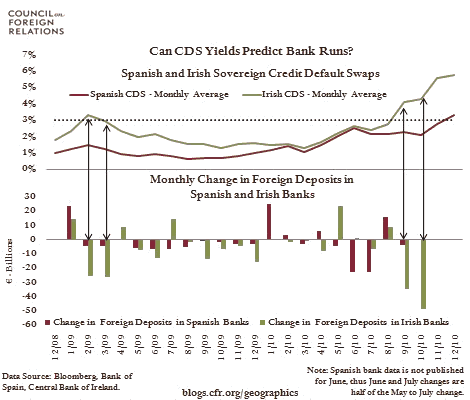

There are, as yet relatively unreported, insidious and persistent bank runs occurring across the EU, as money flees the GIIPS and moves to perceived havens of capital safety.

Until recently the safe havens were the EU core and more specifically Germany. That has now changed.

What has not changed is the increasing momentum of the flight of capital and depositor savings. You can't expect governments, banks or regulators to even hint at such actions. It is only through thorough analytics that you can see what is happening.

The chart to the right was put together by the Council of Foreign Relations where they felt that the level of Credit Default Swap pricing was an early indicator of what lay below the headlines. They used Ireland as a benchmark and related it to the possibilities of what might be occurring in Spain.

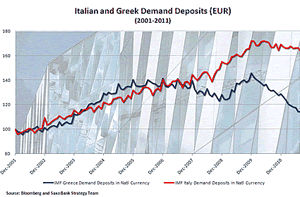

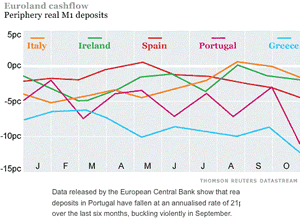

The second chart (below left) shows the contraction in deposits in Greece and early signs of changes in Italy. Both these charts are seriously outdated.

The chart (below right) of plummeting Italian M1, M2 and M3 Money Supply gives a more up to date indication, but still dated.

To the right is a chart of M1 (bank deposits) where all the GIIPS are compared. DEPOSITS ARE PRESENTLY FLEEING THE GIIPS AT AN ACCELERATING RATE.

SHADOW BANKING SYSTEM

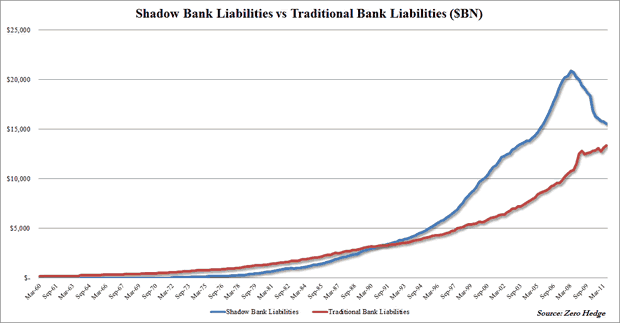

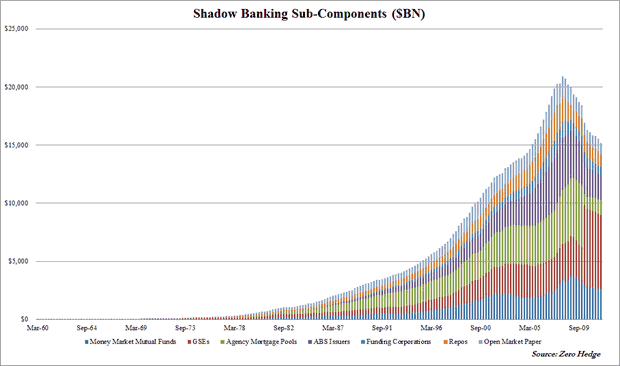

As alarming as the following Shadow Banking are, it must be realized they are for only the US. We need to fully appreciate that the US was a factory producing the toxic debt that was at the center of the 2008 Financial Crisis, but the product of these factories was shipped and sold by the 'boatloads' to the EU. It is so broad based, that I wrote a number of research papers in 2010 pointing out the degree to which litigation over them was being seen quietly across Europe at ALL levels of government, which could not absorb the losses they were creating.

