Gold, Are You Tempted to Sell, or Eager to Buy?

Commodities / Gold and Silver 2011 Dec 20, 2011 - 03:30 PM GMTBy: Jeff_Clark

Jeff Clark, Casey Research writes: It wasn't a fun week for gold. By the close on Friday, the metal was down 6.7% (based on London PM fix prices), the biggest weekly decline since September. It got downright irritating when the mainstream media seemingly rejoiced at gold's decline. Economist Nouriel Roubini poked fun at gold bugs in a Tweet. Über investor Dennis Gartman said he sold his holdings. CNBC ran an article proclaiming gold was no longer a safe-haven asset (talk about an overreaction).

Jeff Clark, Casey Research writes: It wasn't a fun week for gold. By the close on Friday, the metal was down 6.7% (based on London PM fix prices), the biggest weekly decline since September. It got downright irritating when the mainstream media seemingly rejoiced at gold's decline. Economist Nouriel Roubini poked fun at gold bugs in a Tweet. Über investor Dennis Gartman said he sold his holdings. CNBC ran an article proclaiming gold was no longer a safe-haven asset (talk about an overreaction).

While the worry may have been real, let's focus on facts. Have the reasons for gold's bull market changed in any material way such that we should consider exiting? Instead of me providing an answer, ask yourself some basic questions: Is the current support for the US dollar an honest indication of its health? Are the sovereign debt problems in Europe solved? How will the US repay its $15 trillion debt load without some level of currency dilution? Is there likely to be more money printing in the future, or less? Are real interest rates positive yet? Has gold really lost its safe haven status as a result of one bad week?

And one more: What is the mainstream media's record on forecasting precious metals prices?

Our take won't surprise you: not one fact relating to the trend for gold changed last week. We remain strongly bullish.

So why did gold, silver, and related stocks fall so hard?

The reasons outlined in this month's BIG GOLD are still in play (the MF Global fallout, a rising dollar, year-end tax-loss selling, and the need for cash and liquidity to meet margin calls or redemption requests). Last Wednesday's 3.5% fall took on a life of its own, selling begetting selling, fear adding to fear (especially the case with gold stocks). None of these reasons, however, have anything to do with the fundamental factors that ultimately drive this market. Once those issues shift, then we'll talk about exiting.

So, should we buy now? Is the bottom in?

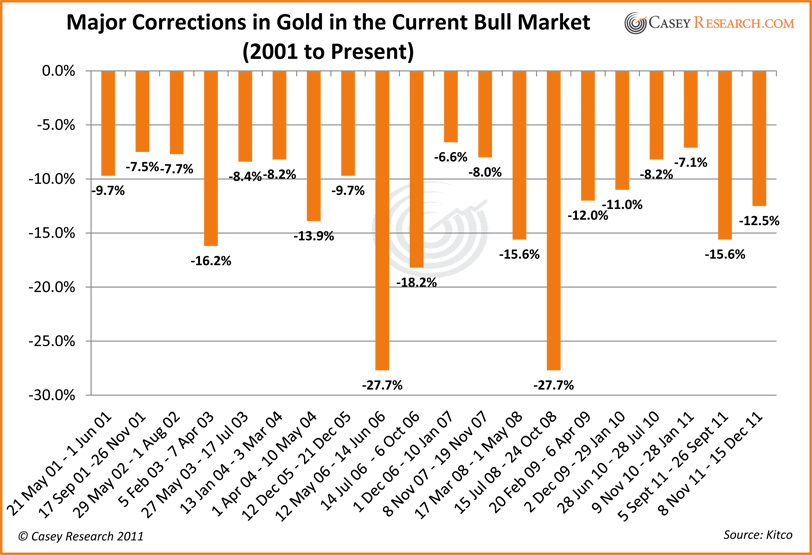

Let's take a fresh look at gold's corrections and compare them to the recent one. I've updated the following chart to include the recent selloff.

