Chinese and Indian Tails Wagging the Global Equity Dog?

Stock-Markets / Stock Markets 2011 Dec 22, 2011 - 05:50 AM GMTBy: Adam_Brochert

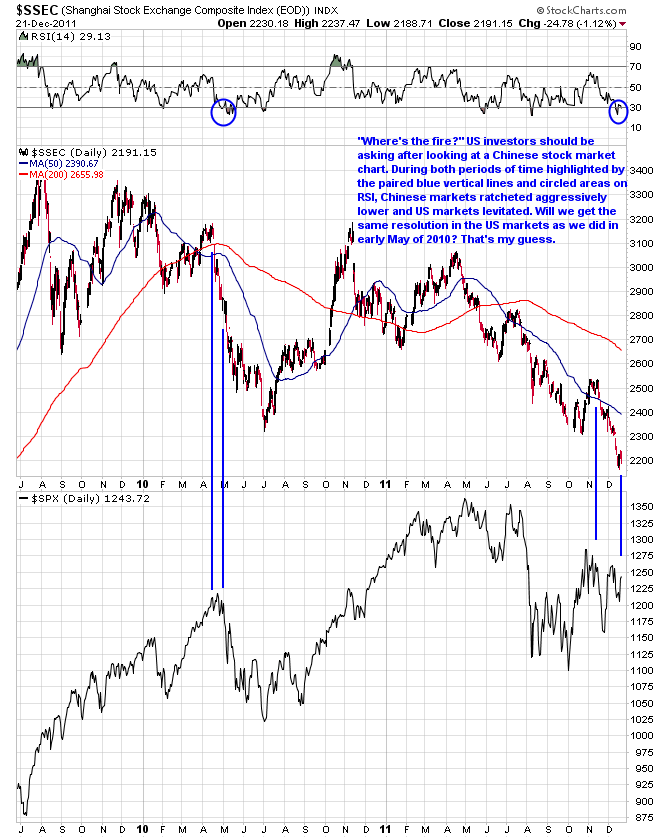

There is no significant decoupling in our current global economy. As I am typing this, the Chinese stock market (Shanghai Index or $SSEC) is making new lows (intraday basis) for the current decline it has been undergoing. Is the Chinese market signaling what comes next for developed stock markets like the US and Germany? Is the tail predicting what the dog will do? I think it is.

There is no significant decoupling in our current global economy. As I am typing this, the Chinese stock market (Shanghai Index or $SSEC) is making new lows (intraday basis) for the current decline it has been undergoing. Is the Chinese market signaling what comes next for developed stock markets like the US and Germany? Is the tail predicting what the dog will do? I think it is.

Here's a 2.5 year daily chart of the $SSEC with a daily plot of the S&P 500 ($SPX) below the $SSEC plot thru today's US market close:

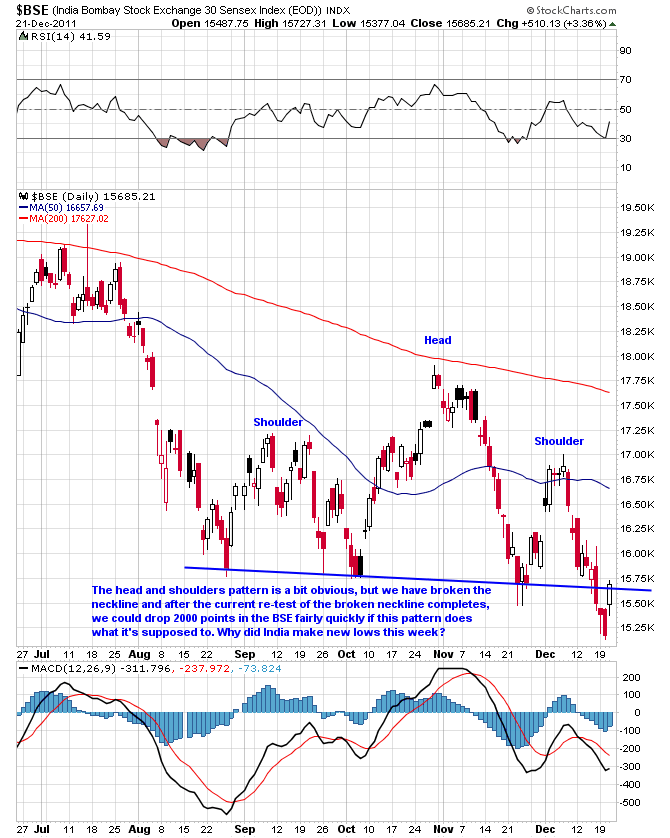

I think another decent decline is imminent in "advanced" economy stock markets that haven't already experienced it. Japan is already in the midst and another BRIC economy market, that of India, looks very weak here. Here's a 6 month daily chart of the $BSE Bombay Index thru the close on 12-21-2011:

