The Stock Market Is Not Physics: Part II

InvestorEducation / Learning to Invest Dec 23, 2011 - 01:14 AM GMTBy: EWI

The following series is excerpted from two classic issues of Robert Prechter's Elliott Wave Theorist. Although originally published in 2004, the valuable series has been re-released in the Independent Investor eBook, along with over 100 pages of other reports that challenge conventional economic thinking.

The following series is excerpted from two classic issues of Robert Prechter's Elliott Wave Theorist. Although originally published in 2004, the valuable series has been re-released in the Independent Investor eBook, along with over 100 pages of other reports that challenge conventional economic thinking.

Here is Part II of the series. You can read Part I here. Check back in a few days to read Part III, or you can download your free copy of the Independent Investor eBook here.

Action and Reaction

In the world of physics, action is followed by reaction. Most financial analysts, economists, historians, sociologists and futurists believe that society works the same way. They typically say, "Because so-and-so has happened, such-and-such will follow." The news headlines in Figure 1, for example, reflect what economists tell reporters: Good economic news makes the stock market go up; bad economic news makes it go down. But is it true?

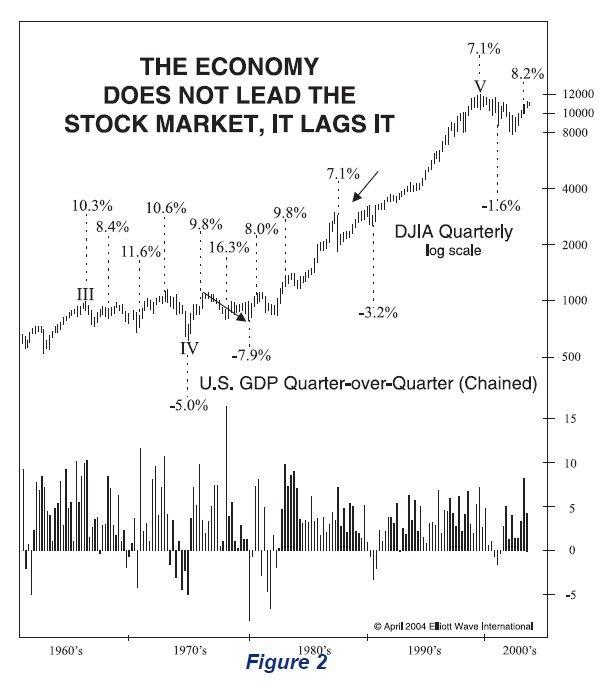

Figure 2 shows the Dow Jones Industrial Average and the quarter-by-quarter performance of the U.S. economy. Much of the time, the trends are allied, but if physics reigned in this realm, they would always be allied. They aren't. The fourth quarter of 1987 saw the strongest GDP quarter in a 15-year span (from 1984 through 1999). That was also the biggest down quarter in stock prices for the entire period. Action in the economy did not produce reaction in stocks. The four-year period from March 1976 to March 1980 had not a single down quarter of GDP and included the biggest single positive quarter for 20 years on either side. Yet the DJIA lost 25 percent of its value during that period. Had you known the economic figures in advance and believed that financial laws are the same as physical laws, you would have bought stocks in both cases. You would have lost a lot of money.

