Should Definition of Central Bank Lender of Last Resort Function Be Expanded?

Interest-Rates / Central Banks Dec 23, 2011 - 05:07 AM GMTBy: Paul_L_Kasriel

A fractional-reserve banking system is susceptible to bouts of liquidity stringencies that, if left unchecked, can result in serial bank failures and an abrupt contraction in bank credit. The sine qua non of central banking is to act as a lender of last resort to otherwise solvent but temporarily illiquid banks so as to prevent their temporary illiquidity from deteriorating into insolvency, which would result in the aforementioned contraction in bank credit. This "narrow" interpretation of the lender-of-last resort function was the catalyst for the Federal Reserve Act of 1913. After the Banking Crisis of 1907, Congress believed that it was necessary to re-establish a central bank lender of last resort so as to prevent temporary financial market liquidity stringencies from deteriorating into severe economy-wide recessions.

A fractional-reserve banking system is susceptible to bouts of liquidity stringencies that, if left unchecked, can result in serial bank failures and an abrupt contraction in bank credit. The sine qua non of central banking is to act as a lender of last resort to otherwise solvent but temporarily illiquid banks so as to prevent their temporary illiquidity from deteriorating into insolvency, which would result in the aforementioned contraction in bank credit. This "narrow" interpretation of the lender-of-last resort function was the catalyst for the Federal Reserve Act of 1913. After the Banking Crisis of 1907, Congress believed that it was necessary to re-establish a central bank lender of last resort so as to prevent temporary financial market liquidity stringencies from deteriorating into severe economy-wide recessions.

The Federal Reserve turned out to be a slow learner. Fifteen years after it opened its doors in 1914, the Fed failed to act aggressively as a lender of last resort in the aftermath of the 1929 stock market crash, which resulted in serial bank failures in the U.S., a sharp contraction in bank credit and a severe recession that persisted through March 1933. Some foreign central banks also failed to perform their lender-of-last resort function, which resulted in serial bank failures in their economies as well.

Although the Fed did let "the puck go through its pads," as it were, in the 1930s, it did not do so after the failure of Lehman Brothers in September 2008. Although criticized by many, the Fed acted aggressively in providing U.S. dollar funding to U.S. banks and nonbank financial institutions directly and foreign financial institutions indirectly through U.S. dollar loans to foreign central banks. This aggressive lending on the part of the Federal Reserve and other central banks prevented the global recession that commenced after the failure of Lehman Brothers from being even more severe than it was.

In 2010, investors began to question the Greek government's ability to service its debt. Since then, investors' concerns have escalated with regard to other European governments' ability to service their debt. Because the eurozone banking system holds significant amounts of sovereign debt whose market value has plummeted in the past year, some European banks have seen the cost of their funding soar in recent months. In response, this week the European Central Bank (ECB) aggressively stepped up its lender-of-last resort function by providing 3-year loans to over 500 eurozone banks totaling 490 billion euros. This aggressive action by the ECB will prevent serial bank failures and a massive contraction in eurozone bank credit that otherwise could have resulted from the eurozone banking liquidity stringencies that were developing. This ECB loan of 490 billion euros to eurozone banks should not be considered net new funds to the eurozone banks. Rather, a large portion of these ECB loan are a replacement for very expensive non-ECB funding.

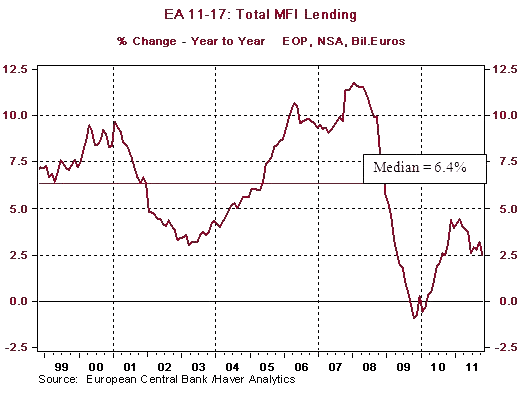

However, it is not clear that there still will not be some contraction in eurozone bank credit. The chart below shows that recent year-over-year growth in eurozone monetary financial institution (MFI) credit has been well below the 6.4% median year-over-year growth starting in 1999. With higher regulatory capital-to-asset ratios being imposed on eurozone banks and with bank managements as well as bank regulators being concerned about possible write-downs of sovereign-debt values, it is quite likely that even the modest growth in MFI credit will not be maintained going forward.

Chart 1

This is where I would recommend an expansion in the definition of lender of last resort. Central bank credit is a close substitute for bank credit. In theory, a central bank could lend directly to the public and private sector. In my expanded definition of the central bank lender-of-last resort function, the central bank would target some rate of growth in combined central bank and commercial bank credit. In the case of the eurozone, assume that the ECB believed that the 6.4% median growth rate in MFI credit was an appropriate rate of growth in combined ECB and eurozone MFI credit. If growth in this combined credit aggregate should slip below 6.4% because of weaker MFI credit creation, then the ECB would engage in balance sheet expansion until combined ECB and MFI credit grew again at 6.4% annually.

How might the ECB expand its balance sheet under these circumstances? Should it purchase Italian and Spanish sovereign debt? Not exclusively or necessarily at all. The ECB could expand its balance sheet by the necessary total amount through the purchases of sovereign debt in amounts of the total weighted by the sovereign's percentage contribution to eurozone GDP. For example, because Italy's nominal GDP is about 17% of eurozone nominal GDP, Italian sovereign debt would account for 17% of the total sovereign debt purchased by the ECB in order to maintain the specified growth in combined ECB and MFI credit.

It is likely that some of the eurozone governments that are experiencing debt-servicing challenges will need financial aid from their fellow eurozone member countries. Assume that some euro funds were raised by the issuance of euro bonds backed by the full faith and credit of the eurozone sovereign countries collectively. These funds then could be loaned at the issuing interest rate to the individual euro governments that were experiencing debt-servicing problems. The funds would be used to retire "challenged" sovereign debt that was coming due. In turn, if the ECB needed to expand its balance sheet to maintain the specified rate of growth in combined ECB and MFI credit, the ECB could purchase in the open market the requisite amount of pan-euro bonds rather than individual-country sovereign debt. In this way, the ECB could fulfill its expanded lender-of-last resort function without taking on individual-country sovereign-debt credit risk.

As an aside, I would recommend this expanded lender-of-last resort function for all central banks, including the Federal Reserve, at all times. Forget about central banks trying to target rates of growth or levels of nominal GDP. Forget about central banks trying to influence investors' inflation expectations. Rather, have central banks determine appropriate rates of growth in what Austrian economists refer to as "created" credit, i.e., the sum of central bank and MFI loans and investments, and then have central banks vary their balance sheets in order to hit these target growth rates of created credit. If central banks were to adopt appropriate target growth rates for created credit and achieve these targets, there would be no runaway consumer price increases or asset price bubbles. There still would be recessions and periods of above potential economic growth, but the amplitude of the busts and booms would be reduced as would be frequency of financial crises.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.