[How do I calculate the data? I look for the periods in every annual gold chart that represent a distinct fall greater than 5%, then measure the highs and lows.]

Our recent drop equals 12.5%. This isn't to suggest that the correction is over, but it does show that we've already matched the average decline, which is also 12.5%. This comes on the heels of the 15.6% fall in September. You'll notice something else: We've now had three major corrections (greater than 5%) in one year, the first time that's happened in this bull market.

The worst-case scenario would be a drop that matched the biggest on record, 27.7%. From $1,795 – the recent interim peak price – that would take us to $1,295. That wouldn't be fun, but a fall to that level would not by any stretch signal the end of the bull market, nor a fall into unprofitability for our producers. And it would represent a true blood-in-the-streets buying opportunity. After all, that's exactly what happened in 2006 and again in 2008, and in both instances gold eventually powered much higher. The bears were wrong then, and they'll be wrong again this time, even if that extreme scenario were to come to pass.

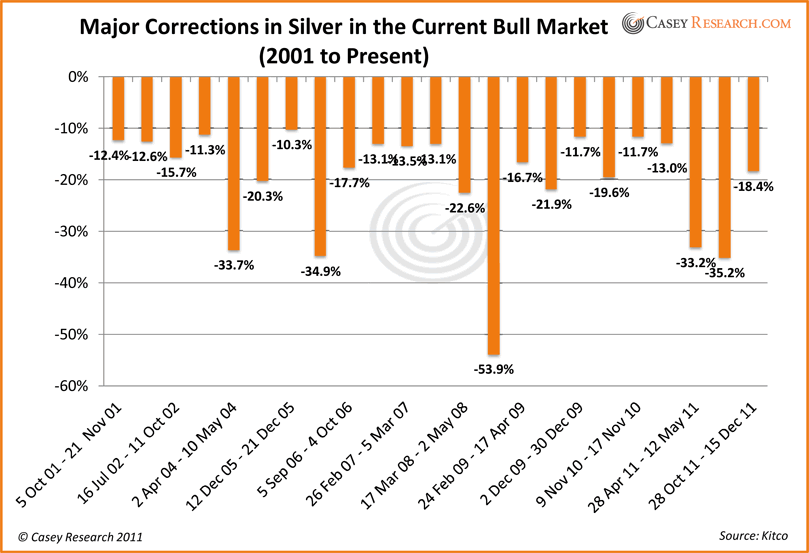

Here's the updated picture for silver:

Silver's volatile nature really comes through in these data, which measure corrections of 10% or more. The recent decline tallies 18.4%. It, too, comes on the heels of a recent correction, a 35.2% tumble in September. The average of these declines is 20.3%, which would take our current correction to $28.22, close to last Thursday's price. Like gold, we've now had more corrections this year (four) than we've ever had in this bull market.

The worst plausible scenario we see for silver in the near term would be a fall to $16.32, matching 2008's 53.9% drop. But you'd have to be awfully bearish to think it will plummet that far.

These data should actually give you some comfort. We've been here before. We've seen worse before. And yet, in every instance, gold and silver eventually climbed higher. So, unless you really believe that Obama and Merkel have brought happy days back to the world economy, precious metals will resume their ascent, and probably sooner rather than later. And when they do, you may well never be able to buy at these prices again. Those who were too scared to buy at $560 in 2006 and $700 in 2008 missed out on what were some of the greatest buying opportunities of this bull market.

Would I buy now? Given that each metal has already met its average decline, and that both have seen more corrections this year than any other, we're likely closer to the bottom than the top. So yes, I added an extra contribution to my favorite bullion accumulation program last week.

Either way, my advice is to spend a little more time watching the drivers for gold and a little less time worrying about the price. Until those things change, look for an entrance, not an exit.

[While no one can know just yet if gold has bottomed or not, those who understand the inevitable path of all fiat currencies know these prices represent a good buying opportunity. Learn more about how to protect yourself from being robbed by your government – and how to invest in gold for maximum profit potential.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.