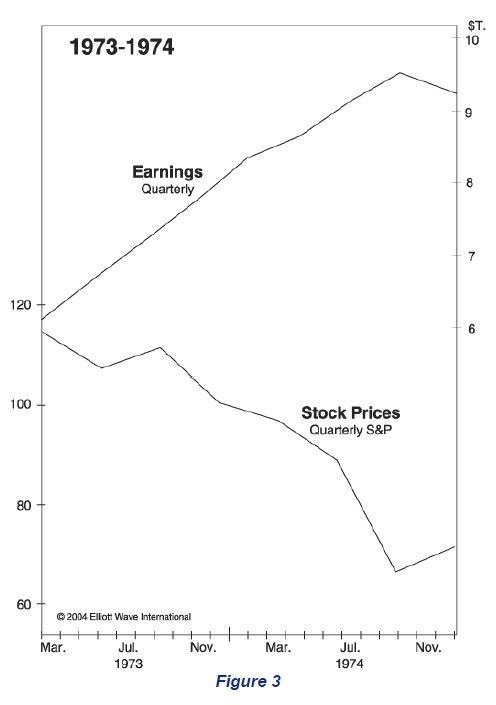

Figure 3 shows the S&P against quarterly earnings in 1973-1974. Did action in earnings produce reaction in the stock market? Not unless you consider rising earnings bad news. While earning rose persistently in 1973-1974, the stock market had its biggest decline in over 40 years.

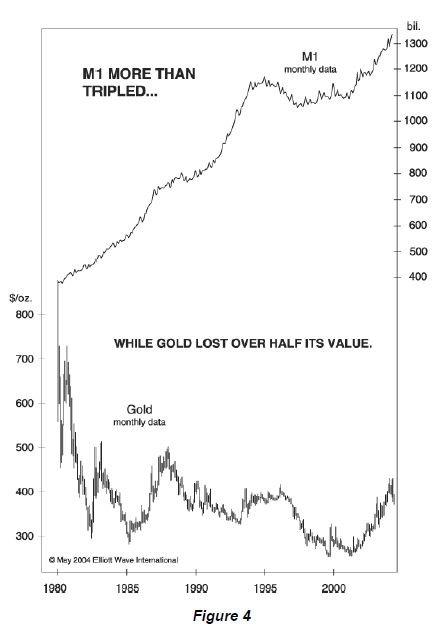

Suppose you knew for certain that inflation would triple the money supply over the next 20 years. What would you predict for the price of gold? Most analysts and investors are certain that inflation makes gold go up in price. They view financial pricing as simple action and reaction, as in physics. They reason that a rising money supply reduces the value of each purchasing unit, so the price of gold, which is an alternative to money, will reflect that change, increment for increment.

Figure 4 shows a time when the money supply tripled yet gold lost over half its value. In other words, gold not only failed to reflect the amount of inflation that occurred but also failed even to go in the same direction. It failed the prediction from physics by a whopping factor of six, thereby unequivocally invalidating it. (I was generous in ending the study now rather than in 2001, at which time gold had lost over two-thirds of its value.)

It does no good to say -- as we sometimes hear from those attempting to rescue the physics paradigm in finance -- that gold will follow the money supply "eventually." In physics, billiard balls on an endless plane do not eventually return to a straight path after wandering all over the place, including in the reverse direction from the way they are hit. (What physics-minded investor, moreover, can be sure that gold should follow the money supply rather than vice versa? Is he certain which element in the picture should be presumed to be the action and which the reaction? Maybe a higher gold price increases the value of central banks' gold reserves, letting them support more lending. Cause and effect arguments are highly manipulable when using the physics paradigm.)

We do know one thing: Investors who feared inflation in January 1980 were right, yet they lost dollar value for two decades, lost even more buying power because the dollar itself was losing value against goods and services, and lost even more wealth in the form of missed opportunities in other markets. Gold's bear market produced more than a 90 percent loss in terms of gold's average purchasing power of goods, services, homes and corporate shares despite persistent inflation! How is such an outcome possible? Easy: Financial markets are not a matter of action and reaction. The physics model of financial markets is wrong.

Learn to Think Independently -- Download Your Free Independent Investor eBook "The Stock Market is Not Physics" is just one report in the more than 100 page, two-volume Independent Investor eBook. You'll get some of the most groundbreaking and eye-opening reports ever published in Elliott Wave International's 30-year history; you'll also get new analysis, forecasts and commentary to help you think independently in today's tumultuous market. |

This article was syndicated by Elliott Wave International and was originally published under the headline The Stock Market Is Not Physics: Part II. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.