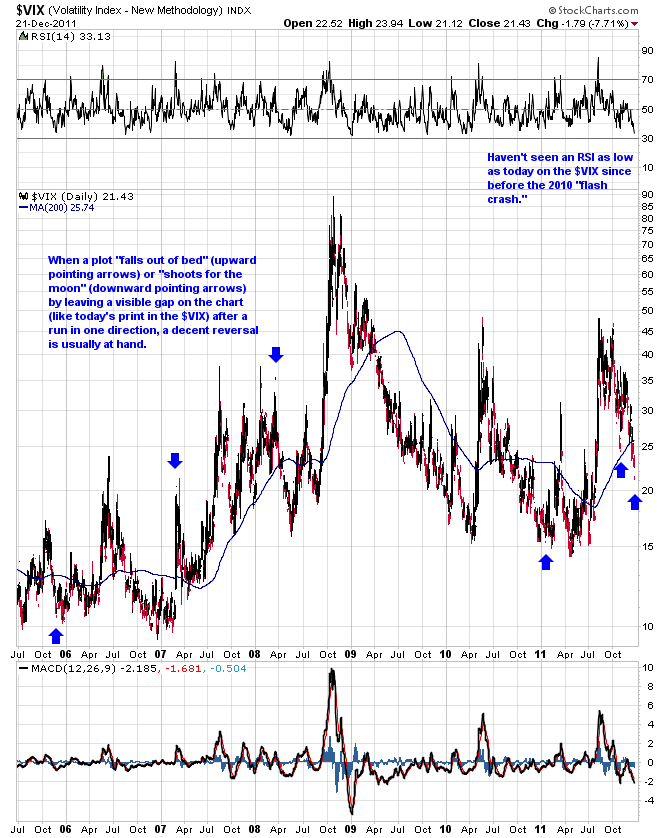

The Volatility Index ($VIX) is also screaming for equity bears to come out of hibernation. Here's a 6.5 year daily chart of the $VIX thru today's close:

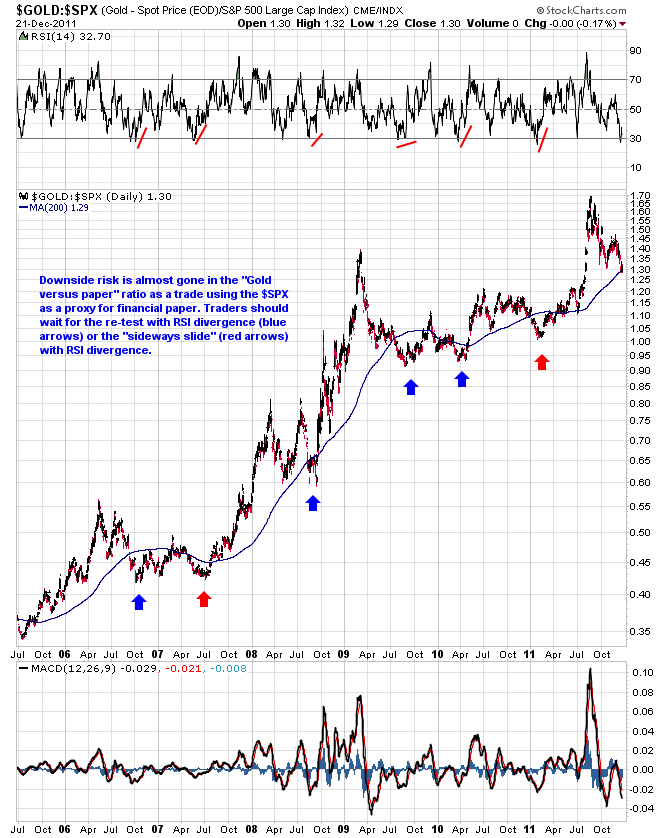

Meanwhile, the "Gold versus paper" ratio is settling in and trying to find a bottom here. There is now an ETF that allows traders to bet on this ratio, a double leveraged ETF with ticker FSG. It represents a double-leveraged way to bet that the Gold to S&P 500 ratio (i.e. $Gold:$SPX) is going to go higher. Here is a 6.5 year daily log scale chart of this ratio thru today's close, using the GLD:$SPX ratio as a proxy:

Of course, the easiest way to play the "Gold versus paper" trade, which is the secular trade of the past decade (and it is not close to ending), is to buy physical Gold and avoid paper financial assets like stocks altogether. For those who like to trade with a portion of their capital, however, we are very close to the re-entry point for this ratio trade in my opinion.

Until the Dow to Gold ratio hits 2 (and we may well go below 1 this cycle), Gold will continue to outperform paper. It's really that simple. The twists and turns give commentators like me a chance to hear ourselves talk and traders a chance to try to juice the gains of a "buy and hold" strategy, but they are simply noise for conservative investors who understand the current secular trend. If you are crazy enough to try and trade in this environment, consider giving my low-cost subscription service a try. My subscribers and I have recently been and are still short emerging markets and are waiting for a good entry point to go long Gold stocks as our next trade.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.