If the US Shadow banking has seen liabilities collapse by $5T, surely the EU is this and more likely a multiple larger.

As Bloomberg and Zero Hedge pointed out, the loosening of rules on ABS as collateral, loosening of collateral criteria for loans, going to 2-3 year loans for banks and allowing more uncovered bonds as collateral for the LTRO was driven by a European Shadow Banking system in "tatters" and imploding.

GLOBAL INVESTORS PULLING INVESTMENTS

The euro zone swung back to a current-account deficit in October after one brief month of positive inflows, as foreign investors continue to relentlessly shed European debt and stocks. The euro zone's current account -- the balance of payments between the 17-member currency bloc and the rest of the world -- was a seasonally adjusted deficit of €7.5 billion in October, compared with a €2.2 billion surplus in September.

Net outflows from the euro zone's financial account reached €32.1 billion in October, on an unadjusted basis. The drop reflects the sale by foreign investors of €53.3 billion in euro-zone debt instruments and €6.6 billion in equities.

This is collateral that is lost to being 'chained' in collateral chains.

INTERBANK LENDING

PARIS 12/05/11 - MERKOZY SUMMIT "NO HAIRCUTS"

INTERBANK LENDING IS NEARLY FROZEN

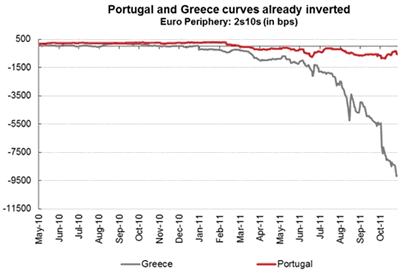

INVERTED YIELD CURVES

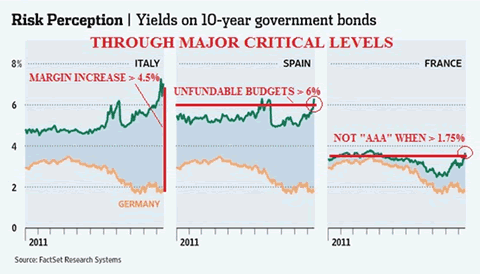

Over the last six weeks, sovereign bond yields, spreads and risk metrics have surged to unprecedented and unfundable levels.

Only recently, with the anticipation of workable solutions coming out of yet another EU Summit on December 9th, 2011 and further ECB buying, have yields fallen back somewhat.

However, the fact is alarming that yield curves across the GIIPS are now inverting.

Money is no longer available to sovereigns even in the short term at acceptable rates, as €300B of debt roll-overs alone come due across the EU.

The scare that is starting to sink in is that there may now be insufficient liquidity in the system to in fact fund rollovers and new sovereign funding requirements in the EU.

Additionally, the ECB is not seen to be injecting sufficient liquidity fast enough.

The funding requirements are also significantly US dollar denominated, which the ECB cannot address without global dollar swap arrangements with other global central banks.

As a result, a massive intervention happened on November 30th to address this urgent problem.

The intervention did not fix the yield curve inversion nor the collateral requirements to access these dollar swap funds.

CONCLUSION

It is very hard to conclude anything other than:

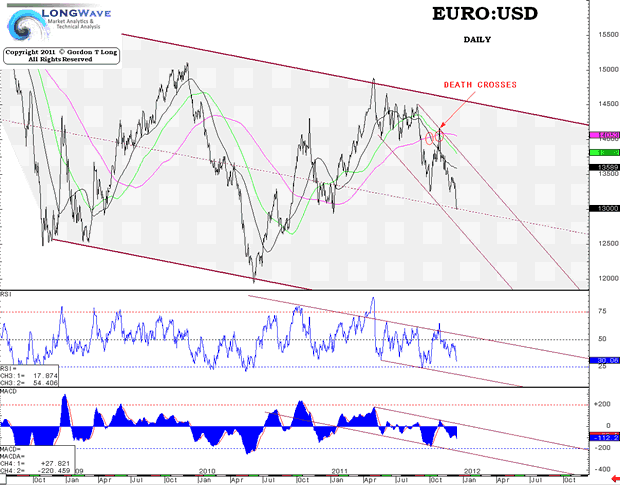

1- EURO BELOW 1.20: The Euro currency is exposed against most currencies and likely headed for a currency cross of less than 1.20 against the US dollar. A cross of 1.15 to 1.20 would not be a surprise. We have already seen technical 'death crosses', suggesting this is in the works as the Euro has broken below its 200 DMA in a downward trend channel.

