Gold, Stocks or Bonds, What Would Ron Paul Own?

Politics / US Politics Dec 23, 2011 - 01:24 AM GMTBy: Jeff_Berwick

When looking for guidance in life people have been known to ask, "What would Jesus do?" After all, Jesus was an anarchist and very principled so it makes sense to look to someone like him after which to model their life.

When looking for guidance in life people have been known to ask, "What would Jesus do?" After all, Jesus was an anarchist and very principled so it makes sense to look to someone like him after which to model their life.

Today, the closest thing to Jesus in American politics is Ron Paul. Paul is a rarity in politics because he has principles. You can boil down Paul's position on anything by asking, "is it constitutional?". He doesn't flip flop on issues because he sticks to his principles. Does he support the IRS and income tax? No, because it's unconstitutional. Does he support the Federal Reserve and the fiat dollar? No, because it's unconstitutional. And, the reason he believes in the constitution is because he believes it is the best document written to uphold freedom and liberty.

So, when Ron Paul recently released the contents of his investment portfolio ("The Ron Paul Portfolio") as part of his congressional filings we looked on with interest. Would his investments be as principled as the other facets of his life? Would he hold to his convictions about gold as money? In this case, it isn't "What would Jesus do?", it is, "What would Ron Paul own?"

THE RON PAUL PORTFOLIO

An unprincipled person is a person who is essentially adrift, with no anchor by which to hold them steady. They float about, being whisked one direction or another without a core belief system to base all of their actions upon. Your typical member of Congress isn't principled. Their vote goes to the highest bidder on almost any subject. And so it comes as no surprise that their investment portfolios are, on average, directionless and unprincipled. And poorly performing as a whole.

According to the Wall Street Journal, "Give or take a few percentage points, a typical Congressional portfolio might have 10% in cash, 10% in bonds or bond funds, 20% in real estate, and 60% in stocks or stock funds."

Compared to this, they state, Ron Paul's portfolio is "shockingly" different.

What does Ron Paul own? Other than real estate and some cash, the majority of his holdings are in gold and silver mining stocks. 64% of his portfolio is in mining stocks and 5% of the total is in Canadian based junior mining stocks.

In other words, his investment portfolio mirrors his principles. He believes that gold and silver are money and he is heavily invested in them and the companies that produce the precious metals - as are we.

RON PAUL VS. CONGRESS

So, how is Ron doing with his portfolio compared to the rest of Congress? If we assume he's held these positions for the last decade and that congress has done the same, let's see who has performed better.

Over the last decade, Ron Paul's portfolio has outperformed the average "stocks and bonds" held by congress by a factor of 5 to 10 times.

But, as it does, the mainstream media went out and found a typical government registered investment advisor for his thoughts on Paul's portfolio. Quoting the Wall Street Journal:

"William Bernstein, an investment manager at Efficient Portfolio Advisors in Eastford, Conn., reviewed Rep. Paul’s portfolio as set out in the annual disclosure statement. Mr. Bernstein says he has never seen such an extreme bet on economic catastrophe. ”This portfolio is a half-step away from a cellar-full of canned goods and nine-millimeter rounds,” he says."

It's a good thing Ron Paul doesn't listen to government trained financial advisors for his investment advice! Ron's investment portfolio has outperformed the "status quo" handily for a decade... and if Paul is smart, he would have extra food on hand and some guns for when this statist, anti-capitalistic monetary system collapses.

IF YOU CAN'T IGNORE, DISCREDIT!

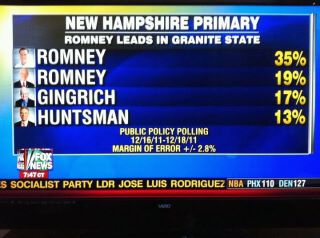

The mainstream media has been trying all it can to avoid Ron Paul but it is getting harder and harder to ignore him. But even the brainwashed, sedated American populace may notice something wrong with their coverage, when Mitt Romney can come in both first and second in a recent New Hampshire primary.

And so, now that they are forced to acknowledge his existence they have reverted to trying to discredit Paul. They say he is paranoid for investing his entire portfolio on the basis that the monetary system as we know it is in a state of collapse. They say he is shockingly different than his congressional counterparts.

We say, he is the only sane man in the room. When it comes to investing, ask yourself, what would Ron Paul own?

Interested in investing like Ron Paul? Subscribe to The Dollar Vigilante Premium newsletter. Ron Paul has a significant portion of his portfolio in major gold mining stocks that we cover and the Canadian based junior miners as well. TDV covers all aspects of the world's geopolitical and financial events. Or, subscribe to our new TDV Golden Trader if you want a trade alert service on these types of stocks.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.