2- ECB LEVERAGE 471:1: The ECB borders on insolvency. It cannot monetize sovereign debt (print money for sovereign debt) by treaty law and its stake holders have insufficient assets to pledge in which to place the ECB on sound financial footing.

The ECB's balance sheet is now beyond bloated and is realistically insolvent based on the quality of its collateral.

The paid up Capital of the ECB is €5.2B as of January 2011. The Balance sheet currently approximates €2,450B. This is 471:1. Even using the pledged capital of €10.76B expected to be paid in by 2012, it is still 228:1

Considering a significant amount of the debt is of poor quality and worth significantly below its purchased price, the ECB is technically insolvent.

Even if we were to be ridiculously conservative and use €65B of GIIPS bonds bought by the ECB in 2010 and assuming only a 10% devaluation, we have €6.5B, losses which is more than the paid up capital of the ECB. The insolvency is orders of magnitude worse than this, but you get the point. The ECB cannot withstand much further stress before all of this is called into question.

The argument is always that the ECB cannot be insolvent because it can always print more Euro's. The question I would therefore raise is what is the Euro really worth then?

Whether: YOU BUY ASSETS, or you: LEND MONEY ON QUESTIONAL COLLATERAL & LEVERAGE, the ECB'S BALANCE SHEET SHOWS WHAT IS REALLY GOING ON.

Is the ECB realistically solvent - The 'controlling' German and French owners are incapable of supplying more capital!!!

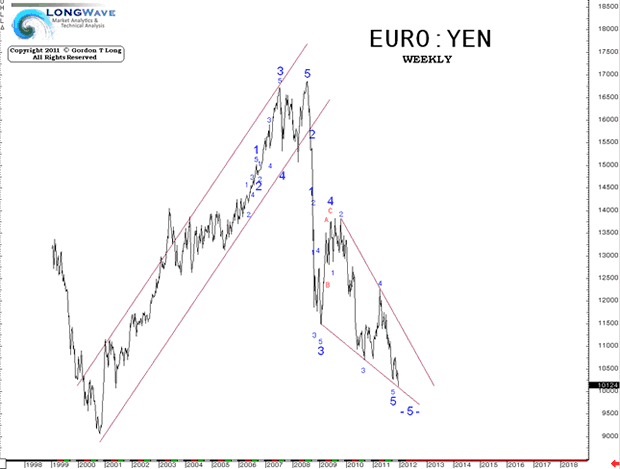

3- YEN CARRY TRADE - A FORCED UNWIND:

When you appreciate that the YEN Carry trade was a huge financier of the EU and the Euro, you can appreciate why the above problems has resulted in the Euro plummeting against the YEN. This is forcing unwinding of the Carry Trade, as the currency impact losses are too large to be contained without massive adjustments in OTC SWAPS.

Is this what explains the $107 TRILLION increase in OTC Derivative SWAPS in the first half of Q1 and $88T in interest rate SWAPS alone?

FINANCIAL REPRESSION

Let us close by saying that it is critical that you fully appreciate that which would appear as a chaotic situation in Europe is in fact a very well crafted and executed global central bank strategy, using the macro prudential practice of Financial Repression in an attempt to achieve Global Re-Balancing and adjustments in standards of living. I lay all this out in "Thesis 2012: Financial Repression".

Sign-Up for your FREE copy of "Thesis 2012: Financial Repression" that lays bare how this is being executed and what lies ahead in 2012 and 2013.

Gordon T Long gtlong@comcast.net Web: Tipping Points Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2011 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.